Good morning and welcome to today's report.

Today's report is now complete (11.45). See you tomorrow!

Spreadsheet accompanying this report (updated to 24th November): link.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

AstraZeneca (LON:AZN) (£212bn | SR73) | Trial did not meet the primary endpoint of overall survival vs docetaxel in patients with NSCLC. | ||

GSK (LON:GSK) (£74.3bn | SR91) | Voluntary agreement “delivers on all four of President Trump’s requests” and will reduce the cost of prescription medicines on products used to treat more than 40m patients in the US. | ||

Londonmetric Property (LON:LMP) (£4.34bn | SR57) | Sold £64.4m of retail assets at NIY of 4.98%, in line with book values. Has acquired £26.2m of warehousing at a NIY of 6.90%. Expects further acquisitions shortly. | ||

Harbour Energy (LON:HBR) (£2.92bn | SR69) | Acquiring LLOG for $3.2bn ($2.7bn cash, $0.5bn HBR shares). Deal marks “strategic entry” into US Gulf of America. Oil-weighted production of 34 kboepd w/ op costs of $12/boe. 22yr reserve life. | AMBER = (Roland) This is a fairly big deal that seems a little more expensive than the company’s recent North Sea bolt-on purchase. Moving into the Gulf of America is also likely to add both complexity and leverage at a time when oil prices have been falling. The quality and optionality within LLOG’s portfolio may well justify this decision – I don’t know. But as an equity investor I feel a little more cautious about the risk-reward balance here than I did prior to this acquisition. While the company’s plan for a change to its dividend policy makes sense to me given the current uncovered payout, my feeling is that shareholders should also expect a lower yield going forward as Harbour increases its focus on buybacks. My initial view is that Harbour shares are probably fairly valued at current levels. | |

Rank (LON:RNK) (£494m | SR68) | Enracaha and Yo have been the victim of a payment fraud, which in aggregate has totalled c.£7m. | AMBER/GREEN = (Mark) [No section below] While the amounts here are not really material for the business as a whole, they may well be material for this part of the business which looks like it generates around 5% of their Net Gaming Revenue. They don’t give details beyond saying “payment fraud” so this could range from the use of stolen card details on their platform, to employees being tricked into sending company money to fraudsters. Whichever it is, this is a pretty embarrassing revelation and shows that systems may not be as robust as the company would like us to believe. However, the 5% drop in the share price today, wipes £25m off the market cap, so if this is limited to just these subsidiaries, it is potentially an over-reaction to this uncertainty. Hence, I don’t think it is material enough to change Graham’s previously mostly positive view at this stage. | |

Rockhopper Exploration (LON:RKH) (£456m | SR38) | Budgeted costs unchanged at $2.1bn. The placing announced in July will now proceed, raising $142m at 53p per share to fund RKH’s equity portion of Phase 1 of Sea Lion. | ||

MHA (LON:MHA) (£447m | SR81) | Acquiring Moore Stephens LLC and Moore Stephens Consulting LLC (audit & tax/consulting arms) in UAE. Paying c.£7.4m (50/50 cash/shares). FY25 EBITDA expected to be c.£1.1m. | ||

PZ Cussons (LON:PZC) (£318m | SR77) | Jan Brammall appointed CFO, she is joining from Severfield. Previous CFO announced departure in September. | AMBER = (Mark) [no section below] Commenting on this appointment the company says that they are “confident that she will make a very significant contribution to the leadership of the business, helping to deliver improved profitability.” I remain less-convinced. Her tenure at Severfield has been mixed, with recent events casting a long shadow. Severfield finding themselves with a significant industry downturn certainly wasn’t her doing. However, the 65% fall in the share price there is partly due to the company entering the downturn with a relatively weak balance sheet and significant debt. There are perhaps some parallels with the position PZ Cussons finds themselves in, although the root causes are very different. The positive we can perhaps conclude from this appointment is that she sees more of a chance of near-term recovery at PZ Cussons, than at Severfield. How much of that will be due to her business acumen remains to be seen. | |

Pantheon Resources (LON:PANR) (£245m | SR19) | SP -43% Dubhe-1 well has been on clean-up for two months, so far it has produced 100k barrels of water, 20m cubic feet of gas and only 100 barrels of oil. The company says it’s only flowed 50% of the stimulating fluid injected when the well was fractured and may need to flow more water before achieving meaningful oil production. But it’s uncertain and management have decided to pause testing for further analysis and to “reassess our operating cost base” – winter flowback operations are costing c.$150k/day. | RED (Roland) [no section below] Commiserations to any holders. Initial results from the much-hyped Dubhe-1 well appear to have disappointed, at least so far. While the company says there is still some hope, flow testing is being paused due to high winter costs. According to an update earlier in December, Pantheon has spent $33m on this well so far, with little to show for it yet. If nothing else, this is a useful reminder of the importance of reading to the bottom of RNS statements. This update starts with an optimistic-sounding shareholder letter about the exciting prospects that may lie ahead. However, the real news was below this, covering disappointing Dubhe-1 results and the news that Pantheon doesn't expect to drill an appraisal well for Kodiak next winter, at the earliest. Looking ahead, preparations for a US listing have now been paused and management are looking for partners to help fund future development work. Pantheon has raised c.$46m in new equity so far in FY26 and says it had $27m of cash on 21 December, prior to some outstanding Dubhe-1 related costs. However, the company’s FY25 results (y/e 30 June!) haven’t yet been published -- the shares will be suspended if the results aren't issued by the end of the year. Pantheon has no revenue and very little funding, while oil prices are falling and the firm's equity is much less valuable than it was yesterday. I would speculate the company might soon be short of cash again. I think it’s prudent to take a cautious view today. | |

CLS Holdings (LON:CLI) (£231m | SR49) | Buyer is London Square, sale conditional on certain planning criteria. Best estimate is that “current valuation of the site will be achieved” if the transaction completes (c.£70m). | ||

Duke Capital (LON:DUKE) (£149m | SR68) | Investing £3m existing partner Tristone, a care provider. £2.5m will be used as credit financing (yield 13.5%), with remainder increasing Duke’s equity stake from 28.4% to 51.0% post-deal. | AMBER ↓ (Mark) | |

Shield Therapeutics (LON:STX) (£120m | SR40) | US FDA has approved extension of indication for ACCRUFeR (treatment of iron deficiency) to include adolescents. | ||

Invinity Energy Systems (LON:IES) (£104m | SR10) | Sale to Pacific Northwest National Laboratory. Will be used to demonstrate the potential for batteries to provide grid services. | ||

Watkin Jones (LON:WJG) (£73.4m | SR75) | Brownfield site in Wimbledon will be redeveloped. Expected to generate £40m of revenue at margins consistent with guidance. | AMBER/GREEN = (Roland) [no section below] I covered Watkin Jones’ latest results on Tuesday last week. One concern I had was that the company’s pipeline of future work looked a little weak in places. Today’s update won’t solve this, but it does seem to be a step in the right direction. Revenue of £40m over 2.5 years is probably material for a company generating c.£300m of annual revenue. I note that commissioned research provider Progressive has published FY26 forecasts following our coverage last week – its estimates suggest revenue of £306m and adjusted EPS of 2p in FY26, consistent with Stockopedia consensus. While FY26 EPS is forecast to be below the FY25 figure of 2.3p, last year’s results included a substantial contribution from a large, one-off property disposal. Looking ahead, Watkin Jones has substantial net cash and its forward pipeline is seemingly starting to recover. With the stock still trading at a deep discount to book value, I don’t see any reason to change my previous moderately positive view today. | |

Enwell Energy (LON:ENW) (£67.3m | SR96) | Attacked by Russian military drones, resulting in “significant damage”. Facilities had previously been mothballed so there were no active operations. No casualties. | ||

ECO Animal Health (LON:EAH) (£66.1m | SR88) | European Commission has adopted a decision granting EU marketing authorisation (MA) for ECOVAXXIN® MS, the Company's poultry vaccine against Mycoplasma synoviae. | ||

Caspian Sunrise (LON:CASP) (£64.8m | SR41) | Acquisition of Tau-Cen LLP, a Kazakh registered limited liability partnership for $0.7 million ($0.35m cash and $0.35m by the issue of 5,223,881 shares.) | ||

Atlantic Lithium (LON:ALL) (£59.2m | SR9) | A revised Mining Lease has been submitted to the Parliament of Ghana and referred to the Select Committee, per the necessary process for ratification. | ||

Helix Exploration (LON:HEX) (£51.2m | SR14) | PSA compressor has been fully assembled and is en route to Rudyard, expected in 3 days. Commissioning is expected to take 4-5 business days once onsite. Offtake agreement discussion ongoing. | ||

Ondine Biomedical (LON:OBI) (£49.9m | SR4) | Significant research collaboration with LMU University Hospital Munich. | ||

Naked Wines (LON:WINE) (£49.1m | SR88) | Panmure Liberum will conduct a Reverse Accelerated Bookbuild to buyback £2m of shares on the company’s behalf. | AMBER (Mark) [No section below] This announcement is like a placing in reverse. Instead of potential investors submitting bids for how much they would buy at a given price, they submit how much they would like to sell. The final price will be the lowest price point within the range at which the total sales equals or just exceeds the number of shares made available. Shares are then bought at this single, final price from all investors who bid at or below that price. In many ways, it is the fairest way to price the buyback a block of shares. However, it has a couple of problems. Firstly, it favours institutions or larger investors who are able to access the bookbuild quickly. Secondly, it may attract short-term speculative investors. In this case, those who can borrow shares, could bid to sell them to the company at a high price, hoping to buy back in the market lower. In reality, the market likes this move today, with the shares up 4%, so even smaller shareholders are unlikely to be too concerned. We haven’t reviewed this on the DSMR recently. Fundamentally, it seems to be trading well, looks expensive on earnings but cheap on assets, so I’ll stay neutral. | |

Helium One Global (LON:HE1) (£34.5m | SR12) | Start-up and commissioning of the Pinon Canyon processing facility completed with helium gas now being successfully processed. Short term offtake contracts expected to generate sales in January. | ||

Strategic Minerals (LON:SML) (£33.2m | SR35) | Cuprum will now pay the Company the sum of A$150,000 by no later than 24 December 2025. Following the payment of the First Instalment, the parties by which Cuprum will acquire LCCM from the Company and will make a payment of A$1,750,000 on the earlier of (i) completion of the Definitive Agreement, or (ii) 31 May 2026. | ||

Corcel (LON:CRCL) (£33.2m | SR8) | Loss of £7.02 million (2024: £3.04 million). July placing added £1.1m, the accelerated exercise of outstanding warrants contributed £3.9m and £3m raised in December at £0.0035 per share, providing full funding for planned technical work in Angola and continued execution of the international growth strategy. | ||

Ariana Resources (LON:AAU) (£32.2m | SR36) | Xinhai to make an A$8 million equity investment to be completed in Ariana CDIs inclusive of the payment of a A$500,000 Signing-fee, at a price of A$0.30 per CDIs. | ||

Christie (LON:CTG) (£25.6m | SR64) | Vennersys, its loss-making visitor attraction software business sold to Digitickets for £0.5m +£0.9m CoCo. | AMBER/GREEN = (Mark) [no section below] | |

Solvonis Therapeutics (LON:SVNS) (£19.1m | SR32) | SVN-001, continues to advance through a potentially pivotal Phase 3 clinical trial for severe AUD in the United Kingdom. “Solvonis enters 2026 with a diversified CNS pipeline spanning late-stage clinical development, near-term regulatory catalysts, and early-stage discovery programmes supported by external validation and non-dilutive funding pathways.” | ||

Indus Gas (LON:INDI) (£17.6m | SR59) | Half-year Financial Report & Proposed cancellation to trading on AIM | Delists on 22nd January, with 82.7% shareholder Gynia Holdings supporting the delisting. H1 Revenue +71% to $4.0m, PBT +56% to $1.9m. 3rd party net debt $168m (FY24: $169m). | |

East Star Resources (LON:EST) (£16.6m | SR18) | Drilling identified 120m of disseminated sulphides, including 90m @ >20% pyrite at Rulikha North. Follow up work programmes planned in 2026 | ||

Mineral & Financial Investments (LON:MAFL) (£15.5m | SR90) | NAV +20% to £13.7m. Cash £209k. | ||

Catalyst Media (LON:CMX) (£10.4m | SR25) | 21% share in SIS: PAT +37% to £387k, CMG paying no dividend. SIS will see growth in its overall like for like operating profit, before investment in new titles, in its financial year to 31 March 2026 |

Roland's Section

Harbour Energy (LON:HBR)

Down 6% at 194p (£2.7bn) - Strategic acquisition of LLOG - Roland - AMBER

This FTSE 250 oil and gas producer can trace its roots back to the Premier Oil business. It’s not a stock we cover often, but as it’s very quiet today and this Harbour has announced quite a large acquisition, I thought I’d take a brief look at the details.

To provide a little context, this is the third transaction Harbour has announced in the last two months:

12 Dec 25: acquisition of UK North Sea firm Waldorf out of acquisition for $170m, adding 20 kboepd of “oil-weighted production” and 2P reserves of 35 mmboe (c.$4.90/boe). Transaction is also expected to release c.$350m of cash currently posted to secure Waldorf’s decommissioning liabilities + tax losses.

8 Dec 25: sale of Natuna Sea Block A and Tuna development project in Indonesia for $215m in cash

LLOG Acquisition

Turning to today’s deal, here are the main highlights:

Harbour is acquiring LLOG for $3.2bn, comprising $2.7bn cash and $0.5bn in Harbour shares

LLOG operates in the US Gulf of America where it has 34 kboepd of production with operating costs of $12/boe;

LLOG production will increase HBR group production by 7%, on a H1 2025 pro forma basis;

LLOG comes with a 2P reserve life of 22 years and will add 271 mmboe of 2P reserves to Harbour’s portfolio (an increase of 22%) – a cost of $11.81/boe;

Production from LLOG assets is expected to “approximately double by 2028”;

The acquisition increases Harbour’s oil weighting and extends the group’s 2P reserves life from seven to eight years.

This acquisition appears to be nearly three times more expensive than the recent Waldorf acquisition on a $/2P boe basis. However, this may reflect the scope for further upgrades in LLOG’s portfolio and perhaps other financial factors. Without in-depth analysis, it's hard to be sure of the exact basis for the valuation.

Financing & Debt: while management expects the contribution from LLOG to be accretive to free cash flow per share from 2027, the $2.7bn cash portion of the deal seems likely to add significantly to leverage, with $2bn of new lending:

A $1bn underwritten bridge facility

A $1bn term loan

Harbour’s existing sources of liquidity

In addition to this, c.175m new shares will be issued at 215p ($0.5bn). This is expected to give LLOG shareholders an 11% stake in HBR, when the existing buyback completes in Q1 2026.

Harbour reported net debt of $4.2bn at the end of September. Assuming this remains broadly unchanged suggests the group’s pro forma net debt may now be $6.9bn.

Dividend: The company makes the following statement on shareholder returns today:

Intention to move distributions policy to a payout ratio approach in 2026, incorporating a base dividend and share buybacks, to align with international and US oil and gas peers

Harbour has been noted for its generous dividend policy in recent times and the shares currently yield nearly 10%. My reading of this statement is that the dividend is likely to be cut from next year, with additional variable payments returns made through buybacks.

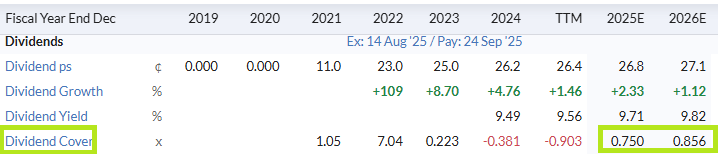

Given that the current payout is not covered by forecast earnings, a change to the distribution policy isn’t entirely surprising in my view:

Roland’s view

This acquisition will increase Harbour’s operational control of its production and its weighting to both oil and OECD jurisdictions. Despite weaker oil prices recently, the political environment in the US is obviously favourable for oil drillers; perhaps more so than in the North Sea.

I’m not familiar with LLOG, but this firm appears to be a mid-sized operator whose assets should increase the longevity of Harbour’s portfolio and provide some growth opportunities.

I can see the rationale for this deal, but as an equity investor I do feel a little wary about the amount of debt involved here.

While this business can be highly cash generative, the amount of surplus cash it produces does depend heavily on the oil price. In contrast, the cash flows required to service the company’s debts do not vary with the oil price – they stay the same. This can be a problem for oil producers that gear up at the wrong point in the cycle.

Harbour’s current guidance is for 2025 free cash flow of c.$1.0bn. However this was achieved during a year when oil prices were often higher than they are currently:

Taking this $1bn as a free cash flow benchmark, I estimate the additional debt announced today means the business may be valued on a EV/FCF multiple approaching 11x.

For me personally this is probably high enough, especially given the potential for a dividend cut and the complexity of a further large acquisition.

Harbour may offer value at current levels, but I think the growing debt pile also carries some risks unless oil prices start rising again.

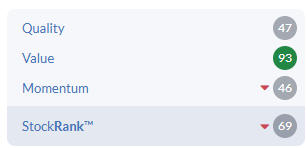

I’d prefer to see a consolidated set of accounts and 2026 guidance before forming a stronger view, so I’m going to mirror the StockRanks and leave our previous neutral view unchanged today.

Mark's Section

Duke Capital (LON:DUKE)

Up 1% at 29.5p - Follow-On Investment into Tristone Healthcare Ltd - Mark - AMBER

This sounds like a simple follow on investment in an existing holding. However, when I look at the details, they worry me slightly:

…a follow-on investment of £3.0 million into its existing capital partner, Tristone Healthcare Limited ("Tristone"). This investment will enable Duke to become the majority shareholder in Tristone, moving from 28.4% ownership currently to 51.0% post-deal, as well as assist in the funding of future deferred consideration payments relating to prior bolt-on acquisitions.

Unlike in the past, this financing is not said to be so the investee can grow via acquisition, but instead to meet the agreed payments from previous acquisitions. I would argue that the implication is that Tristone might not be able to afford to meet these obligations without this capital raise.

Then there is the structure of the deal:

£2.5 million of Duke's additional funds will be invested as additional credit financing in Tristone, bringing the total credit financing amount to £24.3 million

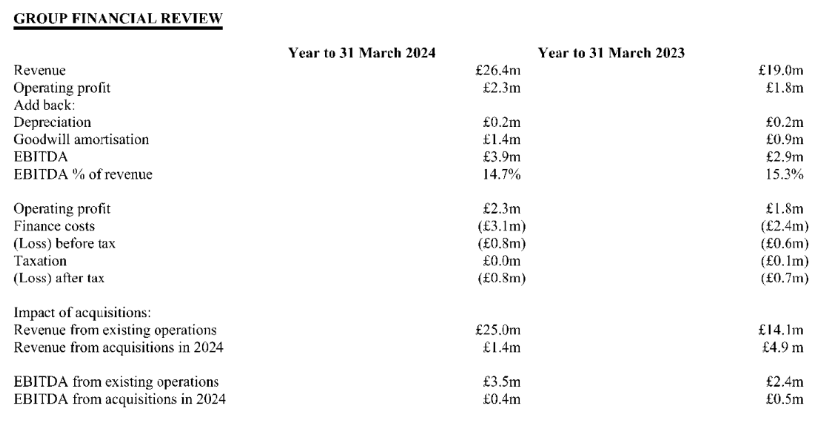

Looking at Companies House, the accounts for Tristone are from 21 months ago now. I would speculate that this might be because they have not been able to complete the accounts to 31st March 2025 on a going concern basis until this funding was agreed.

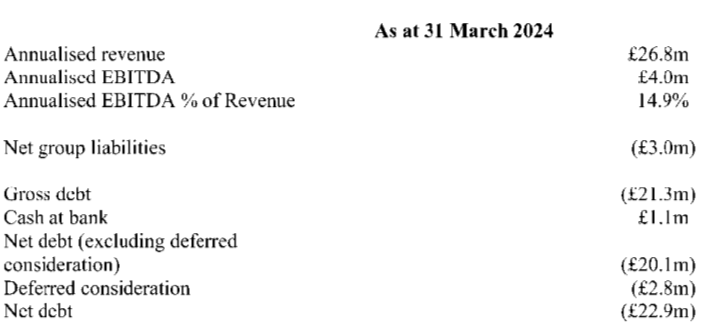

For the year ended 31st March 2024, Tristone had £4m of annualised EBITDA, meaning that Duke has now lent them 6x that figure. That’s a leverage ratio that would often make banks highly uncomfortable.

At least the interest rate reflects the risk they are taking here:

The investment terms are the same as Duke's initial investment into Tristone, including a yield of 13.5%

The other side of this transaction is:

The balance of funds will be invested as equity and used to acquire a further 22.6% stake in Tristone, bringing Duke's total equity ownership from 28.4% currently to a 51.0% majority stake post-deal

So that’s £500k paid for 22.6% valuing the whole business at £2.2m and Duke’s enlarged stake at £1.1m.

In June, they also put fresh capital in, on the following terms:

As part of the deal, Duke will also invest £500k of additional equity in Tristone, increasing their ownership stake from 21.3% to 28.4%.

The implied valuation here was £7.0m, valuing their stake at £2.0m. This means that in less than six months the valuation of their equity stake has declined by 69% and they have effectively been forced to put fresh capital in.

Looking at the last available income statement for Tristone, they made an operating profit. However, the interest on the loan from Duke, took them into a loss:

Mark’s view

Some investors will see this as Duke taking advantage of their position as pretty much the lender of last resort, to get as much cash out of the business as interest and increase their equity stake on the cheap. I think that may be a good argument if it were not for the fact that it is Duke themselves who have to put in the extra credit and equity finance to enable the investee business to meet its obligations. What worries me most is the difference between what appears to be the reality - a company requiring additional funding to meet agreed payments, whose equity valuation has dropped 69% in less than six months - and the narrative from Duke:

Duke is excited to support Tristone via an additional £3.0m investment, increasing our stake in the business to 51.0% post-deal, and setting up the platform for continued growth in the years to come. The funding creates a stable base to allow Tristone to focus on increasing the number of service users it caters for, as well as ensuring the highest quality of care across the group.

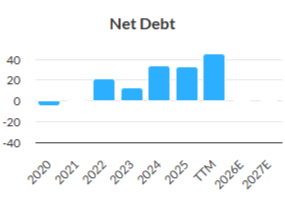

It leads me to question how much of Duke’s portfolio may be on similar leverage multiples, and reliant on further support from Duke to meet their obligations. It clearly can’t be all of the portfolio, as the company has been able to pay a very generous dividend for a number of years. However, that payout has been partly debt-funded:

And the valuation of Tristone leads me to put less weight on metrics such as Tangible Book Value as I may do elsewhere:

We have been mildly positive here in the past based on these sorts of metrics, so I can’t help feeling we should take a more cautious view of AMBER, following the details of this latest deal becoming apparent. There may well be no read-through to the rest of the Duke portfolio, but given that management are resoundingly positive today, how would we ever tell if there was?

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.