Good afternoon. Apologies for me running late today - I've been preoccupied with some very volatile share price movements, on newsflow from 2 of my largest positions - IQE & G4M.

Anyway, the decks are clear now, so I'll spend the rest of the afternoon & early evening writing up on newsflow from: IQE, G4M, EGS, Spectra (reader request), and anything else I have time for.

IQE (LON:IQE)

(at the time of writing, I hold a long position in this share)

This one is now well above our usual market cap limit here of c.£400m, being now valued at a whisker over £1bn, taking into account today's price rise. It's such an interesting company that I hope you will permit me the indulgence of commenting briefly.

I read today's interim results first thing, and was left feeling rather underwhelmed. Adjusted profit before tax for the 6m to 30 Jun 2017 actually fell 5% to £9.6m. That's hardly compatible with a £1bn market cap.

EDIT - here is the link to the investor presentation slides, at the meeting this morning which was confined to just "City analysts and institutions". Everyone else (including me, for the first time ever) was denied entry.

So early doors, the share price plunged from 138p to about 120p. As it's my largest, leveraged position, I was forced to sell some, as a couple of my smaller spread bet accounts had gone onto margin calls.

However, at that point I collected my thoughts, and recalled why I had bought the share in the first place. Namely for the growth potential of multiple new product lines which are coming on stream over the next 2 years. The narrative contained enough red meat on that to satisfy me that holding, and riding out any further price falls, was the right thing to do. Then I did what I often do in situations like this - went back to bed! I'd made my decision, on a rational basis. So now the main risk would be allowing emotions to take hold, and panic selling if the price fell some more.

The good news is that when I awoke for the second time this morning, the market panic had subsided, and IQE was now up 6p on the day. What caused such huge volatility intra-day? I think it must have been a stampede for the exit, possibly driven by stop losses being triggered, from what may have seemed lacklustre interim results? Who knows?

However, most of the valuation of IQE is actually based on projected growth from numerous new product lines. IQE develops highly sophisticated, bespoke wafers for semiconductor companies. Silicon chips are no longer capable of providing the sophistication needed for the latest technologies, so bespoke composite materials are now being used. These are highly sophisticated, and very difficult to make. IQE appears to be the world leader in this technology, and has dominant market share, globally. That's why it's such an exciting growth company.

EDIT - I only (vaguely) understand this share, due to a presentation at Mello Beckenham, by IQE's CFO, Phillip Rasmussen. Thankfully, PI World captured this for posterity on video, and it's really a masterclass in how to explain complex subject matter in an accessible way. This video is a must-watch for anyone who wants to learn about IQE, or to learn how to give accessible presentations. Watch it, and you'll see what I mean. This is the best presentation I have ever seen, from any company. It explains IQE very well. Also, importantly, everything he said 18 months ago, has come true.

I was excluded from the analyst meeting by the company, who refused to give me a seat. That's the first time ever I can recall me not being given access to an analyst meeting.

Usually PR companies & brokers are pleased for me to meet companies. That's because I only ever request to attend meetings where I'm already positive about a share. Also I "play the game", by turning up in a suit, being courteous to everyone, and ask a few intelligent questions!

Plus then my findings are disseminated to 10,000 readers of these reports. So you would think companies would see that as a positive thing. Usually they do. Also, I dislike being told that I'm not an analyst. What the hell are these SCVRs then, if they're not analysis??? It's all a bit of City closed-shop mentality I'm afraid. If you don't work for a City firm, then people assume you're a muppet. I can't stand that attitude, it's so short-sighted, and arrogant. Also, the City analysts are usually NOT independent.

Therefore, it seems that perhaps IQE is now turning its back on the private investor community, and is now courting institutions instead? Whilst that is annoying for us, it's also where the opportunity lies. I think it was either Mark Minervini and/or Ian Cassel, who are both brilliant share trader/commentators, who said that we should be buying shares in the companies that the institutions will want to buy in future. So that strategy is all about spotting big winners early on. Then buying & holding, as institutions spot them too & chase up the share price, often to multiples of where we bought. That's exactly what's happening with both IQE, and G4M (below).

Anyway, broker updates are now filtering through to me, and seem positive about the new growth areas. The first one seems to be the new Apple iPhone, with 3D sensing, which requires chips made from IQE wafers. The RNS narrative from IQE today seems to confirm this, indirectly.

Brokers are also forecasting strong growth from multiple other growth areas. Several brokers are already talking about hiking 2018 and 2019 forecasts up by a large amount. One broker has already mooted earnings could rise to 12-15p range for EPS over the next couple of years. This is what's driving the share price. Personally I see possible upside to 300-500p per share, if that upside scenario plays out.

Anyway, I'm more relieved than anything that this morning's plunge in price was only temporary. It's a reminder of the risks when you take over-sized positions in conviction stocks, which is my strategy (although I use a very strict stock selection process). The drawdowns can be gut-wrenching, as I experienced this morning.

In summary then, the 2018-onwards upside case for IQE seems to be intact, and potentially very exciting, so I'll continue holding for the foreseeable future.

Gear4Music Holdings (LON:G4M)

Share price: 798p (down 1.4% today)

No. shares: 20.9m

Market cap: £166.8m

(at the time of writing, I hold a long position in this share)

Trading update - this is the largest UK-based internet retailer of musical instruments & accessories. It updates us today on the 6 months to 31 Aug 2017.

I flagged an inflexion point in growth in my report here on 6 Sep 2016. That was a year ago. In the short-term, the share price shot up from around 150p to 200p on that positive news last year. Yet that was just the beginning of a much bigger move, as the market's perception of G4M changed from seeing it as a sleepy internet minnow, into a highly rated growth stock. Situations like this are great - if you spot something game-changing early on. In this case that was a major acceleration of growth. Plus international growth starting, with the company accelerating expansion into Europe, and then more recently announcing its global ambitions. So since the original, game-changing RNS a year ago, the share price has roughly 5-bagged. Very nice indeed. I've held it all the way up, following the mantra of "run your winners". There's been a bit of top-slicing along the way of course, but it remains one of my 4 big long positions.

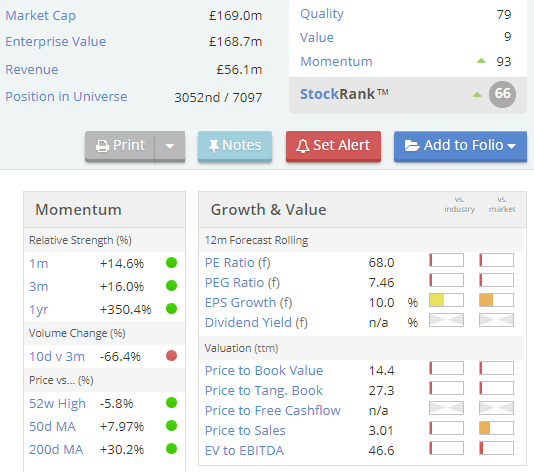

However, when a share is rated on a forward PER of 68, then there's no room for anything to disappoint;

As you can see, the growth & value metrics are very poor. That's because the market is valuing high growth stocks aggressively at the moment. Particularly internet retailers which are gaining market share rapidly, as G4M is.

Note how the StockRank neatly encapsulates things, as it usually does. So the Stockopedia computers see G4M as high quality, with very strong momentum, but poor value (on conventional metrics). I think that is a fair assessment.

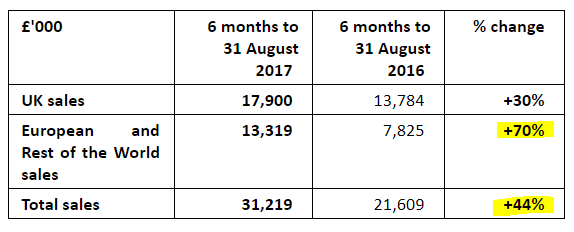

Today's update from G4M is good, in my view. Above all, the top line growth is continuing to be strong, especially overseas;

Clearly the UK market is maturing, but even so, +30% organic growth is highly respectable.

Europe & RoW sales growth is much stronger, at +70%. This is very encouraging indeed, and it's what justifies the premium rating for this share, in my view. Remember that these are only 6m figures. So assuming strong growth continues, then this should be a £100m+ revenues business next year.

The thing with internet businesses, is that they have to achieve scale to become more profitable. During the rapid growth phase, profits are not really of much importance. It's all about gaining market share. Once scale is achieved, then the big marketing spend can be eased back, allowing the profit margin to rise substantially. We've seen this in action with Boohoo.Com (LON:BOO) for example. For this reason, I think it's a mistake to try to value rapid growth companies on a PER basis, as the result will look nonsensical in the early, rapid expansion years.

What else does it say today? This bit is important;

Strong start for new distribution centres in Sweden and Germany

It looked ambitious, opening 2 new European distribution centres at the same time. I know some people wondered whether the company's relatively small management team would be able to cope. It appears they have coped well. I really rate management here highly, it's one of the key reasons to hold this share, in my view. The new distribution centres in Sweden & Germany also have showrooms too, which enables the company to stock certain branded goods whose manufacturers require a local presence. The local distribution centres also allow much faster delivery, and returns, plus localised customer service, and even local purchasing.

The CEO comments include this;

A period of investment into our proposition and infrastructure in H1 has increased our operational costs and restricted margins in the short term.

Encouragingly, revenue growth over the last six weeks supports our expectation that, as previously stated, revenue and profitability is likely to be more H2 weighted in FY18 than in FY17.

The H2 weighting comment might have spooked a few people into selling. If so, they were not paying attention, because all this was flagged in advance! Obviously creating 2 new European distribution centres will incur operational costs in advance of them opening for business. So whilst an H2 weighting comment would normally be an amber flag, in this case it was flagged in advance, and there is a perfectly sensible reason for an H2 weighting. So there's nothing to worry about here, in my view. In fact, the rumblings for H2 sound very positive. With the new distribution centres now running smoothly, I am hoping that H2 might even out-perform against expectations, who knows?

Overall, everything looks good here;

The Group continues to trade in line with our expectations and is well prepared for a busy seasonal period."

My opinion - this is a long-term hold for me. I like niche internet retailers, as there are more barriers to entry than for a business like AO World (LON:AO.) for example, which is just selling generic, low margin electrical products. To my mind, G4M is a much better proposition. It has a huge product range, with many products selling in smallish, but regular amounts. Core product ranges (e.g. guitars) are fairly low margin, but quite big ticket. So if you're selling one item for say £200 (excl. VAT), but it has a 25% gross margin, then whilst the margin is low, it's still £50 profit for each parcel that is shipped - so actually very good business. Also, mostly the musical products don't go out of fashion, and are not perishable.

It's taken G4M many years to develop its own branded range of products, which is a considerable barrier to entry. Own branded product is higher margin too, and is sourced from a network of factories in China.

The niche in which G4M operates is too small, and margins are already quite low, to attract the attention of say Amazon in a big way. So I think the competitive threats are limited. The market leader is Thomann, which operates a different model to G4M, in that it has one large concentrated site. Whereas G4M is going for more local distribution. The market opportunity looks big enough, globally, for G4M to continue gaining market share. This is both from other internet competition, and also the many traditional, High Street music shops, which sadly look set to decline in numbers as internet business grows & takes their market share.

Overall, my view is that G4M remains a good long-term hold, which is what I intend doing. Yes the share looks expensive on conventional metrics, but roll it forward say 5 years, and this should be a very much larger, more profitable business. That's what the share price is anticipating. It won't appeal to value investors of course!

EDIT - there are 2 new broker notes out today on G4M. The one from Edison is freely available, through their website. The house broker, Panmures, has also put out a note which is available via Research Tree.

Edison says that it is leaving forecasts unchanged, but with added confidence.

Panmures strikes a similarly upbeat tone in its update today.

eg Solutions (LON:EGS)

Share price: 110.5p (down 12.6% today)

No. shares: 22.7m

Market cap: £25.1m

(at the time of writing, I hold a long position in this share)

Recommended cash offer - this was a third announcement this morning, which threw me off balance! EGS is a small software company, which specialises in back office optimisation. It has a very impressive client list, and recent newsflow has been strong (hence why I took a long position in it a while back, despite my reservations about greedy management, and the company's poor track record).

As I clicked on the RNS, I wondered what the agreed bid price would be? 200p sprung to mind, as it should be a decent premium to the recent peak of 136p at the end of Aug 2017. Imagine my disbelief, and horror almost, when I read that the recommended cash offer was only 112.5p!

Memo to the Directors of EGS: You're supposed to demand a premium price if you want to sell the business, not a discount!

Maybe Ms Gooch just wants to cash in her chips, to buy more pink stuff? (I've been told that Reception at EGS's offices has a pink colour scheme, and that she drives a pink Bentley).

Reading the Chairman's comments, it's clear that this deal is really all about giving the institutional shareholders in EGS an exit route;

Commenting on the Offer, Nigel Payne, the Non-Executive Chairman of EG, said:

"I am pleased to recommend this offer to our shareholders. The Offer Price of 112.5 pence per share represents a premium of 85 per cent. over the share price of the business just one year ago, a premium of 53.0 per cent. over the last six month's volume weighted average share price and is an attractive exit price when viewed against the fundamentals of the business, against the way comparable small technology companies are currently valued by the market and importantly against what we believe was the last institutional price at which EG's shares traded, which was on 23 May 2017 at a price of 71.7 pence, some 40.8 pence (35.0 per cent.) below the Offer Price.

Since 23 May 2017, we believe there have not been any institutional trades and the median trade is only 2,000 shares with all purchases and sales since that date being driven by small volume trades. Other than in the period since late July 2017, we also believe that there have been no trades in EG Shares at a level at or above the Offer Price in the last decade."

This is quite an interesting point. A lot of smaller companies have effectively 2 markets for their shares. The small trades done by retail investors. Then the institutional trades - which are basically just one institution selling to another.

Irrevocables - to accept the deal have been received as follows;

Directors 18.31%

Employees BT 6.68%

Others 43.01%

Total 67.99%

That's a fairly high level of irrevocables, so this deal looks likely to proceed. A vote of approval by holders of 75% of the shares is required, so it's already close to that.

Note that the irrevocables dissolve if a higher competing bid at 110%+ of the 112.5p existing offer from Verint is tabled. So that's 123.75p+ for a higher competing bid, and obviously the clock is ticking, so if anyone else does bid for the company, they'll have to be quick.

My opinion - I'm so disappointed with this. Just as the company appeared to be making decent progress, the upside is whipped away from us, because the big holders want to cash out. That's very disappointing indeed. OK, I've made a 50% profit on this in a short space of time, so I shouldn't complain too much.

Let's hope another, higher offer appears from someone else.

Spectra Systems (LON:SPSY)

Share price: 106.5p (up 8.1% today)

No. shares: 45.4m

Market cap: £48.4m

Interim results - for the 6 months to 30 Jun 2017.

This is a US-based company which specialises in technology-based security solutions. It used to focus on banknote cleaning (yes, that is a thing!), but seems to have made a breakthrough in performance for other services to central banks, and security features for other sectors, e.g. mobile phones.

Checking our archive to refresh my memory, I flagged here on 4 Jan 2017 that the share might be worth a fresh look. However, foolishly, I didn't follow up on the idea. It's since 3-bagged! Graham reviewed it here recently, in Aug 2017, finding it intriguing & potentially worth taking a closer look at.

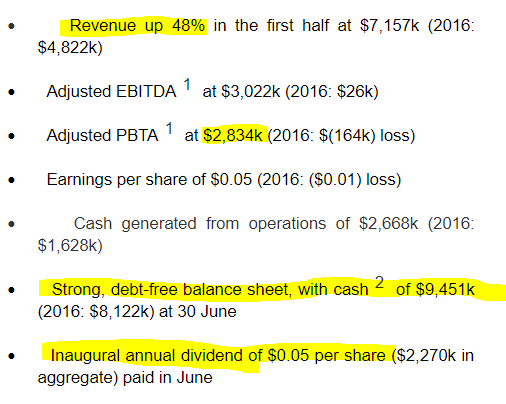

Interim results out today look fantastic;

The company has gone from around breakeven, to suddenly making big profits (relative to its size). The danger with that, is that it might be unsustainable - if the company has just happened to win a one-off contract.

I particularly like that SPSY is cash-rich, and has announced a generous inaugural dividend too. So it ticks a lot of the boxes which I like.

My opinion - for now, I don't have time to really research this in-depth. Therefore, I'm just flagging up the stock idea, for readers to have a look at, if you wish.

The key question is how sustainable this big jump in profits is? This company has had false dawns in the past, e.g. in 2014. The bank note cleaning division has never interested me. However, if other divisions have now hit on new, lucrative revenue streams, then the picture may be more positive? I don't know, as I've not done anywhere near enough research on it.

What do readers think? Is this a stock we should be looking more closely at? It's certainly on my shortlist, to take a deeper look, when time permits. Reader comments welcomed, as always.

I'm done for today. See you in the morning.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.