Morning!

News has been a bit hectic over the past few weeks, as companies updated for trading to the end of 2017.

Edit: Thanks for your requests, I am now also looking at Computacenter (LON:CCC) and Learning Technologies (LON:LTG).

I am updating my schedule today as follows:

- Accrol Group (LON:ACRL) - interims to October 2017

- Dixons Carphone (LON:DC.) - Christmas trading update

- Connect (LON:CNCT) - trading update

- Animalcare (LON:ANCR) - trading update

- Strix (LON:KETL) - trading update

- Revolution Bars (LON:RBG) - trading update

- Computacenter (LON:CCC)

- Learning Technologies (LON:LTG)

To cover everything, my usual article length will have to be cut - apologies in advance!

Graham

Accrol Group (LON:ACRL)

- Share price: 36.5p (+1%)

- No. of shares: 129 million

- Market cap: £47 million

To recap: this loo roll cutter listed on AIM at 100p in 2016, ran into financial difficulties last year, and has now resumed trading at a much lower level, after raising fresh equity.

The major cause of the difficulties was that the commodity Accrol uses, hardwood pulp, increased in price by 40%. Passing on this price increase to discount retailers couldn't happen fast enough to prevent a serious deterioration in the company's performance.

Indeed, Paul went back to the company's admission document, and found the risk warning where they stated in black and white that hardwood pulp was currently experiencing "oversupply", and that if its price increased, it would adversely affect the company's performance.

So it's another classic example of a well-timed IPO as investors got caught out by temporarily strong earnings, just before it floated.

Anyway, what next?

These results show revenue +13% to £72 million, but loss of margin results in a 35% reduction in gross profit, pushing the company into an operating loss of £5.7 million.

The company has a new CEO and COO, and has received £16.8 million in cash from investors through a placing.

The key debt-related figures are as follows:

- £29 million at October 2017

- Accrol then raised £18 million in a Placing, or £16.8 million net of expenses, so debt would have been reduced to c. £12 million if all funds were used for debt reduction and no further losses experienced.

(Of course, the funds raised weren't only used for debt reduction/working capital management. They are also being used for restructuring operations and improving health and safety procedures, which is an area where the company has had some difficulties in the past.)

- In November, the company forecast it would have maximum net debt of £23 million by April 2018. Latest broker forecasts are suggesting that net debt will rise to £24.6 million by April 2019.

Margins - this key operational metric has collapsed, down to 18% in the most recent period, from 28% in the equivalent period the year before.

Much more than investors may have realised, therefore, this stock is in large measure a bet on pulp prices. Passing on the price rises to customers is happening, but at the expense of top line volumes, and what if pulp prices keep rising? Won't the company suffer these same difficulties again?

My opinion - as flagged when I covered this company last, I think Accrol would need to raise more funds if it suffered a little bit more bad luck, e.g. if pulp prices rose again, if it hit against unexpected FX tailwinds, or if the operational measures it's taking turn out to be more expensive than forecast.

The net debt level is forecast to increase and is already not far off the level at which it was forced to raise more funds.

Arguably, there is a high-risk/high-reward equation here, so that if it did manage to avoid raising any more funds, and worked its way back to profitability, especially with the help of some macro tailwinds, then it could be very cheap at the current level. Maybe if you have a gambling mindset, it could be an entertaining trade! But not one for me, I'm afraid.

Edit: thanks to tabhair in the comments for pointing out that the CFO has resigned, to "pursue other interests". While the company might benefit from a replacement, I think this news elevates the risks involved for shareholders.

Dixons Carphone (LON:DC.)

- Share price: 194p (+3%)

- No. of shares: 1153 million

- Market cap: £2,237 million

Christmas 2017/2018 Trading Statement

I'm covering this well-known electricals/phone retailer as it is another important barometer of high street activity, which has knock-on effects for many other companies.

The Christmas update is a Q3 update for the full financial year, which ends in March.

It's a positive update:

- UK & Ireland Like-for-like revenue +3%

Electricals were a bit weaker at 1%, but mobile was up 8% with the help of the new iPhone.

International growth was stronger again versus the UK. Very positive in the Nordic region and Greece.

The "Headline PBT" forecast for the full-year is narrowed from £360 - £400million range, to a 365 Agile (LON:365) - £385 million range.

The company believes it grew market share in UK&I, i.e. that most competitors will have done worse than 3% LFL growth.

That's probably right. According to the ONS (external link), December retail sales across all segments were up just 1.4% by volume, the slowest growth since 2012.

If you add in the effect of inflation of 3%, spending was up 4.4%.

While I don't have the time to do a full assessment of Dixons Carphone (LON:DC.) as a potential investment opportunity right now, it's worth pointing out that its net debt level of £250 million is only a sliver of the company's market cap, and is lower than the net income forecast for this year alone.

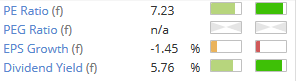

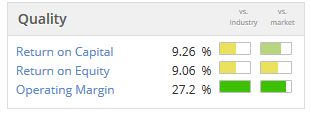

It's trading very cheaply, no doubt as a consequence of the general gloom hanging over retailers, and looks worthy of a second look in my opinion:

For the high street generally, what can we take away from this update? I suppose it shows that in the current environment, it's more important than ever to find the stores which are growing market share - because if you're not growing market share, you're likely to be shrinking on an absolute basis in these conditions.

And with the cost pressures facing these companies, a bare minimum level of sales growth is needed just to stand still in terms of earnings.

I'm taking a balanced approach to the sector, being careful to only own my favourite names in my own portfolio, and keeping their combined weighting to a moderate overall level.

Connect (LON:CNCT)

- Share price: 75.7p (-28%)

- No. of shares: 248 million

- Market cap: £187 million

This is a specialist distributor with a particular emphasis on newspaper and magazine wholesaling.

Paul last covered it in October, noting that huge dividend yield it offered at the time (the share price was 96p). Offsetting that was the risk from the secular decline in newspaper volumes, and the company's debt and pension deficit position.

The market really doesn't like this update, though it doesn't sound that bad on the face of it:

Total Group revenue for continuing operations of £564.5m (FY2017: £584.9m) has decreased by 3.5% year to date, with the anticipated decline of newspaper and magazine sales more than offsetting revenue growth in Mixed Freight and Pass My Parcel (PMP).

Newspapers and magazines are performing in line with expectations in terms of profitability, but the other divisions aren't doing so well.

A nasty combo of contract delays, low margins and "market uncertainty" in Mixed Freight, and slower than expected cost reductions, reduce the anticipated PBT result for continuing operations for the entire group to a £42 - £45 million range.

According to the estimates available to me, previous guidance was for this come in around £49 million. So this is a material profit warning.

The rest of the statement is not very comforting. Planned cost savings of £15 million over two years will be more heavily weighted in the second year - shareholders can be sceptical about this, because weightings towards later periods have a habit of not happening.

Books division - it was in fact a double-whammy of bad news today, as Connect is potentially in dispute with a German investment vehicle which had (allegedly) agreed, conditional only on anti-trust approval, to buy Connect's books division. The vehicle now says it's not going forward. It's only a c. £12 million deal, but another unwanted distraction

My opinion - I'll be steering clear of this, as I find logistics a very difficult sector at the best of times. But it's worth noting that Connect (LON:CNCT) is still profitable. And it's operating in the hyper-depressed newspaper sector, which nobody wants to invest in. So if you are willing to do the research and satisfy yourself about the company's financial position, it could be a rewarding use of your time.

Royal Mail (LON:RMG) has a StockRank of 98, and a 500-year history. So I'd probably buy shares in that first, before I started researching Connect!

Animalcare (LON:ANCR)

- Share price: 295p (unch.)

- No. of shares: 60 million

- Market cap: £177 million

As you might guess from the name, this is an animal healthcare company.

It looked very attractive to me up until it engaged in the reverse-acquisition of a large Belgian company operating in the same space, in a deal which weakened the balance sheet and created massive dilution for existing Animalcare shareholders. At that time (July 2017), I thought the shares had become overpriced.

The shares have been drifting lower since then, so it might be worth putting them on our watchlist again.

Animalcare has deep relationships with vets and indeed with pets thanks to its range of medical products which are complemented by its microchipping business - it runs the second-largest pet microchip database in the UK.

Much hinges now on the integration of Animalcare with its European entity. Today's update informs us:

The integration is progressing as anticipated, but it is still at an early stage and as expected margins for the period to 31st December 2017 have yet to reflect the synergies that we expect to realise in the medium- to long-term. The Group is implementing a wide-ranging change agenda in order to establish a strong platform for the future that will deliver long-term shareholder value through the many opportunities available.

If the integration works, it could lead to a really successful and stable business.

It all became a bit too uncertain for me to want to get involved, but I could see these shares becoming a value opportunity again if they keep drifting, and as we get more news on the integration. Stay tuned.

Strix (LON:KETL)

- Share price: 142.5p (+3%)

- No. of shares: 190 million

- Market cap: £271 million

Strix listed in August 2017. It owns the patents for kettle safety controls, and has the global no. 1 position in this arena.

This is a full-year update for 2017. It is in line with expectations.

Global market share is maintained at 39% by volume (the company website previously put its market share at 38%).

Plans are on track with new product launches and newly-automated procedures.

My opinion - this share is increasingly attractive to me, due to its market-leading position, and simple products.

We need updated financial statements to settle the nerves, as the company was reorganised for its IPO. At the moment, it still carries the general risk that comes with newly-floated shares. The vendors left it with some net debt, which is now estimated to be at £48 million. So that needs to be taken into account when looking at the cheap-ish PE ratio of c. 11x. And the customer list is a bit concentrated.

All that being said, I'm genuinely intrigued about the potential here. In the small-cap space, it's not too often we get to invest in companies with huge global market share in their industry. Full-year results are due on March 22.

Revolution Bars (LON:RBG)

- Share price: 172p (+3%)

- No. of shares: 50 million

- Market cap: £86 million

This bar operator updates for the half-year ending December 2017.

It was all drama last year, with a major profit warning, personnel changes, takeover offers, etc.

See for yourself:

An all- cash offer was received at 203p per share, but the necessary 75% of votes in favour of the proposal could not be found.

Anyway, today's update bullishly presents a 10.6% increase in total sales and a 1.9% increase in LFL sales. Sales and profits are in line with expectations.

The LFL comparison uses a little bit of adjustment, taking 27 weeks to January 6 for each year, so as to include New Year's Eve.

I've had a quick look at Revolution's annual report for 2017, to see what is going on.

From the annual report:

The company has an accounting reference date 30 June and prepares accounts to the Saturday closest to this date. Throughout this report references to "2016" relate to the 53 week period ended 2 July... when discussing LFL metric the prior period comparisons have been adjusted to reflect an equivalent 53 week period.

Because the company always uses a Saturday as its year-end date, it creates this slightly messy half-year situation.

Last year, the 26-week period ended exactly on New Year's Eve.

This year, it ended the day before, creating an imbalance for comparative purposes.

So we have a 1.9% increase in LFL sales for H1. Within this, Q2 was up 3.1% and the 4 weeks in December were up even more. So the trend accelerated as the period continued.

Without the adjustment to include New Year's Eve, LFL sales are considerably less attractive: just +0.4% for H1, and +0.6% for Q2.

How to interpret this? Firstly, you need to trust that management aren't manipulating the figures. It seems reasonable to add an extra week to H1, so as to include New Year's Eve. But remember that if you do that, you can't also incorporate the benefit from NYE in your H2 numbers.

The other thing it implies is heavy reliance for performance on just a few days of the year. That goes with the territory in this sector, but it's a reminder of the risk you're exposed to.

Total sales were £73.7 million, helped by four new venues opening (Belfast, Solihull, Inverness, Putney).

Restatement - There were some accounting issues last year, noticed and remedied in H2. So the upcoming H1 results will show restated H1 accounts for last year. That's fair enough.

Outlook comment from the Executive Chairman is confident.

My opinion

I view the shares as approximately fairly valued. I understand that the company seeks to differentiate itself as a premium offering, but I tend to think of the bar/pub scene generally as being very price-competitive, except at the absolute top end.

If we generously ignore all of the "exceptional costs" from last year, the company earned £8 million in operating profit. Revenues are forecast to grow another 12% or so this year, and with the help of a little operating leverage, pre-tax profit is expected to grow to reach c. £10 million.

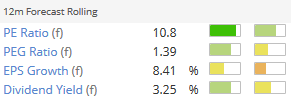

That's how we get the following value metrics:

Again, that's probably about right, in my book, for a bar chain which is performing reasonably (assuming the adjusted LFL figures are the most relevant ones).

Personally, because of how the sector works, I'd need an above-average and well-covered dividend yield to invest in a bar/pub chain.

Stonegate were willing to pay more than the prevailing share price, because of their capability to strip out central costs, so that earnings would be higher within their stable. The company is not worth quite so much as an independent entity.

Also, 61% of votes were in favour of the Stonegate offer in October, so we already know that many shareholders would have been happy with 203p.

I can see this recovering toward 200p as the company continues to make progress. And then it will be up to the economic winds to determine what happens next. Putting my technical analysis hat on for a moment, I would expect to see psychological "resistance" at 203p!

Computacenter (LON:CCC)

- Share price: 1170p (+0.5%)

- No. of shares: 123 million

- Market cap: £1,435 million

This is a popular share in the comments. It was chosen by Ed for his New Year NAPS last year, having first entered the portfolio in 2015.

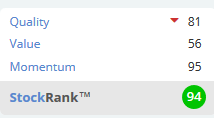

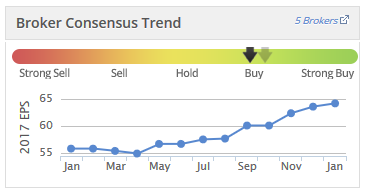

Share price performance has been excellent, and the Value Rank has moved back to an average level. The Quality Rank and Momentum Rank are thus the key attractions:

Some people hate the name, but it's a serious business, providing a wide range of IT infrastructure services to businesses. If It was listed on the NASDAQ instead of in the UK, it would probably have a PE ratio of 40x!

Estimates for 2017 were repeatedly upgraded. Today's update says results they will be ahead of the expectations given in November.

Rather than spending too much time analysing 2017, let's go straight to the outlook:

While we believe the positive momentum in the market is set to continue, there will be a number of one-off costs and investments within the Group in 2018 that will not repeat in 2019, which will hold back the enhancement of profitability in 2018. While it is still very early in 2018, the Board expect the year to be one of stable profitability.

This company produces forecasts and results in a clear and straightforward manner, which is one of the benefits of big-caps.

As 2018 progresses, maybe the share price momentum is finally going to run out, now that profitability is set to stall?

The long-term outlook remains fine, however. It has an impressive mix of public and private customers, which look like they might be quite "sticky" business.

I haven't spotted any red flags with it and suspect that it could be a good buy-and-hold investment.

Learning Technologies (LON:LTG)

- Share price: 84p (+12%)

- No. of shares: 572 million

- Market cap: £480 million

Thank you to readers for flagging this in the comments.

I covered this e-learning business in July, when the share price was 49p. Unfortunately, I had to put it into the "too difficult" basket, due to its acquisitive "buy and build" strategy.

Some far-sighted people have been discussing it here at Stockopedia, at this thread.

Today's news is an update for the full-year to December 2017. Adjusted EBIT and cash are both materially ahead of expectations.

Total revenues have almost doubled from £28 million to £52 million. This is partly driven by the £54 million acquisition of NetDimensions Holdings (LON:NETD) in March last year (see management interview here - external link).

On the much more interesting organic basis, revenues are up by more than 20%. The CEO discussed performance this morning in an interview which can be viewed here.

Note that one of the reasons for the improved cash position is the exercise of employee share options. I feel I must point out that this is not a positive event for external shareholders! The company gets cash from options being exercised, but at the cost of diluting the company's other owners.

The cash was also boosted by software licenses which were invoiced in Q4 - but I don't think all of these sales will have been recognised as revenues yet.

Those are only minor points. The big question is whether the company will succeed in its strategic objective:

In October we announced our new strategic objective to deliver run-rate revenues of £100 million and run-rate EBIT of £25 million by the end of 2020, financed through the use of internally generated operating cash flows and prudent debt financing, minimising dilution for shareholders. These impressive results for 2017 are an encouraging indicator of the progress that is being made towards this ambitious goal."My opinion - firstly, congratulations to those who have held this over the past couple of years.

I like the CEO's interview style. While he is describing a superb performance by the company for the year, he is careful to point out that the cash boost was thanks to some one-off factors and that it still won't be easy to reach the strategic objectives.

Apparently, the company started out as a professional services business. It was charging customers for its employees' time, but it wanted to evolve towards being a software business with recurring revenues. From an investors' perspective, the latter is far more attractive than the former! And on a run-rate basis, recurring revenues are now more than the 39% mentioned in today's update.

Company-commissioned research suggests that adjusted PBT will have been £13 million for 2017, rising to £14.6 million in 2018, off £56 million of revenues.

I don't think anybody can deny that the valuation of nearly £500 million is now at the expensive end of the scale, versus those forecast earnings. To justify the current share price, and achieve its goals, further acquisitions will be required.

Let's keep an eye on the company's progression from the current level.

I'm out of time for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.