Hi, it's Paul here.

Thanks for the reader requests in the comments. I appreciate people taking on board my request to post a few comments yourself, about the company you're requesting. That makes the comments section much more useful. Unfortunately, most of the things people have asked me to look at at over £500m market cap, so not within my normal remit here.

Just to flag up that I've gone semi-nocturnal this week, so my reports have been late, and flimsy initially, but I've then done loads more work on them in the afternoon & evenings. So you might have missed some (even if I say so myself) quite good new sections.

Here is the link to Weds report which now includes quite detailed reviews on:

Safestyle UK (LON:SFE) , Avingtrans (LON:AVG) , Foxtons (LON:FOXT) , Science (LON:SAG) , and Croma Security Solutions (LON:CSSG) . I'm enjoying doing more detailed work this week, but it's very time-consuming.

Tuesday's report, link here, ended up covering:

Johnson Service (LON:JSG) , Swallowfield (LON:SWL) , dotDigital (LON:DOTD) , Image Scan Holdings (LON:IGE) , and Crimson Tide.

Mello Derby - 26 & 27 April 2018

My friend, renowned investor David Stredder is organising a wonderful mainly small caps focused investor event again. His previous 2 investment shows were absolutely brilliant, with about 1,000 investors converging to meet interesting companies, and hear interesting presentations from a wide range of top quality speakers (e.g. Giles Hargreave, Lord Lee, Leon Boros, Katie Potts, Gervais Williams, and many others). To get a flavour for what a terrific event Mello Derby 2014 was, please take a look at this short video. You might even spot some upstart doing a live SCVR, blink and you've missed it!

Anyway, 4 years on, and David is putting the finishing touches to Mello Derby 2018. More details are here. As you can see from the website, there are proper companies presenting. David isn't interested in giving a platform to spivvy junior resource stocks (unlike other investor shows!). So Mello Derby is for proper investors (of all levels of experience), not speculators.

Many of us know each other through Twitter, and communities such as this one here at Stockopedia, so Mello events are a real gathering of the clan. They're super-friendly, and social, with many of us staying overnight and socialising. We all love investing, so you instantly have common ground with everyone else there, so it's not awkward even if you attend on your own.

David's events are not commercially-driven, they are organised by investors, for investors. So really unique. I shall of course be in residence, and have been roped into doing some small caps presentations, which should be fun! Ed and the Stockopedia team will also be there, along with pretty much everyone who's active in the small caps world.

So please join us! Tickets can be booked here. The entry charge keeps out muppets, and sandwich/goodie bag-chasers! Instead you get great access to companies, and sensible investors. It will be a fantastic event, so I hope to see you there.

Derby is 1hr 25m from St Pancras station, or quite near to the M1.

Carpetright (LON:CPR)

Share price: 57p (down 27% today)

No. shares: 67.9m

Market cap: £38.7m

Update on trading & financial position

Carpetright plc is Europe's leading specialist floor coverings and beds retailer. Since the first store was opened in 1988 the business has developed both organically and through acquisition within the UK and other European countries. The Group is organised into two geographical regions, theUKand theRest of Europe(comprising The Netherlands, Belgium and the Republic of Ireland).

The title of this announcement sounds ominous - whenever you see "financial position" mentioned, it's usually serious trouble.

Looking at the long-term chart below, it almost seems as if we're seeing the whole life cycle of the company from early stage to, possibly death?

Current trading - doesn't sound disastrous, but clearly not good;

Trading conditions in the weeks since the Group last updated the market on 19 January 2018 have remained difficult, characterised by continued weak consumer confidence.

While the trend in the Group's UK like-for-like sales has improved through the intervening period, it remains negative.

Trading in the Rest of Europe has also improved, led by a recovery in like-for-like sales in the Netherlands.

Although the important Easter trading period is still to come, UK like-for-like sales remain below management expectations and the Group now expects to report a small underlying pre-tax loss for the year ending 28 April 2018.

Looking back to last year's results, for the 52 weeks ended 29 April 2017, Carpetright made an underlying pre-tax profit of £14.4m, on sales of £457.6m. So it's now slipped into the red, for the current year. Not good. With the profit trend downwards, and consumer confidence seemingly under pressure now, it's looking likely that 04/2019 could be a year of increased losses.

The problems seem to be weaker sales, weaker gross profit margins, and no doubt the usual cost pressures that other retailers have reported. I think competitive pressures are another issue, although as mentioned yesterday, few companies admit to losing ground to competitors, instead they blame it on weak consumer confidence. Might it be that consumers are simply buying their carpets elsewhere? Or buying laminate flooring? Topps Tiles (LON:TPT) (in which I have a long position) seems to be trading OK, and remains decently profitable.

Discussions with bank - this is a very worrying development. Today the company says;

The Group is therefore proactively engaged in constructive discussions with its bank lenders in order to ensure it continues to comply with the terms of its prevailing bank facilities. The bank lenders have indicated that they currently remain fully supportive.

I don't like the wording of that one bit.

Net debt was £9.8m at 29 April 2017, then rose to £22.8m at 28 Oct 2017, mainly due to the cost of refurbishing its stores portfolio - which should be boosting sales & profits, but doesn't seem to be doing so. Either that, or the older stores are performing very badly, and that's possibly being partially offset by improvements at refurbished stores? It's not clear at this stage.

Balance sheet - the company does seem to have some freehold property - quite a bit actually, £61.0m in freeholds & long leaseholds. Therefore it has scope to sell off, or possibly do sale & leasebacks on some of that property. Also, banks are not likely to withdraw borrowing facilities if they are secured on freehold property assets.

Bank facilities - were reported in Dec 2017 as being £54.4m in total, of which a £45m revolving credit facility matures in July 2019.

Bank covenants - are a crucial consideration. I'm rummaging through the last Annual Report, with a CTRL+F search for the word "covenant", which appears 22 times. Here are some snippets;

The facilities are subject to a number of financial covenants, including a leverage covenant, a fixed charge cover covenant, and a capital expenditure covenant.

The fixed charge cover covenant is the most sensitive to changes in the Group’s profitability.

I'm not familiar with the terminology "fixed charge cover", but doing some googling, it appears to be a test to determine whether profits are enough to cover interest charges & lease payments, possibly? There are different definitions online, so I'm not 100% certain on this. Anyway, by saying that it's "the most sensitive to changes in the Group's profitability" in the 2016 Annual Report, it's clearly going to be a problem now that the group has become loss-making.

Therefore, I imagine the company will probably be seeking a waiver from its banks on potential covenant breaches. That's implied by the announcement today. This is not necessarily a problem. Banks tend to be supportive in this low interest rate environment. Although don't be surprised if the company announces an equity fundraising, which is hinted at in this bit in today's announcement;

In addition to the discussion with its lenders, the Group is examining a range of options to accelerate the turnaround of the business and strengthen its balance sheet. This process remains at an early stage and the Group will update the market on these initiatives as required.

That sounds like freehold disposals, and a possible equity fundraising. Or a disposal of the overseas operations, maybe? The question then, is what discount would a fundraising be done at? Would there be investor appetite to strengthen the balance sheet, given that the company is now loss-making?

I think the freehold property assets probably gives the company breathing space. The other key question is whether suppliers & their insurers will remain supportive? Investors often forget that trade creditors (suppliers) are often extending more credit to a company than its bank. If they lose confidence, and stop sending in supplies, then the shutters can come down very quickly. That was what killed the original Game Group - not the banks, but the trade credit insurers froze its credit, forcing it into administration.

My opinion - this looks risky. The problem facing Carpetright, and many other traditional retailers, is that more difficult trading conditions now mean that they're locked into rents which are far too high, in many stores. They can't get out of them, this is the trouble. Landlords (understandably) prefer to collect in the excessive rent, and risk their tenants going bust, rather than reduce rents to more affordable levels. This is a structural problem with the UK commercial property system. Often a CVA is the only way to escape from excessive rents which threaten to pull down the tenant's whole business.

The CEO of Carpetright alluded to this in a Q&A section of the 2016 Annual Report;

Are you looking to accelerate the property disposal programme this year?

Yes, but we will have to overcome significant landlord inertia. We are offering significant premiums to get out of unprofitable sites but when they have a tenant with a strong covenant, paying the rent on time every month – on a lease that has ten years to run – they don’t appear to have the appetite to find another tenant. I find this a rather odd call.

Of course, I doubt that landlords will now regard Carpetright as a strong covenant any more. So maybe they might be more amenable to help?

I took a decision (thankfully) in early to mid last year to get out of all my main positions in old-style retailers (e.g. Debenhams (LON:DEB) ). It's becoming increasingly clear that some existing retailers won't survive in their current form, due to various well-known factors. The inability to get out of loss-making shops with long leases could well kill Debenhams in my view. I think Mothercare is probably also doomed to the same fate - i.e. either a CVA, or Administration. The profitable shops would then continue, but in a newco, and with shareholders in oldco walking away with nothing, probably.

Is Carpetright in the same category? If it's unable to pull something out of the hat fairly soon, then I would say quite possibly. Its freehold property assets could however provide a buffer, so I wouldn't write it off just yet. The bank might agree reduced facilities, secured with a fixed charge on the freehold property. There could be a fundraising to shore up the balance sheet, but at what price?

I wouldn't want to risk catching this falling knife. All struggling retailers are just best avoided, in my view. Although temptation did get the better of me, and I picked up a little scrap of Laura Ashley Holdings (LON:ALY) at 5p, but only with money I can afford to lose.

Very tricky, retail, at the moment. This cold snap won't be helping either. Maplins & Toys R Us obviously went into administration this week too. Others are likely to follow. The only solution is that High Street rents are going to have to fall, dramatically. So retail-facing commercial property is a definite no-go area as far as I'm concerned. I think we also need to avoid "anchoring" onto previous share prices of bombed-out retailers. There could still be some good shorting opportunities in this sector actually. It's a hideous sector at the moment.

Koovs (LON:KOOV)

Share price: 7.25p (down 31% today, at 13:30)

No. shares: 175.4m

Market cap: £12.7m

Strategic Acceleration Plan

This should be interesting! Koovs is an Indian fashion eCommerce site, which has burned through a lot of cash, and to date has delivered only very modest sales. It's speciality seems to be selling clothes at below cost price - the gross margin has historically been negative.

Let's see what the latest horrors are;

Following the success that Koovs has achieved to date in establishing itself as a leading affordable fashion brand in India, the Board has performed a review of its operations to identify medium-term objectives to support its future growth plans.

The Company continues to be actively engaged in a dialogue with potential capital providers, whilst prudently managing cash resources until the first round of new financing has been closed and the next stage of major capital investment in the Koovs journey begins.

I'm momentarily speechless. New levels of delusional thought seem to have been reached. This business has been a dismal failure to date, not a success. That's why it keeps running out of money, which it looks to have done so again.

The Chairman's comments suggest that having gone this far, burning through £70m, there's no going back;

"With over 70 million invested in Koovs to date and with a series of business building successes achieved there is a clear opportunity to capitalise on the platform that we have built to unlock superior shareholder value over the coming years."

I'm speechless again.

The RNS then lists Koovs supposed achievements. No mention of its horrendous losses, although that is implied in the £70m "invested" (i.e. frittered away through trading losses).

They're really going for it, trying to raise another £50m;

The Board has now determined that a total of up to 50m of further investment will be required to fund the acceleration plan. A significant part of this investment will be devoted to marketing and brand where Koovs has clear evidence of a strong correlation between cash investment and sales achieved.

The trouble is, with a £12.7m market cap, raising another £50m means serious dilution is on the way. Although, as things stand, the existing equity is clearly worth nothing, because this is not a viable business.

Cash position - it has about 4-5 months' cash left currently;

In the immediate term, and pending a first round of new investment into Koovs, the Board will continue to focus on cash preservation.

As at 1st March 2018 the Company had cash balances of 3.5m, with future monthly outgoings forecast to be 0.75m per month.

The exact timing and amount of fundraises will balance the Board's desire to provide short term working capital and to invest quickly, in scale, to take advantage of the opportunities presented, with the obvious need to limit dilution of existing investors as much as possible.

The company's completely at the mercy of anyone daft enough to put money into this financial black hole. So who knows what the terms might be?

Trading update - in a word, disastrous;

H1 gross sales, as previously announced, were flat at 7.9m, and the Company now expects H2 gross sales to be down due to the cash conservation plan highlighted above.

Accordingly, FY18 sales are expected to be 14.5m (FY17: 18.6m). EBITDA is expected to improve to a loss of 14.4m (FY17: 19.6m), whilst the Company's trading margin has continued to increase to 11% (FY17: +4%).

The gross margin is now positive, at just 11%!

Losses are reducing, but only because they're cutting costs. However, cutting costs means that sales are now falling significantly. This looks like a business that's imploding to me. It seems only able to generate sales growth if vast amounts are poured into marketing. With no cash, the marketing taps are being turned off, or down, and that's leading to sales falling.

My opinion - as mentioned numerous times before here, Koovs is going nowhere fast, and at great cost. I feel sorry for investors who've seen their money burned up here. When a business fails to achieve anything like the planned sales or growth, It's always a very difficult decision on when to just cut your losses, and say enough is enough. I think Koovs is way past that point. The dogged determination to continue with a business model that just hasn't worked, is now just looking like madness.

It's possible that Koovs might find investors bullish enough to take a punt on it. There are plenty of people prepared to bet on heavily loss-making, early stage companies, on the basis that it's option money - i.e. they know they'll probably lose their money, but if it does miraculously work, then there could be upside of 100 times the investment. Koovs is trying to be the new Asos, but so far it just hasn't worked, or even shown signs that it might possibly work.

The question is whether the track record of failure might mean that it's too late to persuade investors to put in fresh money on terms that are not highly punative to existing holders. That makes the existing shares way too high risk to even consider an investment here. I hope the company proves me wrong, and becomes a great success, as we all like to see the under-dog come good, against the odds. On a rational basis though, this share is completely uninvestable right now.

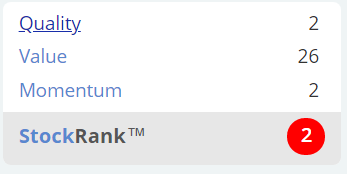

Stockopedia's computers agree with me, classifying it as a "Sucker Stock", with one of the lowest StockRanks possible;

Idox (LON:IDOX)

Share price: 37.25p (up 9.6% today)

No. shares:

I've run out of steam, so will try to finish off this section & look at Indigovision (LON:IND) tomorrow, when Graham's doing the main report.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.