Good morning! Taking into account reader suggestions so far, my list is as follows:

- Focusrite (LON:TUNE)

- £RM2 (LON: RM2)

- TT electronics (LON:TTG)

- Volvere (LON:VLE)

- Innovaderma (LON:IDP)

Only the first two were announced today, but there was quite a lot of news during the week, so plenty to discuss.

Also worth mentioning that I think Paul did a fine job discussing the late profit warning from Conviviality (LON:CVR) in yesterday's report, so I'll leave that one alone for now.

Cheers,

Graham

PS: There is an investor event coming up on March 28th in London, featuring the CEOs of Cloudcall (LON:CALL), Xpediator (LON:XPD) and Realm Therapeutics (LON:RLM). You can get your free tickets at this link.

Focusrite (LON:TUNE)

- Share price: 380p (+7%)

- No. of shares: 58 million

- Market cap: £221 million

This company makes hardware and software products for the music industry, under its own brands. Headquartered in the UK, it distributes its products worldwide.

Rather than making or distributing musical instruments, the company makes the tools used by producers - microphone preamplifiers, audio interfaces, synthesisers and apps.

This is a nice update, which has been warmly received. First-half revenue, profits and cash are up year-on-year.

As a result, revenue for the half year ending 28 February 2018, is expected to be over £38 million, up from £32.0 million in the same period last year. This represents an increase of over 25% on a constant currency basis.

Conversion to cash has also remained positive and, as at 28 February 2018, net cash was £19.7 million, up from £14.2 million on 31 August 2017 and £9.4 million on 28 February 2017.

For a company which sells internationally, such as this one, constant-currency measures are what I focus on. Needless to say, 25% is a fantastic gain.

The CEO comments that the recent Christmas holiday period gave the company a big boost, stating that the outlook remains "confident" for the future:

We keep a close and cautious eye on some of the headwinds being experienced by the music retail industry, particularly in the US, but overall believe we remain well positioned to continue to grow as our strategy of "making music easier to make" resonates with consumers throughout the world.

Some have expressed dissatisfaction that there is no reference to market expectations in the statement.

For what it's worth, I can see revenue forecasts for the current year of £72.6 million, up 10%, i.e. much lower than the growth actually reported for H1. If you include the negative currency effect (beyond Focusrite's control), the revenue growth reported is 19%.

Full-year revenue growth may be difficult to sustain at 19%, as the CEO's comments regarding Christmas suggest that buying might be more weighted to Christmas than it was before. In doing so, he has helped to manage expectations at a lower level.

Because of this cautious approach, commissioned researchers (linked to in the comments below) have increased their EBITDA/PBT expectations for this year and next by only around 4-5%.

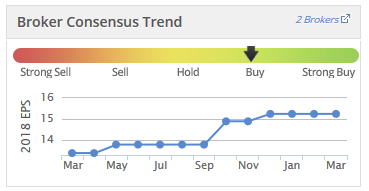

As Paul has noted before, Focusrite has a track record of beating expectations. Today's statement and the response by analysts give the company plenty of room to beat expectations again in the rest of FY 2018 and in FY 2019, I think:

My opinion: so far, I like what I see. The company's products are high-tech and potentially best-in-class, although I would need to perform more research to confirm this. Even though it's in roughly the same industry as Gear4Music (G4M), it's a completely different animal. And while Gear4Music is a good company in it's own right, I would personally attach a much higher multiple to Focusrite.

So I agree with Focusrite's StockRank - it looks attractive, even if it is more expensive than average.

£RM2

- Share price: 4p (+260%)

- No. of shares: 407 million

- Market cap: £16 million

Financial Position and Product Update

This next-generation pallet manufacturer comes storming back above our minimum market cap threshold with a positive update.

I've written very bearishly about it in the past, and expressed the view that it wouldn't be refinanced, so it's only fair that I mention it when the situation is less gloomy.

To recap, RM2 previously warned that it would run out of funds in February, and then later said that it would run out in March. Today, it announces that it has found the funds to survive into April:

The Company is now pleased to report that, following the sale of a non-core office building in Switzerland and repayment of the related mortgage, it received net proceeds of approximately $2 million and is therefore able to extend its cash resources to continue operating through mid-April based on information available to it today.

Great news, but I do have to wonder why the building hadn't been sold already, given how close the company has been to going bust? Furthermore, RM2 has its head office in Luxembourg, and its headcount had already been reduced to 44 by the end of 2016. So I wonder what the purpose of owning a "non-core" office in Switzerland, valued in excess of $2 million, could have been?

All that having been said, it's a good thing the company will survive a bit longer. And it's still trying to raise equity:

The Company is in advanced stages of financing discussions with the support of its existing shareholders and will announce developments to the market at the earliest possible opportunity.

Last September, at the interim results, RM2 said:

"The Company confirms that it is in an advanced discussions with one particular party, which has conducted extensive due diligence on the Company over the past few weeks, and hopes to be able to conclude negotiations in the coming weeks.

So the refinancing has been a long time coming, especially considering how close it was to happening six months ago.

There is a well-known fund manager who might be involved in the refinancing, should he not wish to be diluted. I previously assumed that he would let the company find some other resolution to its financial difficulties, even if that meant shutting down.

As the company continues to claim that it's in advanced stages of discussions, I'm beginning to doubt myself. Maybe I was wrong, and there really is another tranche of fresh funds coming RM2's way?

Tantalisingly, the company promises that it will be EBITDA-positive, next year, if it can only convert and execute some sales:

Significant opportunities with Fortune 500 companies are in final trial phases. The conversion of a subset of these opportunities, deployed and financed on schedule, is expected to result in the Company generating positive EBITDA in 2019.

My opinion

My view is a simple one: there is no point in getting involved with these shares in the secondary market, before the refinancing has occurred. Of course, anybody who does that might get lucky (e.g. someone who bought yesterday and sold today).

But there is no getting away from the fact that the company is running out of money, and that existing shareholders are going to be diluted, perhaps very heavily. If I believed in the story, I would seek to take part in the refinancing, or buy shares afterwards.

Buying the shares before the refinancing means risking the loss of your capital if a) the refinancing fails to proceed, or b) existing shares are diluted to negligible value by the deal. That level of risk is ok for gambling money, but not ok for investing money.

The company's products are in "final trial phase". They've been in trials for a long time, and sales/rental income has remained very low.

TT electronics (LON:TTG)

- Share price: 227p (+1%)

- No. of shares: 162 million

- Market cap: £369 million

This is an electronics business we occasionally cover in these reports. It was reorganised last year into three divisions: Sensors and Specialist Components, Power Electronics and Global Manufacturing Solutions. It engineers and delivers electronic products to a wide range of end-markets: industrial, aerospace, defense, medical.

I had a positive impression of the company and thought that the shares looked reasonable value last August, at the half-year results (share price at the time: 214p). It had great cash conversion, modest underlying growth, and an admirable focus by management on ROIC.

Also, its balance sheet was transformed by a big disposal, so that it now had substantial net cash rather than net debt.

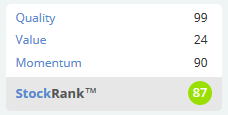

Here are the financial highlights, with the yellow marker added by me:

So there was 5% revenue growth at constant exchange rates - not bad. This is the organic growth rate.

Underlying profit increases 28% at constant exchange rates to £22 million - excellent. The high growth rates in operating profit and PBT show the benefits of operational leverage.

Return on invested capital breaks through 10% - great news. I mentioned before that 10% was not a particularly high rate, but that management's focus on it was a green flag for investors.

Finally, cash conversion is close to perfect, using underlying numbers. Another good sign.

Alternative performance measures

Let's try to make sense of the adjustments used to get the underlying profit measures. There were £4.3 million of favourable adjustments to get underlying operating, as follows:

- Negative £3.7 million in site restructuring costs

- Negative £2.3 million of amortisation of acquired intangible assets

- Negative £0.4 million of acquisition related costs

- Plus £1.9 million in unusual pension gains

- Plus £0.2 million in profit on sale of properties

If I scroll back to 2016, there were £3.7 million in favourable adjustments, and in 2015 there were £5.4 million in favourable adjustments.

While I can understand the rationale to make all of the adjustments, and the company has made a strong case for their inclusion, I still have the impression that unusual expenses are a fact of life for the company. I would therefore be inclined to emphasise the reported numbers, rather than the adjusted numbers, for the purpose of valuation.

I could possibly make an exception for the amortisation of intangible assets - maybe compromise by adding back half of them instead of all of them? Their presence is one of the reasons why the company generated fantastic underlying cash flow (pre-tax) of £38.6 million.

Profit on Disposal

Note that there was a big profit on the disposal of its transportation division, including both the profits generated by this division before it was sold, and the gains made in the sale itself.

Profit for TT electronics (LON:TTG) including discontinued operations, i.e. including the benefits of the transportation division, is £32 million, and basic EPS including discontinued operations is 29.5p. Be careful not to use any figures which include these numbers, as the disposal-related profit is not repeatable.

Net cash - the company's pile of cash is set to be used up for the purchase of Stadium (LON:SDM), which will cost £45.8 million plus £11.8 million in net debt.

With the cash being used up in this acquisition, TT declares a somewhat modest 4% increase in the final dividend, to 4.05p.

The outlook statement is confident:

We enter 2018 benefiting from the increasing proliferation of electronics in our markets. We are focusing our resources where we have strong and differentiated capabilities and are again increasing our investment in R&D and business development to maximise this opportunity. Momentum in our operational performance and our improved order book give us confidence, despite current foreign exchange headwinds, of making strong progress in 2018.

My opinion

I still have a positive impression of this company, indeed even more positive after browsing these results.

Customers sound very keen, making their orders earlier in the year than usual and giving the company a stronger order book. Organic revenue growth is not huge, but should hopefully hold up around the current level. Brokers have been forecasting revenue to grow another 2-4% in FY 2018.

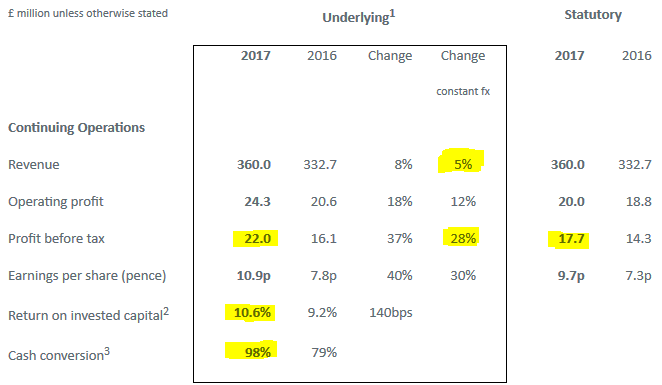

The StockRanks also view it as better-than-average.

Volvere (LON:VLE)

- Share price: 1000p (+2%)

- No. of shares: 3.7 million

- Market cap: £37 million

Trading Update and Notice of Final Results

(Please note that I own shares in Volvere)

This is my largest personal holding by some distance, currently almost 20% of my portfolio (excluding cash). I wrote about it last year in this report: in May and in September.

Please note that I didn't intend for it to be such a large percentage of my portfolio, and wouldn't put 20% of my portfolio into it today! The share price increase is what has created this situation for me.

Also worth noting is that its bid-ask spread can be vicious, perhaps a by-product of the small free float. The directors own 38.5% of the company.

On Wednesday, the share price gained about 11% on the back of this trading update for the full-year ending December 2017.

Headline numbers are excellent: revenue of £43.2 million (2016: £33 million) and PBT of £3.2 million (2016: £1.9 million).

As discussed before, Volvere is an investment company with effectively just two investees (there is a third, but it remains tiny for now). It is extremely patient in acquiring new businesses, and typically only holds a few at a time. It searches for opportunities to buy companies when they are in need of some kind of restructuring, and can be bought at a favourable price.

Impetus Automotive (link), for example, provides support services to the automotive industry. Clients have included VW, Jaguar Land Rover, Audi, and many others. It helps these companies to optimise their sales and aftersales strategies.

Impetus was bought by Volvere for just £1.25 million in March 2015. That figure includes the funds which were needed to pay off some outstanding bank debt. Further funds were needed for working capital, so that Volvere put about £2 million in total into the business. It turned a small profit in 2015, and then trading really took off.

Revenues grew to £17 million in 2016, and £27 million in 2017. Pre-tax profits grew to £1.5 million in 2016 and now £3.4 million in 2017. These figure are stated before the interest and management charges which Volvere Plc charges to Impetus.

How did they do it? One of the things which they seem get right is supporting the existing management - they don't try to tear everything down and start again. Instead, they listen to company management and help them to implement positive change. They incentivise management too, with an equity stake in their businesses. Because of this, Volvere Plc only owns 83% of Impetus (and is thus entitled to 83% of the profit figures mentioned above).

Support services businesses have had some notable calamities recently, but Impetus is bucking the trend and performing extraordinarily well, if these figures can be believed.

The other major investee, Warwickshire-based Shire Foods (link) produced a modest profit of £0.6 million for 2017, after a one-off impairment charge of £0.2 million. Conditions have been tough for makers of pies and pastries.

If you're wondering how all of this can add up to a market cap of £37 million, bear in mind that Volvere has cash of £18.4 million.

So even after all of the share price gains so far, the investees are only being valued at about £18 million. You could argue that this is quite a generous valuation, given how much was paid for them (not much - only about £2.5 million was put into Shire).

On the other hand, it's not very much compared to trailing pre-tax earnings (before impairment charges) of £4.2 million (£3.4 million from Impetus and £0.8 million from Shire), of which Volvere Plc's share is worth about £3.4 million. I make this a pre-tax earnings multiple of about 5.4x.

Not bad, especially when you consider the growth trajectory that Impetus is on. And the £2.4 million of freehold property owned outright by Shire Foods. Any disposal would trigger large bonus payments to the directors, but the multiple is arguably still too low.

Conclusion - I am happy to continue holding.

When the results arrive, it will be interesting to see what are the £6.3 million in marketable securities which Volvere has purchased over the last year. The boost from rising short-term interest rates could have a lovely effect on the cash pile's profitability.

Innovaderma (LON:IDP)

- Share price: 122.8p (-2%)

- No. of shares: 14.4 million

- Market cap: £18 million

This profit warning was published after the market opened yesterday, and we are catching up on it today.

Innovaderma is a small house of brands in the personal care space. You can see the portfolio here (external link). Skinny Tan has been the most exciting element so far.

As was pointed out in the comments, it hasn't been long since publication of the interim results - only three weeks, in fact. The outlook printed then didn't point to any problems.

Times have changed:

"...revenue growth for the year will now be less than anticipated at the time of the interim results. This has been mainly driven by lower than expected orders placed by Superdrug for Skinny Tan despite the brand's continued growth."

That is a surprise. Skinny Tan was previously reported to be best-selling product in its category at Superdrug. Perhaps the company simply got too optimistic about how fast the progress would be?

Indeed, the company reports today that Skinny Tan sales more than trebled in the year ending on Feb 24, 2018. This year-on-year growth had slowed to 60% for the last 12 weeks of that period.

As a consequence of growing pains, there won't be any profit growth this year:

The Group expects revenues to be substantially higher than last year. The profit before tax is now expected to be similar to FY17 due to the significant investment made across the business over the last six months.

Company-funded research points out that Superdrug's exclusive Skinny Tan license is due to expire later this year, which might explain the retailer's reluctance to continue stocking large quantities of the product.

The company has a June year-end, and has been heavily weighted to the second-half. Let's figure out what is likely to happen in H2 2018:

- In FY 2017, Innovaderma made a pre-tax profit of £1 million, with H2 profit of £1.2 million.

- In H1 2018, it was close to breakeven.

Therefore, to match the FY 2017 result this year, pre-tax profits in H2 2018 should be around £1 million. That's about a 15-20% deterioration compared to H2 2017, and the full-year result is even more disappointing when you consider that FY 2017 results were affected by about £0.3 million of one-off listing and set-up costs.

My opinion - I am sympathetic to the company. Rapid growth is hard to manage, and doesn't happen in a straight line. The huge order growth from SuperDrug was inevitably going to be difficult to predict.

Having said that, this is a serious blow to investors. Pre-tax profit this year was supposed to be £2.3 million, according to previous forecasts, and now it is going to be less than half of that. It's a dramatic worsening.

At least we are told that every other part of the business is performing as planned, in particular the Direct to Consumer platform for Skinny Tan and the very promising Roots haircare range.

My major concerns around the stock over the past year have been

- I thought the company had expanded too much, too soon, distracting itself with acquisitions and eventually causing itself to run out of working capital (it raised £4.4 million at 276p in October).

- The valuation become very racy, as the share price at one point exceeded 400p (not long before the company ran out of working capital).

I am a bit more interested now, with the share price back down to 120p. After-tax net income is going to be a disappointment this year, and EPS will be negatively affected by the increased share count. But I'll keep this on my watchlist, looking for evidence that FY 2019 will be a return to form.

That's all for today and for the week. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.