Good morning!

RNS announcements have hit the tape at 7.25am, giving us 35 mins to read and decide what to do in advance of the market open.

Would anybody like to start a petition for after-hours updates instead of 7am (when we're lucky) updates?!

Anyway, here are some stocks which have caught my attention so far.

- Orosur Mining Inc (LON:OMI) - Q3 results

- PCF (LON:PCF) - £100 million in retail deposits (I hold)

- Carr's (LON:CARR) - interim results

- XLMedia (LON:XLM) - "acquisition of leading UK Bingo comparison site"

We also had trading updates from Cerillion (LON:CER) and Kainos (LON:KNOS). I originally thought that Cerillion was in-line, but it looks like an EBITDA miss with the shares down by 7% in early trading.

Mello 2018

A quick word on the Mello 2018 conference which is coming up in less than two weeks. Paul, I and many of the Stockopedia team will be there so hopefully we will meet as many of you as possible.

Paul will be presenting a session on small-cap opportunities and threats while I will be taking part in a ShareSoc Masterclass event with Peter Higgins, Lord Lee, Leon Boros and Phil Oakley. We'll be covering two crucial topics - risk management and red flags.

Tickets for the Masterclass are sold separately and are nearly all sold out, but if you'd like to attend then please use the form on ShareSoc's website: link here.

Orosur Mining Inc (LON:OMI)

- Share price: 5.625p (-12%)

- No. of shares: 117.6 million

- Market cap: £7 million

Apologies for going off-topic with this South American gold miner (we don't usually cover resources here).

Production is down and cash operating costs are up ($1065/oz). The company performed to expectations for several years but is now enduring a period of bad luck.

It is taking some drastic measures to preserve cash:

During the Quarter, and in large part due to the performance of the SG UG [San Gregorio Underground Mine], the Company commenced the implementation of a strategic initiative to reduce costs in Uruguay and corporate structure aimed at improving profitability and preserving cash. As part of this initiative, during Q3 18, greenfield exploration was suspended and non-essential corporate and support costs have been drastically reduced, with Directors and officers agreeing to reduce their fees and salaries by 20%.

I've followed this company on and off for several years and have always been impressed by management's execution at the mine. For many years, they hit their production targets and kept costs under control.

More recently, things have not been going so well. Staff have been let go. Directors have shared in the pain by taking salary cuts.

This stock serves as a reminder for me of the difficulty of investing in the mining sector. Even when you have a mine generating substantial quantities of gold and the directors/Chief Exec are skilled, it's still hard to make money in the long-term.

Investing cash flow has always been a significant expense at Orosur. Over the last nine months, it has spent an additional $12.55 million, compared to $10.3 million during the previous 12 months. Compare this to the current market cap and you get a sense of how material it is.

The company is in net debt and that is despite selling nearly $3 million of new shares in a private placement last year.

One area I'm working on is my ability to appraise management, and sticking with managers who (more or less) do what they say they are going to do, while avoiding those who don't.

I owned shares in Orosur back in 2013/2014, when a dividend was promised from the free cash flow which the company was going to generate in the years ahead. The dividend never materialised, as the company preferred to make various investments instead, and I bailed out of the shares, potentially dodging a bullet. So far, shareholders have had to put more money into the company, instead of getting a payout.

I don't see how this share can end well for investors, unless the price of gold can come to its rescue. In my opinion, the StockRanks correctly identify it as a Value Trap.

PCF (LON:PCF)

- Share price: 33p (unch.)

- No. of shares: 212 million

- Market cap: £70 million

PCF Bank reaches £100 million in retail deposits

Please note that I own shares in PCF.

This has become a top-5 stock in my portfolio as the share price has crept up during Q1 of this year. Today's update allows for extra confidence in the evolution of this online bank:

PCF, the AIM-quoted specialist bank, is pleased to announce that the total value of deposits the Company has accepted from retail customers has surpassed the £100 million mark.

This milestone has been reached in a relatively short time, and sooner than previously anticipated, as PCF Bank only began accepting retail deposits at the end of July 2017. During this period, some 2,500 new retail customers have been welcomed to PCF.

Retail deposits were last reported at £81 million at 28 February, so we are up by at least another £19 million in 6 weeks. By my calculations, this is a little bit better than the average rate since the bank was first launched.

It's a wonderfully simple business model. Savers sign up online, and are offered competitive interest rates for a notice account (1.45% AER) or term deposit (e.g. 2.1% for a 3YR deposit, 2.6% for a 7YR deposit).

These retail deposits then replace the (more expensive) wholesale bank funding which PCF has been using to finance its loans to individuals and businesses for cars, vehicles, plant and equipment.

Besides improving its net interest margin in relation to subprime borrowers, cheaper funding will also enable PCF to profitably lend to more prime borrowers, improving the risk profile.

The big-picture targets remain unchanged:

The Group's strategy is to grow the lending portfolio to £350 million by September 2020 and £750 million by 2022. PCF announced last month that the lending portfolio had grown to £172 million already.

PCF achieved a record low impairment charge last year of just 0.5%. Defaults are very low at the moment. To be bearish on this stock, I think you would have to assume that defaults will skyrocket from the current level.

While anything is possible, I like the risk:reward of investing here. I think it's going to be a much bigger company in a few years, and the September 2020 target for a £350 million lending portfolio remains in play with less than 30 months to go.

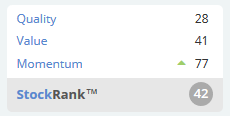

Digging into the StockRank, you see that Momentum is strong, but Quality is holding it back:

The company is targeting a return on equity of 12.5% by 2020 and achieving this should see the Quality Rank improve. The ROE metric has been temporarily held back by the large equity boost caused by raising capital to launch the bank, and then the upfront costs of launching the bank.

So I'm betting that ROE and Quality will improve, and the StockRank will improve too. I'd be interested to hear from you if can offer any counter-arguments!

XLMedia (LON:XLM)

- Share price: 154.5p (-2%)

- No. of shares: 220 million

- Market cap: £340 million

Acquisition of leading UK Bingo comparison site

A reader in the comments has already done a bit of digging into this, and found the published 2016 accounts for Whichbingo Limited, owner of whichbingo.co.uk.

Background: XL Media is the Israeli "performance marketing" group which we have occasionally covered in this report. Using its own content management system, it manages a wide range of websites and funnels its readers to gambling and credit card companies, sharing in the revenue they go on to generate for XLM's marketing clients.

Today's announcement says that XL Media has bought the whichbingo.co.uk website. We can make a distinction between buying the website and buying the company. XL Media has not said that it bought the company.

For what it's worth, the company reported £1.47 million in its balance sheet P&L account for 2016, up from £0.87 million the previous year. We don't have 2017 accounts and we don't have an income statement. Thanks to bestace for figuring this out.

Whatever the merits of the deal, it's almost certainly going to be a very small piece in the puzzle given the £340 million market cap attached to XLM.

As has been pointed out in the comments, today's deal was announced via RNS Reach. For anyone unfamiliar with this, RNS Reach announcements are "non-regulatory", which for our purposes means approximately the same thing as immaterial. It's for voluntary announcements by companies:

RNS Reach is a high-profile investor communication service aimed at assisting listed and unlisted companies to distribute non-regulatory news releases such as marketing messages, corporate and product information into the public domain.

So in summary - the strategic rationale for buying "whichbingo" is clear enough, but the deal is probably not material in relation to XLM as a whole.

XL Media - Review

Last September, I said that XLM was probably a fine opportunity, with the shares priced a tad below 140p.

Since then, they flew up to 220p before returning to their current level.

Operating income announced last month was up by 33%, and the Board printed an optimistic outlook, guiding for "the continued execution of our strategy".

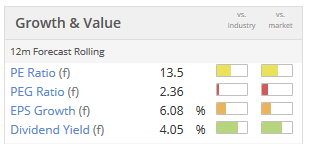

I expect that the share price will be supported soon, if it heads much deeper into value territory:

Nervous investors such as myself will stay on the sidelines, due to caution around the type of stock this is (a gambling/online AIM stock based outside of Europe), though I also note the presence of high-quality institutions on the shareholder register. But still, given the type of stock that it is, the valuation multiples could struggle until it is bought out by or merges with a more familiar name, or lists on a more trusting stock exchange (unlikely, given that UK institutions have bought into it).

It's uncomfortable when you see a successful growth stock trading at a nice valuation, but it just doesn't fit into your risk profile. I'm know I'm probably missing out. That's how I feel about XLM.

Cerillion (LON:CER)

- Share price: 148.5p (-5%)

- No. of shares: 29.5 million

- Market cap: £44 million

I conducted an informational interview with the management of this telecoms support business on its results day last year. It provides billing and customer relationship management software to telecoms and other industries.

Overall, I came away with a positive impression of the company. The obvious risks from a financial performance point of view related to concentration risk and contract risk:

- Concentration - the top 5 customers accounted for 60% of revenues. In response, the company pointed out that it wasn't the same 5 customers in the top slots every year. There were different customers who needed implementation/upgrades every year.

- Contract: less than 30% of revenues were recurring. In response, the company said that it hoped that this would increase with the launch of its new Skyline cloud billing solution, and more managed services.

Today's update is an implied miss in EBITDA terms:

Group revenue for the first half is expected to total c.£8.4m, an increase of 12% year-on-year (2017: £7.5m) and in line with management expectations. The mix of software revenue, services revenue and third party income returned to a more normalised weighting compared to the same period last year, which benefited from an exceptionally high level of software licence sales to existing customers. EBITDA in the first half is expected to be c.£1.4m (2017: £1.5m), with the difference mainly accounted for by adverse currency movements. On a constant currency basis, the Company estimates that EBITDA is approximately 13% ahead year-on-year.

The constant-currency result is more important to me than the reported result, and 13% growth looks reasonably encouraging. I presume that management were expecting something slightly better than this, since currency movements were "mainly" to blame.

If investors hadn't seen the currency blow coming down the tracks, it makes sense to mark the shares down a few percentage points. But long-run profitability shouldn't be affected.

The statement also reminds us of the presence of contract risk, with the opportunity for more growth if contract talks are successful:

The Group is in tender discussions for a number of significant contracts, which if successful, will underpin ongoing growth in the second half of the financial year and beyond.

My opinion

Overall, I retain a positive impression of the company. Even though it's competing in the same sector as vastly larger players such as Oracle (US:ORCL), it's able to win a lot of business from smaller telcos, and has done so for a long time. And there is potential upside from its new products which have a much wider range of applications.

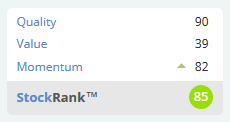

The StockRanks are particularly impressed in terms of Quality - which I guess is due to the consistency and stability of its profitability, strong balance sheet and cash position.

Kainos (LON:KNOS)

- Share price: 347.5p (+6%)

- No. of shares: 118 million

- Market cap: £410 million

This is a medium-sized IT services company whose employee and contractor numbers have expanded to well over 1,000 over the past year. Headquarters are in Belfast but there are 13 offices in total.

This also indirectly competes with Oracle, this time in the field of human capital management (HCM). I say "indirectly" because Kainos has a particular specialisation in implementing Workday (US:WDAY) software for clients.

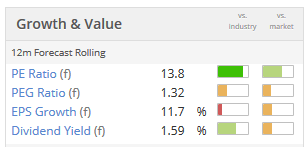

I've just had a thought that Oracle shares might be a good hedge for holders of competing companies, whether UK or US based. And Oracle shares look attractive in their own right at first glance. They have a StockRank of 85, a perfect A+ Magic Formula Score, and pass the "Earnings Upgrade Momentum" screen.

So if you are interested at all in US tech stocks, I would certainly recommend doing some research into Oracle!

Anyway, I digress!

Today's update from Kainos reports that trading is in line with expectations.

Digital Platforms has performed in line with expectations, mainly driven by the Kainos Smart platform, where we have continued to acquire new clients successfully. The constrained funding in the UK NHS continues to impact short term growth of the Kainos Evolve platforms, although sales activity levels are showing signs of improvement that are consistent with our expectations.

Kainos Smart is the Workday implementation platform, and is growing - this is to be expected, since Workday's sales and market share are growing, too.

I suppose my concern is that it doesn't sound like a business stream which is going to last for a terribly long time - helping clients to implement 3rd-party software. I can understand why it would persist for a certain number of years, while Workday penetrates the market, but would I put a big chunk of retirement funds into a company doing this? Probably not.

Sooner or later, Workday's market share will max out, and the demand for help implementing it will surely crumble?

It's one thing if you're Workday and you at least own the underlying, value-adding software. But this is not the case for Kainos.

The other part of the business mentioned in the update, Evolve, is evidently struggling with patchy public sector contracts.

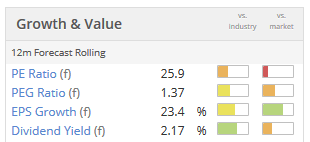

The valuation is on the expensive side and I fail to see how this can be justified:

That's all for today! I hope your week has got off to a good start.

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.