Good morning!

Various things I have spotted today, with your help from the comments:

- Trackwise - admission to AIM

- Water Intelligence (LON:WATR) - trading update

- Gocompare.Com (LON:GOCO) - interim results

- NWF (LON:NWF) - final results

- Games Workshop (LON:GAW) - annual financial report

Trackwise (TWD)

Admission to AIM - This is a small IPO, raising £5.5 million for the company and £1.5 million for selling shareholders. Trackwise makes specialist circuit boards with applications in telecoms, aviation, etc.

It's topical because I was only yesterday talking about the results at Arden Partners (LON:ARDN), who it turns out will be Nomad and Broker to Trackwise. Arden is earning commission of up to £900k from this transaction.

A quick look at the admission document tells me that Trackwise made an adjusted operating profit of £270k last year, after adding back some non-recurring expenses, from revenues of £2.8 million.

Its largest two customers accounted for 46% of revenues. That gives the appearance of a very high degree of customer concentration risk, at least for now.

And the market cap at the IPO price is £15.5 million. So we don't have much of a cushion in terms of the historic earnings multiple.

So it's not for me, but perhaps you will be able to build a more bullish perspective. It has a patent for a new method of manufacturing flexible circuit boards, which it thinks opens a huge opportunity for future growth. It might be worth looking into in more detail.

Water Intelligence (LON:WATR)

- Share price: 413p (+6%)

- No. of shares: 15 million

- Market cap: £63 million

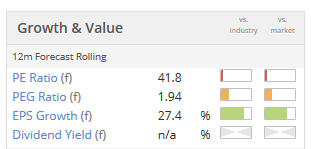

This US-based leak detection business is another example of a High Flyer (aren't these categorisations very useful?)

For the uninitiated, that means high quality and high momentum, but little value, at least as value is traditionally understood.

Paul last covered it with the share price at 200p, in February. So congratulations to anyone who has earned a 100% return so quickly, by holding it since then. Some of you have probably been holding it for a lot longer than that, and have a much bigger return!

The first time I wrote about this share, in 2016, it was priced at 70p.

Ok, let's see how things are going according to the latest update.

Trading is comfortably in line with expectations, a phrase which can be interpreted to mean that we have a good chance to see an earnings beat later in the year.

The top line and bottom line are both mentioned in this regard, so we have the perfect combo of strong sales and strong margins.

We are on track to meet the goals set forth in the Chairman's Statement for the 2017 Annual Report released earlier this year: passing $20 million in annual sales during 2018 and passing $25 million in annualized sales in the near-term.

The capital base grew in March with an equity fundraising - when we have more detailed numbers for 2018, I will do my usual checks for the returns generated on this increased base. I expect they will come back very positive.

Excitingly, the company cites "strong worldwide demand" for its products, and expresses the wish to go international with a "scalable business model". Its international business is active in the UK, Australia, Ireland and Romania.

If the strategy succeeds, I am confident that Water Intelligence (LON:WATR) will prove to be worth a lot more than its current market cap, despite the high rating.

H1 PBT is up almost 50% year-on-year, to $1.25 million.

So it's understandable that the share price has gone on a tear. Holders don't have any particular reason to cash in their chips, with a company that is performing so well and looks to have so much potential.

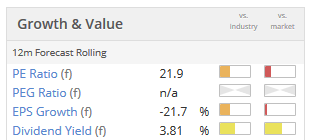

I think the very high rating is probably justified:

Gocompare.Com (LON:GOCO)

- Share price: 121.6p (-8%)

- No. of shares: 418 million

- Market cap: £509 million

Most of us will be familiar with this price comparison website.

The shares were re-rated back in May, when a US private equity shop announced that it was acquiring ZPG (delisted: ZPG), owner of property portal Zoopla and uSwitch.

uSwitch and Gocompare are direct competitors, and the strong outcome for uSwitch led to renewed bullishness for Gocompare. I should note that uSwitch is a bit more valuable from an internet ranking point of view, achieving #375 in the UK according to Alexa.com. Gocompare.com is at #536.

GOCO shares were drifting in advance of these results:

The highlights:

- Revenue flat at £75.8 million

Within this, revenue in the core price comparison business fell by 5%.

There were fewer customer interactions, "reflecting a focus on targeting profitable customers as well as the downward trend on car insurance premiums".

- Marketing margin (price comparison) up almost 700bps to 46.4%

Those interactions which did occur were significantly more profitable.

One gets the impression that GOCO decided to fine-tune its operation and has behaved rather conservatively in the period. Instead of chasing more business, it allowed business volumes to fall, but maximised the subsequent returns. It had a "targeted and disciplined approach to marketing".

- Adjusted basic EPS up 19% to 3.8p, basic EPS up 11 to 3.1p

The discrepancy between adjusted and actual EPS is caused by what looks to me a fairly standard set of adjustments. So you can use whichever one you are more comfortable with.

I tend to err on the conservative side, and use a number closer to the actual EPS.

There were a couple of acquisitions ("MyVoucherCodes" and "Energylinx"), and they are doing well so far.

Expectations for the full year are unchanged. Investors weren't expecting the half-year results to look like this, however, as otherwise they wouldn't have marked down the shares by 8%.

In the webcast today, the CFO revealed that £2 million of revenue was lost in Q1, following "a product release on car insurance that didn't quite function as we'd initially expected", leading to "a temporary dip in conversion".

The mishap is responsible for more than half of the reported revenue reduction in price comparison.

I don't think investors should read too much into this. The occasional mishap doesn't eliminate all of the company's achievements over the years.

The CFO also confirms my initial comments, saying that GOCO "has not been doing, nor will we do, chase volume in a market where growth is slowing".

My view

Management have presented these figures as being in line with company strategy, but some shareholders were clearly unaware that this was the plan, given how they have reacted.

From my point of view, I don't mind whether earnings are increased through top-line growth or improved margins. In different situations, it will make sense to focus on one or the other. I'd be willing to give GOCO management the benefit of the doubt that it makes sense to focus on margins in these conditions.

The company is carrying net debt of £74 million, so this needs to be taken into account for valuation purposes. Debt has been drawn down to pay for recent acquisitions, bringing the leverage ratio back up to 1.7x (defined as net debt to adjusted EBITDA).

Putting it all together, I would potentially pick up some shares in GOCO, ideally on future price weakness.

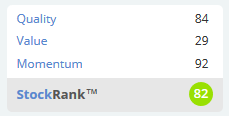

The StockRanks agree that it looks interesting:

In exchange for paying a rich multiple, you get a valuable piece of internet real estate and what I perceive to be a disciplined and far-sighted management team.

NWF (LON:NWF)

- Share price: 195p (-1%)

- No. of shares: 49 million

- Market cap: £95 million

NWF Group plc ('NWF' or 'the Group'), the specialist distributor of fuel, food and feed across the UK, today announces its audited final results for the year ended 31 May 2018.

Paul covered this company in a lot of detail last January.

Most of its revenues are "pass through" - buying oil, wheat, milk and soya and selling them on to customers for a small margin.

Fuel - vastly improved result with headline operating profit of £6.9 million during the "long, cold winter", described as "exceptional" conditions. I suppose it would be prudent to assume that such a fine performance will not be repeated in the 2018/2019 winter?

Food - this division went the wrong way, headline op. profit falling to £0.7 million from £3 million. A big contract came to an end, and NWF struggled operationally as multiple new customers all came on board in January. This division looks set to return to more normal profitability in future periods, and now enjoys a more diversified customer base.

Feeds - great performance as commodity prices increased. Revenues up 7% and headline op. profit doubled to £3 million.

Outlook - performance in the new financial year is in line with expectations so far.

Net debt halves to £6.4 million. Working capital management is good, some reduction in the amounts held at year-end.

Pension deficit reduces to £17 million thanks to a rising interest rate used in the calculations. This pension is not overly leveraged (assets of £36 million versus liabilities of £53 million).

ROCE (key performance measure) improves to 15.1%.

My view

An attractive set of results, in my view. We have another example of a "mishap" to look at today, this time in NWF's Food division, which made an H2 loss thanks to the strain of taking on multiple new clients at the same time.

Mishaps are part and parcel of equity investing. If you don't want to suffer any mishaps, you are in the wrong asset class!

The Food division should recover, and will hopefully offset any reduction in Fuels as the latter has a particularly difficult comparative to beat this winter.

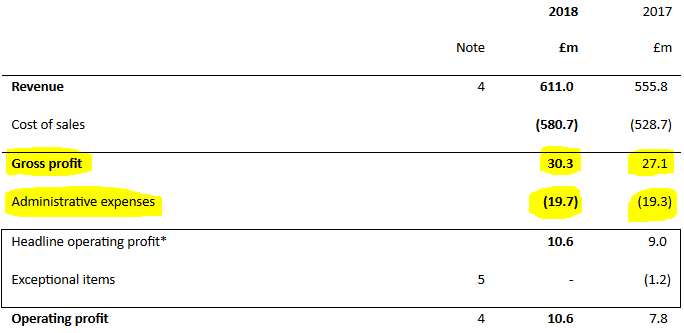

Incidentally, I would recommend almost ignoring the revenue line for this company. It's a commodity distributor, so it makes more sense to me to focus on gross profits. Gross profits are a relevant measure of NWF's "value-add" for its customers, and then we can work our way down to operating profit:

As you can hopefully see from the above, NWF managed to increase its gross profits by over £3 million, while administrative expenses increased by just £0.4 million. Very nice.

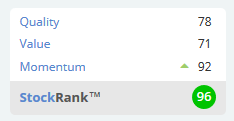

NWF has a near-perfect StockRank and is classified as a Super Stock:

I tend to stay away from distributors, but if I had to pick just one of them to invest in, it could easily be this one!

Games Workshop (LON:GAW)

- Share price: 2995p (-5%)

- No. of shares: 32 million

- Market cap: £970 million

I love the clarity and the simplicity with which Kevin Rountree, Games Workshop CEO, speaks when he publishes these reports. It's a lesson not just for other CEOs but for anybody who wants to write things for a public audience.

While some companies use MBA-school language in a bid to make their pronouncements sound more professional, Mr Rountree says things in a matter-of-fact way that is no less impressive and does not prevent him from making big claims about the value of the business he is running.

It just goes to show that there is no need to make things sound more complicated than they really are. I'm certain that under a different management team, these results would be much more difficult to analyse.

For example, the Strategic Report leaves the reader in no doubt about what the company is trying to do, and what its priorities are:

Our ambitions remain clear: to make the best fantasy miniatures in the world, to engage and inspire our customers, and to sell our products globally at a profit. We intend to do this forever. Our decisions are focused on long-term success, not short-term gains.

The five-part strategy is essential reading for anybody who is remotely interested in this stock.

The financial KPIs look well-chosen and include return on capital employed.

The shareholder value and M&A strategies are faultless: it has no intention of doing any M&A, and returns its surplus cash to shareholders.

Sales are up 39% and operating profit up 95% for FY 2018.

Despite the sparkling results, the share price may have fallen today due to the CEO informing the market of certain challenges being faced as the company gets used to its bigger size, and refusing to promise that the extraordinary growth rates of recent times can continue:

...we are now in unchartered waters, doing everything we can to ensure our success is maintained. The challenge of managing global sales volume growth at the same time as delivering a step change in our capacity (not forgetting delivering major IT projects) is, I hope you appreciate, a fair challenge.... It would be unrealistic, if not daft, of me to promise that we can continue to grow at the rates we have reported over the last two years. I am not, however, planning to scale down our ambitions, I am just informing you of the back drop.

My view

A fine company and I'm hugely impressed again by the company's results and its presentation of same.

I believe this share price multiple is justified for a high-quality company with sound management. Note however that there is an element of lumpiness (a bit like the lumpiness for a video games publisher) as sales are a function of GAW's product cycle and campaign launches:

This is another stock that I would like to purchase some day, should it ever become available at a bargain level again.

All done for today. Thanks for bringing GAW to my attention - I missed it first thing this morning.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.