Good morning, it's Paul here!

STOP PRESS: please see the extra bits added to the NWF (LON:NWF) section below, after talking to a company adviser, and a link to PIWorld.co.uk . All good stuff - I welcome helpful input from everyone - investing is a team sport!

MiFID II

This continues to wreak havoc. What on earth were the regulators thinking, to expend so much time & energy in creating the c.1.5 million paragraphs of regulations in MiFID II, fixing problems that were of so little consequence that they didn't really matter in the first place!

I think the whole thing should just be repealed as soon as possible, and the regulators should all be fired. Let's get some people in who actually know what they're doing, and want to help, rather than impede the investment sector. We didn't cause the financial crisis, the banks did. So I suggest that's where regulation should be focusing.

I lost my access to Peel Hunt research yesterday, which I'm absolutely gutted about - as it's superb quality, and helps me a great deal, both in understanding companies, and also in valuing them using sensible forecasts. I'd happily pay £500 p.a. for access to Peel Hunt research. Unfortunately though, I think they want £10k+ p.a., according to my broker, who politely declined their offer. That sort of figure is not realistic for private investors, as it would represent too large a percentage of our portfolios. Whereas a fund manager with say £1bn under management, can justify those sort of charges. I do hope a solution is found. The financial world tends to be full of people with creative minds, who are good at findings ways around problems. So I live in hope that my access to research won't dry up completely.

I just don't understand how it is that regulators can be seemingly so detached from reality, that they introduce all this nonsensical regulatory burden. Regulators have long impeded private investors, by restricting our access to research. The latest restrictions on dissemination of research have simply harmed the interests of private investors, by shutting down our access to important information about companies from research houses. Whilst the fund managers in the City now have privileged access to that research. How is that fair? Once again, the little people are stitched up by what appears to be a cosy cartel between the big finance companies, and the regulators.

Hopefully more brokers might sign up to distribute their research through Research Tree, a wonderful service which is becoming more useful by the day, as other sources of research dry up.

Today I shall be reporting on;

Quarto Inc (LON:QRT) - 2017 trading update

Sprue Aegis (LON:SPRP) - 2017 trading update

YouGov (LON:YOU) - trading update, 6m to 31 Jan 2018

Filtronic (LON:FTC) - interims to 30 Nov 2017

NWF (LON:NWF) - interim results to 30 Nov 2017

Quarto Inc (LON:QRT)

Share price: 155.5p (up 4.7% today, at 09:10)

No. shares: 19.7m

Market cap: £30.6m

The Quarto Group,Inc. (LSE: QRT,"Quarto" or "the Group"), the leading global illustrated book publisher, has published a trading update for the year ending 31 December 2017.

Relief for Quarto shareholders today, as trading seems to have improved;

The Group expects to report revenue and profits in line with its last trading update on 9 November 2017, following a strong trading performance in H2 and over the holiday period.

This is particularly important, because Quarto has a strong H2 weighting to its performance. It badly needed to perform well in H2, following awful H1 2017 results (an adjusted loss before tax of -$8.7m, versus a prior year H1 comparative loss of -$1.6m).

Quarto had an annus horribilis in 2017, as you can see from the vertical drops in share price shown below. These are profit warnings, and the short-lived but unsuccessful bid approach in the summer (the price spiked up & down again, in July).

It's good to see the share price staging a bit of a recovery recently;

Valaution - this is tricky, because the broker consensus figures look to pre-date the Nov 2017 profit warning.

I've found one broker note, which suggests $4-5m adjusted PBT for 2017. This looks accurate, as their workings use the information given by Quarto in its various trading updates. If we take off notional tax of 26% (being the average of the P&L tax rate in 2015 & 2016), then I make that post tax earnings of $3.3m, divided by 19.7m shares = 16.9c = 12p EPS estimate for 2017.

That produces a 2017 PER of 13.0 - which is far from cheap, given that Quarto also has a heavy debt load. Talking of which...

Net debt - updated today as follows;

While net debt reduced over the second half from $75.8m to $64m, year on year net debt increased by $2.1m, largely due to the previously disclosed poor H1 performance.

That's £45.5m net debt in sterling, which is greater than the market cap of £30.6m.

Directorspeak - is light on specifics, although I like the bit about debt reduction, which for me is a key issue preventing me from owning this share;

"While 2017 was, overall, a challenging, transitional year, we are now a pure-play intellectual property business. We are particularly pleased with our strong trading performance in the second half, including the holiday period, with our Children's business once again showing growth.

"We have moved into 2018 with clear objectives about realigning our portfolio with the broader market and consumer trends and making the financial and operational improvements required to fulfil our ambitions, including strengthening our balance sheet as a platform for growth."

My opinion - I'm still not really clear why H1 in 2017 was so poor. Therefore it's difficult to determine whether 2018 is likely to be any better.

I wonder if Quarto is likely to benefit from the US tax cuts? It operates in the USA, so presumably there could be some boost to future earnings from lower tax? This is not mentioned in today's update, so perhaps the company is still assessing the situation.

Checking back my notes from Nov 2017 profit warning, the company indicated then that it would not pay a final dividend this year. As mentioned at the time, I think that makes complete sense. Whilst it might have upset some income-seeking shareholders, I think debt reduction is much more important. Plus it makes sense for the company to continue making acquisitions, if cheap, bolt-on deals can be found. Paying generous dividends as well turned out to be too much of a stretch.

I'll continue to monitor things at this company, but for me the net debt position remains too high for me to consider investing here. Once that's sorted out, it could be worth a closer look.

Sprue Aegis (LON:SPRP)

Share price: 196p (down 5.2% today, at 12:36)

No. shares: 45.9m

Market cap: £90.0m

Sprue (AIM: SPRP), one of Europe's leading home safety product suppliers, announces the following trading update for the year ended 31 December 2017. The figures set out in this announcement are subject to audit.

- Revenues of £54.3m, down 4.9% on 2016 (and lower than expected, the company says)

- Operating profit is in line with market expectations, at £4.5m, up 114% on 2016

- Significant improvement in gross margin

- Pro-active management of the cost base, whatever that means. Cost control, I suppose.

- Changes to sourcing of product expected to commence in April 2018

My opinion - the shares look expensive based on the 2017 figures - a £90m market cap seems a lot for just £4.5m operating profit. So clearly the market expects profits to rise in future, and is paying up-front for that profit growth.

Note that the company has a strong balance sheet, and a good track record of dividend payments.

I've held this share in the past, so am reasonably familiar with it, including before it even listed on AIM (it was on plus markets I think, or whatever permutation of that it was at the time - the name keeps changing).

The downside is that it's been rather accident-prone, with lumpy sales (e.g. French legislation driving a spike in sales), product faults (e.g. issues with batteries), and strange supply arrangements with connected parties on licence (or something like that). Although it sounds as if the company is sorting out its supply arrangements.

For those reasons, I find it slightly perplexing as to why this company has retained such a supportive & loyal cohort of private investors. I'm not convinced that such loyalty has been justified by the company's performance, hence why I decline to own this share.

The price looks up with events for now, but if it out-performs against forecasts, then it could rise further maybe?

YouGov (LON:YOU)

Share price: 350p (up 5.6% today, at 13:15)

No. shares: 105.3m

Market cap: 368.6m

YouGov, the international market research and data analytics group, today issues a trading update for the six months ending 31 January 2018.

This company has an unusual 31 July financial year end.

Things seem to be going well;

We are pleased to report that half year trading is anticipated to be ahead of previous expectations.... The Board remains confident of achieving its full year targets.

My opinion - as mentioned here many times before, this company's reporting of adjusted profit is just plain wrong. It capitalises a load of operating costs (which in itself is tolerable), which are then ignored completely in the adjusted profit figures - i.e. the company doesn't account for the capex, or the amortisation charge either. It's as if those (hefty) costs just miraculously disappeared. So the adjusted profit figures are total fantasy here, and greatly over-state genuine profitability.

Therefore, its real profits are far below the reported adjusted numbers. As such, the shares are significantly over-priced. But, nobody seems to care! So there we go.

That said, there is a strong growth trend in earnings, so the company is clearly trading well. Also, bulls point out that the company is unique on the UK stock market, so perhaps deserves a bit of a scarcity premium? Not this much though:

Filtronic (LON:FTC)

Share price: 8.8p (down 24% today, at market close)

No. shares: 206.9m

Market cap: £18.2m

Filtronic plc (AIM: FTC), the designer and manufacturer of antennas, filters and mmWave products for the wireless telecoms infrastructure and adjacent markets, announces its half year results for the six months ended 30 November 2017 ("H1 2018").

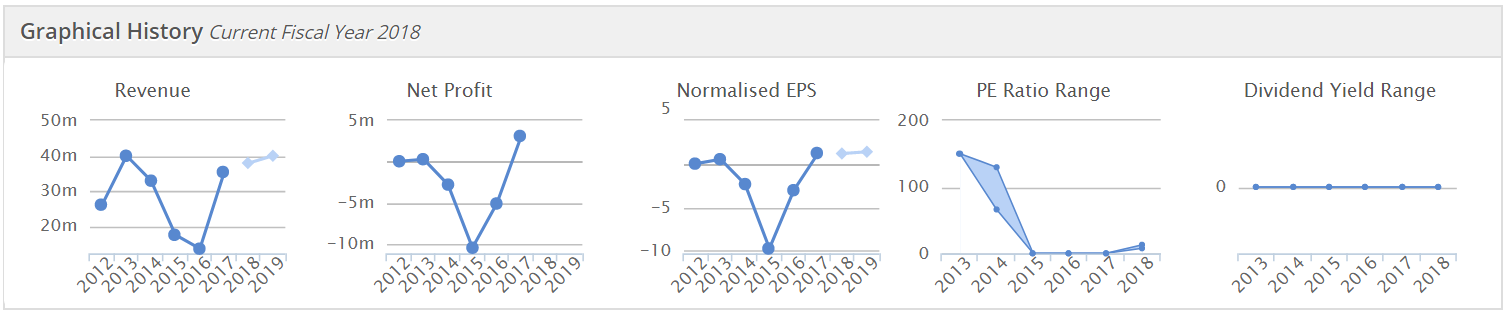

This is a company that I've followed for a few years, and it's really sailed close to the wind, as you can see from the Stockopedia graphs below;

The number of shares in issue has more than doubled over this period, as money was raised from shareholders to keep the company afloat. It's bounced back into modest profitability now though, so maybe this is a turnaround?

- Revenue for H1 is down 41%, at £12.8m (H12016/17: £21.6m)

- Adjusted operating profit is down 50% to £904k

Not very impressive so far.

Outlook - this seems to be the reason for the 24% share price fall today - it's an H2 profit warning;

"It is very pleasing to see our strategy to broaden our customer base and the markets we serve has been validated by recent contract wins that will position us to participate over the long term in the development of future communication networks and in particular in the nascent 5G technology space. Recent extensions to our multi-year defence contracts also provide welcome baseline revenues for the next few years.

Notwithstanding these positive developments, we remain at the early stages on a number key initiatives and projects where progress toward production volume orders has been slower than anticipated. As a consequence, we now anticipate a 2nd half performance broadly similar to our 1st half performance, with further growth being pushed into FY2019."

This implies full year adjusted profits of about £1.5m to £2.0m. Checking back to the last full year results, it made an adjusted operating profit of £1.8m, so it looks as if this year is probably heading for the same sort of ballpark.

If we assume middle of the range, so say £1.75m adjusted operating profit for 2017/18, then take off say £0.05m finance costs (as there's little to no debt now), that's £1.7m adj PBT. Take off say 20% notional corporation tax, and I make that £1.36m estimated earnings. Divide that by 206.9m shares in issue, and that arrives at 0.66p EPS on a normalised tax charge. That's a current year estimated PER of 13.3 - neither cheap, nor expensive.

Balance sheet - overall this looks reasonably solid to me.

NAV is £11.6m, take off intangibles and NTAV is £8.1m - quite respectable for the small size of the company.

One item stands out as potentially an issue - receivables looks too high at £6.0m, given that revenues were only £12.8m in H1.

My opinion - I don't really understand why this company is listed on the stock market. It seems to just be a contract manufacturer of electronic parts. Revenues & profits seem unpredictable, which in turn gives rise to a volatile share price.

I think the only reason to buy this share, would be if you developed a deep understanding of its products & markets, and concluded that there was good growth potential. So for me, I've got no idea on that side of things, so can't really take this any further.

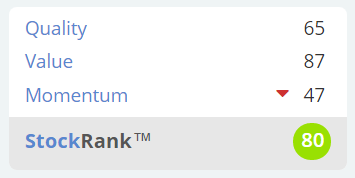

It has a surprisingly high StockRank, at 80, but a "Neutral" style;

NWF (LON:NWF)

Share price: 167.2p (up 1.0% today, at market close)

No. shares: 48.7m

Market cap: £81.4m

NWF Group plc ("NWF" or "the Group"), the specialist agricultural and distribution business delivering feed, food and fuel across the UK, today announces its half year results for the period ended 30 November 2017.

I last looked at this company when it issued a trading update here on 19 Dec 2017.

As a reader comments below, the profit margin here is absolutely tiny - H1 headline profit before taxation is only £2.2m (up 10% on prior year's H1), on £295.8m revenues.

EDIT: please see below, at the end of this section, for interesting comments emailed to me by an adviser to the company. (end of edit)

Looking at the last full year comparatives, the business does seem to have an H2 revenue & profit weighting, presumably because animals would need more feed, and farmers use more fuel over the winter? So it generated £8.5m headline profit before tax in the year-ended 31 May 2017 - on revenues of £555.8m - a 1.5% profit margin. You wouldn't need many customers to go bust, leaving bad debts, to wipe out all the year's profits.

Balance sheet - not great actually. NAV is £39.6m, take off intangibles and that falls to £16.8m.

The current ratio is 1.11 - adequate, but not great.

What does surprise me, for a business with such high revenues, is that the inventories figure is so small, at just £4.6m. How on earth does the company manage to achieve £500m+ with just £4.6m in inventories? Maybe the period end is an artificial low, or perhaps it supplies customers on a "just in time" basis straight from the factory? It looks very unusual to me though. Have any readers looked into this?

EDIT: Many thanks for the comments emailed to me by an adviser to the company, which helps explain the business model - see the end of this section. (end of edit)

The company has bank debt of £16.9m, less £0.6m cash, so net debt of £16.3m - this is down 14.7% on a year earlier. That looks fine, it's not an excessive level of debt.

Freehold property - there is £27.6m at Net Book Value, and note that this appears to be at historic cost, less depreciation. It would be interesting to find out if the market value is higher than book value. Sometimes there can be nice hidden value at this type of company, in the property portfolio. The bank debt is secured on freeholds, so should be very safe, even in a downturn.

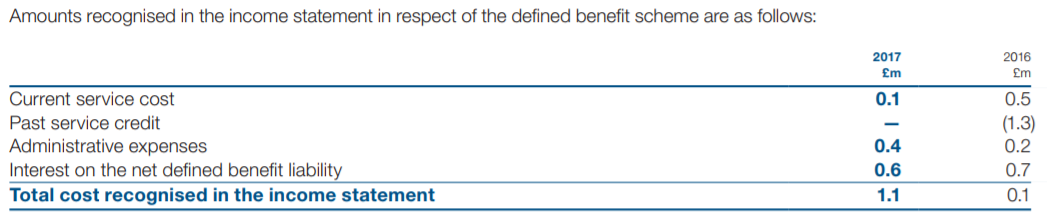

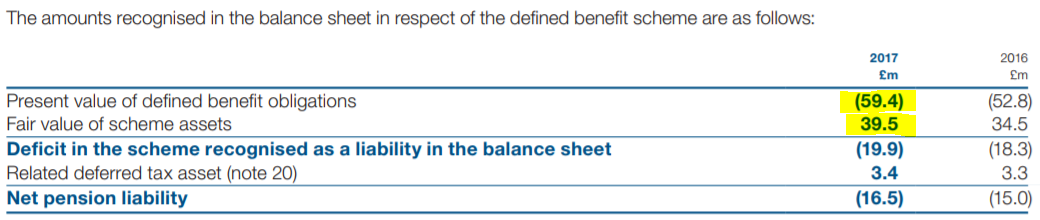

Pension deficit - is shown at £19.0m on the balance sheet, slightly reduced. This is a significant drain on cashflow, so needs to be taken into account when thinking about valuation;

The triennial actuarial valuation of the Group's defined benefit pension scheme was completed in the half year ended 30 November 2017, with a deficit of 19.1 million at the valuation date of 31 December 2016. In these interim financial statements, this liability has been updated in order to derive the IAS 19R valuation as of 30 November 2017. The triennial valuation resulted in Group contributions of 2.1 million per annum, including recovery plan payments of 1.8 million per annum for 11 years from 1 January 2018.

I'm a bit rusty on pension scheme accounting. However, I think I'm correct in saying that recovery payments into pension schemes don't go through the P&L as a cost. I've had a rummage through the 2017 Annual Report, and this is what note 22 says are the pension costs which go through the P&L (i.e. the income statement), which seems to confirm my view;

Looking at the cashflow statement, in y/e 05/2017 the company paid out £2.8m in dividends. I like to compare this with the pension scheme recovery payments, which are £1.8m here. So you can see that the company would be able to pay out considerably more in dividends, if it didn't have this pension deficit.

Another thing to consider is that the percentage gap between pension scheme assets £39.5m, and liabilities £59.4m, here is large. Therefore, the deficit is unlikely to disappear completely through interest rates rising a bit, nor from good investment performance;

Outlook - more detail is provided today, but for my purposes this is the bit that matters;

Overall the Group continues to trade in line with the Board's expectations and I look forward to updating shareholders later this year.

My opinion - the annual report shows last year saw 14.0p headline, diluted EPS. The consensus forecast seems to be 14.3p for this year - so only limited earnings growth. That gives a current year PER of 11.7. I'm struggling to find any justification for the company being on a higher rating than that - especially considering it has debt, a pension deficit, and that the pension fund is sucking out over £2m (including costs) in cashflow each year, for the next 11 years.

There could be hidden value in the freehold property, but that would only really matter if someone bids for the company, or if property is sold.

I'm struggling to grasp why the StockRank is so high, at 96.

This share would only interest me if it became a margin improvement story - i.e. say if new management came along, and said they could raise the net profit margin from 1.5% to say 3-5%. That would be very interesting, as if achieved, that would be a reason for a re-rating of the shares. As it stands though, I can't see any catalyst to drive this share price any higher. So a shareholding in NWF would have returned little to no profit if held for the last 2 years - in a roaring bull market, when shareholders could have made fantastic profits on many other shares.

There's a time & a place for boring companies that chug along paying reasonable divis, but roaring bull markets are not that time - when much more money can be made on more exciting growth companies.

POST SCRIPT: Here is a short video from PIWorld.co.uk which allows private investors to see a presentation & slides from the company's CEO. All companies should do this.

Also, I have had an interesting email from an adviser to NWF, which I think is worth repeating in full, as it helps understand the business model (I have re-formatted, and added my own bolding);

Just read your note on NWF and you have forgotten what I have told you about margins from previous sets of results when you made the same point!

The reason for them being so low is very straightforward, namely that the majority of revenues in Feeds and Fuel are pass through. For example, they buy the fuel in the spot market (principally domestic heating oil and commercial diesel) and then immediately (ie daily) sell it to consumers and businesses for a 1p gross margin.

Revenues are entirely dependent on the commodity price – clearly with the rising oil price, revenues go up! And it then looks like the margin is even more wafer thin.

If I tell you that the ROCE in the fuel businesses is was a whopping 45.5% last year then you can see from that it’s a good business, just a shame they have to report revenues on a gross basis.

Similarly in Feeds, the revenue line is at the mercy of the input price of wheat and soya – if the prices rise as they have done, revenues go up, whatever happens to tonnage (which in fact was flat in H1).

Hope that helps!

All done! See you in the morning.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.