Hi, it's Paul here.

This is initially a placeholder article, ready for your comments from 7am onwards.

To get you started today, please note that I updated yesterday's report in the evening, with some new sections. So it now includes additional sections on;

- Stadium - profit warning

- Snoozebox - it's gone bust

- Tracsis - results for y/e 31 Jul 2017

See you in the morning!

Good morning, it's Paul here.

No larger cap preamble today, as it takes up too much time, which is limited today.

Swallowfield (LON:SWL)

Share price: 390p (down 1.3% today)

No. shares: 16.9m

Market cap: £65.9m

(at the time of writing, I hold a long position in this share)

AGM Statement (trading update) - this company has a June year end, so this update covers the first 4 months of its 06/2018 year. Description;

... a market leader in the development, formulation, and supply of personal care and beauty products, including its own portfolio of brands

The key sentence is reassuring;

"The Board is pleased to report that trading in the first four months of the year is in line with expectations.

Outlook for the full year is also reassuring;

While we remain conscious of the continuing macro uncertainty both in the UK and internationally, overall we expect to maintain our positive progress and are well positioned to deliver against our expectations for the full year"

The following comments might have spooked some investors (the H2 weighting), but it sounds fine to me;

Our manufacturing business is also performing steadily against strong prior year comparators. As previously indicated we are seeing volumes normalise against the significant new products launched in the first half of last year. Pleasingly, there is a fresh wave of new product launches and contract wins that will contribute to our full year performance and bode well for future momentum. This is likely to give a second half bias to the year in this segment of the business.

New product launches is a good reason for an H2 bias, and might even trigger out-performance, who knows? Christmas ranges have seen "another year of growth".

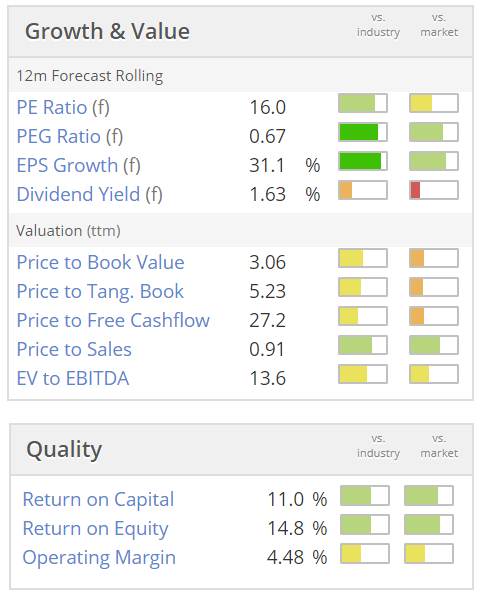

Valuation - on the face of it, the PER looks about right;

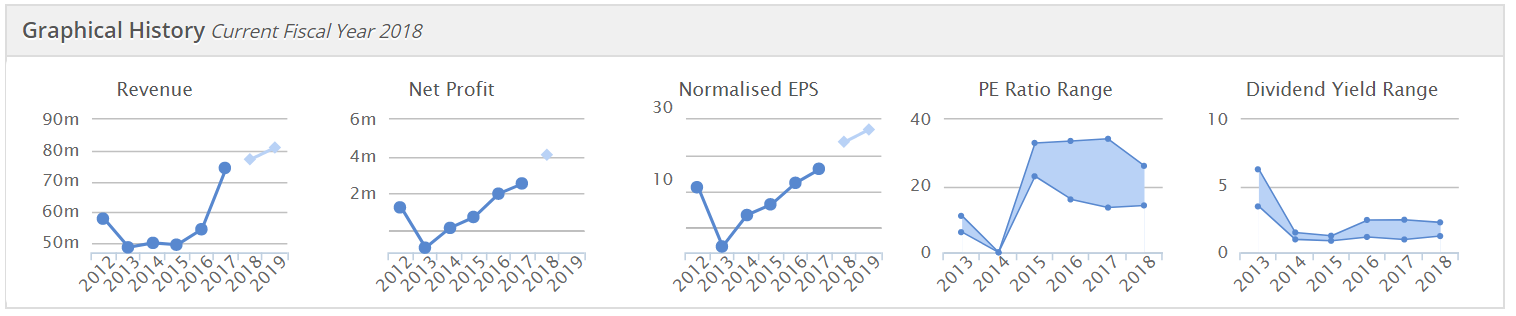

Although digging a little deeper, the earnings growth really has been excellent, as you can see from the Stockopedia historic graphs;

Broker comments - One broker this morning has kept their forecasts unchanged, at 23.8p EPS for 06/2018, and 27.2p for 06/2019. It says that the update today provides a reasonable level of visibility for the full year.

My opinion - I hold a few of these in my personal portfolio, and may use any further price weakness to top up.

This to me looks like a quite nice GARP share (growth at reasonable price). The shares have rallied strongly since an unusual, and unjustified dip in Sep 2017. In my view it's reasonably priced, and worth a closer look.

Quarto Inc (LON:QRT)

Share price: 122.5p (down 16.4% today)

No. shares: 19.7m

Market cap: £24.1m

Trading update (profit warning) - bad luck to holders of this illustrated book publishing company. This piles more misery onto shareholders after previous profit warnings. I reported on its profit warning on 4 Jul 2017 here. Then there was a spike up on news of a potential bid for the company, which fell through in Aug 2017.

What's gone wrong today then? This relates to the current financial year, ending 31 Dec 2017.

Strong publishing list drives solid H2 trading performance to more than recover the H1 loss but will not be enough to meet Board expectations for full year profits.

This is a very heavily H2 weighted seasonal business, so more than recovering the H1 loss is an absolute must.

It gets worse;

Full year adjusted profit before tax now expected to be significantly lower than Board expectations.

That leaves us in the dark. Why can't they just give an estimated range of PBT expectations? I've sought out a broker update, which just says that they're withdrawing estimates, and working on revised figures.

Unfortunately, that leaves me in a position where I cannot value the share.

Looking back at the interim results, they were awful - an adjusted loss before tax of $8.7m (prior year loss of $1.6m). So it looks to me as if this year may not be much above breakeven? The current forecasts look way too high, so that's why the forward PER of 2.51 shown on the Stock Report is a red herring. That PER will go up considerably when revised, more realistic forecasts flow through.

Dividends - sensibly, the company has decided to cancel any final dividend. This makes complete sense. The company tried very hard to continue paying generous divis, but that really isn't realistic any more. This could trigger an exodus from the share, from people holding it for income? With debt very high, I wouldn't expect divis to resume any time soon, unless there's a dramatic improvement in financial results next year or beyond.

Net debt -

Year-end net debt expected to be lower than net debt at 30 June 2017 [Paul: $75.8m] but to increase year on year. [Paul: $61.9m at 31 Dec 2016]

I think it would be sensible to try to find out what the position is wrt bank covenants. Nothing is said in today's announcement about that, but it could be a risk.

The Directorspeak suggests to me that a placing could be on the cards, to strengthen the balance sheet & reduce debt?

"In 2018 we have two clear objectives - more granular asset management particularly in our Adults publishing portfolio, brought about by enhanced financial systems and control, as well as looking at all options to reduce our debt and strengthen the balance sheet."

My opinion - as I've repeatedly said here before, over several years, the indebted balance sheet is the deal-breaker for me. I think there's a quite good business here, but personally I wouldn't touch it unless & until the balance sheet is strengthened considerably with fresh equity.

Gattaca (LON:GATC)

Share price: 309p (down 0.3% today)

No. shares: 31.6m

Market cap: £97.6m

(at the time of writing, I hold a long position in this share)

Preliminary results - for the year ended 31 Jul 2017. This company is;

... the specialist Engineering and Technology (IT & Telecoms) recruitment solutions business

Underlying diluted EPS has come in at 34.3p, which seems to be slightly ahead of 33.8p broker consensus. Although I'm not sure whether the broker consensus figure is basic, or diluted (which makes 1.0p difference to EPS). This is a PER of 9.0

Note that EPS is 22% down on last year, so things are not going particularly well.

Divis - this is the main reason to hold this share. Pleasingly, the generous payout is maintained, at 17.0p final, giving 23.0p for the full year - a yield of 7.4% . The fact that the divis are static, not increasing, suggests that the company might be struggling a little to maintain the payout - increasing the risk that it might be cut in future, if trading deteriorates further.

Net debt has risen from £25.0m a year ago, to £40.3m. This looks a bit too high to me. Although with recruitment businesses debt is par for the course - to fund the big receivables book (debtors). In this case debtors is huge, at £115.0m, so actually having net debt of £40.3m is fine in that context.

Balance sheet overall is fine.

NTAV is £32.9m.

Working capital - the current ratio of 1.85 looks very healthy, although note that there are also £26.0m in non-current liabilities. So if we move them into current liabilities, then the current ratio including all liabilities would be a still-healthy 1.32 .

Therefore there are absolutely no worries with this balance sheet, or the level of debt. I saw some commentary a while back arguing that the company was dangerously over-geared. That was wrong, because the writer had not looked at the balance sheet as a whole.

Outlook - light on specifics, but sounds generally positive;

We will continue to position the Group to maximise growth opportunities both in the UK and internationally. We believe the investments we have made during the year, will deliver good returns in 2018 and beyond. We are now well placed strategically to take advantage of the increasing convergence between the engineering, IT and telecoms skill sets, and to grasp the opportunities presented by infrastructure investment commitments around the world, particularly those made by the UK and US Governments.

While we continue to monitor uncertainty in the wider economy, we will invest selectively in strengthening the business to support our medium and longer-term performance.

They've been saying that kind of stuff for a while, and it hasn't paid off yet.

My opinion - whether you like this share really depends on your macro view. Personally I see bumpy, but not catastrophic times ahead. We'll muddle through with Brexit, and a wobbly Government, probably.

Therefore, for me, I'm happy to hold for the generous divis. Although if the economy does go into a proper recession, then I'd want to exit from this probably.

Devro (LON:DVO)

Share price: 239.5p (down 0.5% today)

No. shares: 166.9m

Market cap: £399.7m

Trading update - readers have asked me to look at this update. The company calls itself;

... one of the world's leading manufacturers of collagen products for the food industry

Looking at Devro's website, the products page is all sausages - Devro makes the sausage skins it seems.

The company has a 31 Dec year end, so it's updating today on Q3 performance. Things sound fine;

Trading for the period was in line with the Board's expectations, with total sales volumes ahead of the equivalent period last year, continuing the momentum delivered in H1...

The Board's expectations for the year ending 31 December 2017 remain unchanged.

Cost savings are going to plan.

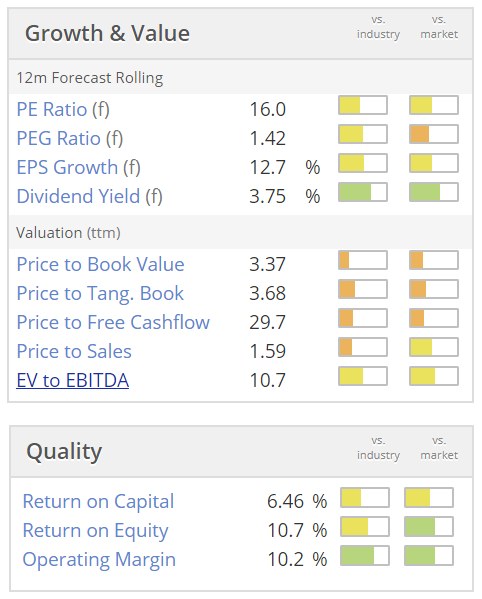

Valuation - looks reasonable, in a frothy market;

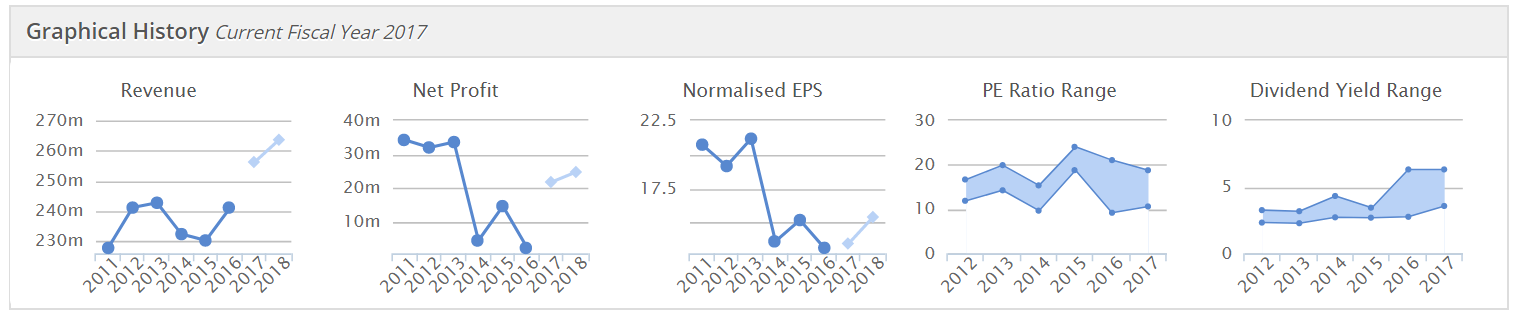

My opinion - I don't really have an opinion on this. It looks quite a capital-intensive business, and looking back at the history, something seems to have gone wrong in 2014, and the overall record of EPS is not very good;

On an admittedly very superficial look, I can't really see what the attraction is here? Brokers are forecasting 14.4% EPS growth in 2018, which is respectable (if the company achieves it). The PER on 2018 forecasts is 15.7 - which looks about right. Divis of 3.7% are reasonable.

Is there something more exciting in the pipeline that I've missed? I assume the company will face a lot of competition for what seems a fairly generic product. So my worry would be that its margins might be eroded over time. It's not for me.

Tracsis (LON:TRCS) - CEO/CFO interview

I put yours & my questions to the CEO & CFO of Tracsis today. Here is the link to the audio recording (apologies for the background beeping). They sounds pretty happy about how the year ended, and the prospects for the future.

I reviewed the accounts for y/e 31 Jul 2017 in yesterday's SCVR here.

I'll probably have to leave it there for today, due to needing to prepare for my CEO interview with Tracsis (LON:TRCS) imminently, then travelling to London. If I can grab some time later today to add some more, brief comments, then I will do.

Graham will be looking after you tomorrow!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.