Good morning!

A couple of things which caught my eye so far:

- Games Workshop (LON:GAW) - trading statement

- Zytronic (LON:ZYT) - trading update

- Tatton Asset Management (LON:TAM) - trading statement

- Peel Hotels (LON:PHO) - interim results

Games Workshop (LON:GAW)

- Share price: £30.175 (-9%)

- No. of shares: 32 million

- Market cap: £977 million

This is almost comedic in its brevity:

Following on from the Group's update in September, trading to 7 October 2018 has continued well. Compared to the same period in the prior year, sales are ahead and profits are at a similar level to the prior year.

However, the Board remains aware that there are some uncertainties in the trading periods ahead for the rest of the 2018/19 financial year. A further update will be given as appropriate.

The share price has now fallen by 25% from its recent high, with a further 9% fall today.

Isn't it remarkable that nearly £100 million pounds in value can be wiped away merely at the mention of "some uncertainties"?

I suppose there's a little bit more to it than that. There is a slight cause for concern in that profit margins must have slipped, if sales are up and profits are flat.

But there's also a discrepancy (in the company's favour) between official forecasts and this update.

Official forecasts for the full-year ending in June 2019 are that sales will be a little lower and pre-tax profit will fall by c. 17% to £62 million, before the trend turns positive again in FY 2020.

But according to this note, sales so far are up and profits are flat. So if this trend could be sustained for the rest of the year (not guaranteed by any means, since there are still 7-8 months left), then we would be on course for an earnings beat by the end of the year.

Given that management have expressed some caution (over unnamed uncertainties), I'm inclined to think that we won't get an earnings beat in the end. As I've said many times, the product cycle with GAW can be a bit lumpy and we shouldn't necessarily view this on a 12-month cycle.

Anyway, let's not read too much into this cryptic RNS. The company is doing ok, but the future is uncertain (as always). As you were!

Zytronic (LON:ZYT)

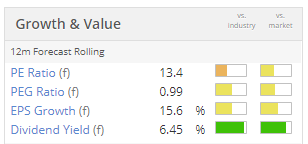

- Share price: 385p (-9%)

- No. of shares: 16 million

- Market cap: £62 million

This makes touch screens used in casinos, ATMs, etc.

When studying it before, I've come away with the view that it's a good, quality company with conservative management.

By "conservative", I mean that only a small fraction of operational cash flow has been reinvested into capex and R&D. Instead, the company has chosen to pay out hefty dividends (>6% yield currently) and to build up a big cash pile on its balance sheet.

Let's bring the story up to date:

- Full year revenues £22 million, in line with market expectations.

- PBT £4.2 million, which is behind expectations. I can see a forecast for £5.2 million, so this is 19% miss.

The causes of the PBT miss are litigation (now settled) and lower margins arising from the increase in sales.

The company affirms the strength of its cash pile (£14.6 million) and says it is working to improve margins with the new product designs and production techniques required.

My view - the litigation looks like a genuinely one-off event, and is irrelevant to Zytronic's long-term value. The failure to maintain margins is more disappointing, but I would expect the company to successfully address it.

It's important to understand that this company has been around for a long time, has a long-standing CEO, and is managed very carefully (as I mentioned earlier).

So for me, looking at the big-picture context, I think the market is currently pricing this about right. It's unlikely to shoot the lights out, but it's also unlikely to be mismanaged into oblivion.

Tatton Asset Management (LON:TAM)

- Share price: 268p (+0.4%)

- No. of shares: 56 million

- Market cap: £150 million

Tatton Asset Management plc (AIM: TAM), the on-platform discretionary fund management (DFM) and IFA support services business, is today providing an un-audited period end update for the 6 months ended 30 September 2018.

I mentioned this financial stock in June, noting good organic growth but feeling that the valuation was a little bit overcooked (at 233p).

It provides services to IFAs and their clients through the provision of fund-based portfolios, mortgage assistance, etc.

Momentum in its investment management division remains very strong and I'm starting to think that TAM might in fact deserve its generous valuation:

Assets under management increased to £5.7 billion at 30 September 2018 (31 March 2018: £4.9 billion) an increase of £0.8 billion or 16.3% for the six-month period.

Trading is in line with expectations.

My biggest concern is that this is only its second year as a public company (floated by Zeus), so I almost expect a mishap. Perhaps this will be the exception?

Peel Hotels (LON:PHO)

- Share price: 72p (-1%)

- No. of shares: 14 million

- Market cap: £10 million

Quite poor results (to mid-August) from this owner of nine hotels:

- sales down 6.4% to £8.1 million

- operating profit down 64% to £220k

That's what happens when operating leverage goes into reverse!

The KPIs are poor too (as you'd expect, given the financial outcome). Revpar and occupancy both down. Interestingly, the company hasn't reduced its average room rates.

The Chairman says that sales have now stabilised and have turned higher in the most recent period, to early October so he is looking for a recovery.

It's critical that this happens, because the company has breached its banking covenants. The bank is showing forebearance for now, but there is a material uncertainty over the company's future until it resolves this problem.

Balance sheet - it has £36 million of assets, of which £34 million is tied up in its hotels and other long-term assets. Against that, it has £9.5 million of borrowings (which are counted as current liabilities, since the bank has the right to call in its loans while covanants are breached).

Balance sheet equity of £23 million makes the shares superfiially attractive but the company's track record is patchy when it comes to profitability, the brand has questionable value, and returns will never be stellar due to the captal-intensive nature of the industry.

There's also the risk that it fails to sort out its debt problems. Even at a >50% discount to book value, I can't convince myself that this is a good opportunity.

That's it for today, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.