Greetings - we have a bunch of exciting updates today, making the World Cup Group F games at 3pm pale into insignificance!

Stocks of interest today are:

- Tatton Asset Management (LON:TAM) - results

- ULS Technology (LON:ULS) - results

- Fastjet (LON:FJET) - funding update

- Crawshaw (LON:CRAW) - trading update

- Xaar (LON:XAR) - trading update

- 1pm (LON:OPM) - trading update

- IWG (LON:IWG) - trading update

- Liontrust Asset Management (LON:LIO) - results

Stories are presented below in order of the headline to this article!

Fastjet (LON:FJET)

- Share price: 4.95p (-68%)

- No. of shares: 522.4 million

- Market cap: £26 million

Mentioning this first as it is the simplest story today. A bad business in a bad sector, listed in London but based in Africa, is running out of money again.

This had many hallmarks of a stock to avoid. The most obvious and important one being that it repeatedly ran out of money.

And it was remarkable that a few City fund managers kept putting fresh funds into it. I only wish I could have been a fly on the wall to hear their conversations and rationale in advance of each placing.

Perhaps they are about to throw in the towel at last:

The Company is currently in active discussions with its major shareholders regarding a potential equity fundraising, in the absence of which the Group is at risk of not being able to continue trading as a going concern.

Fastjet would never have existed if stock market investors had not been found to throw money at it. I continue to believe that it is worth close to zero.

The algorithms appropriately identify it as a Sucker Stock.

Crawshaw (LON:CRAW)

- Share price: 5.25p (-25%)

- No. of shares: 113 million

- Market cap: £6 million

Today's trading update from this chain of butchers strikes familiar themes: high street shops doing poorly, factory shops doing well. The macro environment is blamed (lower footfall on the High Street) and like-for-like sales are very poor:

Group sales were at -1.6% for the first 20 weeks of the current financial year with like-for-like sales down 12.9% for the same period. The trading performance of our high street shops remains challenging and reflects the widely reported lower footfall and softer consumer sentiment. Our factory shop format continues to perform well in this environment.

I'm very curious to see Crawshaw's interim results (out in September), to check for evidence that its transition to the factory shop model is starting to yield financial benefits.

The results for the year ending January 2018 showed an EBITDA loss and further losses are anticipated in FY 2019.

According to the FY 2018 results, Crawshaw "should be able to operate within its cash reserves" during FY 2019, so it has not acknowledged any need to raise fresh equity yet.

The shares are still much too speculative for me, personally. But I am leaving it on my watchlist, to check for any signs of a turnaround.

The Stocko algorithms have a very suitable classification for this stock, too: Value Trap.

Xaar (LON:XAR)

- Share price: 237p (-14%)

- No. of shares: 78 million

- Market cap: £185 million

Another quick profit warning to cover today.

Xaar is a Cambridge-based manufacturer. It makes the high-tech printheads that get used in industrial printers for advanced or demanding applications like ceramics, wood, glass, 3d printing, etc. See here for a list of applications.

It's been a while since I've studied Xaar in any depth. It first appeared on my radar around 2014, when I thought it looked good value after some sustained share price weakness (unfortunately for me, it went on to have several nasty profit warnings).

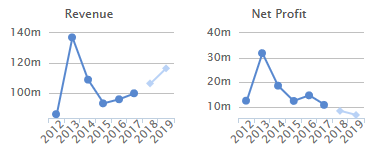

It has a volatile track record, as these charts help to illustrate:

Overall, the trend in profitability is downward (see right-hand-side), and the share price is back around those 2014 lows.

This puts it firmly within the remit of a Small Cap report such as this.

Today's update again points to a lack of visibility in its end-markets, and volatile sales results:

Our strategy remains one of diversifying the business, introducing a broader range of products across a wider range of market sectors and developing partnerships to exploit the on-going analogue to inkjet conversion within print markets. We continue to make progress with this but the rate of market adoption remains difficult to predict.

We are guided toward the dreaded second-half weighting and guided for full-year profit to be in line with expectations, despite ceramics sales being below expectations.

Job losses are on the cards. Xaar employees have suffered too, from the company's volatile results. Back in 2014, 160 employees were let go in a single swoop (about a fifth of its entire workforce at the time).

I imagine that there is more pain to come, given the H2-guidance and the weak sales guidance.

Having said all of the above, I still have the belief that there is money to be made in this niche, and that Xaar is not a badly-run company.

It has always had a strong balance sheet, and nearly always been profitable (using the past 20 years as a guide).

If I perceived that shareholders had finally crossed the threshold into peak gloom, and the shares were sufficiently cheap, there is a level at which I'd be interested to buy into it again.

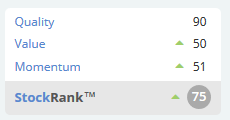

Stocko algorithms are picking up on a few positive characteristics, too:

Tatton Asset Management (LON:TAM)

- Share price: 233p (unch.)

- No. of shares: 56 million

- Market cap: £130 million

My first time looking at this stock - it has been listed only since last year.

It provides services to the mass affluent population via independent financial advisors. From its website:

Tatton Asset Management offers on-platform only discretionary fund management, regulatory, compliance and business consulting services, as well as a whole of market mortgage provision, to Directly Authorised financial advisers across the UK.

A strikingly positive headline for today's announcement. These are results for the year ending March 2018:

"Excellent debut - Strong growth across all businesses"

A few of the highlights:

- Tatton's discretionary assets under management ("AUM") increased 25.6% to £4.9bn

- Average AUM inflows of over £80m per month maintained

- Adjusted Operating profit1 up 44.7% to £6.5m

Tatton Investment Management Limited (TIML) is key to the story. It has over 300 adviser firms on board and almost 50,000 client accounts (average size: £100k, so nearly £5 billion under management).

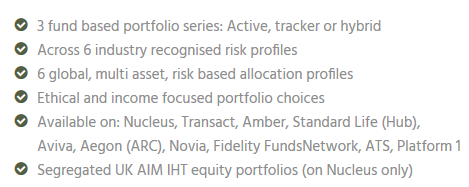

This is what it does:

Route to market seems to be working, given the fast growth in AuM.

I like the overall strategy, organic growth being highlighted ahead of "selective acquisitions":

The Group's strategic objective remains focused on organic growth through the provision of all major products and services that an IFA requires to service its clients.

The full-year dividend is 6.6p. That makes for a helpful yield against the current share price.

Outlook statement is confident, as you would expect given the preceding tone.

My view

I'm still getting to grips with the details of what Tatton does, but my initial impressions are positive.

For context, it's important to realise that the FIML business is providing a service to IFAs and acting as a go-between for the fund management companies who are actually managing client assets, so its slice of total fees is relatively small.

As usual with recent IPOs, I will be more comfortable with it when it has a slightly longer record as a listed company.

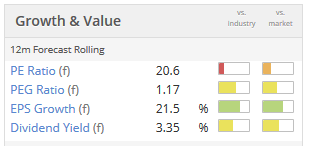

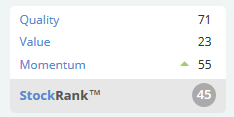

Stocko algorithms see little value at the current share price, and I am inclined to agree. It would need to continue growing at current rates to disprove this:

Liontrust Asset Management (LON:LIO)

- Share price: 608p (+3%)

- No. of shares: 50.5 million

- Market cap: £307 million

This is more like the type of asset management business that I would typically invest in: one that is actually running money and earning most of the fees.

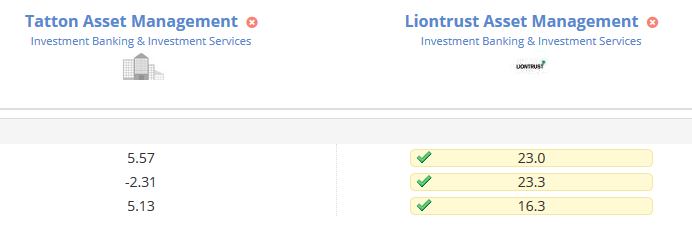

As Gus, suggested in the comments, Liontrust is doing better than Tatton according to several metrics.

I would have suspected that Liontrust would have good quality metrics: this is a general feature of fund management companies.

The Tatton numbers should improve, but there is no doubt that Liontrust is already doing very well. From top to bottom, this is Stocko's view of their Return on Capital, Return on Equity and Operating Margin:

Liontrust's results today are sparkling.

It has achieved large inflows, massive growth in AuM, bigger performance fees and substantial top and bottom line growth.

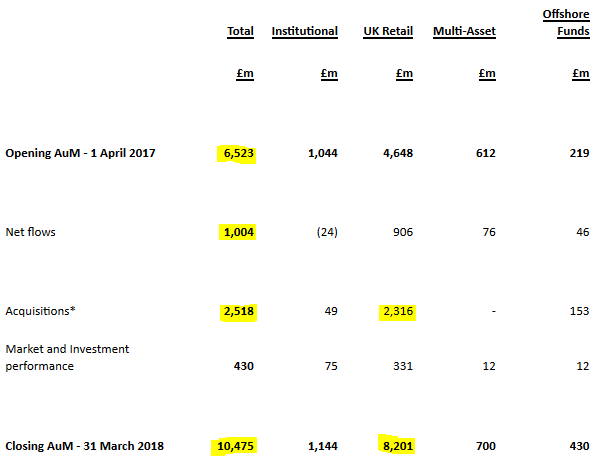

AuM analysis is as follows:

Organic growth from inflows (£1 billion) was 15% of the starting level (£6.5 billion) - pretty good.

If that was achieved every year, combined with decent performance, AuM would snowball to massive levels.

Acquisitions were nearly all UK retail-based, increasing that category as a percentage of the total. It's an attractive category, so there's nothing wrong with that. Liontrust bought out the investment management division of Alliance Trust (LON:ATST).

The team joining from Alliance Trust focuses on Sustainable Investments, similar to Impax Asset Management (LON:IPX) which we have covered in this report.

Environmentally-focused investing is extremely popular at the moment, and fund flows to this particular team of managers may have been suppressed by its association with Alliance Trust (which was the subject of a shareholder activist campaign).

The Sustainable Investments team now has £3 billion in AuM, up by half a billion during the year. It was an acquisition that worked out even better than expected:

Following the completion of the acquisition, the positive fundflows were significantly higher than initially expected. The perception of corporate instability surrounding AT Plc and to what extent it would suppress demand for ATI's retails funds had not been fully considered. Additionally management had not been fully aware of the increase in UK investment consumer demand for 'Sustainable' investments.

My view

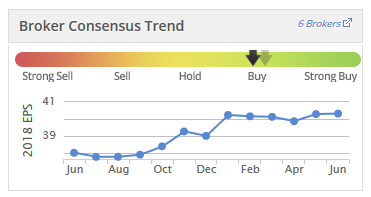

I think there are a bunch of positive characteristics to this stock. See how it has been enjoying strong earnings momentum:

The forward P/E multiple is not too demanding (13.4x, according to Stocko) and the StockRank is an excellent 88.

So I think this is certainly worth a second look.

ULS Technology (LON:ULS)

- Share price: 135.5p (unch.)

- No. of shares: 64.8 million

- Market cap: £88 million

ULS Technology plc (AIM:ULS), the provider of online technology platforms for the UK conveyancing and financial intermediary markets, announces its Full Year results for the 12 month period to 31 March 2018.

This stock is new to me. Paul covered it once last year.

I need a simple explanation of what it does. From its website:

Customers use our service to compare conveyancing quotes based on price, location and service rating, made possible by the quality assured solicitor and licensed conveyancing firms with whom we partner.

FY 2018 is ULS' first full year of ownership of a company it acquired for £10.6 million (including earn-out), during the prior financial year.

I can't see what this acquired company ("Conveyancing Alliance") contributed to ULS's results in each year, but it was earning revenues of £4.4 million and PBT of almost £1 million as an independent company, back in 2015.

So the growth rates seen below will include a significant element of growth from the inclusion of CA for a full year:

- Revenue increased by 38% to £30.7m

- Underlying EBITDA1 increased 25% to £6.4m

- Underlying Profit Before Tax1 increased by 26% to £5.5m

The adjustments to PBT need to be treated with care.

For example, it excludes the amortisation of acquired intangibles.

These intangibles include customer relationships (which have been found to have a much shorter life than originally anticipated) and a technology platform which is assumed to have a useful life of 10 years.

I would think that the amortisation of these intangibles does need to be included in a reasonable PBT measure.

In addition, underlying PBT gets a £200k boost from the company capitalising more development spending than it amortises.

This use of intangibles ultimately makes the balance sheet less bullet-proof, and a quick inspection reveals that ULS's equity of £9.3 million is outmatched by nearly £18 million of intangibles.

Since its growth is not entirely organic and the balance sheet is weak, I've not seen enough to interest me in making an investment at this valuation, so will stop here.

Stocko robots agree that it is fully priced:

1pm (LON:OPM)

- Share price: 46.5p (unch.)

- No. of shares: 86 million

- Market cap: £40 million

This is a rapidly growing SME finance house, acting as both a lender and a broker. I've neglected to include it within my own portfolio, preferring to invest in PCF (LON:PCF), whose banking licence is spurring it to growth. But I must admit that the momentum at 1pm (LON:OPM) looks excellent, and this share could be excused for feeling neglected by investors.

Despite not having a banking licence, 1PM's lending capacity has still shown tremendous growth, thanks to support from the wholesale markets:

The Group's raw material is cash. The Group is pleased to report continuing and increasing support from the providers of wholesale funding facilities and debt investors. As at 31 May 2018, total borrowing facilities stood in excess of £160 million (2017: £74.5 million), an increase of over 2 times.Its cost of borrowing has fallen to less than 4%, enabling it to increase net interest margin.

It is growing primarily by acquisition: the total lending portfolio is up 50%, but only 10% of this is organic. Revenue is up 75%, of which 30% is organic.

An emphasis on growth-by-acquisition is one reason for me to feel cautious toward this stock. Another reason is that reliance on the wholesale markets is much less secure over the entire business cycle than, for example, retail deposits.

Despite these negatives, I'd still be inclined to think that the market is being unnecessarily harsh in terms of the share price. According to Stocko, 1PM is trading at a 10% discount to book value and at a P/E ratio of just 6x.

All done for today!

Cheers,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.