Good morning folks,

Shares are likely to be low on the list of priorities today for most, and the exchange closes early. For whatever it’s worth, we’ll be keeping an eye out for interesting company announcements.

All the best

Graham

The NASDAQ is in a long-overdue bear market after falling 3% on Friday. I've been saying for some time that this is the most overvalued major index.

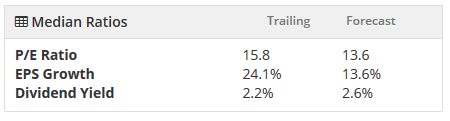

Its median ratios, as measured by Stockopedia, are as follows:

This suggests to me that there is (selectively) some value to be had within this large index.

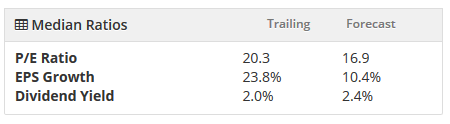

Note there is a big discrepancy between the above table and the corresponding table for the NASDAQ-100, which is restricted to the top 100 non-financial companies.

The NASDAQ-100 has a higher valuation, lower growth and a lower dividend yield. People are paying a big premium for big tech companies:

I would expect the other major US indices to follow suit and to become technical bear markets, too (20% down).

Bear markets typically last a little over a year. However, after one of the longest bull markets in history, perhaps we can expect the subsequent bear market to be longer than usual?

Gamfook Jewellery Plc (GAMF)

- Share price: 15.5p

- No. of shares: 100 million

- Market cap: £15.5 million

Curious to see that a Chinese company has listed on the NEX Exchange. It sells bespoke jewellery online and in Shenzhen and Fujian.

After all the failed ventures on AIM, are Chinese companies finding that NEX is a more suitable home for them now?

Some things I've noticed:

- The corporate advisor is Daniel Stewart, who brought us the fraud Naibu (NBU).

- Coincidentally, the Executive Chairman and Head of Sales at Gamfook both have the same surname as the Naibu Chairman. Both also have connections to Fujian province, which is where Naibu was founded.

- Scrolling through the Director biographies, I see that the token Westerner on the Board currently lives in London and does not speak any form of Chinese. He owns no shares in the business.

- There is one other NED who speaks Chinese and English, but none of the Executive Directors speak English.

- The company is registered in Jersey, with one Hong Kong subsidiary and three Chinese subsidiaries. As the Admission Document says, "The ability of Shareholders to bring actions or enforce judgments against the Company or the Directors may be limited."

- Following Admission, the Executive Chairman is a 73% shareholder.

- The company claims to have 4.6% market share of the custom jewellery market in China, with revenues and profits growing at incredibly rapid rates over the past three years.

- It uses the same set of accountants ("Crowe LLP") as Naibu used ("Crowe Clark Whitehill LLP").

Conclusion

Regardless of the value of the business in China, this particular IPO is dripping in red flags. The shares are uninvestible.

GRC International (LON:GRC)

- Share price: 117p (-2.5%)

- No. of shares: 57.5 million

- Market cap: £67 million

I covered this stock when it IPO'd in March.

My conclusion at the time was that it would probably continue to grow revenues very well in the short-term, due to the sector it's in (cyber security & GDPR compliance). But at the same time, I said I would be cautious about investing since it's essentially a consultancy/training/professional services type of business (i.e. a "people business").

Today's results show organic revenue +54%, heavily weighted to GDPR-related work back in Q1.

GRC thinks that GDPR-related work can pick up again:

We believe that the current slowdown in GDPR billings will be short lived as we estimate that 70% of organisations are yet to be fully compliant and the Information Commissioner's Office (ICO) has indicated that the imposition of fines is imminent

GDPR is one of the worst pieces of legislation ever written, if not the worst (it's in close competition for that title with the EU's "Cookie Law").

To maintain the post-Brexit regulatory framework, the UK government passed the Data Protection Act 2018, which means that GDPR-type rules will continue to be imposed on Britain even after Brexit.

And even without the DPA 2018, British firms would have had to comply with GDPR when processing the data of EU citizens.

So yes, there is going to be an ongoing need for compliance work by firms, not just in Britain but internationally (GRC has offices in Ireland and New York).

But I can't avoid the conclusion that this work is going to die down to a much lower level, sooner or later. At some point, most firms will be compliant. Eventually, it will only be new firms and a small number of non-compliant ones which continue to need work done.

It's also possible that these rules will be scrapped some day, to get rid of the unnecessary burden of compliance.

So I don't think that this is the kind of niche that I'd want to put money into as a long-term investment.

The financials

Nearly all revenue is generated by the labour-intensive activities of consultancy and training.

The company generated an H1 loss of £2.2 million on revenues of £8.9 million. It reckons that if you exclude one-off spending on various growth initiatives, there was a small cash inflow from the core business for the period.

Losses and investment spending have continued so far in H2, and the company has resorted to a bank overdraft and a Director loan to fund itself.

My view

Very unattractive as an investment: a barely profitable/loss-making consultancy whose main business is linked to compliance work for a recently introduced piece of legislation.

This is not a share to hold for the long-term, in my view. And the market cap at £67 million makes little sense.

Not much Christmas Cheer in today's report, oh well!

I had to visit the doctor today, who diagnosed me with a viral infection and fatigue. I have four drugs to take for the next week. Time to put the feet up and rest for a while, as recommended by a wise person in the comments!

Thanks for all of your support. Paul will be back when the markets re-open.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.