Good morning!

This list is taking shape:

- QUIZ (LON:QUIZ)

- Debenhams (LON:DEB)

- Ted Baker (LON:TED)

- Christie (LON:CTG)

- Toople (LON:TOOP)

- Instem (LON:INS)

QUIZ (LON:QUIZ)

- Share price: 18.55p (+7%)

- No. of shares: 124 million

- Market cap: £23 million

Leo has already written up a nice summary of the situation at QUIZ (LON:QUIZ) - see the comments. We can also refer to Paul's comprehensive analysis in January.

As a reminder: this share price has fallen by 90% since a series of profit warnings (starting last October).

It is now in turnaround mode, "undertaking a thorough review of all aspects of the business". It would have been helpful if that had been done prior to the July 2017 IPO!

EBITDA for FY March 2019 will sneak in at £4.5 million, as anticipated in the most recent trading update.

Note that this is significantly lower than the £8.2 million EBITDA result the company anticipated as recently as January, as sales in its standalone stores through January and February turned out to be very poor. This followed weak trading in late 2018.

Working my way back from the FY result, I see that Quiz has suffered a loss at the EBITDA level in H2 (before taking into account depreciation and other important costs).

I'd also note that the guidance given last month was based on the sales shortfall continuing through March, i.e. meeting EBITDA guidance today simply confirms the continuation of the January/February trend. There was no deterioration, and there was also no improvement.

This is very short-term analysis but maybe it's a reasonable approach for a fashion group where trends can change very rapidly, based on short-term missteps.

Because of these considerations, I think we should forget about P/E ratios based on annual eanings at this stage. It's more important to understand that the company has a very bad Autumn/Winter, and poor trading continued through March. Recovery in FY 2020 now requires a 180-degree turnaround, i.e. the new range of clothing for Spring/Summer needs to be a hit. You can view the company's latest styles at this link.

Some other well-known positives and negatives about this share:

- Net cash position.

- Strong growth in online sales (58% growth from Quiz websites).

but...

- Deteriorating like-for-likes (not published)

- Significant exposure to Debenhams (23% of sales).

- Online sales only about 1/3 of total.

My view

I'm afraid I don't have a view on what is going to happen here. It wouldn't surprise me if it went bust after a couple more seasons of bad trading, and it also wouldn't surprise me if it managed to pull through.

I don't take risk just for the sake of it, so this isn't something I would add to my personal portfolio. But I don't claim to be an expert when it comes to this share - those with a proper understanding of it may feel that it is worth a punt at this level.

Debenhams (LON:DEB) (in administration)

On a related note, I didn't realise how much money Mike Ashley had ploughed into Debenhams shares - £150 million! If he can get it so badly wrong, that seems like a good reminder of just how difficult it is to get it right in this arena. And also a reminder that equity is a very dangerous asset class.

The lenders who have taken control of Debenhams are said to include a couple of banks, along with the distressed debt investors GoldenTree and Silver Point.

They are the only ones who might be able to come out of this process with a win, and they took on much less risk than Mike Ashley did with his purchase of the ordinary shares in the open market. I'm sure they did a full scenario analysis and figured out that even in a worst-case scenario, the losses wouldn't be too awful.

As a general principle, it's far safer to buy the distressed debt of a struggling retailer, rather than its equity.

Ashley's strategy looks more like dangerous, risk-seeking behaviour than it does a sober investment programme. Hopefully he can avoid falling into the same trap in future!

Ted Baker (LON:TED)

- Share price: 1479p (-0.6%)

- No. of shares: 44.6 million

- Market cap: £660 million

Appointment of Chief Executive Officer

Conclusion of HSF Investigation

Quick update on Ted Baker.

The company is implementing new HR policies following the departure and resignation of Ray Kelvin, and is making permanent its acting CEO.

I used to look at the TED valuation and think "if only this was at a reasonable multiple, it would be great to own some".

Well, now we have a reasonable valuation, but for reasons which are fairly unpalatable!

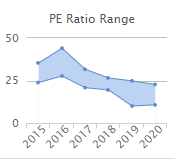

The forward P/E multiple is currently 11x. Here's Stockopedia's historic PER measurement:

So if the Ted Baker brand still has a bright future, this looks like a super buying opportunity.

The reviews on trustpilot are still mostly excellent, for whatever that's worth.

A trading update should be due around the AGM on 11 June. That will be the perfect time to revisit the investment thesis and to confirm that trading is still on track.

Christie (LON:CTG)

- Share price: 98.5p (+1.5%)

- No. of shares: 26.5 million

- Market cap: £26 million

Christie provides a wide range of professional services - click here for the group structure.

The primary division is between Professional Business Services and Stock & Inventory Systems and Services.

Lord Lee is a 3% shareholder, and the company has shown a good deal of resilience over the years. The share count hasn't moved much since 1989 (it had 23 million shares outstanding back then!).

But there are a couple of reasons why I don't want to spend much time on this:

- Complexity - it offers over 80 services, ranging from valuation to consultancy to insurance. It seems like it would require a lot of work to figure out what is really going on with such a diverse range of activities.

- Professional services - these come with high staff costs and low margins, and are difficult to scale.

Today's results show an operating profit margin of 5.4% - not very exciting.

The company points to synergies between its businesses:

...the opportunity each company has to benefit from each other's activities, collectively delivering an integrated set of advisory and transactional services that are desirable for anybody buying, running or selling a property-based business;

Balance sheet - no value here, only borrowings and a pension deficit.

My view - I'm afraid this one doesn't interest me.

Toople (LON:TOOP)

- Share price: 0.335p (-9%)

- No. of shares: 954 million

- Market cap: £3 million

Toople PLC (LSE: TOOP), a provider of bespoke telecom services to UK SMEs, gives the following update on trading ahead of its interim results, which will be announced in early May 2019.

Interim results at this tiddler are expected in line with expectations. The little bit of selling that's taken place seems to be down to the reduced cash balance of £1.1 million.

The company raised £2.2 million in September, which it said would be enough to deliver cash generation.

There are positive noises - "March 2019 was a record month of small business sign ups contracting directly with Toople". But I'm afraid this one is beyond my risk tolerance.

Instem (LON:INS)

- Share price: 310p (-6%)

- No. of shares: 16 million

- Market cap: £50 million

Proposed placing to sell 1,660,000 shares

Insiders at this IT solutions business, including the Chairman, have sold 10% of the company's shares. They will still own 16% of the company. The sale price was 290p.

It's not great news and I expect the share price could drift towards that 290p level in the short-term. In the grand scheme of things, based on how I generally approach insider sales, it probably doesn't matter very much.

There's nothing else of interest to me, so I will call it a day.

Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.