Good morning!

A very busy morning in RNS-land, with a lot of "small" updates, including 3 relating to my own portfolio holdings.

This list is final:

- Goco (LON:GOCO)

- B.P. Marsh & Partners (LON:BPM)

- DP Eurasia NV (LON:DPEU)

- Mission Marketing (LON:TMMG)

- Swallowfield (LON:SWL)

- Northern Bear (LON:NTBR)

- Instem (LON:INS)

- Amino Technologies (LON:AMO)

Tablets

It's that time of the year for me to take my main holiday, so I'll be jetting off to Italy soon and you'll be in Paul's capable hands again for a while!

That's not investment-related, but perhaps of more interest is my research into the Tablet market. The only one that I have ever owned is an iPad from about 2012, possibly the iPad 3. It barely works any more (though perhaps I should be glad that it works at all, due to its age!)

I've been looking at some of the models currently for sale, with a view to finding one that I can bring to Italy. It's for light work purposes - I need to log in occasionally while I'm away to do a few small tasks, which should only take a few minutes. What I'd like to do is leave my laptop at home more often, and just bring a tablet instead.

It's easy to forget about the tablet market, since phone screens have become so big in recent years that the need for a mid-size device has diminished. But there is still a market for multi-functional devices with a screen size of 7"-12".

Anyway, despite being a huge fan of Apple ($APPL) when it comes to phones, there is actually no chance of me buying an Apple tablet. The choices available from Samsung, Huawei and Lenovo seem to be more than sufficient, and at very attractive price points. There's also the interesting possibility of the Amazon Fire HD 10. Or if I was going for a more expensive, heavy-duty device, I'd be inclined to go for the Microsoft Surface Pro.

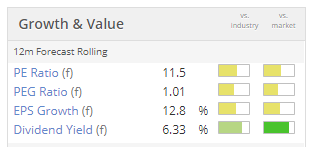

This is a long-winded way of saying that I'm contributing to the trend whereby iPad sales were stronger in 2012 than they are today:

(Source)

And if I have a good experience with a non-Apple tablet, does that mean I'll be more likely to buy a non-Apple phone next time? iPhone revenues haven't been on a positive trend, either. Once we escape the Apple ecosystem with one device, maybe we are more likely to escape it with another device, too?

Goco (LON:GOCO)

- Share price: 86.5p (+0.4%)

- No. of shares: 418.5 million

- Market cap: £362 million

(Please note that I currently have a long position in GOCO.)

This is pleasant news for Goco (LON:GOCO) shareholders. We have a tie-up with B, the digital banking service from CYBG (LON:CYBG). A new service will allow B customers to:

"...quickly and easily find and switch to better energy deals, all within the B mobile banking app. As the GoCompare energy switching service is integrated with B, their customers' details are used to pre-populate a lot of the questions needed to carry out an accurate comparison, making the process as hassle-free as possible."

Comment from CYBG:

Having been early adopters of Open Banking, our new partnership with GoCompare has launched the first energy comparison and switching service for bank customers in the UK.

The financial value of the deal is unclear. In simple terms, we have 300,000 B customers who are now more likely to use Goco to switch their energy service, as it will be very convenient for them to do it on their phone. That can't hurt!

I also think it's encouraging to see external validation, from CYBG, of Goco's technology platform.

This has been a pleasant, small position for me since I bought it late in 2018. I reckon the most likely outcome is that it will get gobbled up by someone else in the next few years, hopefully at a generous premium.

It deserves a better rating, in my view (but I would say that!).

B.P. Marsh & Partners (LON:BPM)

- Share price: 287p (+1%)

- No. of shares: 37.5 million

- Market cap: £108 million

(Please note that I currently have a long position in BPM.)

This is an investor in the insurance sector.

As mentioned last month, I increased my position size here on the back of its final results. I'm attracted by its long track record, portfolio diversification, management style, financial position and share buyback policy. NAV per share is 350p.

Over the past month, there have been several small share purchases by insiders. There has also been a very small repurchase of its own shares, at 291.5p. It can buy back its own shares at a >15% discount to NAV, so it can buy back anywhere below 297.5p.

Today's news relates to an £800k investment, with contingent consideration of a further £600k. So it's a fairly small piece of the entire portfolio.

BP Marsh, via a holding company, will own 36% of Ag Guard, an Australian insurance services provider.

Note that there is an Australian theme at BPM, which is 20% owned by the Australian insurance company PSC (ASX:PSI).

My view - when I'm investing in an investment company, I tend to think much more about the quality of the people running it, rather than attempting to copy the due diligence that they are doing on their investees.

I was delighted to have a meeting with BP Marsh recently, which helped to cement my view that they are running the organisation with a strong sense of stewardship and with a very long time horizon.

This is one of my favourite types of investment, and I'd put it in a similar category to Volvere (LON:VLE).

DP Eurasia NV (LON:DPEU)

- Share price: 86.7p (-2%)

- No. of shares: 145 million

- Market cap: £126 million

(Please note that I currently have a long position in DPEU.)

Yet another company of mine has made an announcement this morning. Very unusual!

Full-year adjusted EBITDA at this Dominos business is in line with expectations.

We have like-for-like sales growth of 7.7% in Turkey, when measured in Turkish Lira. The problem is that this is not keeping pace with the depreciation in the Lira, in terms of the local inflation rate and the value relative to GBP.

However, I note that there are signs the Lira is firming up. It is currently not far from the levels seen before the savage sell-off in mid-August 2018.

While the collapse in the Lira was very distressing for this share, I took the view that currency movements would eventually wash themselves through the system and that a fair equilibrium would be reached again. It was not DP Eurasia's fault that the currency value had fallen, and indeed DPEU's results have been quite reasonable, when you put that issue to one side.

To give you an idea about what happened:

- 6 August 2018: DPEU share price 148p

- 13 August 2018: DPEU share price 91p (loss of 39% in a week)

- 6 August 2018: one Turkish Lira is worth 14.7p

- 13 August 2018: one Turkish Lira is worth 11.3p (loss of 23% in a week)

The Turkish Lira is currently worth 13.9p, so you can see it's not that far from those levels in mid-2018. Turkey's main interest rate is currently 24% and even though President Erdogan wants to see this reduced, it's likely to remain at extremely high levels as the central bank seeks to preserve the value of the currency.

So I'm sort of bullish on the possibility that the Lira can recover. Even at its current levels, I don't think that the DPEU share price reflects the recovery it has made or the progress at the company itself.

DPEU's Russian sales are up 63% (including sales at owned and franchised stores). And like-for-like sales in Russia are up 4.7%, measured in Russian Roubles. This is despite the previous period including the World Cup, hosted in Russia.

The Russian business needs a new CEO, as I've mentioned before - a new appointment is sought before the end of the year.

Online deliveries continue to improve for the entire group, and are now at 67.5% of total (versus 59.3% last year).

CEO comment:

We remain on target for store openings for the full year in both our main markets and the Board expects the full year Adjusted EBITDA(5) for 2019 to be in line with expectations."

My view - this remains my smallest holding, and an extremely risky one at that, but I remain hopeful! It hasn't put a foot wrong in terms of the growth strategy, and I view the collapse in the share price as being almost entirely macro-related.

Looking forward to next year, analysts are targeting EBIT of 102.7 million Lira, which is worth about £14.3 million at current exchange rates. The following year, if growth targets are hit, it is looking for 131.9 million Lira, which is worth £18.3 million.

It is carrying some debt which needs to be serviced, and the uncertainties are many, but I continue to like this as a small, speculative position.

Mission Marketing (LON:TMMG)

- Share price: 85.5p (-6.6%)

- No. of shares: 85 million

- Market cap: £73 million

This is a network of marketing and advertising agencies, created via a series of acquisitions.

Today's H1 update makes no reference to market expectations, only to KPI targets, making my job slightly harder.

However, I have checked last year's H1 update and it did not refer to market expectations either, so at least the company hasn't changed its format in that regard.

The Board is pleased to report that the Group expects to report results for the first half of the year in line with its KPI targets of revenue growth of 5% and profit* growth of 10% from continuing operations**, continuing the Group's track record of growth over the past eight years.

A note published by Edison last month forecast that revenue would increase by 5.6% this year, and PBT would increase by 7.4%. So the numbers presented above look ok, in that context.

Debt has been a hot topic with this share and it sounds like progress is being made in terms of develeraging. Net debt at the end of the period is £5.2 million, and the company thinks that its net debt/EBITDA ratio is only 0.5x, before making adjustments for the new lease accounting rules.

There will be "a significant bias towards the second half", which the company says was true in previous years, too.

Checking the archives, the company did indeed say almost exactly the same thing in 2017 and in 2018, too.

Since it has been consistent, I wouldn't punish it for repeating what it has said before.

My view - this update seems fine to me, but judging by the share price it is clear that some shareholders were expecting more.

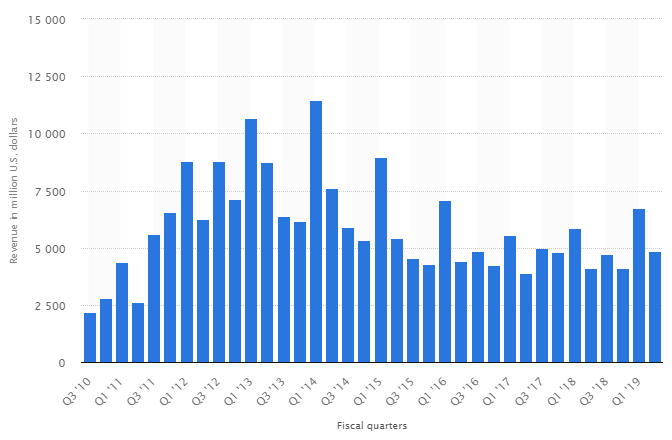

Historically, this has been valued at cheap earnings multiples. As of last night, the PER was 9.4x. Perhaps it is headed back to the 6x-8x range where it has often traded before?

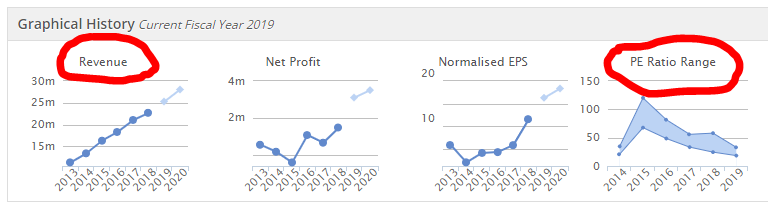

You can see from this Stocko graphic that the PER has been unusually high in 2019:

Swallowfield (LON:SWL)

- Share price: 230p (+19%)

- No. of shares: 17 million

- Market cap: £39 million

Proposed Disposal of Manufacturing Business

Terrific news for Swallowfield shareholders, as it proposes to change from a manufacturer and brand developer to being a pure brand developer. Its manufacturing business will be sold for £35 million (subject to some adjustments), and the name of the remaining group will be renamed "Brand Architekts".

Readers will know that I'm a shareholder in Creightons (LON:CRL), another cosmetics manufacturer. The quality metrics at Creightons have been excellent, reflecting (in my view) the skill of its managers and its operational efficiency. But the deal today by Swallowfield suggests that even a modestly profitable manufacturing business can still command healthy disposal prices.

Swallowfield acknowledges that its manufacturing business has not done terribly well:

Over recent years significant volatility has been experienced in the Manufacturing business, of late due to the impact of material cost inflation, weaker product mix and the prevailing external environment.

Core financial metrics for the manufacturing business:

- Revenue for 53 weeks to June 2018: £31 million

- Operating profit for 53 weeks to June 2018: £2.6 million

- Value of assets being sold: £23 million

So the premium to book value of assets is >50% and the multiple being paid relative to trailing operating profit is 13.5x.

The deal will benefit the manufacturer, by putting it in the hands of a larger organisation that can manage it without being so sensitive to short-term volatility.

It also benefits SWL by achieving a sale price in excess of its total market cap, and still leaving it with ownership of its Brands business!

Note however that SWL does not expect that it will be sitting on £35 million of cash. There is some debt to clear:

Following completion of the Proposed Disposal, the Directors expect the Group's net cash position will be approximately £23 million, after taking account of deductions and the expenses of the transaction. The Board intends that these funds should be retained by the Group to fund investment to drive organic growth and to pursue future earnings accretive acquisition opportunities.

Payments to executive directors: there are large bonus payments being proposed for SWL's three executive directors in relation to the deal, adding up to almost £600k. They seem to be designed as a thank-you for getting this deal done, but are they perhaps a bit generous?

My view - Swallowfield looks like it might be priced at bargain levels at the moment, seeing as this deal could leave it sitting on £23 million of cash, leaving the Brands business theoretically valued at £16 million at the current share price.

The Brands business generated £2.6 million of underlying profit in H1, before central costs and exceptional items. Central costs and exceptional items should surely reduce now that the manufacturing business is leaving?

In the prior year, the Brands business generated underlying PBT of £4.8 million (over a 53-week period), again before central costs and exceptional items.

Today's trading update says that there are still some pressures on Brand sales:

As highlighted previously, the pace of growth has slowed in the Brands business with revenues declining by 3% over the prior 52 week period (5% on 53 weeks). This is a result of lower UK consumer confidence and pressures within the retail environment which have led to a softening in demand and retailer reductions in category space and promotional activity.

Even with these headwinds, the market cap looks possibly too low to me.

Northern Bear (LON:NTBR)

- Share price: 66.7p (+8%)

- No. of shares: 18.5 million

- Market cap: £12 million

This building services provider has produced good numbers for FY March 2019.

The cash generated from operations is unusually large at £5.1 million, helping the company to increase its regular dividend and declare a special divi of 0.75p (though I note that this is lower than the special divis in 2017 and 2018).

The Chairman's statement, in response to feedback from shareholders, includes a few paragraphs to explain why the company's results are "very difficult to predict".

This share nearly always looks dirt-cheap but this is for all the right reasons, in my view. Building services are a tricky place to build a sustainable business and the Chairman himself rightly states that there is little or no visibility when it comes to results in any given period.

I will give full marks to NTBR for stating their lowest, highest and average net cash or net debt position during the year. That is the best way to disclose net cash or net debt, and not enough companies do it.

Outlook - not worth the pixels it's printed on, probably, but here it:

The Group continues to hold a high level of committed orders although, as stated in the Trading section, we have limited short term visibility as to when these orders will be realised.

My view - it doesn't interest me, as I try to avoid small, order-driven B2B businesses, and I don't invest in building services. This cheap stock is reserved only for those who have the stomach for it.

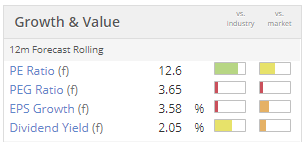

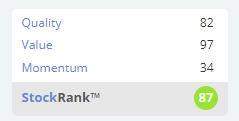

Fittingly, Stocko categorises it as Contrarian:

Instem (LON:INS)

- Share price: 360p (+1%)

- No. of shares: 16 million

- Market cap: £59 million

Instem plc (AIM: INS), a leading provider of IT solutions to the global life sciences market, is pleased to announce a trading update for the six months to 30 June 2019 (the "period").

I'm afraid that I'm not familiar with this software company. But for what it's worth, today's update sounds fine, and is in line with expectations. Sell-side analysts have made no changes to their estimates as a result.

- 10% year-on-year revenue growth

- SaaS revenue is replacing perpetual licenses

- Good macro conditions wiith R&D pipeline growing

CEO comment:

"...it was particularly pleasing to see a faster rate of transition than anticipated from perpetual software licensing to SaaS subscriptions. We believe our SaaS value proposition offers both Instem and our customers enduring benefits and increases shareholder value as the visibility of our revenue continues to improve."

Outlook

Checking the analyst forecasts, I see that the company is supposed to generate adjusted PBT of £3.6 million this year, rising to £4.4 million next year.

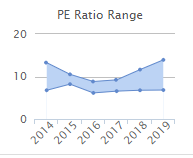

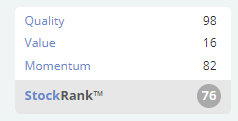

Stockopedia likes it, calling it a High Flyer:

I was chatting with Ed recently, and he reminded me that the Momentum Rank includes earnings momentum, so it's not just a technical tool based on share price movements. It also has an important fundamental ingredient. Something to bear in mind!

Checking the progress of revenue and the historic P/E ratio range, I see very encouraging lines of progression. Revenues have been on the march and the company has been growing into its valuation - the P/E ratio has declined even as the share price has increased over the past few years:

It all adds up to a nice set of indicators.

Amino Technologies (LON:AMO)

- Share price: 121p (+2%)

- No. of shares: 73 million

- Market cap: £88 million

Acquires 24i to accelerate online video strategy

I'm running out of steam now, but let's take a quick look at this one, which has been mentioned in the comments. It makes TV-related technologies - software, hardware, and cloud solutions.

Paul and I have generally made positive noises about this company, without claiming to bring any particular sector expertise to the party. See Paul's comments on it in June. I've only covered it once before, and that was last year.

Today's update is significant: Amino is making a €21.4 million investment in exchange for 92% of 24i, an international business with its HQ in Amsterdam.

24i makes "TV apps for every screen". Its apps can be used on all sorts of TV devices and on games consoles, tablets and phones.

The valuation is a bit punchy, as you might expect. 24i's revenue last year was just €7.1 million, and the Amino deal gives it an implied enterprise value of €27.5 million. So the implied Price to Sales multiple (trailing) is in the region of 4x. As regards profitability, 24i has been trading close to breakeven.

Rationale - the two companies share a vision of the future, and their customer bases and product suites are described as "highly complementary".

24i shares Amino's vision of where the modern TV industry is heading and, like Amino, recognises that the industry is at the beginning of the curve of disruption. This is a fundamental shift from broadcast and hardware to streaming and hosting video platforms in the cloud. Like Amino, 24i has an agile culture of innovation and is focused on capturing this market opportunity.

The Acquisition will enable Amino to deliver full 'end-to-end' and on-demand personalised content solutions to its customer base. It will also build momentum in Amino's software and services revenues, as well as its recurring revenues.

This is not the takeover of a competitor, in other words - it's designed to increase the overall product offering at Amino.

My view - it sounds logical, so hopefully it will create value for everyone concerned.

Amino is yet another Contrarian share on our list today, and it pays out a surprisingly high dividend yield for a tech stock. Might be worth looking into:

Ok, that's it for today! Thanks for all your feedback.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.