Good morning! I'm back from holidays and looking forward to getting back into the swing of things here.

This list is final:

- Begbies Traynor (LON:BEG)

- Luceco (LON:LUCE)

- Carclo (LON:CAR)

- Fireangel Safety Technology (LON:FA.)

- Yu (LON:YU.)

- Fastjet (LON:FJET)

- NWF (LON:NWF)

- Xpediator (LON:XPD)

Italy

A brief word on Italy. This was a terrific holiday which incorporated the central Italian countryside, Sorrento and Rome.

I was deliberately avoiding "work", and did not for one moment think about the threat posed by Italian debts as I toured the Colloseum, the Vatican and the catacombs.

Thanks to my almost total avoidance of work, I have only a few investment-related observations to provide you from this trip.

One thing I did notice was Banca Monte Dei Paschi Di Siena (BMPS). This is arguably the oldest bank in the world which is still operating (despite some financial difficulties) and it was intriguing to see its branches in real life.

Another thing I noticed was chaos on the streets of Naples. It was my first time driving on the wrong side of the road, and this difficulty was compounded by the refusal of the Italians (both motorists and pedestrians) to leave alone any square inch that they did not need.

It reminded me very much of my trip to China, but at least in China I was on foot. Driving a mid-sized SUV through Naples is not something that I would recommend to anyone from the UK or Ireland, unless it is absolutely necessary. Indeed, I'm surprised that the injury rate from road traffic accidents in Italy is only 12% higher than the EU average.

The countryside, by contrast, was a very pleasant drive. The motorways were in good condition although there were a surprising number of roundworks.

This brings me to my point that as a tourist, I would have no idea that the Italian economy suffered a mild recession at the end of 2018. With plenty of roadworks underway (presumably not abandoned before they were finished), with the trains running very well when we needed to use them, and with nearly all public places being in excellent condition, it was easy to forget about the country's alleged financial problems.

Having said all of that, I was reliably informed that jobs for young people in the region are scarce, forcing them to leave (e.g. to Milan) to have a chance of finding useful work. Youth unemployment was sitting at 33% earlier this year. I imagine that in southern Italy, the choices are extremely limited for young people hoping to start a career.

But as a tourist, I would definitely go back for more of the same: more bresaola, more saltimbocca, more pollo alla Romana, and more panna cotta. A great place to eat, to relax, and to forget about work! And yet there is always something nice about coming home.

That's enough rambling for today.

Begbies Traynor (LON:BEG)

- Share price: 79.25p (+1%)

- No. of shares: 114.5 million

- Market cap: £91 million

Latest Red Flag Alert for Q2 2019

This regular alert has less to do with the insolvency practitioner Begbies and more to do with the general health of UK businesses.

To give me some more context for this alert, I've also gone back and looked at the highlights from Q2 2018.

Key points for the latest report:

- 484k businesses in distress, 14% of all economically active businesses.

- For context, 472k businesses were reported to be in distress in Q2 2018. So that's a 2.5% increase, year-on-year.

- Average insolvent company debt more than doubles to £66k over three years.

Consumer Spending

The property, leisure and tourism sectors are the most badly affected by financial distress currently. Begbies says there has been weakness across the broad consumer economy, including hotels and sports/health clubs (i.e. gyms), and that this has fed through to sectors which are "indirectly reliant" on the consumer, such as property companies. Think of all the empty space which needs to be put to use if a hotel or gym is closed, for example.

Companies with a physical presence aren't the only ones which are hurting. The online retail sector has taken a noteworthy hit, with a 12% increase in significant financial distress. Begbies says that it is seeing the "the weakest consumer spending since records began in the mid-1990s". This could spell very bad news for our consumer stocks.

Begbies also reports significant distress in the financial sector, but it reckons that financial companies can recover once Brexit has been resolved.

My view

This confirms my view that we need to be extremely selective when it comes to consumer stocks. Not only is disruption making many business models obsolete, but the disruptors in online retail are themselves prone to financial distress and the problems posed by a weak consumer. Trade carefully.

Luceco (LON:LUCE)

- Share price: 103p (-13%)

- No. of shares: 161 million

- Market cap: £166 million

Luceco plc is a leading manufacturer and distributor of high quality and innovative LED lighting products, wiring accessories and portable power products for a global customer base.

This update is in line with expectations.

The company helpfully provides market expectations: underlying operating profit for the full year of £17 million - £17.2 million.

Unusually, the share price has dipped despite the company reporting that it's in line with forecasts.

Whenever this happens, we can conclude that the forecasts aren't in line with what investors were actually hoping for.

Luceco shares have surged from a low around 33p at the start of this year, having turned performance around after the company suffered the typical post-IPO flop.

This "in-line" update suggests that the run of upgrades may now be over.

My view - this might be around fair value now, though still at a discount to the 130p IPO?

I am turned off by its macro risks (commodity prices and exchange rates) and can see few attractions to invest in the LED lighting industry, so I will be staying away.

Carclo (LON:CAR)

- Share price: 11.9p (-3%)

- No. of shares: 73.4 million

- Market cap: £9 million

Update on banking position and timing of results

This company makes "technical plastics products", including for the medical and LED lighting sectors. The share price has been a rollercoaster for long-term investors but the fact that the market cap is now sub-£10 million suggests to me that it is ending badly for shareholders.

Perhaps we do well if we avoid any company with "LED" in its description?

The "banking position" update is ok, with financing in place until January 2021.

Producing numbers for FY March 2019 is proving to be difficult, however, due to the planned disposal and poor performance of (you guessed it) an LED lighting subsidiary:

Consequently, the Board now believes the Group and its auditors will not be able to finalise the audit and publish the accounts for the 2019 financial year by 31 July 2019.

Carclo is main-market listed, and therefore has only four months to get its numbers ready (unlike the six months that AIM companies enjoy). So a temporary suspension could be on the cards.

It is fascinating to me that large PLCs can produce numbers so much faster than small PLCs.

My view - Net debt of £36 million as of September 2018 seems inappropriate, relative to the size of the group.

If it pulls through, it could turn out to be ludicrously cheap at current levels. But it looks a poor-quality business, is very highly leveraged, has had issues with banking covenants recently (prior to agreeing new terms), and is unable to produce its results on time. These are the stocks which should be ludicrously cheap.

Fireangel Safety Technology (LON:FA.)

- Share price: 29p (-16.5%)

- No. of shares: 75.9 million

- Market cap: £22 million

This unfortunately-tickered company makes fire alarms and related home safety devices. We have frequently reported on its difficulties in this report.

Today's update is in line with expectations, but with a strong second-half weighting:

With sales momentum continuing into the second half of 2019, and gross margins expected to improve based on the mix of revenue, the Board expects results for the full year will be in line with market expectations. With approximately 55% of the expected full year revenue to be generated in the second half, full-year performance is dependent on securing several exciting pipeline opportunities which are well-advanced in negotiations and trials.

55% of revenue in H2 means H2 needs to be >20% bigger than H1. That's a lot to ask for, even with excitement in the pipeline.

The CEO is leaving, with no reason given. He has been in charge since February 2015, when the share price was North of three quid. I guess the Board doesn't need to give a reason in these circumstances? He is thanked for his hard work and commitment.

My view - this is extremely speculative, having changed strategy to become a "connected devices" company. Even after raising £6 million (gross) in April, it is still in a net debt position, making use of its invoice discounting facility.

I would treat this one with extreme caution.

Yu (LON:YU.)

- Share price: 155p (-9%)

- No. of shares: 16 million

- Market cap: £25 million

Trading update and notice of results

Yü Group PLC, the independent supplier of gas, electricity and water to the UK business sector, today provides an update on trading for the six months ended 30 June 2019.

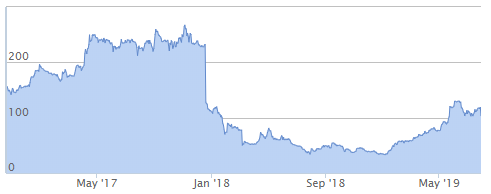

Yet another stock which has been in the wars, this 2016 IPO went on a run before crashing back to reality late last year, after its accounts turned out to be bogus.

There has been a "thorough and extensive review":

The Board is pleased to confirm that... key control and process improvements have been made and are operating routinely, providing good visibility on contracted revenues and facilitating greater financial control.

That sounds good, but the turnaround needs more time and an adjusted EBITDA loss of £2.5 million - £3 million is forecast for H1.

The founder, CEO and major shareholder remains in his position, and was apparently misled by Yu's finance function about the profitability of his own company (a bit like CAKE, maybe?).

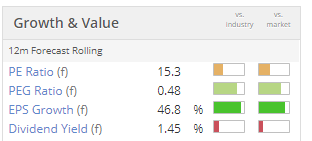

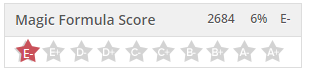

This all strikes me as rather low-grade. Even without accounting problems and red ink, I wouldn't be in a rush to buy into an energy supplier to SMEs. The Greenblatt Magic Formula indicates that it is a bad business and is also overpriced:

Hopefully the next company I report on today can be something of quality...

Fastjet (LON:FJET)

- Share price: 1.475p (unch.)

- No. of shares: 3,800 billion

- Market cap: £56 million

Nope. This is one of the worst businesses ever floated in the UK, in my opinion. It's a low-cost airline operating in Zimbabwe and Mozambique.

It continues to exist only because of some fund managers who repeatedly threw good money after bad, and because one of its suppliers has been happy to take on most of the equity, in exchange for the services it provides. This supplier now owns nearly 60% of the shares.

Fastjet's H1 loss this year from continuing activities is £4.5 million, from revenues of £20 million. To be fair, this is much better than its usual performance. "Revenue per available seat kilometre", an important KPI, is up by 39%, as ticket prices increased where possible.

Load factors remain absymal, however, at 62%. Fastjet thinks they can improve to 74% in H2.

My view - This fully deserves to be given the bargepole treatment.

NWF (LON:NWF)

- Share price: 167p (+0.6%)

- No. of shares: 49 million

- Market cap: £81 million

NWF Group plc ('NWF' or 'the Group'), the specialist distributor of fuel, food and feed across the UK, today announces its audited final results for the year ended 31 May 2019.

The company is happy with these results.

They aren't as good as FY 2018, when extreme winter conditions boosted the performance of the Fuels division. But they are ahead of original market expectations.

The full-year dividend increases to 6.6p (FY 2018: 6.3p).

The weather exposure does not go in one direction only: cold temperatures around the year increase the demand for heating oil, while warm temperatures in summer increase the demand for animal feed.

Overall, I get the impression that cold weather is more favourable.

Net debt is £10.4 million, or 0.7x EBITDA. Should be manageable.

Operating profit for the year is £9.6 milion. The company also reports "headline operating profit" of £10.2 million, applying some light adjustments.

Outlook: in line with expectations.

My view: I've not got the time to look at this in detail today, but it seems to be performing reasonably well.

It gets a big thumbs up from me for producing a clean "Headline" operating profit figure, without making any large adjustments.

It also gets a green flag for reporting its adjusted ROCE, which it says is a very reasonable 13.4%. Its acquisition strategy seems to be going well, so far.

This isn't a sector where I want to play, but I continue to suspect that this is a decent company being managed by decent people.

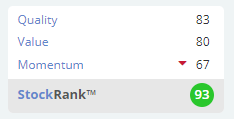

StockRanks love it: from a quantitative point of view, I agree that it looks like a winner.

Xpediator (LON:XPD)

- Share price: 28p (-45%)

- No. of shares: 136 million

- Market cap: £38 million

Xpediator, (AIM: XPD), a leading provider of freight management services across the UK and Europe, announces the following trading update for the year ending 31 December 2019.

This is a major profit warning, as PBT will be "materially below market expectations".

Reasons given:

- loss of a large storage customer in the logistics division (the space is going to be put to a different use, requiring investment).

- an increase in labour rates, again in the logistics division, which can't be passed on to customers.

- lower volumes in e-commerce

- loss of managerial focus in Regional Express, as the managers focused on winning two big contracts for 2020 and future years

- Additional costs to prepare for a no-deal Brexit

It's a bewildering range of problems.

This company listed in 2017, and performed well initially. This profit warning brings us back to the IPO price.

As stated previously, I don't invest in logistics companies (not even NWF). Things always seem to go wrong, sooner or later. It's a cut-throat and accident-prone sort of industry. I also tend to avoid highly acquisitive PLCs.

As knife-catching exercises go, this one might be ok. After all, the reasons given for today's profit warning don't sound like they are fatal. The fact that there are so many of them, on the other hand, is a bit of a worry.

It's not for me, but good luck to anyone who is currently holding this one.

That will do for today. Maybe we will get some better companies reporting tomorrow!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.