Good morning,

Timings - I have a lot of other work commitments every day this week, so I plan to write these reports very early - just so you know!

RNS announcements on my radar today (list is growing):

- Eddie Stobart Logistics (LON:ESL)

- MJ Gleeson (LON:GLE)

- H & T (LON:HAT) / Ramsdens Holdings (LON:RFX)

- Finsbury Food (LON:FIF)

- Learning Technologies (LON:LTG)

- Alfa Financial Software Holdings (LON:ALFA)

Black Gold

Brent crude was up as much as 19% overnight, with a high around $70 (versus a close of $60 on Friday). It has dropped back as of now to c. $65.50.

Drone strikes on Saudi Aramco knocked out 50% of Saudi Arabia's oil production, or 5% of total daily production, according to an expert quoted by CNBC.

Oil stocks might be fun this morning!

8.15 update: Royal Dutch Shell (LON:RDSB) is up 3%, BP (LON:BP.) is up 4%, Gulf Keystone Petroleum (LON:GKP) is up 6%.

Eddie Stobart Logistics (LON:ESL)

- Share price: 71p (suspended)

- No. of shares: 379 million

- Market cap: £269 million

This company had a nightmare RNS last month, announcing that its CEO was standing down with immediate effect, that revenue recognition needed to be more prudent in future, and that profitability would therefore be "significantly lower".

On top of all that, the shares were suspended (pending clarification of the company's financials).

Interim Results

In the previous update, the company said that it expected to release interim results in early September.

It hasn't published them yet, and doesn't give a new forecast of when they might be out. Instead, it merely says that it will publish them "following further clarity"!

As far as the H1 results are concerned, ESL says it expects revenue of £450 million and underlying EBIT of £10 million to £11 million.

Context: in H1 last year, ESL produced revenue of £359 million and underlying EBIT of £18 million.

Full-year outlook

Three bullet points are given for the company failing to meet expectations this year:

· An adverse performance against an ambitious budget alongside delays in the implementation of operational efficiencies;

· Provisions made against customer recoveries, a significant proportion of which relate to underperforming contracts which have been exited during the year; and

· Delays on a significant property consultancy project and lower than planned property utilisation.

Counting the above, it looks like at least 5 reasons to me.

When I see something like this, I tend to think that something worse than bad luck is responsible for it.

Given the abrupt and recent departure of the CEO, and the fact that the treatment of contracts has been questioned and found wanting, I am inclined to think that previous management gave a very unrealistic picture to the Board and to shareholders. It could be that they were simply too ambitious but, for whatever reason, there was a severe mismatch between what the Board thought was possible versus reality.

Avoiding accident-prone companies and sectors is an important part of what I try to do with my own portfolio. I've never invested in logistics companies and having seen so many problems occur at them, the truth is that I have no real desire to!

If a Board of Directors are unable to figure out the true financial performance of their own company, then how on earth are minority shareholders supposed to figure it out?

Anyway, let's scroll on to see how this RNS finishes:

Steps taken - the company is conducting a "wide-ranging review" - ok.

Capital structure - the dividend is cancelled. ESL's balance sheet has been negatively impacted by the growth of the business (!), by a reduction in EBIT, poor cash collection and excessive dividends. Net debt has grown from £155 million as of the end of H1. ESL is therefore considering raising new equity.

Offer update - DBAY Advisors, which is a 10% shareholder in ESL, has sent in "a preliminary expression of interest". It might make an offer for the entire company, or it might not!

My view

Firstly, some speculation on the offer - if ESL needs fresh equity, this could provide an opening for DBAY to make an opportunistic (cheap) bid.

DBAY could offer to take out other shareholders and to recapitalise the company at the same time, replacing its debt load. They might not need to pay too much for the existing equity, unless other shareholders are willing to cough up funds for the recapitalisation, too.

Studying logistics companies in recent years, I have found that they suffer misfortune of one kind or another all too often. It's an example of a B2B, contract-driven sector where I sleep better by not getting involved. Those investors who have some sector expertise might do well with the right company (e.g. Clipper Logistics (LON:CLG) hasn't made any terrible mistakes - long may it continue!) but finding that right company strikes me as difficult.

The equity value at ESL is highly uncertain now, not least due to the fact that a fundraising of one sort of another is coming. We don't know how desperate the company is for fresh equity, and we don't know the terms at which it might be offered. So the financial prospects for shareholders could be anything from "not bad" to "dire".

MJ Gleeson (LON:GLE)

- Share price: 845p (-0.6%)

- No. of shares: 54.6 million

- Market cap: £461 million

Slightly larger than our traditional cut-off, let take's a gander at results from this housebuilder and "strategic land specialist".

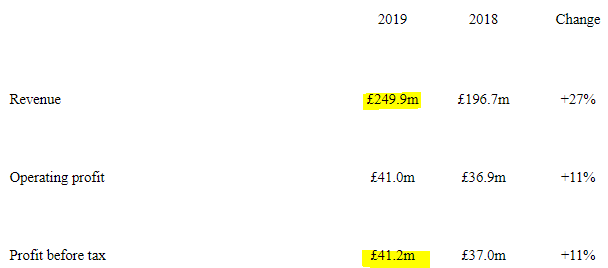

Headling numbers are good:

The company reports its ROCE - good!

ROCE falls from 26.% to 25.9%, which is less good, but it's still very high on an absolute basis.

Note that Stockopedia thinks Return on Capital is a bit lower, at 22% (this is not uncommon, as Stockopedia uses unadjusted numbers).

Housebuilding is a very lucrative activity, when conditions are right. When conditions are wrong, of course, profitability can collapse.

For now, conditions are pleasant and Gleeson continues to make hay.

In the homes business, volumes are up 25% (1,529 units) and operating profit up 15% (£30 million). The pipeline has grown, too - very important. The company is looking for the number of units sold to increase by another ~33% by 2022.

The "strategic land" division has also done well, and the Board has decided to keep it rather than sell it:

The division had a record year and continues to benefit from high levels of demand for consented land in prime locations from both large and medium-sized housebuilders. The division has a strong portfolio of sites and anticipates that it will continue to maintain its successful track record in promoting potentially high value developments through the planning system.

Market context

Some interesting tidbits here.

1) Young first-time buyers and low income families in the in the North of England continue to access mortgage finance on attractive terms and the Help to Buy Scheme, helping the demand for Gleeson's low-cost homes to remain "robust".

2) No-deal Brexit not considered a major threat for Gleeson, relative to other housebuilders. In their own words: "we employ small, locally based suppliers and subcontractors... and do not rely on foreign labour". And Gleeson thinks its larger suppliers are well-prepared for a no-deal Brexit.

CEO - interim CEO in position since June, looking to make a permanent appointment.

Outlook - "comfortably on track" to meet its long-term unit sales target and confident for the current year and beyond.

My view

It's hard not to like what this company does: helping young people get out of the "rent trap" by buying their own low-cost home.

Checking back to the last time I covered this share, I mentioned three risks:

- most customers use Help to Buy - regulatory risk

- macroeconomic risk (ever present for housebuilders)

- execution risk

On the Help to Buy scheme, what do readers think - is it here to stay? Or should investors pencil in the risk that it gets taken away at some point? (thank you to readers for pointing out that its current extension lasts until 2023, only).

Macroeconomic risk: other sectors (e.g. banks) are virtually pricing in a recession now. Should housebuilder stocks price it in, too?

Execution risk: the land pipeline and number of plots are growing, so perhaps execution risk is reducing as the company grows?

When it comes to valuation, Gleeson has made great gains and the market cap now stands at an even larger premium to its net assets of £204 million, or 374p per share.

Existing shareholders may not see any particular reason to sell, but should prospective buyers be interested at these levels? From my perspective, this valuation makes no allowance for economic weakness, implying that the company's business model is robust enough to generate attractive ROCE throughout the economic cycle.

That seems a bit too optimistic to me, but what do I know?

H & T (LON:HAT) and Ramsdens Holdings (LON:RFX)

(Please note that I have a long position in HAT.)

This was very interesting news over the weekend.

Albemarle and Bond has shut stores - possibly all of them - but the company has not yet confirmed anything.

Bad news for customers

It has caused anguish among customers. Two of the customers spoken to by the Liverpool Echo said that they are going to the police to talk about what A&B has done with their jewellery.

According to A&B's homepage, pledged items "will be held securely in our Pawnbroking Centre for the duration of the loan".

The procedure to get the items back doesn't sound very convenient:

Once you have repaid your loan in full, you will need to return your original Pawnbroking Agreement to us via Royal Mail signed for 1st class post. The Postage cost of £1.90 will be deducted from your final redemption amount, at no additional cost to you. Once your loan has been repaid in full and we have received your Pawnbroking Agreement we will arrange for your pledged items to be returned to you. This may take up to 10 days.

This is much worse than simply turning up at the store to collect the item. I can understand why customers would feel angry about it (besides the fact that family jewellery has been transported from the local shop to an unknown location!).

A&B says "we were unable to contact all customers prior to the closure date". I wonder if any customers were contacted prior to closure?

The National Pawnbroking Association has criticised A&B:

"Their decision to downscale UK operations is a strategic matter for the company but the NPA has expressed its concern that the communication of their actions to their customers falls below the standards expected of its members... In particular we are most unhappy with the fact that customers cannot get through to the helpline."

Good or bad news for other firms?

My instincts tell me that this is good news for rivals H & T (LON:HAT) and Ramsdens Holdings (LON:RFX), who are seeing a major competitor struggle and perhaps permanently shut down. What's not to like about capacity getting taken out of the industry?

Obviously, the fear is that A&B's struggles could reflect difficulties which the other firms might experience, too.

A&B has been private since its administration many years ago (when I was unfortunately a shareholder and experienced my first and only 100% wipeout!). From public accounts, however, we know that it has been loss-making in recent years. After a period of over-expansion and loose lending, it looks like it failed to ever properly turn itself around.

So hopefully, its demise is a consequence of its own mistakes, poor management, and poor brand, rather than any fundamental problem in the industy. H&T and Ramsdens are profitable with good outlooks.

To give you some context: A&B has 116 stores, versus H&T with nearly 250 and Ramsdens with c. 160 (following acquisitions from The Money Shop, which failed as a consequence of its own strategic errors).

H&T shares are up by 2.5% this morning, while Ramsdens shares are up by only 0.5%. While I don't know the exact geographical layout of A&B, I do know that it has (or had) a heavy presence in London and Birmingham, which are H&T's home turf. It would make sense, therefore, if H&T enjoyed a stronger benefit from the collapse of this entity.

Finsbury Food (LON:FIF)

- Share price: 71p (+8%)

- No. of shares: 130 million

- Market cap: £93 million

Finsbury Food Group Plc (AIM: FIF), a leading UK speciality bakery manufacturer of cake, bread and morning goods for the retail and foodservice channels, is pleased to announce its preliminary results for the financial year ended 29 June 2019.

As discussed last time, I find it difficult to get excited about this company, for many reasons.

Credit where it is due: Finsbury's like-for-like revenue performance of 4% is better than I would expect, based on its track record.

Also, the company's adjustments to its results have calmed down. Adjusted operating profit for the year is £16.8 million, while statutory operating profit is £15.3 million. Not bad.

But the cash flow statement helps to illustrate that this is still a complicated picture:

- £17 milliion spent on an acquisition (this company has a lot of M&A activity)

- another £3.5 million of "costs relating to closure of bakeries and acquisitions"

- a negative working capital swing of £5.5 million

- capex spend of £11 million, much higher than depreciation of £7.4 million.

The CEO says:

As we come out of our intense investment phase, with capital expenditure of £11.0m in the period, the Group will continue to benefit from the investments made for years to come.

Net debt at period-end is c. £36 million, with £48 million of debt offset by £12 million of cash. I would encourage all companies to publish their average net debt, too, so that we don't have to worry about window-dressing!

My view: this looks cheap but it's a leveraged, low-margin business with limited IP. Cheap for the right reasons, in my view.

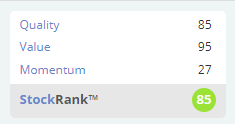

The StockRanks disagree with me:

Learning Technologies (LON:LTG)

- Share price: 119p (-2.6%)

- No. of shares: 668 million

- Market cap: £795 million

Learning Technologies Group plc ("LTG" or the "Company"), the provider of services and technologies for digital learning and talent management, is pleased to announce its half year results for the six months ended 30 June 2019.

Mentioning this one briefly, as some of you are following it.

Rather than a single company, it's better thought of as a portfolio of companies. It lists ten major brands on its website (3 under "Content and Services" and 7 under "Software and Platforms").

At the H1 trading update, LTG said:

"Adjusted EBIT is anticipated to be ahead of expectations at not less than £20.0 million for the first half of 2019."

Today, it says:

Adjusted EBIT ahead of expectations, up 134% to £19.4m

Am I going crazy, or is there something a bit off about this?

Outlook

Trading is in line with upgraded expectations. Net debt has been reduced to <£8 million.

My view

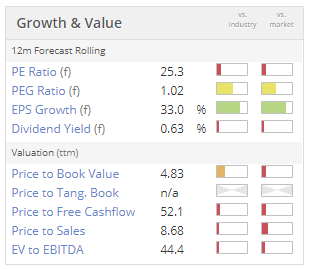

I don't have a strong view on this one. Stockopedia is nervous about the valuation, giving it a Value Rank of only 4 (out of 100!). It must be doing something very special to justify this rating:

Alfa Financial Software Holdings (LON:ALFA)

- Share price: 77p (-17.6%)

- No. of shares: 300 million

- Market cap: £231 million

Trading Update and Notice of Results

This is a software company, serving the asset finance industry.

It listed in 2017 with an IPO price of 325 pence.

It has been an unhappy ride for investors. Alfa reports today that H1 operating profit is only going to be about £5 milion (versus £8.6 million in H1 last year), after projects were delayed and customers reduced spending. "Broader macro uncertainty" gets the blame.

Revenue for the full year is expected to be "in the region of £63-£65 million". That would be the smallest result since 2015, two years before it listed on the public markets. Profit will be significantly below previous expectations.

This company enjoyed super growth in revenues and profits in the two years prior to IPO, and has been on the decline ever since. There's a surprise!

All done for today. See you tomorrow - same time, same place.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.