Good morning, it's Paul here with Thursday's article.

Estimated timings - early start, and needs to be finished by noon, because I have to head into the City for a 1 pm meeting with Intercede (LON:IGP) management (in which I have a long position). If there's anything interesting from the meeting, I'll let you know at a later date.

Update at 11:57 - today's report is now finished.

Malvern International (LON:MLVN)

(At the time of writing, I have a long position in this share)

Profit warning. At c. £2m mkt cap, it's too small & illiquid for a full section.

My reaction on reading the profit warning was that it's not too bad. A setback, for sure, but does that really justify a more than 90% fall in share price since the peak just over a year ago? I would say not.

Underlying trading is currently around breakeven, and there are good reasons to expect a return to profit in 2020 (e.g. disposal of loss-making Malaysian operation, and improved forward bookings). Therefore, I'm leaning towards buying some more of these, once I've double-checked all the figures. The way I approach situations like this, is to ignore the fact that I already hold shares in it. When assessing the profit warning, I look at it completely fresh, in terms of would I buy today, if I didn't hold it already? That's the crucial thing, as it takes the emotion out of it, and stops you throwing good money after bad.

Very small & illiquid, and so far the turnaround under new management is proving a struggle.

Motorpoint (LON:MOTR)

Share price: 262p (up 2% today, at 10:27)

No. shares: 90.8m

Market cap: £237.9m

Motorpoint, the largest independent vehicle retailer in the UK, today announces its unaudited interim results for the six months ended 30 September 2019 (FY20 H1).

It's pleasing to see the share price up about 30% since I last reported on a possible buying opportunity here on 6 Sep 2019, relating to a spike down on the founder selling shares to fund a divorce settlement.

I like the business model, of selling nearly new cars at attractive prices, from large sites, known as car supermarkets.

It is not immune from the problems generally affecting car retailing, and interim profits are down;

Of the £2m fall in operating profit, the company says that half is due to one-off factors.

Also note that the company hasn't opened any new sites in the period. The roll-out seems rather slow.

Outlook comments -

Current trading is consistent with achieving management's full year expectations, albeit with a greater weighting towards H2, however potential outcomes from the Government's Brexit negotiations could influence our future performance in unpredictable ways.

I think what that is really saying, is that there's an increased risk of full year forecast being trimmed back a bit. That's what an H2 weighting often turns out to mean.

Another thing to consider, is that it's so cheap & easy to get a new car on a personal lease, which does raise the question of whether the popularity of new car leasing might be curbing demand for nearly new cars?

Balance sheet - is quite thin, mainly being a load of inventories (the cars), offset by trade creditors. The completely pointless IFRS 16 numbers have made an unwelcome appearance, but it's easy enough to cross those out.

My opinion - I like the format, but given a soft H1, can't see any reason to chase the share price any higher. The valuation looks about right to me. The forward PER is 12.2, which could turn out to be maybe 13-14, if forecasts for FY 03/2020 come down in the event of a soft H2.

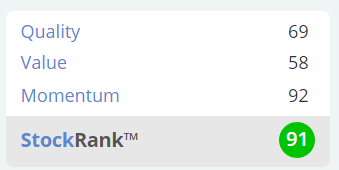

Stockopedia is more keen, with a high StockRank;

James Latham (LON:LTHM)

Share price: 920p (roughly flat today, at 10:47)

No. shares: 19.9m

Market cap: £183.1m

James Latham plc is a timber and panel products distributor. The Company is engaged in timber importing and distribution, carried out in approximately 10 locations. The Company offers a range of wood-based panel products, natural acrylic stone, hardwoods, high grade softwoods, flooring, cladding, decking and plastics. The Company also supplies commodity and specialist products to timber and builders' merchants.

[taken from the Thomson Reuters description, on the StockReport]

Operating profit - these interims look solid. Last year's H1 PBT benefited from a one-off disposal profit of £1.05m, therefore the more meaningful comparison excludes this factor, at operating profit level - which shows a 9.6% rise to £8.5m in H1 - a respectable result.

Outlook comments sound upbeat;

The second half of 2019/20 has started well with margins slightly ahead of the previous period. We are seeing increased sales at Abbey Woods, the Irish timber distributor purchased in February 2019, and also an improvement in our panel product volumes. Purchase prices of our commodity panel products remain weak. The investment in our Gateshead facility, to improve the site efficiency, is going well, and should be completed in June 2020. The racking investment at Purfleet will be completed by the end of December 2019. The majority of our customers are busy, and we remain confident that we can continue to grow our business, but remain mindful of the uncertainties caused by the forthcoming General Election and a weakening global economy.

Balance sheet - is remarkably strong. This gives the group plenty of scope to fund more acquisitions, thus adding to future profits.

Pension deficit - note that this has risen considerably. Up from £3.1m a year ago, to £14.6m now. This is a result of continued low interest rates & low bond yields. It's worth bearing in mind that companies with pension deficits are not likely to be bailed out by higher interest rates any time soon - unless of course Mr Corbyn's fantasy-world communists get their hands on the levers of power.

My opinion - a very nice company, which we've been commenting on favourably here for years.

The share has done very well in the last year, and this re-rating upwards looks fully justified.

To my mind, the price now looks about right. Given buoyant house-building numbers, I imagine that Latham's probably has a few more good years ahead of it.

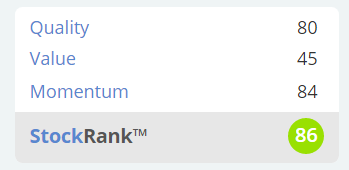

This is just the type of solid, profitable, growing business that the StockRank system likes. So predictably, it scores highly;

Vitec (LON:VTC)

Share price: 1,000p (down 12% today, at 11:21)

No. shares: 45.3m

Market cap: £453.0m

Trading update (mild profit warning)

The Vitec Group plc ("Vitec" or "the Group"), the international provider of premium branded products and solutions to the fast changing and growing "image capture and content creation" market, issues the following scheduled trading update...

The current financial year ends 12/2019.

Mild profit warning - the group says that things generally are going well, but there are 2 specific problems;

... However, 2019's financial performance is likely to be impacted by two, specific, one-off events. First, retail de-stocking in Imaging Solutions has been unusually severe. Second, there is a slower than expected trading recovery at SmallHD, following the fire in April 2018 and the ending of receipt of insurance income...

Financial impact is helpfully quantified, with revised guidance;

As a result, the Group's adjusted PBT for 2019 is now expected to be in the range £47.0m - £50.0m, with December (as usual) an important trading month.

The most recent broker note I can find (on Research Tree) is from Aug 2019, and that has a forecast adj PBT of £54m. Therefore, taking the mid-point of the above range, of £48.5m revised guidance, this looks like a c.10% drop in forecast for FY 12/2019.

Whilst that isn't particularly bad, it is coming very late in the year. That can sometimes imply a drop off in trading that could continue, and even be more serious, in the following financial year. Although in this case, the company does mention 2 specific reasons for the profit warning, which makes it less worrying.

Outlook comments are a mixed bag - positives include the 2020 Olympics & US Presidential election. Negatives include limited visibility, H2 weighting, and continued impact of the fire.

My opinion - I'm not terribly familiar with this company, but did review its interim results here in Aug 2019. I quite liked it at the time, although the big increase in net debt was a slight worry.

Today's profit warning looks mild, and has been triggered by 2 specific problems. The price has fallen 12% today, but that's on top of previous falls.

Providing there's nothing bad going on below the surface, which has not been disclosed, then this looks like the type of profit warning that can turn out to be a buying opportunity.

If you've done your research properly, and you like the company (and it does look like a decent, highly profitable group of businesses), then this might be an opportune time to top up at a discount, maybe? Personally I don't know the company or its markets well enough to want to get involved.

Renowned investor, and FT columnist Lord Lee holds this share. So he might update readers in his next article at the weekend, perhaps?

As you can see, this is the cheapest price today in the last 2 years, for what seems a fundamentally good company;

T Clarke (LON:CTO)

Trading update reads positively, but is ultimately just in line with expectations, so no reason for the share price to move.

It looks cheap on a PER of 6, but that's probably about the right price for a low margin contractor, in a very cyclical industry.

I don't like that it's paying out divis, when it should be retaining cash to strengthen its balance sheet.

That said, given the positive comments on order book & outlook, the current share price run could have further to go, possibly? There again, if the economic outlook continues to darken, then the market might start to price in a recession, and take this share back down again?

Personally I don't touch any low margin contracting companies any more, after too many mishaps in the past.

Sorry, I've run out of time. See you tomorrow.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.