Good morning!

Lots on the newswire today, including:

- Loungers (LON:LGRS)

- QUIZ (LON:QUIZ)

- PCF (LON:PCF)

- M&C Saatchi (LON:SAA)

- LoopUp (LON:LOOP)

- Numis (LON:NUM)

- Impax Asset Management (LON:IPX)

- Character (LON:CCT)

Finished at 5.15pm.

This section by Paul Scott:

Loungers (LON:LGRS)

- Share price: 205.2p (+4%)

- No. of shares: 92.5 million

- Market cap: £190 million

Loungers plc ("Loungers" or the "Group") is pleased to announce its unaudited Interim results for the 24 weeks ended 6 October 2019 (the "period").

This is a hospitality sector roll-out, opening 25 new sites each year. It floated in April 2019.

My hospitality sector expert tells me that the management team are very good. After getting my fingers burned with losses on a bars roll out that went wrong, Revolution Bars (LON:RBG) , but seems to be starting to get back on track again, I’ve been a bit reluctant to get involved in another one. Hence I’ve had just a watching brief on LGRS since it floated.

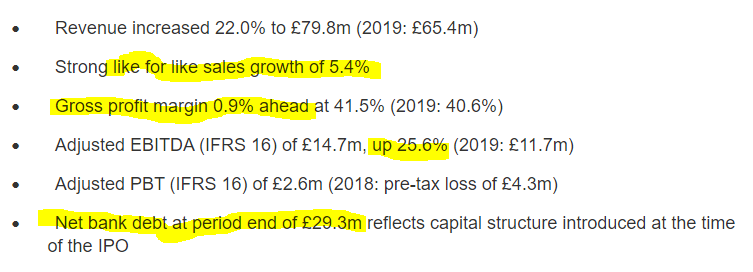

The headlines look fine to me;

In particular, generating LFL sales growth (of 5.4% here) is the key number. Since many costs are rising, especially staffing related, then hospitality sector companies have to be eking out at least some LFL sales growth. In this case, 5.4% is good, and similar to what some of the pubcos are achieving.

The 25.6% rise in adjusted EBITDA is also good, and reflects the expansion capex on new sites. Although the recent changes in how leases are accounted for has distorted the figures, and made analysis more difficult (with no benefit whatsoever from the changes). Hence we’re given 2 different EBITDA figures. It seems to me that the lower figure is the only one that makes sense, since EBITDA really should be stated after all rental costs.

For my purposes, IFRS16 has completely messed up accounts for multi-site companies, rendering them largely useless, unless I adjust out all the spurious numbers inserted under IFRS16;

Net debt doesn’t look a problem.

Current trading & outlook also sound OK, although no figures are given, and there is no mention of full year expectations;

- Continued to trade well and to outperform the market

- Five new sites opened in H2 to date and on plan to deliver 25 new site openings in the financial year with Lounges in locations such as Sutton, Watford, Sittingbourne and Chorley and Cosy Clubs in Nottingham and Brindley Place, Birmingham

Statutory profit is not so good. There are lots of adjustments, and £3.7m in exceptional costs, which takes statutory profit to a minus £2.5m loss for the 6 months – not good. Looking at note 3, the exceptional costs all relate to the IPO, which is justified in treating as a one-off. So that’s actually OK.

Balance sheet – is strikingly thin. Only £10.4m in NTAV. The lease liabilities & right of use assets can be safely crossed out, as they’re meaningless numbers. Once that is done (reducing current liabilities), the current ratio comes out at just 0.3 – which is one of the lowest I’ve ever seen.

Admittedly, hospitality groups don’t need much working capital (they sell for cash, so don’t have anything much in receivables, and inventories can be kept quite low and turn quickly). Even allowing for that, I’m surprised that LGRS can operate using so little working capital. It looks a bit stretched to me (especially trade creditors).

Why does this matter? It increases risk, were the company to go into a period of weak performance. Also it means that divis are not on the cards – although in future, once it has stopped expanding, there should be scope for divis. This is a sensible policy. Once of the things RBG got wrong, was to expand (heavy expansion capex), plus paying generous divis, which proved too much, and in the end both expansion & divis had to be put on hold.

Valuation – based on consensus forecast of just under 10p EPS, that puts LGRS on a fairly toppy PER of 20 times. It’s a roll-out, which normally attracts a higher rating of 20-ish, so in that respect, it’s probably priced about right, assuming nothing goes wrong.

My opinion – roll-outs are a lot harder to manage than many investors realise. The danger is that opening new sites takes up so much management time, that the existing sites become neglected, staff morale drops, and before you know it, the business is in crisis. That is precisely what happened with Revolution Bars. That also had the distraction of 2 takeover bid approaches, which dragged on for a long time.

I’ve had a 2 meetings this year with management of Revolution Bars, and gone through all the detail of what went wrong, and how they’re fixing it. That brought home to me just how delicate multi-site bars are. If a few key people leave (especially Area Managers) then it can do serious damage to the business. This is because when Area Managers leave, they often take their best site managers with them, to please their new employer, doing serious damage to their old employer.

For this reason, I’ve learned how fragile a roll-out can be, with a lot of risk attached. Hence I’m not particularly interested in investing in a fully-priced roll-out (PER of 20, weak balance sheet) that LGRS appears to be. Having said that, based on today’s interim results, LGRS seems to be performing well, and no cracks have appeared as yet.

This section also by Paul Scott.

QUIZ (LON:QUIZ)

- Share price: 14.85p (-11%)

- No. of shares: 124 million

- Market cap: £18 million

QUIZ, the omni-channel fast fashion brand, announces its unaudited interim results for the six months ended 30 September 2019 ("H1 2020").

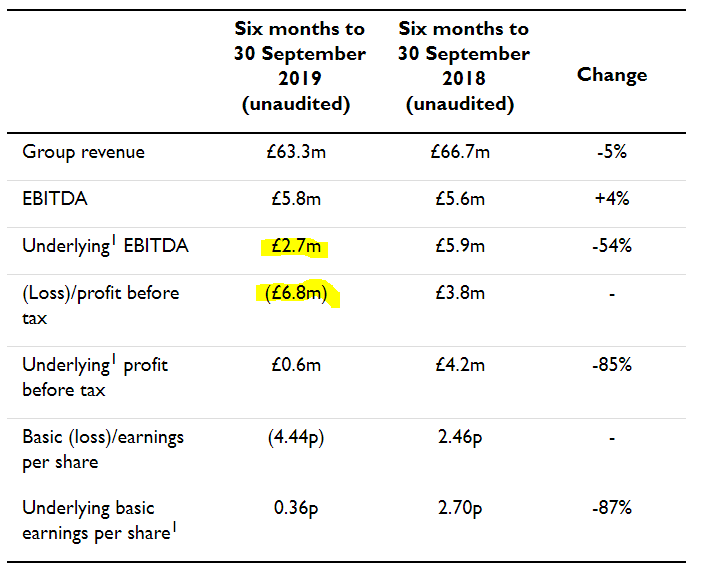

Given how bombed out the share price has been, the highlights are not as bad as I was expecting. In particular, note that EBITDA is still positive (a reasonable proxy for cashflow) in the seasonally slower half year that excludes Xmas;

The main reason for the large difference between positive EBITDA and the negative -£6.8m loss before tax, is £7.0m exceptional charges, as follows;

The exceptional administrative costs in the current year relates to store impairments, onerous lease provisions and other associated costs. The total charge amounts to £7.0m; being £4.6m in relation to store impairments, £1.9m for onerous lease provisions and £0.5m for other associated costs.

Balance sheet – is still OK. I don’t see any immediate risk of insolvency here.

The cashflow statement is also quite interesting, in that the business operated around cashflow breakeven in H1. With the peak A/W season now underway, it could be that cashflow for the full year might be positive.

New store expansion has stopped, very sensibly, as it’s the physical stores which are creating the problems, with lower footfall.

Half the problem stores have leases up for expiry in the next 2 years. Hence, QUIZ should be able to exit from a lot of its loss-making stores, in 2020 and 2021, thus hopefully leaving a smaller, but more profitable remaining business.

Outlook – more of the same – i.e. struggling with physical stores, but online somewhat better;

Since the end of H1 2020 we have continued to achieve growth through QUIZ's websites with sales up by 16%. However, consistent with the six months to 30 September, the performance of our stores and concessions has remained challenging. Given this, total Group sales for the nine weeks to 30 November 2019 reduced by 6% year on year (excluding international franchise sales which are wholesale in nature and therefore, can fluctuate from month to month).

My opinion – this business looks down, but not out.

Providing trading from the physical stores doesn’t get any worse, then Quiz should be able to gradually close the loss-making sites as the leases expire or come up for a break clause. Although with fewer stores in future, the business will also need to downsize its central costs.

The online side of things is interesting. It seems to be the case that some brands can grow fast in the early stages, but then hit a brick wall of market saturation. Maybe Quiz is suffering from that? Although the latest online growth of +16% isn’t too shabby.

As we saw recently with Sosandar (in which I hold a long position), sales growth is mainly driven by marketing spending. What matters after that is how sticky customers are. Sosandar has high customer loyalty, hence its high marketing spend makes sense. I’m not sure whether the same applies to Quiz or not? I suspect it probably doesn’t apply to the same extent.

The other problem for Quiz is that it’s trying to compete with the fash fashion online behemoth Boohoo (LON:BOO) – with its multi-brands, and highly aggressive pricing policy. BOO has made no secret of the fact that it wants to dominate the younger, fast fashion space, and squeeze the competition out. It’s an over-crowded space, and Quiz could struggle to make much more progress, against such intense competition, and without any brand strength to speak of.

Although note that Quiz’s 61.7% gross margin is exceptionally high, so they’re doing something right to achieve that level of gross margin.

Overall, at just £18.6m market cap, I think Quiz could possibly be worth a speculative punt.

This section and the rest of this report is by Graham.

PCF (LON:PCF)

- Share price: 35.2p (-2%)

- No. of shares: 250 million

- Market cap: £88 million

Please note that I have a long position in PCF.

PCF Group plc, the AIM-listed specialist bank, today announces its preliminary results for the year ended 30 September 2019.

These results are in line with expectations.

The market had priced this in, as the share price recovered from its low at 25p back up to 35p over the last 3-4 months.

Most pleasingly of all, the company has hit its strategic targets (loan book and ROE) a year ahead of schedule.

Quick recap: this is the lender which got a bank license a few years ago. This cleared the way for a rapid increase in size and a greatly reduced cost of funds.

I've been invested in it since December 2017. The core investment thesis is that with increased scale, there will be a big profit opportunity as the overhead costs from running a bank are spread out over a much larger portfolio, i.e. operational gearing.

Results

- new loans for PCF's own portfolio up by 50%, with brokerage income on top of that.

- total portfolio up 50% to £339 million

- retail deposits up 40% to £267 million. These haven't grown as quickly as the loan portfolio, but they still cover a majority of the portfolio value.

PCF is skewing new loans to better-rated borrowers, making it a safer business that has a better chance of surviving a downturn.

The disadvantages of this are a) it's more competitive among lenders in this space, i.e. you have to face off competition from larger and more prestigious financial institutions to get the business; b) interest rates charged to customers must fall, to reflect their lower risk of default.

As such, PCF's net interest margin has declined by 40bps to 7.8%.

It's also important to mention the small matter of impairments. These more than doubled to £2.2 million, although £600k was due to the new accounting standard (IFRS 9).

As a percentage of the portfolio, the impairment charge increases from 0.5% to 0.8%. Without the new accounting standard, it would have increased only to 0.7%.

It's unfortunate that this has occurred despite an improvement in customer credit ratings. But as followers of Begbies Traynor (LON:BEG) will know, the economy has more than its fair share of financial distress at present.

In PCF's own words:

The part of the portfolio reported as 'up to date' deteriorated slightly in the period to 95% (2018: 96%). The less benign environment has been most noticeable in our Business Finance Division where the UK is experiencing an increased incidence of business failure across most industry sectors.

The company itself is cautious (one might say bearish) on the economy:

Over the course of the year our views on the political and credit environment have changed and as a result we have amended our risk weightings to reflect a less benign credit environment and a more uncertain outcome for Brexit.

As a shareholder, I'm happy that the company is taking a cautious view. I want them to be paranoid about a recession, so that when it eventually comes, they will be prepared for it!

Profits - aren't hugely important to me this year, because it's all about what the company can grow into. But for what it's worth, PCF has returned statutory net income of £6.4 million, or EPS of 2.7p. This is slightly below the forecast on Stocko for EPS of 2.8p.

This is a fine result when you consider that average equity during the year was just £50.6 million, for a highly satisfactory ROE of 12.6%.

The underlying performance is even better than that, when you consider that the company raised £11 million during the year. It will have taken some time to deploy the additional funds.

Outlook

There are some very interesting statements in the outlook section.

Firstly, PCF continues to target a portfolio of £750 million and ROE of 15% by September 2022. But the CEO is already thinking about getting to a size of £1 billion in "the medium term".

Secondly, the CEO highlights the company's cautious approach to the economic environment. In addition to the possible miss on EPS, this might help to explain why the shares initially sold off this morning.

While still positive about PCF's business model, he says they are "not sanguine" about the economy:

Economic uncertainty arising from the current political situation does remain a risk. This could manifest itself as decreased demand in our market places, a fall in our growth rate or rising impairments due to a downturn.

My view

I'm a content shareholder with this one. Ultimately, I just want them to keep their feet on the ground, keep doing the basic things well, keep moving up the credit spectrum, and see where it takes them.

If costs can be controlled, then I don't see why ROE of 15% can't be achieved. I would be perfectly satisfied with that level of return and I imagine that most other shareholders would be, too.

At some point, the growth will have to level off, or the returns will have to fall. There are limits to growth in banking: at some point, if you pursue endless growth, the larger banks will start to notice you and your returns will fall to their levels. But I think there is still quite a long runway (several years) before that happens to PCF.

On the other hand, PCF benefits from the lack of any legacy business. It's a new set-up, purely online, and can make a clean run at the opportunities afforded by its banking license.

The existing forecast for FY September 2020 is EPS of 3.6p, followed by 4.6p in 2021 and significantly higher again in 2022.

I'm still a bit nervous about future fundraising activity, and hope that the company won't do it unless the price is right, i.e. at a significant premium to book value.

Book value now is £58.8 million or 23.5p per share. The current share price (32.5p) therefore produces a P/BV of 1.5x.

For a company earning ROE of 12.6% and with the potential to earn 15% and higher, I think this might possibly undervalue its prospects. I would say that the upper end of fair value is probably around 2x book balue, i.e. 47p per share.

M&C Saatchi (LON:SAA)

- Share price: 79.1p (-46%)

- No. of shares: 93.1 million

- Market cap: £74 million

Accounting Review and Trading Update

Hot on the heels of the inventory review at Ted Baker, we have another accounting scandal to look at.

Do you remember what I said (courtesy of Warren Buffett) about cockroaches in the kitchen? There's usually more than one.

In August, Saatchi said that it needed to take an exceptional £6.4 million charge:

We believe we have discovered the full extent of the issues, but to be doubly sure, the Board is appointing independent advisors to undertake a review of all the Group's accounts and accounting systems, as well as setting aside an extra £1.5m as a conservative measure to provide for any potential further items arising.

Making "doubly sure" has resulted in the discovery of more cockroaches, which now add up to £11.6 million.

This bit is shocking:

Separately and in relation to 2018, PwC has identified that the 2018 half year reported profit was adjusted by approximately £6.4m. Such adjustments may have occurred in half year reports since 2014.

What does "adjusted by" mean, if not "inflated by" or "falsified by"?

For the record, PBT in H1 2018 was given as £16.7 million.

The new FD now has the job of bringing in completely new financial controls and reporting systems.

2019 trading update - this goes back to another point raised in relation to Ted Baker. After an accounting scandal, when they start telling the truth, companies might not be able to generate the profits which investors had come to expect.

Saatchi's 2019 result will be "significantly lower" than expected, and that's before taking heavy exceptional costs into account.

Additionally, minority shareholders get to keep around 20% of Saatchi's profits, and the company warns that their share will increase.

My view

Checking the interim results, I see that it reported net cash of £9.5 million. So it might be able to survive from a balance sheet point of view. Though I note that it reported £40 million of borrowings, offset by £50 million of cash. Why borrow £40 million, if it has £50 million in cash?

Checking the annual report, it sounds like the cash is sitting at its subsidiaries while the PLC holds the debt:

During 2019 we will perform a strategic review of our banking facility and other banking requirements and will determine how we can better utilise positive working capital balances in some subsidiaries and currencies against negative working capital balances elsewhere.

Either way, it would take an awful lot of convincing for me to want to get involved in a situation like this. This now deserves to be on a dirt-cheap earnings multiple.

LoopUp (LON:LOOP)

- Share price: 67.5p (unch.)

- No. of shares: 55 million

- Market cap: £37 million

Measures relating to 2018 and 2019 options grants

This reads like the latest edition of "heads we win, tails you lose" from a listed company.

In August 2018, LOOP awarded 2.3 million share options to staff at 440p, which was approximately the share price at time.

In June 2019, it awarded another 1.1 million options at 317.5p, which again approximates to the share price at that time.

Since then, the share price has collapsed after a nasty profit warning in July followed by another one in September. The share price was bashed and for good reason: revenue was millions of pounds lower than expected as customers started using the product less.

But the Remcom thinks that the staff who failed to hit the company's targets must be retained at all costs, so it's repricing the option scheme:

The Group's Remuneration Committee and the Board consider that these grants have become ineffective in their primary purpose: the future retention of business-critical staff...

All current employees not under notice who were granted options in August 2018 and June 2019 will be given the choice whether to keep those grant contracts as is, or whether to cancel those grant contracts and enter simultaneously into new contracts with different terms.

New options will have an exercise price of 75p. How would that make you feel, if you were a minority shareholder who bought in at 400p two years ago?

At least the new scheme will not apply to the co-CEOs.

My view

If Loopup feels the need to do this, because the staff receiving the options are necessary for the continued functioning of the company, then I reckon that these staff should not be on an option scheme in the first place.

They should instead receive variable pay, in cash, depending on the attainment of their individual and team objectives. Because if their work is truly vital, then retaining them should not depend on the vagaries of the stock market. Pay them the necessary amounts in cash, and stop diluting your shareholders. Simples.

Numis (LON:NUM)

- Share price: 244p (+3%)

- No. of shares: 105 million

- Market cap: £256 million

Investment banking is a feast-and-famine industry and the famine is currently underway.

Revenues are down 18% but administrative expenses are only down 8%.

On top of this, Numis has suffered writedowns in its investment portfolio of early-stage private companies (total value of this portfolio is now £15 million).

The result is an operating profit of just £12 million, versus £31 million last year. Operating margin almost halves.

It's less extreme if we exclude the results in the investment portfolio. Through that lens, operating profit was £14 million this year (versus £30 million last year).

Comment from the co-CEOs:

"It has without doubt been a challenging year for everyone in the industry and our results have inevitably been impacted by the persistent political uncertainty, macro-economic factors and subdued, yet volatile markets...

We continue to be actively focused on our clients and believe we are better positioned than ever to continue winning market share...

There just isnt enough activity at the moment to keep bankers cheerful. Numis says that equity trading volumes have declined and there was "a far smaller group of deals" compared to better years. Big transactions are few and far between (which ironically might be a good thing for the economy, if you take the view that most M&A destroys value).

And Numis gives us an insight into the view of big money:

The persistent uncertainty facing the UK also impacted institutional investors as they typically adopted a more cautious approach toward investing in UK equities. Many overseas institutions maintained underweight positions limiting their exposure to the UK market, whilst many domestic long-only institutions suffered outflows in UK equity strategies.

Let's be clear: this is a good thing for anyone buying UK equities right now. Many shares look too cheap in comparison to interest rates and their prospects, and this can be partly explained by the absence of foreign investors and the general disdain towards the UK stock market.

As a rough measure of this, the FTSE is currently stuck around 7200, having made no progress in the past three years. And small-caps are particularly unpopular.

This won't be much comfort to anyone cashing in their portfolio, but it's a nice environment in which to be a buyer.

If half of the FTSE-100 is nationalised after the next election and we get the long-awaited recession, then macro bears will doubtless feel vindicated. But if you can find stocks which won't be wrecked by macro factors (this bit isn't easy), I think that now is a perfectly reasonable time in which to be a buyer.

Let's get back to Numis. It further notes that private markets remain buoyant, attracting more funds and higher valuations. Though it is a public market specialist, its revenues from private market deals meaningfully increased.

It's an interesting contrast. I do think that private markets are currently the venue for much of the speculative froth which undoubtedly exists in certain sectors (fintech, bitcoin, SAAS). But sooner or later, I do expect that successful private companies will want to benefit from the unparalleled liquidity that public markets can offer. This could take a while, but should eventually lead to a rebound in popularity for the public markets.

Outlook is upbeat, in the circumstances. Revenue for the first two months of the financial year is up, compared to last year:

Market conditions and the upcoming general election will likely impact the pipeline of deals in the short-term but we remain well positioned to progress our strategy.

My view

I admire this company and I do expect it to recover to a much more profitable level, although the timing of this is impossible to predict.

It doesn't pass the filters that I currently apply to my personal portfolio, so I won't be buying it, but I do think that shareholders could do well.

Another factor is the much smaller Cenkos Securities (LON:CNKS), which trades at a discount to book value and a yield of c. 10%.

With Numis trading at a substantial premium to book value (1.85x) and a much lower yield, its profitability absolutely must return to prior levels, to justify the value differential. In other words, It seems to me that relative value is already pricing in a recovery at Numis.

Either that, or it sees no hope for Cenkos. I would be interested to understand why.

Impax Asset Management (LON:IPX)

- Share price: 290p (-3%)

- No. of shares: 130 million

- Market cap: £378 million

Impax Asset Management Group plc ("Impax" or the "Company"), the specialist investor focused on the transition to a more sustainable global economy, today announces final audited results for the year ending 30 September 2019 (the "Period").

This company's assets under management just keeps on growing. Impax is at the forefront of "ethical" or "environmental" investing, a popular niche at the present time.

AUM is now £15.7 billion, up from £12.5 billion fourteen months ago.

The balance sheet is very healthy, showing cash and equivalents of £32 million and no debt, after Impax paid off the loan it used to buy a similar US-based fund manager (Pax).

In hindsight, it was a brilliant move to structure this deal using debt, instead of issuing more shares. The Impax share price has doubled in the last two years, and has done even better on a longer timeframe. The gently rising share count must get some of the credit for this.

Outlook is measured:

In 2019 markets have become harder for investors to navigate. With the US-China trade war leading to the implementation of tariffs, widespread concerns about prospects for global growth, and unprecedented levels of political turmoil in several countries, including the UK, there are many reasons for investors to be cautious.

Nevertheless, the commitment of policy makers, the business community and wider civil society to combatting climate change, reducing pollution and forging a path towards a more sustainable economy has never been stronger. Against this backdrop, Impax's committed teams, well-established investment philosophy, broad range of investment solutions and acknowledged leadership position across many markets should stand the Company in good stead to deliver further growth over the coming years.

Results are good, but revenue growth is a little constrained at 12%, for a total of £73.7 million.

The entity in the US has seen some outflows, and profits have not matched the expectations at the time of the transaction. This results in the defcon due to the sellers being written down to the zero.

Costs ran faster than revenues, up 22% on an adjusted basis to £55.7 million.

Fortunately, revenue run-rate finished the period at £78.3 million, and it will be even higher after the AUM gains seen since then.

My view - these results could have been better, but I think that the outlook is still positive for patient shareholders. The rating is currently quite high, reflecting the strong revenue run-rate and the secular trend for more environmentally-focused investing.

I expect dividends to rise considerably, in line with its new payout policy (55% - 80% of adjusted PBT). This is likely to support the share price.

Character (LON:CCT)

- Share price: 380p (-8%)

- No. of shares: 21 million

- Market cap: £81 million

I'm running out of time, so my comments on this toy company will need to be brief.

CCT continues to exhibit good margins, a high ROE and plenty of cash on the balance sheet.

Formatting issues struck here and destroyed this section. Sorry about that. See you tomorrow!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.