Good morning folks,

in today's news, IQE (LON:IQE) has promised to adjust its remuneration policy next year after 42.9% of shareholders voted against it at this year's AGM. More on this to follow.

Elsewhere, there is a holdings RNS from Tandem (LON:TND) (in which I have a long position). Jupiter has been reducing its 10% stake - I wonder is this for fundamental reasons?

Due to a lack of news flow, I can cover other topics for you - any requests? A roundup of Tesla might be fun, after the stock reached the fabled $420 level yesterday.

Timings: I will wrap this up at 12.30-13.00, as the market closes. Finished at 13.00.

IQE (LON:IQE)

- Share price: 45.46p (-3%)

- No. of shares: 793 million

- Market cap: £360 million

AGM LTIP resolution voting and proposed actions

LTIPs ("long-term incentive plans") are considered to be perfectly standard devices and respectable consultants are available to advise companies on how to structure them. But I think it's difficult to find any, in real life, which are structured well.

And since remuneration is a very boring topic, few investors give it much thought. So we miss out on an understanding of how company executives are incentivised.

Shareholder dissent

IQE has noticed that 42.9% of shareholders voted against its 2019 LTIP at the most recent AGM. This is a rare level of opposition to an LTIP.

The company says it "did not anticipate any significant dissent", i.e. that the vote came as a surprise to it.

On the other hand, it was aware that ISS (a respected advisory body used by fund managers) had recommended voting against the LTIP.

Let's scroll back for a minute. The AGM took place all the way back in June. Why has it taken so long for a response?

I note that 173 million votes went against the LTIP. This says to me that some of the funds on the shareholder register (Invesco/Oppenheimer, T Rowe Price, Schroders) must have voted against it, in line with the advice from ISS.

Only about half of the total share count voted at the meeting - this is not a surprise. Most of us (myself included) only very occasionally vote at shareholder meetings.

If you agree with what a company is doing, and if your vote won't make a difference anyway, then I think it's reasonable not to vote. But it's important to remember that you do have the right to vote, in case you might ever want to exercise it.

The details

ISS recommended voting against the LTIP for two principal reasons:

1. That the dilution limits sought under the plan exceeded the standard dilution limit expected by institutional investors of 10% in 10 years for all of the Company's share schemes; and,

2. That the plan permits the vesting of outstanding options to good leavers without a pro-rata reduction to vesting based on performance and the portion of the vesting period expired up to the time of the termination of employment.

Dilution of more than 10% is extreme, when we are talking about a large company.

I must admit here that I own shares in Creightons (LON:CRL), where dilution of 12% is possible over ten years, under an existing option scheme.

In my defense:

- the details of the scheme at CRL were announced after I had built a stake in the company

- CRL is a much smaller company than IQE, and so the management at CRL are arguably even more critical to the company's success

- I might end up selling out of CRL ealier than I otherwise would, due to the dilution risk.

But let's get back to IQE. IQE says that it can't get under the 10% dilution limit for now, due to options already granted, but it will do so over time. Fair enough, I suppose. If it gets down to 9.9% in a few years, that would still be an awful lot of remuneration.

With respect to the second point, it means that employees can leave early and get all their options, without any reference to their performance or how long they stayed at the company.

In response, IQE pledges that the LTIP plan will be amended so that entitlements for employees who leave will take account of how long they spent at the company.

But IQE does not pledge that entitlements will be performance-based.

I ought to have a moan about this, but I note that CRL's options do not have any performance conditions, either!

The Solution

Investors need to be aware that we are seen as piggy banks by companies. If we put up with things like this, this is what we will get! We need to vote with our wallets and have a strong preference for those companies with sensible remuneration schemes.

If it was up to me, I would try to do away with share options schemes, or at the very least, reduce their size and importance.

In a bull market, share options work well for employees and investors are getting richer anyway, so they don't mind too much.

The problem is that in a bear market, employees will want cash, not worthless share options.

So instead of risking the company's workforce on the continuation of a bull market in stocks, I prefer to see employees getting paid cash bonuses. That protects the integrity of the company's share count too, which in the long run will boost returns for equity holders.

The IQE share count has been rising for a long time, and I think that investors are right to query whether all of this stock issuance has been necessary, or has really benefited them.

Tesla ($TSLA)

- Share price: $419.22 (+3%)

- No. of shares: 180 million

- Market cap: $75.6 billion

On October 7th, as detailed in the SCVR, I closed my Tesla shorts:

I like to be as transparent as possible when it comes to my personal portfolio, so please note that I have today closed both my short position in Tesla and my long positions in the FTSE Index...

To be clear, this has not been driven by any change in my view of the merits of these trades. I still view them both as extremely attractive. The reason is that I am in the middle of a house-buying process, and need to use the collateral for the deposit and fees. The potential returns from a trading account must be swapped out for the certainty of home equity.

As you can see, I can't claim to have miraculously predicted the rise in Tesla's share price.

Instead, what happened was that I needed to free up some funds, and shutting down my spread betting account was the most responsible way to do it.

A reasonable question would be: out of all your positions to close, why choose Tesla?

My answer to this question was published elsewhere:

As a general principle, spread bet/CFD positions don’t have a positive expected return after trading costs; they rely on the investor betting correctly on market movements (and this is so unlikely and rare that most governments prefer to leave spread bet/CFD profits and losses outside of the tax system).

Physical shares, on the other hand, do have a positive expected return. If you buy and hold a share, and do nothing else, and ongoing charges are close to zero, then you should eventually make money, on average. Stock markets tend to go up, over time. Or as Kimbal Musk would say: stocks generally go up and to the right.

So from that very simple perspective, and despite my strong views on Tesla, I thought it was more responsible to liquidate my spread bet/CFD positions rather than selling any physical shares.

Hopefully that is a clear enough explanation. Making money on a short position requires more skill than making money on a long position, and there were no long positions which I was desperate to close, so I preferred to leave them open.

As recently as August, I had been shorting Tesla with a lot of conviction. The only problem with the short, I noted, was the $5 billion cash balance and the lack of a short-term catalyst for financial collapse.

It turns out that the simple reasoning which justified closing my short ended up saving me a lot of angst.

Tesla has more than doubled from its lows and increased by $190 per share versus where I closed my short, at $231.

Musk Triumphant

One of the great red flags for short-sellers is a stock-promoting CEO.

Twitter has been a gift in this regard. It provides a venue which stock-promoting CEOs can't resist, and where short-sellers can easily monitor their antics.

Musk has already been fined $40 million for what I believe was the largest and most blatant stock market fraud in the history of finance, when he tweeted about a fake go-private deal for Tesla last year.

The fake deal was supposed to happen at $420 - this number is a drug reference that Musk thought would impress his girlfriend.

Tesla had never actually traded at $420 before - until now. It reached that number yesterday.

And Musk wasn't unhappy about it:

And:

And:

This is very foreign to those of us with a City background, where business people tend to behave in a "proper" sort of way, at least publicly!

But even by US standards, it's weird for a CEO to act like this.

If the person in charge of a tiddly small-cap, in any country, said "whoa... the stock is so high lol" about their own stock, it would be a good invitation for bears to look into it and see if there was something wrong with it.

When it's the CEO of a $75 billion company, on the other hand, it's scarcely believable. Except for the fact that this is Musk and Tesla, and we've seen this sort of thing from him before.

I feel bad for the shorts who are sitting on huge mark-to-market losses at present - because I still think their analysis is correct, even if their timing is off.

On the other hand, it's worth pointing out that if you compare Tesla to the index, it hasn't outperformed the NASDAQ by much or at all over the last few years.

In other words: we've been in a bull market, and most things have gone up. So if you've been shorting Tesla for a long-ish period of time, then your performance isn't that bad versus shorting other things.

But if you shorted Tesla in the last few months, then you might be sitting on a 100% notional loss (or more than 100%, if you used options).

That's the nightmare for short-sellers, and it's why short-selling is so dangerous. When you get it wrong, the problem gets bigger and bigger until you eventually get pushed out of the position.

Tesla short interest has declined to 25.5 million shares, versus 43.6 million shares last May.

According to Marketwatch, the number of Tesla shares sold short has not been less than 20 million since mid-2013.

It does feel like we are in the middle of a short squeeze, as shorts desperately close their positions in the midst of a stock rally, adding fuel to the rally's fire.

Musk has been obsessed with his short-sellers for some time. Only last month, he made fun of hedge fund manager David Einhorn with a juvenile letter, posted on Twitter (Einhorn responded, taking up the offer to engage further with Tesla, but nothing came of it).

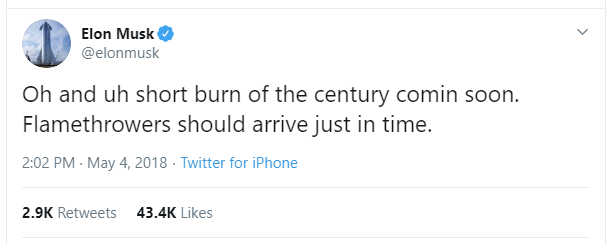

For now, Musk has won his battle with the short-sellers and may yet bring about the short burn of the century which he promised:

Miracle Profits & Chinese Dream

Allow me to quickly give you a recap of plausible reasons why Tesla stock has been roaring higher.

For Q3 2019, Tesla reported after-tax profits of $143 million.

Most of us were expecting it to post another loss.

The belief that Tesla might prove to be sustainably profitable and cash flow positive from now on has undoubtedly played a big part in the subsequent rally.

I remain deeply sceptical. I don't think the Q3 result was exactly as it first appeared.

Foreign Exchange gains

$143 million is not a large profit to begin with, and it was boosted by the fact that it included gains from foreign currency movements, while negative impacts from foreign currency movements were left out.

If you scroll down to "comprehensive income", you see that the real "bottom line" profits were a measly $29 million, which is negligible for a company of this size.

Accounts Receivable

David Einhorn (mentioned above) has been calling out Tesla's accounts receivable balance of $1.1 billion. Tesla's sales are predominantly for cash, so how does this work?

The company has suggested that it has to do with quarters which end on a weekend or bank transfers from European sales taking weeks to clear, but these explanations don't make a ton of sense.

Warranty Reserving

There has been some in-depth analysis (here and here) of whether Tesla is making sufficient provisions for its warranty liabilities.

It hasn't been proven beyond all reasonable doubt yet, but I do think that these are legitimate questions. Many customers can be found on twitter, with their messages following this template:

"I love the car, but [it has some terrible problem and I would really like somebody to fix it please.]"

When Tesla does fix cars, it has a tendency to call them "goodwill" rather than a warranty job.

The argument from bears is that this is a technique to avoid using up its warranty reserves a lot faster than it was supposed to. The argument goes that if it recognised all of these costs as warranties, then it would have to make a bigger provision for future warranties and its reported gross margins and profits would decline.

Cash flow games

Tesla proudly reported $371 million in free cash flow for Q3.

Again, the bears spotted a problem with this.

If you go to the cash flow statement on the 10-Q document, and read the notes, you find that the company classified $223 million dollars as "principal payments on finance leases".

These payments are to do with the purchase of equipment from Panasonic and are capex by another name, but their classification as lease payments removes them from the company's definition of free cash flow.

China et cetera

Tesla bulls are excited by many promises:

- manufacturing to commence at Tesla's Chinese plant in Shanghai

- a new factory to be built in Europe

- the release of a new affordable SUV, the model Y

- the release of autonomous driving capabilities, called FSD ("full self driving"), increasing the value all existing Teslas and creating a fleet of robotaxis

- the release of an electric Semi truck

- the release of the Cybertruck

- I've probably left something out!

From my point of view, it remains one of the most compelling shorts I've ever seen.

But timing is important in this game.

Maybe after a short squeeze, and as the company runs out of money again, will be the perfect timing to get back on this horse.

For now, it remains the purest entertainment.

That's it from me in this report for 2019.

I'll see you again in 2020. Have a wonderful Christmas and holiday season, and stay safe in the markets!

And thanks for all your wonderful comments, feedback and encouragement. We couldn't do it without you.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.