Good morning!

The Dow fell 800 points yesterday, or 3%. The FTSE dropped another 100 points to c. 7150. Let’s see what today brings.

H & T (LON:HAT) footnote

(I have a long position in HAT.)

I had a very brief chat yesterday with Richard Withers, the interim FD of H&T, to clarify one or two things I had been wondering about (see Tuesday's report for background info).

1. Fall in retail margin

H&T's retail division saw a 10% reduction in gross profits and a noticeable decline in margin, and I asked Richard why the company had chosen to get rid of aged items at such a large discount.

Richard explained that these items had been sitting in stores for "quite a while", including things like less desirable watches and gold bangles which were more difficult to sell.

From a financial efficiency point of view, £2 million of cash had been released by this move, and stock turn had improved from 52 weeks to 38 weeks.

Richard confirmed that there had been a gradual buildup of inventory and that this sort of inventory clearance was just something that might be needed from time to time - there is no overall change in the company's retail strategy.

My view - this makes perfect sense and I appreciated the focus on stock turn. H&T's quality metrics tend to be "good, not great" but managing inventory efficiently is the sort of thing that can help to keep them at acceptable levels:

2. Low revenue growth in Pawnbroking

Pawnbroking revenue (less impairments) only increased by 4%, even though the gross pledge book grew by 12.5%. The risk-adjusted margin, which measures the profitability of the pledge book, fell from 67.9 to 62.9%.

Richard gave me some extra detail on this, explaining that there were more 14 carat and 22 carat items being pawned (with origins in Eastern Europe and Asia).

This business mix with more high-value items being pawned results in larger loans being made by H&T. And larger loans tend to have lower interest rates. This is why revenue didn't grow as fast as the pledge book, and the profit margin of the pledge book fell.

My view - I'm satisfied that this makes sense. Redemption rates were flat, so rising customer defaults are not currently an issue.

Conclusion - I'm happy that the core business was managed well in H1. Long may this continue! And I'm looking forward to tracking the progress of the Money Shop acquisition.

Market jitters

The RNS doesn't appeal to me at all, with virtually nothing worth writing about.

So instead of covering the RNS announcements, I'm focusing today on macro.

The FTSE is currently down by 120 points, following yesterday's big fall. The Dow is lower by 200 points overnight, after dropping 800 points in yesterday's session.

For today's report, I'm going to look for value in the broader equity markets at current levels.

What I'm doing - firstly, to put my own cards on the table, I'll remind you what I'm doing with my own funds in the context of a possible recession/market crash:

- continuing to trade infrequently and avoiding large changes to the portfolio. "Business as usual".

- holding a broad mix of shares including defensives and those which should be fine in a recession.

Stocks I hold which should be ok in a recession (fingers crossed):

- My largest holding, Volvere (LON:VLE), is a turnaround specialist with a large cash pile, so a recession could provide lots of new opportunities for it.

- My third-largest holding, H & T (LON:HAT), is in the pawnbroking business - this is a good example of a business which should survive a recession. Its profitability was excellent from 2008 - 2012.

- My fifth-largest holding, IG Group (LON:IGG), flourishes in periods of market volatility. It was very profitable throughout the entire period of economic weakness starting in 2008.

Another stock which comes to mind is the insolvency practitioner, Begbies Traynor (LON:BEG). I'm sure you can come up with plenty of your own examples of stocks which can survive and thrive in a recession or stock market crash.

Now let me be clear: I don't believe that an entire investment portfolio should always be "primed for a crash". But I do think that it can be comforting to have some recession-proof or counter-cyclical holdings, to offset the losses and difficulties which you might suffer elsewhere.

Other relevant things I'm doing:

- Some leveraged long positions on the FTSE, using spread bets. I'm not trying to make vast sums with this strategy, but I do think that I can afford to use a little bit of leverage, given my time horizon and my positive view on the value in the FTSE (more on this later).

- Last night, I increased the position size of my Tesla (TSLA) short, back to its original level.

Trading Tesla

Why did I restore my Tesla short to its original size?

- Having done a lot of due diligence on the company, I was concerned about "missing" a resumption of the sell-off, after it dropped 6.5% yesterday. It fell back to the level where I had previously reduced position size, around $220.

- There hasn't been any positive news flow to change my bearish outlook. The most interesting recent development is that the National Highway Traffic Safety Administration has lost patience with its advertising practices and issued a cease-and-desist letter, and has asked the Federal Trade Commission to investigate how it characterises the safety of its vehicles.

- US-China tensions could make life much more difficult for Tesla in China, where it is building a new factory and where investor hopes for it are huge. It will be fascinating to see how things work out with Tesla's Chinese suppliers. I lived in China for a year and have some understanding of the country and its people. Let's just say that I view Tesla's prospects in the Middle Kingdom as dubious in the extreme.

- Twitter is full to the brim of Tesla's customers asking for help and complaining about inadequate service. See the hashtag #teslaserviceissues. As Tesla's fleet has grown large, its inadequate service capabilities have become more and more obvious. It's not hard to understand why: normal car companies use dealerships who are incentivised to help customers in the aftersales market, but Tesla decided to plough its own furrow and vertically integrate this function. The company's warranty provisioning and service losses are major points of interest for bears.

- We are drawing closer to the day when Tesla will have to face its extremely tough comparatives from Q3 and Q4 2018. Year-on-decline in quarterly revenues and profits could be difficult for the stock to swallow.

Besides these stock-specific reasons, a short can be psychologically helpful in a period of general market weakness.

The one big reason not to short Tesla, in my mind, is the $5 billion cash balance it reported at the end of Q2. This cash balance was achieved by raising fresh sums from the debt and equity markets, and by dumping inventory on a massive scale.

The cash balance gives Tesla some more time and flexibility to come up with a sustainable business plan. So a disorderly collapse in the short-term is now very unlikely, and especially when we consider that the company has ready access to the capital markets.

In summary, I don't see any short-term catalyst for financial collapse, but I do have plenty of reasons to think this stock is going to strurggle in the medium-term. And with markets crumbling around us, it is nice to have at least one big short.

Indeed, if I have enough time to do the research, I might break my rule about only shorting one stock at a time. It feels like there are still a lot of bubble stocks floating around, and we could have a fertile environment now in which to short them. Watch this space!

FTSE Value

Let's take a quick look at the FTSE-100 components, and see which stocks are suffering the most in the current sell-off.

The top 15 fallers over the past week have been:

- EVRAZ (LON:EVR)

- Royal Bank of Scotland (LON:RBS)

- NMC Health (LON:NMC)

- International Consolidated Airlines SA (LON:IAG)

- TUI AG (LON:TUI)

- Kingfisher (LON:KGF)

- Schroders (LON:SDR)

- Anglo American (LON:AAL)

- Hargreaves Lansdown (LON:HL.)

- Antofagasta (LON:ANTO)

- Ashtead (LON:AHT)

- Melrose Industries (LON:MRO)

- Aviva (LON:AV.)

- Legal & General (LON:LGEN)

- Micro Focus International (LON:MCRO)

A mixed bag but I think it's fair to note that financials (5) and resource stocks (3) together make up the majority of the list.

Terry Smith of Fundsmith has remarked that even if "quality" stocks appear overpriced towards the end of a bull run, there is still a strong probability that they will outperform other stocks in the bear market which follows. After all, the other stocks are likely to be more cyclical (e.g. banks, resources) and cyclical stocks can absolutely crater in a bear market.

This is the sort of problem facing investors now: do we buy very expensive quality (arguably this includes the likes of Fevertree Drinks (LON:FEVR), a great company but richly rated) or do we accept lower quality companies which might find a 2020 UK or global recession very difficult to handle?

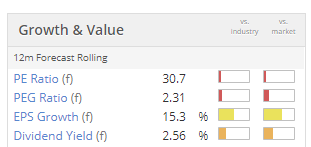

Of the above list, the company that I would be most interested in is the broker Hargreaves Lansdown (LON:HL.). It's easy to argue that this is a quality company, but it's also easy to argue that it's overpriced at a PER in excess of 30x. It gets a ValueRank of just 7 from Stocko:

Other "quality" companies in the FTSE-100 which seem overpriced by traditional metrics include the likes of London Stock Exchange (LON:LSE), Experian (LON:EXPN), Burberry (LON:BRBY) and Rightmove (LON:RMV) (I own shares in the last two).

But then if you look at something like Just Eat (LON:JE.), you see a huge valuation which is actually backstopped by a merger proposal. When a bidding war heats up for a hot company, it's amazing what sorts of valuations can be achieved.

While I don't see many FTSE-100 companies which I want to buy at current levels, I do think that the overall index offers reasonable value for those of us with longer time horizons than 3-6 months. So I have opened some bullish derivative contracts, and might open some more if I have the spare collateral and if pricing remains attractive.

For investors, I think the most important thing is not to panic. Don't get me wrong: it's fine to sell out of your holdings, if that's part of your strategy. But don't change your strategy, just because markets are moving south.

What you want is to develop a strategy so that you have an idea about what you are going to do in a bear market, before it happens.

A pilot doesn't study how to deal with turbulence in the middle of a storm. Instead, he or she follows procedures. It should be the same with us and bear markets.

Thanks everyone, see you tomorrow.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.