Good morning everyone!

There are some interesting releases for me to look at today. This list is final:

- H & T (LON:HAT)

- Watches of Switzerland (LON:WOSG)

- Plus500 (LON:PLUS)

- Marshall Motor Holdings (LON:MMH)

- Card Factory (LON:CARD) (by Paul Scott)

- Cenkos Securities (LON:CNKS)

H & T (LON:HAT)

- Share price: 341p (unch.)

- No. of shares: 39.7 million

- Market cap: £135 million

Unaudited Interim Condensed Financial Statements

(I have a long position in HAT.)

These are a good set of results and I've marginally increased my position size in H&T as a result. It was already a core position for me, and is now 9% of my portfolio.

Note that these results are before the acquisition of 65 stores from The Money Shop, including their pledge books.

The total store estate has therefore jumped sharply from 183 to 248, but we can't see it in today's numbers.

Indeed, the company recognised £0.5 million of transaction expenses so The Money Shop deal has had a negative effect on these interim results.

Without those transaction expenses, PBT would have increased by 16% to £7.3 million. This is in line with the 16% increase in "operating profit before non-recurring expenses", as reported by H&T.

Another factor which I would emphasise is that these results are on the back of an average gold price during the period of £1,010 per troy ounce. The latest gold price per troy ounce is £1,260.

For a long time, these shares have been a vehicle for me to express my goldbug instincts. There's a big part of me that wishes it was an even bigger part of my portfolio, as I do think that the prospects for gold are extremely bright, and I feel like I can analyse the prospects of a pawnbroker (by contrast, I have very little experience in the mining sector).

The other very nice thing about this share has always been my positive impression of the CEO and the culture of the company. To put it simply, I think that it treats its customers fairly and is focused on developing repeat business on a mutually beneficial basis.

For those who are concerned about the ethics of payday lending, note that the proportion of H&T's personal loans which fall under the FCA's definition of high-cost short-term credit has reduced again to 36%.

The Money Shop store acquisition is the riskiest thing that H&T has done in many years, but I am heavily leaning towards the view that it will turn out ok. See my detailed coverage in July when the deal was announced.

Let's look at the divisional performance in H1 in a little bit more detail:

Pawnbroking

People often ask me why I don't own any shares in Ramsdens Holdings (LON:RFX).

While I like Ramsdens, one of the key reasons I prefer H & T (LON:HAT) is that I like the old-fashioned pawnbroking business, and H&T has a much larger pawn book. I think it would be much harder to disrupt this activity at H&T versus, for example, disrupting its foreign exchange services. Pawnbroking is the sort of thing that can't be disrupted by an app - you need a physical store where items can be brought in and examined.

If we compare the two companies: Ramsdens reported the capital value of its pledge book as £7.6 million this year, while H&T reports its gross pledge book (including interest) as £53.8 million. A huge difference! This is before taking into account the complete effect of the Money Shop acquisitions (both Ramsdens and H&T have purchased Money Shop stores).

For H1, the pawnbroking division reports more customer transactions, flat redemption rates and a small increase in revenues.

Pawnbroking scrap/Gold purchasing

These two divisions, which are very similar, did poorly in H1 compared to last year. This is attributed to "delay in the realisation of diamond sales yet to be auctioned" and "timing differences in the sales of purchased gold together with diamonds awaiting auction".

I'm happy to give the company the benefit of the doubt, that the delay and timing issues will unwind in future periods.

Retail

H&T has reduced its retail inventory and this has resulted in lower margins and a 10% reduction in gross profits at this division.

I would be curious to know why the company chose to reduce its inventory - I think I will contact them and ask. They have plenty of headroom on their borrowing facility but maybe they wanted to free up some extra cash to help with the acquisition? It will be good to find out.

Their retail website nearly doubled sales to £2 million.

Personal loans

A few strange numbers in here, but I think the overall picture is great.

The company says it took "proactive action in areas identified as not economically viable".

The loan book at June was down 5% compared to December, though its average size was still 20% larger than H1 last year.

Net revenue in H1, meanwhile, is up 74% to £5.4 million.

As I said earlier, the majority of loans are over longer periods and at cheaper interest rates than the FCA's definition of short-term, high-cost credit. Or in simple language, the majority of them cannot be considered "payday loans".

Larger loans with longer maturities are good for the customer and the company - the company generates more total revenue from similar fixed costs, while the customer gets a lower interest and more time to repay the principal.

Other services

In this section, H&T reports some good progress in foreign exchange. A nice bonus for the company.

Outlook

More than just confident, the company is excited:

"We are excited about the opportunity to achieve uplift and return from our newly enlarged store estate. We will continue to focus on people development and transfer the Group's success factors into the 65 newly acquired ex-Money Shop stores. We will also look at opportunities where the Money shop excelled (for example Western Union, FX, cheque cashing) and transfer knowledge and synergies where relevant."

Trading is in line with expectations.

Cash flow

This is fine: we have £6.8 million of net cash generated from operating activities, versus £2.2 million in investing activities.

I wouldn't mind at all if H&T chose to keep its dividends flat for a while, to help deleverage from its acquisition faster. But there is a 7% increase in the interim dividend.

Return on equity

Average equity during the period was £105.6 million, and comprehensive income was £5.6 million. So we have a return on equity of 5.3% over the six month period - not bad!

Dilution from the acquisition is 5%, but the store count is increasing by 36%. This has the potential to supercharge ROE, in the short-term, if costs can be controlled and if the new stores can be brought up to H&T's standards.

Longer-term, after the planned deleveraging, sustained high ROE may depend on the gold price.

My view

Clearly I'm bullish on this one, as I've topped up my position in it today. I sold out of my starter position in CMC Markets (LON:CMCX) to fund the purchase.

What could go wrong? I suppose they could mess up the acquisition, competition could intensify in lending and FX, the FCA could change the rules, and the gold price could collapse. It's not risk-free, by any means.

The StockRanks share my overall enthusiasm, calling it a Super Stock. Indeed, the computers reckon that it passes no fewer than five bullish stock screens for Quality, Growth and Momentum. Not bad for a chain of pawnbrokers!

Update: Proactive Investors has published an interview with CEO John Nichols. It's available on YouTube at this link.

Watches of Switzerland (LON:WOSG)

- Share price: 280.5p (-1%)

- No. of shares: 239.5 million

- Market cap: £672 million

This is beyond our market cap limits, and I won't spend too much time on it. I'm just curious to see how this recent IPO performs in its first year on the public markets.

This Q1 release covers the period during which it listed. So it is perhaps still too early for the post-IPO wobble which I have come to expect.

Watches of Switzerland reports like-for-like UK growth (excluding online) of 11.5% and UK online growth of 14.5%. Not bad. Just goes to show that luxury doesn't necessarily follow the same trends as ordinary retailing does!

The smaller parts of the WOSG business, namely Fashion and Jewellery, are declining, while Watches are growing strongly. This reflects company strategy to close non-core stores and reduce non-core activity.

In the US, it trades as Mayors and this brand is currently undergoing an investment programme, with refurbishments and relocations taking place.

Outlook

This bit is tentative:

While there are some moving parts, overall our capital project programme is broadly in line with previous guidance. The luxury watch markets in the UK and US remain strong. We do however note the ongoing wider macro-economic uncertainty in the UK and US.

It's a mini-warning that things aren't exactly going according to plan. But they are mostly going to plan. The Board's expactations for FY April 2020 are unchanged.

My view

I find this stock quite interesting. I think WOSG might have some valuable relationships with timeless watch brands, and the luxury segment with its international clientele might be robust even when other retailers are struggling.

This is on my watchlist (see what I did there?)

Plus500 (LON:PLUS)

- Share price: 661p (+16%)

- No. of shares: 113 million

- Market cap: £749 million

Another one that's a bit too big for this report, but let's take a look as it's a controversial one.

I last covered it in this report in April, on a day when the shares were down by 26%.

These H1 results are in line with expectations, but are dire in terms of the reduction in revenue and profitability.

We have a 68% reduction in revenue, and an 80% reduction in net profit, compared to H1 last year.

Average revenue per user (ARPU) collapsed and was below the average user acquisition cost (AUAC) during the period. In H1 2018, ARPU was almost 3x the AUAC.

Offsetting this, customer churn reduced in Q2 to 16%, which is the lowest quarterly churn on record. If customers are hanging around for longer, they have a better chance of paying their acquisition cost.

The share price bounce today may be attributable to several factors:

- investors may have been braced for another miss.

- Q2 was much better than Q1 (new customers increased by 23%, for example), suggesting that short-term momentum has swung back in PLUS's direction.

- the announcement of a new $50 million share buyback programme, deploying some of the company's $330 million cash balance and taking some of the sting away from lower profits and a smaller dividend.

Strategy & Outlook

The company is considering "multiple additional growth opportunities", including new geographies, new regulatory licences within existing geographies, new products and targeted acquisitions.

The outlook statement is "optimistic".

My view

While I no longer hold shares in CMC Markets (LON:CMCX), I remain heavily involved in IG Group (LON:IGG) and am encouraged from a sector point of view to hear PLUS confirm that Q2 had "more normal trading conditions", after a very quiet Q1.

As for PLUS itself, there are a few factors I'd like to discuss:

Firstly, the exchange rate of Bitcoin to USD trebled during Q2. This is clearly going to generate a lot of excitement among customers and prospects. Active customers and customer recruitment were both at their highest level in Q2 2019 since Q1 2018, which is the period when Bitcoin reached its all-time high.

Secondly, the ARPU/AUAC situation is not all bad. The price of acquiring users has fallen, and PLUS reports "the first signs of reducing competition". In other words, other CFD brokers aren't chasing PLUS's customers with the same aggression that they did before.

Thirdly, PLUS's results continue to be skewed by the trading performance of its customers, whose losses can't exceed their deposits but whose potential profits are unlimited.

Plus500's customers have been winning recently, and this cost the company $27 million in H1, reducing revenue to $148 million.

Over the long-term, I don't expect that Plus500's customers will be profitable. So instead of being a headwind, this should be a tailwind in future periods, as it has been before (though it's impossible to predict in advance how any particular quarter will pan out).

While I've been very critical of this company in the past, I recognise the much better value offered by the current share price (it was as high as £20 last year) and can see speculative value in it at current levels. The ESMA regulations have been in place since August 2018, so we are getting some clarity now on what the new, normalised trading performance at PLUS might be.

The market cap is $900 million, with a healthy balance sheet and more than $50 million in net profits having been generated in H1 (including a very strong Q2).

On a pre-tax basis and if we exclude customer wins, the H1 operating profit could have been more than $90 million.

While I had no interest in this at £20 and before we had clarity over customer P&L and the long-term impact of ESMA regulations, I am starting to find this interesting at the current much more reasonable valuation. But I would not bet the farm on it.

The Stocko algorithms correctly idenfify it as Speculative and Contrarian. It passes 11 quantitative screens.

Marshall Motor Holdings (LON:MMH)

- Share price: 138p (-1%)

- No. of shares: 78 million

- Market cap: £108 million

Results from this car dealership group are in line with expectations.

Like-for-like revenues are +1% and underlying PBT is down 5%.

MMH represents 22 brands across 101 dealerships. Following an acquisition, it is now the largest retailer of SKODA in the UK.

I am not currently spending any energy on this sector, as I find it too difficult to distinguish the investment merits of one dealership compared to any other one.

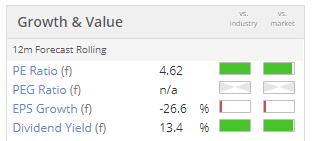

For what it's worth, MMH is trading at a big discount to book value (£201 million) and on a forecast P/E multiple of just 6x, according to Stocko.

Looking at the sources of revenue and profits, I see the following:

- new cars: sales down, but margins higher. MMH says that that it has strongly outperformed the wider market in new cars. Margins improved as sales targets were achieved without pre-registering cars, and thanks to an improved mix.

- user cars: sales up, but margins lower. There were sharper-than-expected seasonal declines in used car values. The company says this was due to strong supply of 3-4 year old cars and a shortage of new cars last year, which artifically increased the value of used cars a year ago. Those of us who own stock in car finance companies might want to keep an eye on this.

- aftersales: sales up, margins lower. Lower margins were seen on an unfavourable mix of low-margin parts. Expecting a margin recovery in H2.

My view

Like other stocks in the sector, this looks like it is probably undervalued. The ValueRank, for example, is 92. It doesn't tick enough of my qualitative boxes, but it may be interesting to those of you who dig around for value and have some faith in the car market.

This section by Paul Scott.

Card Factory (LON:CARD)

- Share price: 156p (-4%)

- No. of shares: 341.5 million

- Market cap: £533 million

Card Factory, the UK's leading specialist retailer of greeting cards, dressings and gifts, announces the following trading update for the six months ended 31 July 2019.

Like-for-like ("LFL") store sales are up 1.2% in H1 - a very creditable performance, given that we know how tough the High Street is these days - as increasing numbers of shoppers buy online instead, and footfall reduces. Note that the 1.5% LFL sales growth shown in this highlights is just for Card Factory brand, not the whole group.

New stores - 26 opened in H1, another 24 planned for H2. I bet the company is getting great deals on new shop leases.

Cash generation is very strong at CARD, and it's planning to "return of surplus cash towards the end of FY20" (01/2020) - sounds like another special divi is on the way, which is on top of the large regular divis - the main reason for holding this share is for the dividend income, which most importantly of all, *does* look sustainable in my view. I see this as a good share to consider for e.g. retirement income portfolios.

Overall trading is *broadly in line with previous expectations* - hence the slight dip in share price today. In the current retail environment, I see broadly in line as being a good outcome!

Getting personal - its personalised gifts website is still struggling, with sales down 10.5>#/p###

Brexit preparations have incurred extra storage costs - implying that they have been stockpiling, which is probably a sensible move. Although I imagine the cards would be manufactured in the Far East, which shouldn't be affected by Brexit.

Net debt was £170.3m at 31 July 2019 - this looks manageable in my view, although I'd be happier if it didn't have any debt at all.

My opinion - I like this share, as a solid dividend-paying business. The profit margin is huge, so even if sales do fall, it should remain decently profitable. I think CARD is doing very well to be generating positive LFL sales growth - clearly the product ranges are good, and they're managing to grow sales, even as footfall reduces.

The big question is, what happens longer term? I don't think online cards will ever replace physically handing someone a card, and it's quite an insult to send an online card, in my view. There's nothing quite like seeing someone's eyes light up, as they open your card, turning to thinly veiled disappointment when they realise there's no money inside the card. Then of course watching in horror as the cheeky and amusing message you wrote inside the card doesn't turn out to be anywhere near as funny as you thought when you wrote it the night before after a couple of sweet sherries.

It's difficult to see much capital growth occurring with this share. But for income seekers, I think it looks attractive.

In terms of valuation, the forward PER is 9.3, and the prospective dividend yield is 8.7%. Maybe that's about right?

Back to Graham.

Cenkos Securities (LON:CNKS)

- Share price: 39.5p (+4% today, but fell about 20% yesterday)

- No. of shares: 56.7 million

- Market cap: £22 million

This one issued a profit warning yesterday at about 3pm.

Company revenues are expected to be "substantially second half weighted", after H1 was a flop.

There is hope:

We are currently working on several transactions and our potential pipeline gives us optimism for the rest of the year. The Board expects that the second half performance will be much stronger than the first half.

Unfortunately, there have been resignations within the Cenkos Investment Companies team and this could impact 2020.

That's the problem with people companies: the people can always walk away and start somewhere else (or even worse, set up a competing business).

That having been said, there is a simple argument which states that Cenkos is currently undervalued. As of December 2018, it had net assets of £28 million and cash of £34 million.

While profitability in 2018 was poor compared to prior years, I always go back to the fact that Cenkos has never made a loss: it has a great track record of reducing executive compensation whenever the revenues dry up. I would expect it to do the same this year, or at least produce something that is close to breakeven.

And the long-standing former CEO is coming back, after his replacement's tenure lasted about two years. Perhaps he can inject fresh life into it.

This one strikes me as attractive at the current share price.

Hanging up my pen there for today. Thanks everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.