Good morning, it's Paul here with Thursday's SCVR.

Estimated time of completion is: 3pm - because there are absolutely masses of updates to cover today, so I'll probably do briefer sections on each company to get through them all.

Update at 14:58 - today's report is now finished.

Please see the header for the updates I'm hoping to cover today (i.e. no need to request anything if it's already on the list!).

First, a few thoughts to get you started (I wrote this first bit on Weds evening).

Revolution Bars (LON:RBG) - in which I have a long position.

A post-script to yesterday's detailed coverage. I added this late to yesterday's report, and am copying it here too, so that everyone sees it.

Expansion - once the basics of the business have been sorted out, and debt reduced, then the roll-out of new sites could resume. This presents an opportunity, in that in future this share could re-rate back to being a growth company.

Property deal - some of us baulked at RBG signing new 25 leases (announced today) on 4 of the sites that it is retaining with a landlord called Aprirose. It's just dawned on me that RBG already occupies these sites (hence knows them inside out, and what level of rent is affordable), and RBG is already committed to occupying these sites for another 12 years from now, on the existing 25 year leases signed in 2007. Therefore it is actually only committing to another 13 years on these sites, over and above what it was already committed to. And the rents have come down, albeit described as only by a small amount.

Macro comment - Inflation, unemployment, & interest rates

Inflation - an interesting article in the Telegraph flags up that inflation has fallen to 1.3% for calendar 2019. Clearly that's good news for living standards. I'm trying to track down source data for macro topics, and making diary entries to check it each time it's released in future.

The inflation data comes from the Office for National Statistics (ONS), here's the link in case you also want to bookmark it.

Incidentally, I'm listening to the audiobook of Ed Balls memoirs (don't laugh, it's actually quite good, after a slow start), and he mentioned that one of the things New Labour did was to make the ONS completely independent (as well as the Bank of England). Whereas previously the ONS had been under a Govt Minister. Hence the data it puts out should be reliable, and not subject to tampering by dodgy politicians!

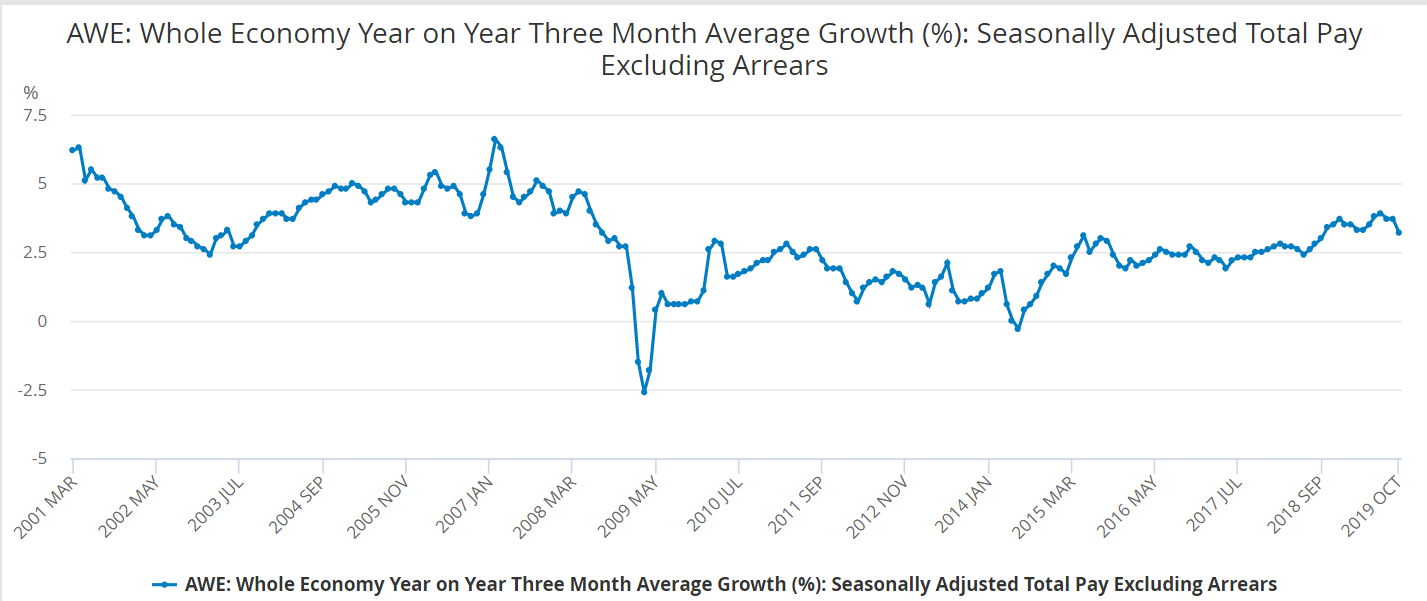

Rising wages - the ONS data on earnings is here (most recent data is Oct 2019).

Annual pay rises peaked at 3.9% in July 2019, and has since slipped back to +3.2% in Oct 2019. However, it's the difference between pay rises, and inflation that matters ("real terms" wage rises), and this is currently running at 3.2% pay rises, less 1.3% inflation = +1.9% real terms increase in average earnings. That's a healthy position, and means that people on average have more money in their pockets. Sooner or later, that tends to find its way into increased consumer spending. Although if consumers are nervous, they do sometimes use extra earnings to pay down debt, rather than consume more.

Overall though, the data suggests that we should be feeling bullish about consumer spending prospects in 2020, and which companies might benefit from this increased spending power.

Rise in Living Wage - the stage seems set for a really large increase in real incomes from April 2020. For over 25's, the Living Wage is set to rise +6.2%, less 1.3% inflation, becomes a massive +4.9% real terms increase in earnings for the lowest paid, from April 2020.

Higher paid workers demand pay rises too, in order to maintain differentials between each rung of the hierarchy. Therefore we can expect to see large upward pressure on wages generally in 2020.

So I think we're on the brink of an explosion in earnings, and consequently consumer spending.

However, that's also likely to put tremendous pressure on businesses large & small where employee costs are a high proportion of total costs. I think supermarkets, and other low margin retailers, are probably going to suffer considerably from higher costs. Competitive pressures mean that many retailers have been unable to pass on price increases to consumers, squeezing their margins, and eventually causing the weakest to withdraw from the market (e.g. look at all the Dept Stores that are closing).

It might get to a point where the Govt has to put a brake on, or pause further increases in Living Wage, if it causes too many companies to go to the wall.

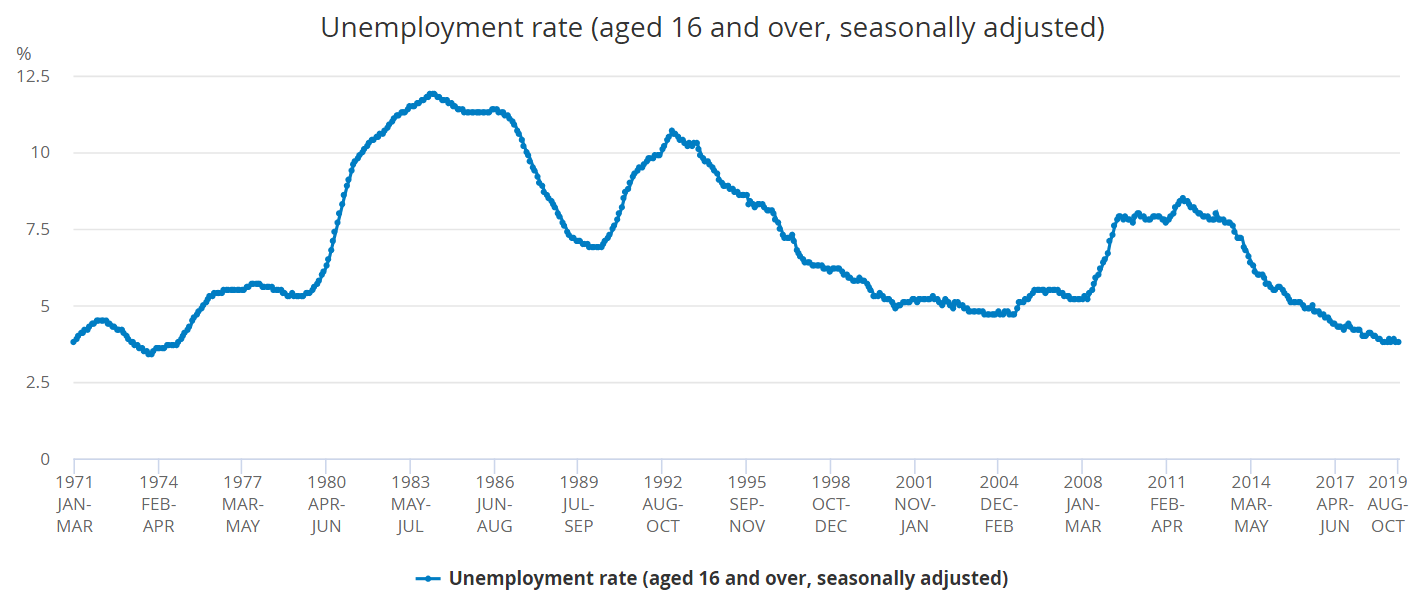

Low unemployment has fallen from a recent peak of 8.5% in late 2011, to only 3.8% today - pretty much full employment, as there will always be a small level of frictional unemployment, as people are fired or made redundant, then get another job a few weeks or months later.

As you can see, this is a historically very favourable position - although the rules are stricter now on who qualifies to be counted as unemployed (i.e. have to be actively seeking work to get JSA)

This low level of unemployment means there are labour shortages in some sectors. This adds more pressure on employers, who are forced to increase wages offered, in order to fill vacancies.

Conclusion - put all that lot together, and I think 2020 could well be a crunch year, where many retail and hospitality businesses come under intolerable pressure, and are forced into insolvency. That leaves more market share for the stronger players, and frees up resources for new entrants.

Higher wages are also likely to feed through to higher inflation, as companies are forced to raise their prices to survive. Finding cost savings, and raising productivity will be key themes for employers. Cheap labour is becoming a thing of the past.

Remortgaging - I was stunned to see an advert today in Nat West's window, offering a 5-year fixed rate mortgage at 1.59%, maximum LTV of 60%, for remortgages only, with a £995 fee. This is stunningly cheap, barely above inflation. Given that inflation is probably going to rise due to the factors noted above, then this looks a golden opportunity to remortgage on amazingly good terms.

Therefore, I'm flagging it to readers, as this is probably your best opportunity ever to remortgage on amazingly attractive terms.

With mortgages this cheap (for the lucky people who can come up with 40% deposits), and nearly as cheap for 25% deposits, then there's only one way house prices are likely to go - upwards. Good for shares in housebuilders, and companies in their supply chains.

There is talk of base rates being cut from 0.75% to 0.5%, due to sluggish GDP growth & low inflation under-shooting the 2% target. That seems pretty crazy to me.

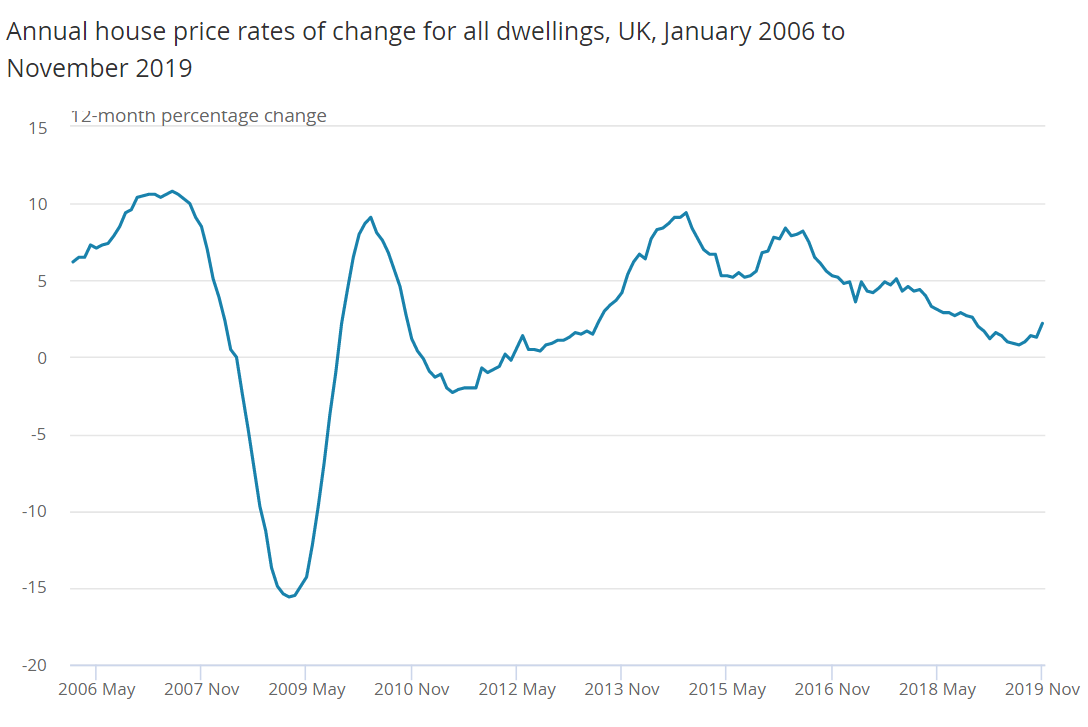

House prices - talking of which, I've just spotted another ONS set of statistics on house prices, here. The most recent figures (Nov 2019) show that average house prices (compiled from HM Land Registry data) grew by 2.2% in the year to Nov 2019. This is up from 1.3% in Oct 2019. Note that this is before the election result, so we could see this trend accelerate after, possibly.

Within the +2.2% average for the UK, England was +1.7%, and the stand out number is Wales +7.8%. Within England, London managed only +0.2%.

Here is the context of house prices since 2006;

Ed's webinar - 2020 stock picks competition

A staggering number of people (over 1,000!) tuned in to Ed's webinar last week.

The topic was Stockopedia data analysis of the 10,765 share picks, of 5 per person from the 2,153 people who entered the 2020 stock picking competition here.

If you missed it, you can watch the webinar video recording here. The competition leaderboard is here. Scanning through the leadersboard, I can see some names that I recognise from regular commenters here at the SCVR, so a shout out to;

- Howard Marx in 4th place, whose portfolio is up 35.4%

- Edward John Canham, in 44th place, whose portfolio is up 15.1%

- peterthegreat in 56th place, up 14.1%

- Andrew Mitchell in 68th place, up 13.4%

- Gostevie in 81st place, up 12.7%

Sorry for anyone I've missed. It's part fun, but part serious, as Ed wanted to analyse the data from a smart crowd (62% of entrants are Stockopedia subscribers), and see if, over a year, we really are smart, and beat the market. Or not.

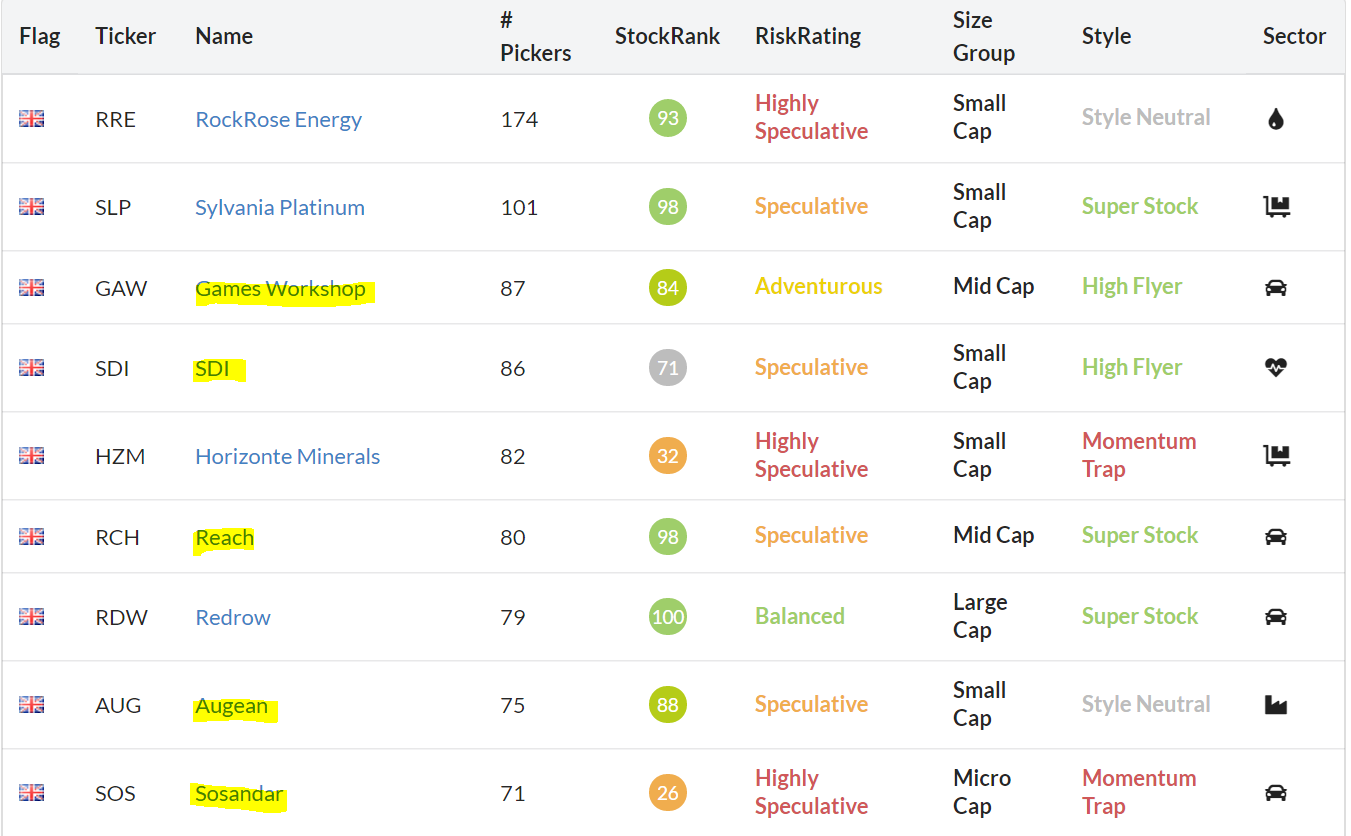

Top picks - it will be interesting to see if the stocks that competition entrants have bunched into turn out to be good or bad. The top pick, RockRose Energy (LON:RRE) has been picked by a staggering 174 entrants (out of 2,153 - 8.1% of everyone in the competition picked this one share). I'm not an expert in resource stocks, but can see that its super-low PER of 2, and cash-backed balance sheet look appealing. Jack Brumby dug a bit deeper, and in this recent article he flags the huge importance of future decommissioning costs, which is the biggest issue to understand.

Here are the top 9 picks, I'm amazed to see Sosandar in there at no.9 with 71 entrants having picked it. I didn't realise it was that popular. I've highlighted below the companies that I'm familiar with.

The stock selections include a lot of shares from USA.

The only problem with share competitions, is that there's no downside risk, and only one winner, so many of us just tend to pick highly speculative shares that might shoot the lights out, but probably won't!

On quiet news days, I might dip into the stock picks list, and do some research on things I'm not familiar with.

OK, on to today's trading updates - lots of them!

Cloudcall (LON:CALL)

Share price: 99.5p (up 1.5%, at 08:13)

No. shares: 38.7m

Market cap: £38.5m

(at the time of writing, I hold a long position in this share)

CloudCall (AIM: CALL), the integrated communications company that provides communications and contact centre software that integrates with Customer Relationship Management ("CRM") platforms, announces the following trading update for the year ended 31 December 2019.

This is a slight miss on revenues, because the forecast was for £11.7m, so a £0.3m shortfall, or just under 3%. I can live with that, because it's still a very good (purely organic) growth rate, up 30% on 2018.

The Group is pleased to confirm that revenues, cash and losses before tax are all expected to be broadly in-line with market expectations, subject to year-end financial close and audit procedures.

Run rate at year end for revenues is over £13m

Recurring & repeating revenues are 89% of the total (and on a high gross margin)

Customer churn rate is low

Put that lot together, and it's a compelling business model, or will be, once growth has passed the tipping point to break into long-awaited profits. That's not happened yet because the company repeatedly increases its cost base, to drive growth. There are two ways to look at that;

- Exasperation at repeated failure to achieve breakeven, let alone profits, or

- Recognition that the growth opportunity is far more important than short-term profitability

Very much a glass half full, or half empty stock then. I'm very much in the half full camp, because I'm more interested in the company maximising the long-term value of the company, than chasing short term profitability and missing a bigger opportunity due to under-funding growth.

Growth in the USA is a stand out positive;

US revenue up 55% year-on-year, with US revenue now approximately 40% of total Group revenue

I reckon a takeover bid from the USA is a possible outcome here. They value tech growth companies so much higher over there, so there could be Americans looking at this and regarding it as cheap. This is evidenced by there already being 2 American institutional investors with disclosable stakes (e.g. Kinderhook 2 LP has 12.1%).

The two standouts for the year are the quantum increase in interest from enterprise companies and the over-50% growth we delivered in the US.

It is worth noting that the US is now responsible for approximately 40% of our total revenue and with nearly half of the total funds raised in the recent placing coming from US investors, I have little doubt there is a huge, largely untapped, opportunity for CloudCall in the US and this is a key focus of our sales and marketing expansion.

Cash - is fine now, as a big placing of £11.3m was done in Oct 2019. It had £11.4m in cash, and an unused £2m debt facility at year end.

Enterprise customers - a key target area for growth is attracting much larger deals. Positive commentary is given on this.

Bullhorn relationship - very important, and is deepening. Improved sales pipeline due to directly incentivising Bullhorn staff to sell the CloudCall add on.

Asia expansion is now underway - important because some larger customers or potential customers want this.

My opinion - I understand & sympathise with the bearish view on this share (repeated failure to meet targets, repeated fundraisings, etc), but that's the past, and it should be the future that we concentrate on. After all, that's how shares are valued. Past mistakes are soon forgiven once a company starts delivering better results.

My view is firmly bullish on CloudCall. The downside risk has now largely gone, due to the big recent fundraising - driven by American investors who want the company to get on with it, and go for the growth opportunity, instead of penny pinching. For what it's worth, that's my view also.

Upside potential looks good, particularly if more enterprise customers sign up. The key thing is that the product is superb - I've been using it for years, and it works superbly. The recruitment sector niche that CALL targets can achieve excellent performance improvements by using CloudCall. There are many other sectors where this product would also add value. Plus it's moving towards being a global service.

Investors here have had to be very patient, but I reckon this share could be a lot more valuable in say 5 years' time, hence I'm happy to keep mine tucked away for the long-term.

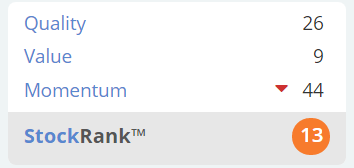

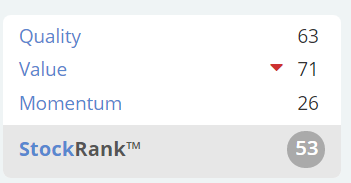

Definitely not a share for value investors though. Stockopedia reminds us of the high risk of failure with this type of share, with a dismal StockRank. I like this, as it's a sense check. Investors in CALL have the be very sure that this is going to work, to overcome the warning flag of such a low StockRank;

I've moved this one up the priority list, because it's today's largest % faller -

N Brown (LON:BWNG)

Share price: 106.4p (down 25% today, at 09:41)

No. shares: 285.2m

Market cap: £303.5m

Trading Statement (profit warning)

N Brown Group Plc today announces the following trading update covering the 18 week period to 4 January 2020.

This update relates to FY 02/2020. The year end date changes slightly each year, as it accounts for 52 or 53 week periods, instead of 12 monthly periods.

This is an unusual retailer. It seems to have closed nearly all its shops (only £6.9m revenues last year), and says today that 87% of product revenue is now online.

The other unusual thing, is that a large proportion of the business is financial services. I think this is high cost instalment credit for customers - if any readers know more about this part of the business, then please post about it in the comments. Revenue from financial services last year FY 02/2019 was £298.6m, almost 33% of total revenues. That obviously brings with it regulatory and balance sheet risk, so I'm not very keen on that aspect of things.

Profit warning - top marks here for clear disclosure (well done MHP Communications!), in particular these 2 key boxes are ticked;

1. Quantifying the revised profit guidance (instead of the bad way of reporting, using ambiguous wording, like materially below, significantly below, etc);

... we now expect FY20 adjusted profit before tax to be in the range of £70m to £72m 5

2. Footnote showing previous guidance, enabling us to instantly see the extent of the profit shortfall vs expectations;

5 Current range of consensus FY20 adjusted profit before tax forecasts is £78.0m to £84.1m

If we take the mid-point of each range, this gets us to;

Old profit guidance: c. £81m

New profit guidance: c.£71m

That's a £10m profits miss, or 12%. That's clearly not good, happening so late in the year, but operational gearing can have that effect.

Reasons given -

- Predominantly due to a lower than expected benefit from the IFRS9 non-cash provision estimate

- combined with lower Financial Services revenue and

- a highly promotional market

What the hell is IFRS9? I hear you cry. Well that was what I cried anyway. Googling it provides the answer, that it concerns rules on how to measure financial assets & liabilities. This seems to relate to BWNG's bad debt provisions against its consumer debtor book.

This extract contains some important points, and seems to be saying that tightening up on its consumer credit offerings is likely to hurt profits. I'm assuming this is driven by regulatory pressure?

Improved credit quality will feed into a reduced IFRS9 bad debt provision; our IFRS9 bad debt provision ratio declined to 11.9% as at H1FY20. This compares with a 17.9% provision when IFRS9 was first introduced. We believe that while further impairment improvement can be expected, the pace of improvement will slow.

In addition, changes to our policies and procedures, specifically the embedding of new measures around affordability and the introduction of new rules concerning credit limits - effective March and December 2019 - and persistent debt, which is due to take effect in March 2020 and December 2020, will have a significant influence on the size and shape of our debtor book.

The Group continues to assess its strategies to mitigate the impact of these changes, including the phased introduction of new financial products and further reductions in its operating cost base.

I've split it into two sections above. The first one sounds positive to me. Surely a reduced bad debt provision is good news? I don't fully understand all of this, but the last section talks about looking for ways to mitigate the impact, which clearly means that the impact of these changes is bad for profits.

Revised guidance for FY 02/2020 is given in a very detailed table - again, excellent transparency. This should enable broker research teams to come up with accurate models.

One stand out item, is that group operating costs are forecast to reduce by approximately -6.5% (mid point of the range given), revised from -4.5%. This demonstrates the advantages of selling online - namely that marketing spending is a major outlay, and can be dialled up & down to suit the circumstances. In this way, profit can be protected (albeit at the expense of growth). That cost flexibility should make successful online retailers far more resilient in a downturn, than traditional retailers which are being killed by fixed, high cost occupancy costs (rent & rates, but also cost of minimum staffing levels).

Outlook - this sounds concerning, as it seems to be saying that the lucrative financial services side of things is going to shrink;

We are making good progress with our ongoing strategic review and look forward to providing further details at our full year results in April. Our work so far has highlighted the need to have a tighter brand portfolio, a sharper focus on product and a cost base appropriate for delivering sustainable digital growth.

At the same time, we will continue to proactively address the accelerating and cumulative external factors which are anticipated to reduce the size of our Financial Services business over the next two years.

These will significantly influence the way we will operate our Financial Services business and we are taking proactive measures to ensure that the change is managed appropriately. This is in line with our strategy of becoming a digitally focused, retail-led business.

Our expectations remain that the retail market will continue to be challenging and promotional, but we are focused on our clear strategy of delivering profitable digital growth."

My opinion - I've read enough to completely put me off delving any deeper into this.

So it's not something I would touch - too complicated, and it sounds like there are significant problems ahead.

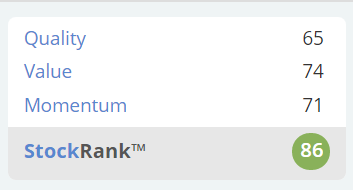

The StockRank is high, at 86, but I imagine that is likely to fall, as reduced broker forecasts feed through the system after today's update.

Portmeirion (LON:PMP)

Share price: 805p (unchanged, at 11:23)

No. shares: 11.11m

Market cap: £89.4m

Portmeirion Group, the designer, manufacturer and worldwide distributor of high quality homewares under the Portmeirion, Spode, Royal Worcester, Wax Lyrical, Nambé and Pimpernel brands...

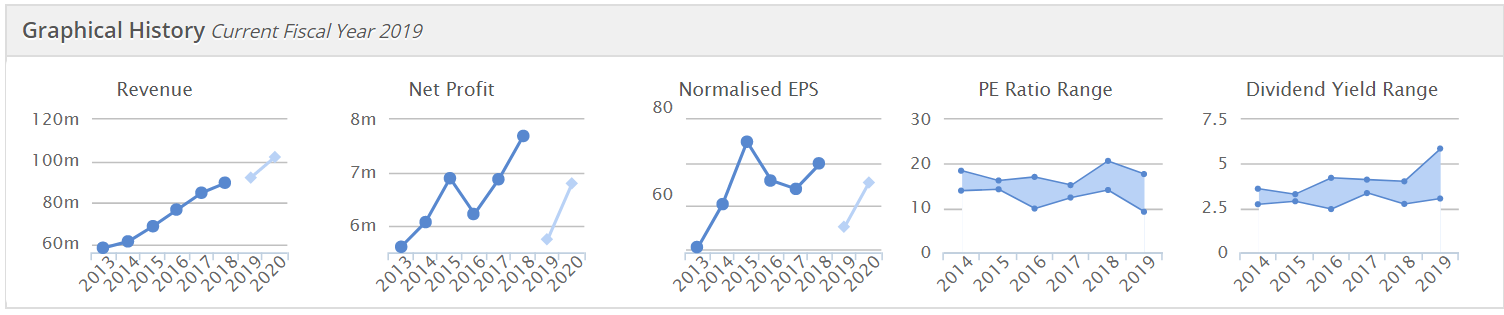

I've traditionally liked this group, but performance of late has been rather lacklustre, which has made me wonder if it's perhaps not as good as I thought?

... pleased to announce that it expects revenue and profit before tax for the year to 31 December 2019 to be in line with revised market expectations.

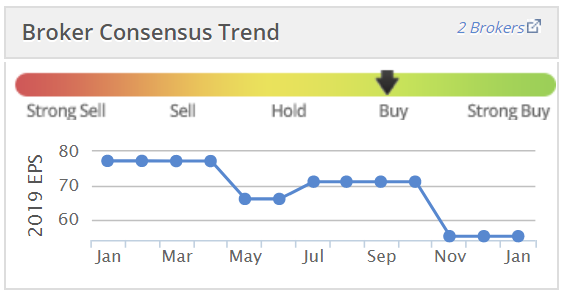

It's an in line update today, but look how much broker forecasts have been reduced;

Or to put it another way, the group has given up all the profit growth from 2013 to 2018, despite having acquired other profitable businesses during that time. This suggests to me that there might be some deeper underlying problem here.

At the moment, brokers are expecting profit to partially recover in 2020, but how much reliance can we place on that, given that 2019 has been so disappointing? The key question then, is whether 2019 was a blip, or if profit is now trending down?

Other points in today's update;

- Revenues up 3% to at least £92m, but driven by an acquisition (Nambe)

- LFL sales declined 5% - driven by poor sales of Botanic Garden range

- South Korea is the problem market (which is PMP's 3rd largest market, after UK & USA) - making good progress to stabilise this market

- Pleased with other markets & subsidiaries

- UK grew 5% despite "tough economic backdrop"

- Online sales growing (I like this bit);

Our migration towards online continues with total online sales in our core UK and US markets growing by 17% year on year. We now estimate that 30% of our total UK/US sales are made through online channels reflecting the strong progress we have made in the transition to online. Sales from our own ecommerce platforms grew 16% year on year and are expected to continue to grow strongly in 2020. Online sales remain a key area of strategic focus for the Group.

A lot of PMP's products are ornamental, collectable items of pottery, or consumable (candles). Therefore knowing who your customer is, and having the ability to contact them directly through digital marketing, cutting out resellers, has obvious attractions - much higher profit margins, targeted special offers, stimulating demand by suggesting items which match what customers have previously bought, building brand loyalty, promoting new product ranges, etc.

Outlook - the way I read the below excerpt, it seems to be guiding us towards continued soft profitability in 2020, and hoped-for better profitability longer term;

We are confident in our strategic plan and the long term opportunities to grow our business. In 2020, we intend to further increase investment behind key strategic areas such as driving online growth and brand marketing including campaigns and product launches to celebrate the 250th anniversary of Spode. The integration of the Nambé business continues to go well and we look forward to seeing the anticipated benefit in future sales growth. "

My opinion - I think the long-term picture looks good, particularly with online. However, I don't see any rush to buy now, because of the hesitant outlook for 2020. It could have another profit warning in it for 2020, perhaps?

On the upside, it pays a decent divi of 4.8%, and there's always the takeover potential for a more highly rated group (e.g. from USA) to buy this in order to bolt on growth at a modest outlay (the forward PER is only 12.3 - although maybe that's because the uplift in profit for 2020 may not happen?)

Overall, revenues are growing, but profit isn't, therefore I'll probably just keep it on my watchlist for now.

Stockopedia's computers are sitting on the fence next to me!

Brief sections now, due to time constraints.

Quarto Inc (LON:QRT) - this is an illustrated books publisher. It changed broker, to Finncap, in Nov 2019, which can often be a precursor to a fundraising.

Today Quarto announces a rather interesting fundraising, in that it's just an open offer (no placing element). i.e. only existing shareholders are participating in the fundraising. This is excellent, as nobody can complain about being diluted. It's just like a rights issue, except that there's no facility to buy or sell entitlements to new shares. With an open offer, you either take up your entitlement, with the ability to apply for excess if you wish, or just let it lapse. Or partially take it up.

Open offer entitlements for existing shareholders are 1 new share for each 1 existing share. The market cap is tiny, only £15m, I hadn't realised it had fallen that low.

Divis stopped in 2016, which is a clear sign of financial stretch whenever it happens.

I've never liked the balance sheet here, so it's a good thing that it's being strengthened with fresh equity.

Price is 68p, about 10% discount to the 75p prevailing price beforehand - which is fine - it needs a discount to nudge people to take up the open offer. Actually, the price could have been set lower, to provide more of an incentive for people to take it up.

Underwriting - 2 existing shareholder groups are underwriting the whole open offer. So it's going to happen, it's just a question of which shareholders take up the new shares. That seems a very fair way of doing things - i.e. giving smaller shareholders the option to put in more money, but without any consequences if they choose not to. That's far preferable to a deeply discounted placing, as happened yesterday with INCE (LON:INCE) .

Clearly this is happening at the insistence of the bank;

The Group has also been in discussions with its banking syndicate to extend the final repayment date of its existing facilities agreement and to extend certain of its covenants. Such amendments would be conditional on completion of the Open Offer. Furthermore, the Group intends to use the net proceeds of the Open Offer to reduce the Group's existing bank debt.

My opinion - I think small shareholders in this have been very lucky!

Large shareholders have bailed you out, basically. This could have very easily been a wipe-out.

Trouble is, it only partially fixes the problem. Net debt was last reported at $65.0m at 30 June 2019. The $16.7m being raised (after costs) in this open offer, only reduces bank debt by about a quarter, quite appropriate for Quarto! My worry is that, if the bank has cold feet, then it might want to ultimately pull out altogether. Therefore this could be the start of a series of fundraisings, maybe? For that reason, personally I wouldn't take up my open offer shares if I held, and would ditch my existing holding in the market, and count it as a lucky escape.

Judges Scientific (LON:JDG) - what an amazing share this has turned out to be! I remember attending a Mello presentation given by David Cicurel many years ago, when this share was about £1, and we all agreed what a clever & charming (and very amusing) chap he was. Little did we know it would turn out to be a 50-bagger!

It's proof that a buy & build strategy can work, if it's done in a disciplined way - buying good, niche businesses cheaply (e.g. when owners want to retire), and using cashflows from acquisitions to pay for themselves over a few years.

Today it says 2019 EPS will be slightly ahead of market expectations (upwardly revised in Sept 2019). Good demand, and favourable exchange rates, are mentioned.

I'm neutral on this one. The market cap is not huge at £309m, so if more shrewd acquisitions are bolted on, then who knows where it could end up? That said, it must be tempting to bank some profits after such a stunning rise?

Headlam (LON:HEAD) - floorcoverings distributor - 2019 results will be marginally ahead of market expectations but down on 2018. Divi maintained. Cautious outlook for 2020, and £10m more capex in 2020 to finish new distribution centre.

Footnote included - bravo Buchanan Communications!

¹Company-compiled consensus market expectations for 2019 revenue and underlying² profit before tax are £705.5 million and £39.3 million respectively (mean), with the expectation for underlying² profit before tax given prior to the adjustments due to the adoption of IFRS 16 'Leases' accounting standard which came into effect on 1 January 2019. The Company currently anticipates, subject to completion of the 2019 audit, that underlying² profit before tax will be impacted by a reduction of £0.8 million due to the adoption of IFRS 16 and that 2020 underlying² profit before tax will be impacted similarly.

My view - a nice company, and looks good value, even after strong rise in the last year. Yield of nearly 5% - worth a closer look.

Kier (LON:KIE) - in line trading update today, from this embattled contracting business.

There's no new bad news.

I have to file this in the "too difficult" tray. I've covered the detail before here on 17 June 2019. There are so many moving parts, and uncertainties, that it's impossible for me to value this company.

Although it looks dirt cheap, and the balance sheet isn't too bad, the potential for a 100% loss scares me off. Why risk my capital on something that could go under if any more serious problems emerge?

Xaar (LON:XAR) - this previous tech star, making innovative print heads, looks a busted flush these days. I can't see anything in today's update to change that view.

It's got cash in the bank though. Doesn't interest me.

That's all I can manage for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.