Good morning! Some announcements I noticed today:

- XLMedia (LON:XLM)

- Stonegate/ EI (LON:EIG)

- IG Design (LON:IGR)

- Joules (LON:JOUL)

- Versarien (LON:VRS)

- eve Sleep (LON:EVE)

- ADVFN (LON:AFN)

Timings: finished at 2.45pm. I didn't cover dotDigital (LON:DOTD), Learning Technologies (LON:LTG) or the big-cap IG Group (LON:IGG).

Trade alert: in the interest of transparency, I'd like to mention that I have sold all of my shares in Creightons (LON:CRL), for the purpose of helping to fund a house purchase.

Update: I have now sold B.P. Marsh & Partners (LON:BPM) too, for the purpose of funding the house purchase.

Update: Goco (LON:GOCO) has now also left my portfolio.

XLMedia (LON:XLM)

- Share price: 35.75p (+5% today, but down from 47p last Friday)

- No. of shares: 187 million

- Market cap: £67 million

Update (issued at 4pm yesterday)

Commiserations to anyone holding this yesterday afternoon.

The company found out some bad news on Saturday, but didn't get this update out until Monday at 4pm:

On 18 January 2020, the Company became aware that a number of its casino sites have been manually demoted by Google*, which impacts the visibility of the sites and their ability to generate meaningful levels of online traffic, and hence revenues, from new visitors.

Whilst it is too early to accurately assess the financial impact of this action by Google, any further material delay to the full restoration of rankings of these online assets would result in a corresponding reduction of both revenue and adjusted EBITDA during that period.

The probable losses aren't quantified, putting shareholders in the worst of all worlds: "things are bad, but we can't tell you how bad".

I'd like to reflect for a moment on the purpose of Google's rankings. After all, they are extremely important. It has been said that the best place to hide a body is on Page 2 of Google Search!

Let's hear it straight from the horse's mouth:

Google ranking systems are designed to do just that: sort through hundreds of billions of webpages in our Search index to find the most relevant, useful results in a fraction of a second, and present them in a way that helps you find what you’re looking for.

Get that? Relevant and useful.

Relevant search results are those pages which are strongly related to the user's search query.

Useful search results are those which the user will get value from.

Unfortunately, the widespread practice of SEO ("search engine optimisation") means that pages are competing with each other to find out what signals Google will use to determine the search rankings. Meanwhile, Google itself is trying to find out what websites people actually want to visit.

It's unusual for Google to manually demote websites. Manually demoting websites is a labour-intensive chore which it would rather not have to do.

But when it does so, it will have good reasons. Most likely, it will have determined that the websites aren't useful, and don't deserve the search ranking they previously achieved.

It strongly indicates that the websites used advanced SEO techniques to game the algorithm, but didn't back that up with content which web users wanted to use and which merited such a high ranking.

Here are three of XL Media's gambling and casino websites. I don't know if these specific sites have been manually demoted by Google. But decide for yourself whether they look useful:

- Freebets (UK)

- Casino.com.de (Germany)

- Casino.se (Sweden)

My own view is that these aren't useful. They are sites from which XL Media can send users to actual casino sites and get a commission for doing it. That's the only purpose these websites serve.

Yesterday's RNS suggests that the casino websites are low-grade in Google's eyes. I wouldn't want to bet on XLM getting their search rankings reinstated.

*I have a long position in Alphabet ($GOOGL), the parent company of Google.

Stonegate/Ei Group

Competition law is one of those things which boggles my mind.

For example, when it comes to pub chains: how does the CMA know with any degree of certainty what the correct size of pub chains should be, or how many different pub owners should compete in any specific geographical area?

But that's all rather philosophical. The fact is that the CMA does think that it knows the answers to these questions, and it has the power to enforce its view. At least it improved the quality of its RNS headlines to include company names, after a little prodding!

This £3 billion acquisition of EI (LON:EIG) (formerly Enterprise Inns) is working its way through the system.

To get the deal past the regulators, Stonegate (owner of Slug and Lettuce) is offering to sell some pubs:

Stonegate has offered a structural divestment of either (i) the individual pub in which a particular catchment area was centred (the centroid pub) (26 instances); or (ii) the entire overlap of the other party (25 instances) individually. In total, this would amount to the divestment of 42 sites to solve the realistic prospect of an SLC in 51 local areas.

(Note that SLC means "significant lessening of competition".)

I don't invest in this sector but I just thought this might be worth flagging anyway. Stonegate is clearly under pressure to prove that it doesn't have monopolistic power in certain locations, and this could be an issue when it comes to further M&A activity in the sector.

IG Design (LON:IGR)

- Share price: 742p (+8%)

- No. of shares: 79 million, or 96 million after Placing

- Market cap: £586 million, or £712 million after Placing

Result of placing to raise £120 million

This one is now too large for us. Let's give it another honourable mention.

The deal was announced yesterday.

IG Design is a large, international manufacturer of gifting products: wrapping paper, Christmas crackers, notebooks, etc. It has an amazing track record of growth over the past 5-6 years.

It is buying a very similar US company, CSS Industries, for £90 million (including the cost of repaying its net debt).

The £120 million raised by IGR will be used "to fund the cash consideration for the Acquisition and related transactionexpenses, repayment of the net debt of CSS and provide further balance sheet growth capital."

My view

US markets were closed yesterday for Martin Luther King Day, so I can't give you a more recent price than last Friday. CSS Industries ($CSS) was trading at $4.69 per share (market cap $42 million).

This means that IGR is paying a premium of 100%. In an arguably overvalued US market, currently at all-time highs, I would seriously doubt that this represents bargain pricing.

I also note that CSS has been loss-making since 2018, and is forecast to remain loss-making until at least 2021.

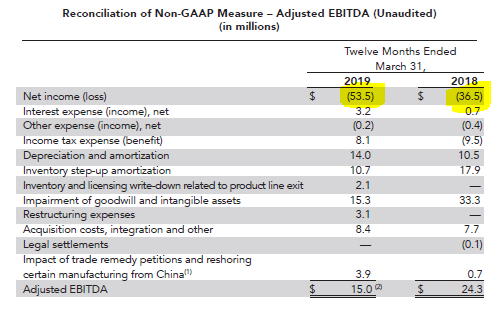

Its results in 2018 and 2019 were dire. There is a net margin in each year of worse than minus 10%. Here's the reconciliation to "adjusted EBITDA" for each year:

IGR says that CSS is forecast to make adjusted EBITDA of $23 million in FY March 2020. But the consensus forecast is for yet another loss on the bottom line (i.e. negative net income).

Checking the history of CSS, I note that it made a $14 million acquisition in late 2016 and then a $64 million acquisition in late 2017.

Those acquisitions must have failed, on the basis that the CSS share price collapsed from $29 in late 2016 to the current (pre-takeover) price of sub-$5. The fact that the CSS market cap is now less than the price it paid for the 2017 acquisition is sufficient to tell the story.

This is making me queasy! I'm wary of excessive M&A. So when I see an acquisitive company which itself is then acquired, I start to wonder if maybe things made more sense before all the deal-making.

Hopefully, IGR has spotted a bargain, i.e. a company whose share price was only temporarily on the rocks and which the market dramatically undervalued. IGR does have plenty of credibility on the back of its good track record in recent years. But my initial investigations suggest that this deal might be poor value.

Joules (LON:JOUL)

- Share price: 193.4p (+8%)

- No. of shares: 89.4 million

- Market cap: £173 million

This fashion retailer succumbed to the retail gloom and issued a profit warning earlier this month. It was covered in detail by Paul.

While that profit warning was supposed to be due to one-off planning and logistics issues, there are a few more problems for us to get into with these results.

For starters, the company has recorded a £6.7 million impairment charge. Of this, £4.3 million relates to stores. The rest relates to changes to Head Office and the company's distribution centre, but I want to focus on the stores:

"...we have identified a small number of stores with low or negative contribution where we do not expect to achieve an adequate rent reduction upon lease renewal. For these stores we anticipate a relocation or closure if we cannot identify a suitable alternative site. Four stores make up 70% of the store element of the impairment charge..."

While it's normal for companies to treat this sort of thing as "exceptional" or "non-underlying", I think it would be a terrible mistake for investors to automatically do the same.

After all, isn't it a normal or underlying risk, when you have a retailing business, that some stores might become unprofitable? Just because they couldn't negotiate a good rent reduction, and just because the charge to close or relocate them is being measured upfront, doesn't mean that it's not a problem with the underlying business.

Furthermore, who is to say that additional stores won't become unprofitable in future periods? There are 125 of them, after all. If more stores become unprofitable, then we will see more of these "exceptional" impairment charges.

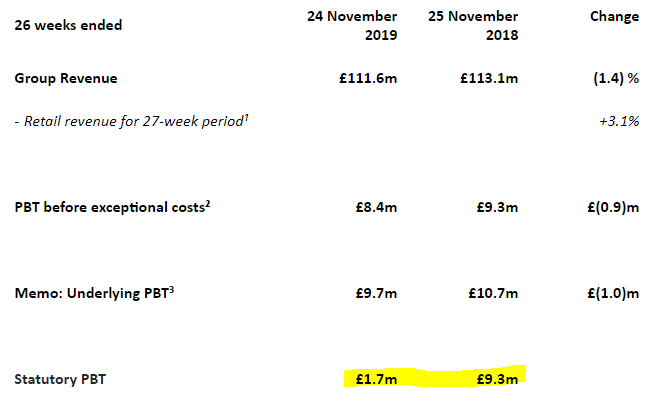

For these reasons, I would highlight statutory PBT as an important measure of profitability.

Now let's take a look at revenues. In this instance I would focus on the adjusted numbers, as Black Friday is sure to make a difference:

Group revenue decreased by 1.4% to £111.6 million. On a comparable 27-week period¹, including Black Friday in both periods, Group revenue increased by 1.3% and Retail revenue increased by 3.1%.

On a more comparable basis, therefore, the H1 2020 vs. H1 2019 performance would have been less bad.

In other words, If it had been measured over 27 weeks, the deterioration in underlying PBT would have been smaller (before getting into the effects of IFRS 16 and the "exceptional" impairment charge). But I think there would still have been a small decline.

Turning quickly to the outlook section:

We will face cost headwinds from China-US tariffs on our US wholesale business during the second half of FY20. We cautiously expect these to continue into FY21.

In addition, we are making strategic developments to our supply chain operations in the UK and US which are planned to commence over the second half of FY20, to support long term growth, improved customer service levels and better productivity. We anticipate non-recurring costs from these initiatives in FY20 and the first half of FY21, with ongoing cost efficiencies from FY22 onwards.

My view

It's good news that e-commerce is now responsible for 50% of retail revenue (up from 46.5% a year ago and 35.8% a year before that).

I also note good news on the lease renewal front: average lease length is now 2.7 years (can't see this mentioned in last year's interim report).

So there are some positives to come away with.

Against that, you have to bear in mind that the size of the store estate is still fairly large, and is clearly posing some challenges (hence the impairment charge).

Personally, I don't bother with physical stores, unless they are best in class (I am long Next (LON:NXT) and £BRBY). For those who take a stronger interest in the sector, Joules might be worth looking at in more detail.

Versarien (LON:VRS)

- Share price: 81.88p (-3%)

- No. of shares: 154 million

- Market cap: £126 million

Versarian is a market-leading supplier of RNS announcements to the London Stock Exchange.

Today's RNS announcement is very high-quality:

The Company continues to make progress with current and potential partners in the US.

It's important to always look on the bright side of life. Even if revenues are falling and losses are growing, an optimistic RNS can help to brighten our day.

As announced on 27 June 2019, the Company appointed Brian Berney as President of North American Operations at Versarien Graphene Inc., reporting to Neill Ricketts, CEO of Versarien.

An exciting new appointment with an impressive job title. These are top-class ingredients for a great RNS.

Since then the Company has continued to enter into confidentiality agreements with potential partners to examine collaborations and develop trials in the region, including in particular, with a global tyre manufacturer.

Confidentiality agreements are wonderful tools: they don't require any revenue (let alone profits). Indeed, they don't require any concrete activity whatsoever. All they require is another company which agrees to possibly do something with you. Not hard to find, but that doesn't lessen the excitement.

Versarien has strengthened its US profile by attending two trade missions in Q4 2019, supported by the UK government.

You know those pictures of company CEOs surrounded by dignitaries and red ribbon? As investors, we like that sort of thing. We want more of it. I hope VRS took some pictures on their trade missions.

Versarien Graphene, Inc. has a serviced office location. Brian Berney, who is the only full-time employee in the US, is supported by the UK Company team, including from within the Company's laboratory facilities at the Graphene Engineering Innovation Centre in the UK.

It would be much worse if this man's job title was something boring like "Sales Executive - US". It shows the creative imagination of the company that it dared to use President of North American Operations instead. Now shut up and take my money!

eve Sleep (LON:EVE)

- Share price: 2.35p (+20%)

- No. of shares: 263 million

- Market cap: £6 million

eve Sleep, the direct to consumer sleep wellness brand operating in the UK, Ireland (together the 'UK&I') and France announces a trading update for the year ended 31 December 2019.

This company sells mattresses and beds.

It's worth watching out for companies showing percentage growth rates only when it's favourable for them to do so. When things go into reverse, the percentages very suddenly get left out.

Consider EVE's financial highlights:

- "Group revenues in core markets of £23.8 million (2018: £29.3m);

- 43% year-on-year reduction in full year EBITDA losses (£10.8m), ahead of expectations;

- 51% full year reduction in cash burn;"

So revenues are down by almost 20%, but they don't bother emphasising this.

Along similar lines, I noticed that Joules (LON:JOUL) showed its percentage increase in underlying PBT in last year's interim results, but switched to showing the absolute change for the metric in this year's results.

It's a common practice, and perhaps not worth shouting about, but I think it's good to know the various different ways that news can be presented, to help support a narrative.

Anyway, let's come back to eve Sleep.

To be fair to EVE, it has abandoned the car crash strategy of 2018 and early 2019, with the result that its insolvency has been successfully delayed. The CEO says that the company is prioritising "profitability over sales growth at any cost".

This sounds promising:

In Q4 2019 the Company made significant further cost reductions, which is flowing through to an improving cash-burn and bottom line performance compared to Q1-Q3 2019. Accordingly, management considers that its trading in the last four months of the year is more indicative of its prospects for 2020. In the last four months of the year, the Company has for the first time broken even at the operating level (positive margin contribution after all direct and marketing costs but before overheads).

The year-end net cash balance of £7.8 implies that the shares are trading at a discount to net cash - interesting.

It's probably still not a very good business, but those who dig around the very bottom end of the market looking for bargains might be motivated to research this in greater detail. According to Stocko screens, it's a "net-net" and an NCAV bargain, i.e. trading at a big discount to asset value.

ADVFN (LON:AFN)

- Share price: 16.5p (-17.5%)

- No. of shares: 26 million

- Market cap: £4 million

Many of you will use this company's bulletin board and other services.

Things aren't going too well. In particular, Christmas trading was poor.

It's a poorly-worded RNS. They could learn a thing or two from Versarien:

Sales during the first half were generally flat although sales overall were in the latter part of the first half below management's expectations.

I'm pretty sure my English teacher at secondary school (RIP) would have flunked me for this. He never gave me an A+, always finding something to quibble! He would have torn this sentence to shreds.

Let's see how bad the result will be:

Given the lower level of sales in the first half (and in particular the period immediately leading up to Christmas) first half sales are estimated to have been approximately £3.6 million (2018: £4.3 million), reflected in an increased loss in the first half (compared to the first half in 2018).

The Company is currently reducing its head count and the Board believes that this cost reduction will be reflected in an improved performance in the second half.

Records show that ADVFN did manage to generate some small profits in 2017 and 2018.

The bigger picture is that revenues have been flat for about a decade, and during most of that time it has been loss-making.

It does have an audience, for sure, but monetising that audience has proven to be difficult. It needs to do something more imaginative than cut costs, if anything is going to change over there.

That's all for today, cheers everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.