hGood morning!

FTSE futures are up at the dizzy heights of 5575 - apparently due to signs that the spread of Covid-19, and deaths associated with it, may be slowing down.

This is the placeholder for your early comments - more to follow.

Cheers

Graham

Covid Thoughts

Wow, it's a sea of blue in my portfolio today. I'm sure many of you are seeing some recovery shoots, too.

Experienced voices in the investing community have been cautious about the recent recovery, viewing it as a temporary reprieve before the next leg down.

The main factor is clearly the duration of lockdown, and the extent to which economic activity can normalise in the weeks/months ahead.

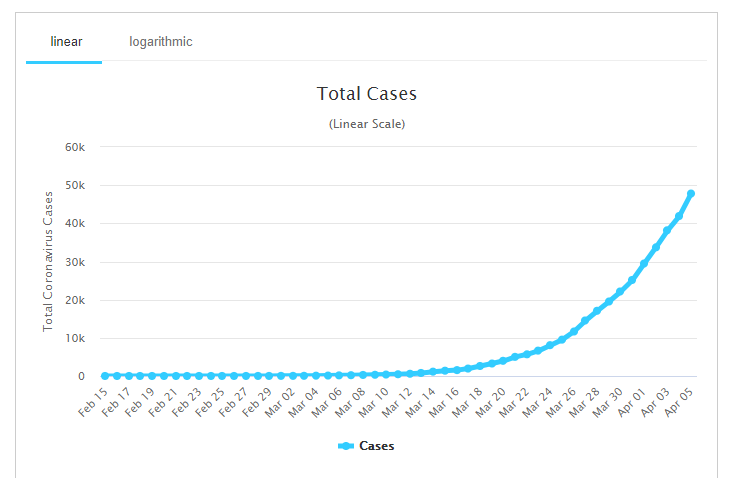

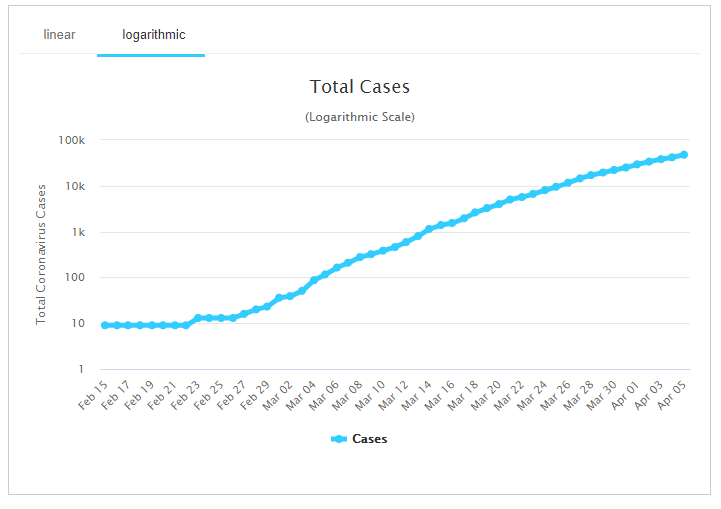

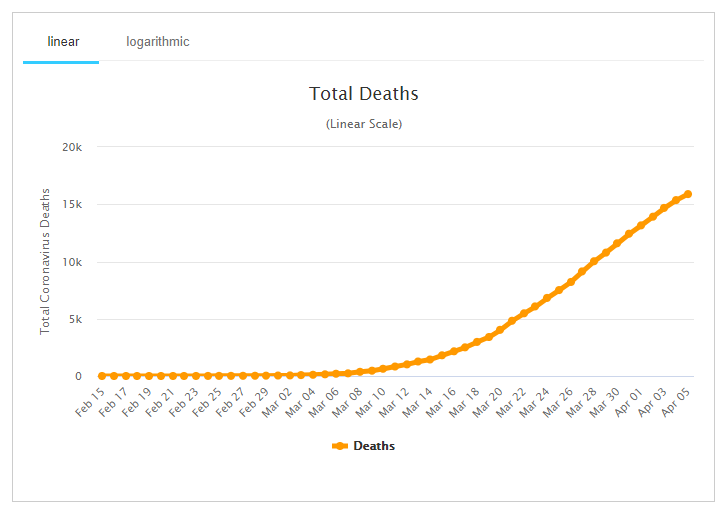

There are some signs that the panic might recede, for example here are the total UK cases:

That might look very bad, but you need to put it on a logarithmic scale to see the rate of increase (thanks to Worldometer for these charts):

As the logarithmic chart weakens, the percentage increase in cases per day starts to reduce (e.g. the total number of cases increases by 1%, instead of 10%).

Obviously I'm leaving out the fact that millions of people in the UK could well have had the virus without getting a test (because they were asymptomatic or because no test was available).

But governments tend to act on official data, no matter how bad it is (since it's the only data they have). These are the numbers which inform the news media and the debate. So there is some merit in watching them, if only to predict what other people might make of them. And they show definite signs of slowing down.

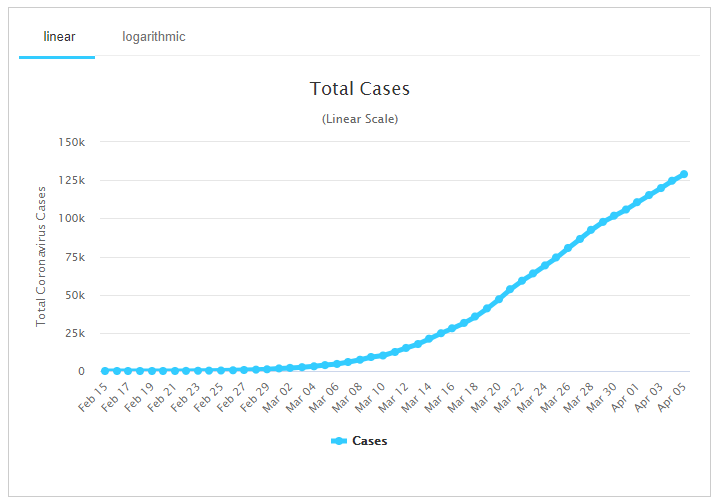

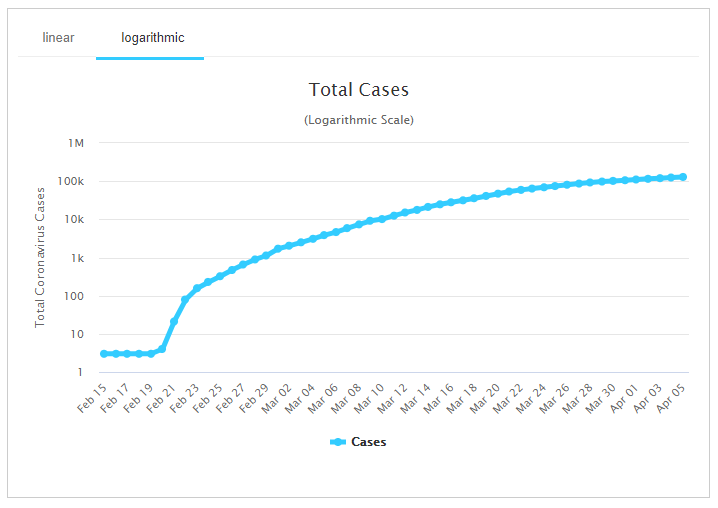

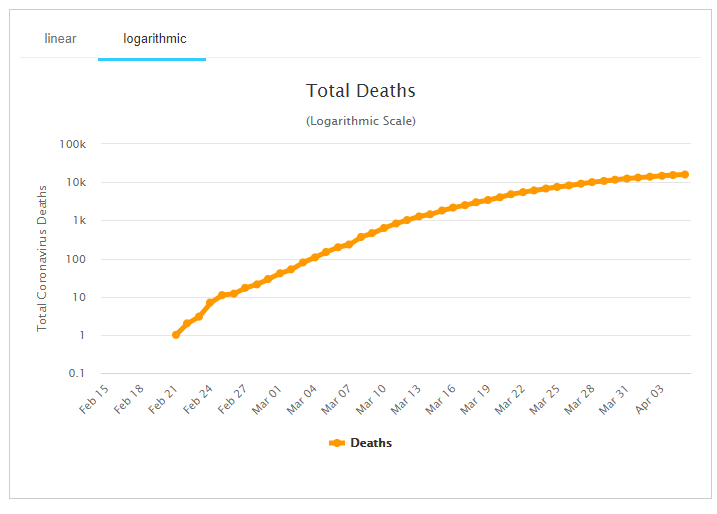

Here are the same charts for Italy, which as you will know was one of the first countries to be gripped by the virus, and is still one of the most badly-affected countries.

Linear:

Logarithmic:

This logarithmic chart shows the recorded growth of the virus in Italy now running at very weak levels. I don't know if this will stimulate the risk tolerance needed to get the country moving again, but it's a start.

Let's also look at the death numbers in Italy.

Again, the quality of this data is very bad. For one thing, it doesn't show the presence of other conditions. But let's look at the data anyway, since it's been making headlines.

Linear scale:

Logarithmic scale:

When viewed from this angle, the trend doesn't look too threatening. It looks like the exponential growth is over, and a stable situation is emerging (or has already emerged).

Remember that the main argument for lockdown across Europe has been to prevent hospitals from becoming overcrowded and overwhelmed. But if recorded cases and deaths are stable in France, Italy and Spain, and the overall trend has been tamed, that might help to inspire the confidence needed for a little bit of risk-taking.

I don't think anybody expects an immediate return to every aspect of normal life. Few political leaders will want to be responsible for a secondary surge of infections and deaths. The recovery won't be easy. But a gradual easing of the rules is becoming more likely, as the argument strengthens for the healthy majority to get back to work.

Anyway, this is why your shares up today - the rate of infection is weakening in several countries, and starry-eyed investors are starting to price in the end of total lockdown, sooner rather than later.

On with it! - I should probably talk about some small-cap shares now.

I don't think I should worry about spending time on the Covid-19 issue, though - it's the issue facing the vast majority of companies right now. For many of them, the duration and extent of lockdown will directly determine their profitability this year and may even determine whether or not their existing equity survives.

Some shares I'm looking at today:

- H & T (LON:HAT)

- Reach (LON:RCH)

- Innovaderma (LON:IDP)

- SCS (LON:SCS)

Estimated timings: seeking to finish by 1.30pm. EDIT: Finished at 2pm.

H & T (LON:HAT)

- Share price: 307.66p (+3.6%)

- No. of shares: 40 million

- Market cap: £122 million

Please note that I have a long position in HAT.

This pawnbroker has seen strange times in its 120-year history. The mandatory closure of its stores for health reasons must rank up there as one of the stranger ones.

As a provider of financial services, I thought H&T might stay open, in a limited way. Banks and building societies are still open, after all.

But retail stores have been asked to shut, and H&T is also in the retail business.

It was already public knowledge the H&T's stores were shut:

I heard the news myself on Twitter, and the company's website was updated, too. A brief RNS at the time would have been appreciated I guess everyone was very busy!

Interest holiday for pawnbroking customers - this is a very nice move, although it's necessitated by the current lack of an online option for the repayment of pawnbroking loans.

Unsecured personal loans don't get an interest holiday, since they do have an online portal.

Dividend cancellation - the cancellation of this 7p dividend will save the company nearly £3 million. I totally support this. The most important thing for now is balance sheet strength, not paying shareholders.

Salary cuts - the CEO and Chairman have reduced their salaries by 50%, while branches are closed.

These salary cuts are in line with my high expectations of HAT management.

For further background: the CEO owns over 1 million shares in the company, and earned a base salary of just £256k in 2018 (the most recent year for which the data is available).

His total pay in 2018, due to a small annual bonus for that year, was less than 10% of the value of his shareholding. He has been with the company for over 20 years.

Before the crisis

The CEO's long-term commitment and shareholding in the company were big factors in my willingness to trust H&T's acquisition strategy. It bought 70 stores and 159 loan books last year from defunct rivals The Money Shop and Albemarle Bond.

At the end of 2019, H&T had borrowings of c. £26 million (total facility size: £35 million) and cash of £12 million, so net debt was £14 million.

Despite the acquisitions, cash inflows from a placing and from operations meant that year-end net debt/EBITDA was less than 0.5x, and EBITDA/interest was an enormous 30x.

I was looking forward to seeing these metrics strengthen even more, if the pace of acquisitions slowed (which appeared likely). The outlook for dividends was excellent, too (the cancelled 7p final dividend compares to 6.6p in 2019).

The positives seemed to vastly outweigh the one primary negative, which was an FCA investigation into H&T's unsecured loans. This investigation caused the company to stop issuing any high-cost short-term loans (c. 4% of revenues).

Current position

The focus has now shifted to survival, and management are confident:

This decision not to pay a final dividend strengthens the Board's view that the group remains appropriately capitalised with recurring strong cash flows at this unprecedented point in time. This action, together with a series of significant measures to reduce costs and tightly manage cash flow, further strengthens our financial position and liquidity.

Today's RNS confirms that it is benefiting from the business rates holiday, the job retention scheme and "other government initiatives".

As with other High Street names, the main ongoing cost is likely to be rents. I am happy for H&T to do whatever it needs to do, to ensure that it can trade through this with its existing equity intact.

Some numbers in this paragraphs would have been very helpful:

H&T has cash on hand and unutilised headroom on its banking facility, together with stocks of gold jewellery. However, in the current extraordinary climate the board believes it is prudent to maximise the group's resilience in the face of this exogenous shock.

If we go back to the December 2019 result, H&T had cash plus unutilised headroom of £12 + £9 = £21 million. Of course, some cash is needed operationally so not all of this could be burned through - and covenants always need to be satisfied.

Inventories were big, too: £29 million.

I would hate to see the company melting its own gold to stay alive, as Albemarle Bond did in its 2013 death throes (I suffered my one and only wipeout from that disaster). However, as a last resort measure it could have some merit. I hope it doesn't come to that.

Using information in the footnotes for the 2019 final result (Note 12), I am led to believe that the annual rent bill at H&T used to be in the region of £6 million, or £500k per month.

This will have increased thanks to store growth since then. But if I compare the company's recent cash plus headroom to the likely rent bill, the odds still look favourable to me for the company's survival.

This may help to explain why the shares are only down by 7% since the beginning of March.

The outperformance has helped H&T to become 12% of my personal portfolio, and my second-largest holding.

Reach (LON:RCH)

- Share price: 82.5p (-8%)

- No. of shares: 299 million

- Market cap: £246 million

Covid-19 Update on Key Mitigating Actions

The media industry has been devastated by the Covid-19 crisis.

It's not that people don't want to read the news - far from it.

There is simply no point in advertising products which are A) forbidden by the lockdown or B) unaffordable in the current economic climate.

And while online news has never been more in demand, the demand for printed copies of newspapers is not the same.

Daily trips to the newsagent have been replaced by weekly shopping trips which resemble something out of a dystopian horror movie.

Cost cuts - senior executives at Reach, including all Board members, are taking a 20% pay cut. Bonus schemes are suspended and the LTIP may or may not get paid.

All staff face a 10% pay cut (though not below Living Wage) and 20% of staff will move to the job retention scheme (or its equivalent in Ireland).

No dividend - as of March 26th, Reach still planned to pay a dividend. It has changed its mind.

Balance sheet - net cash of £20.4 million as of year-end and £65 million in banking facilities (subject to covenant).

My view - I've had to remind myself what is the "catch" with this share (it can't really be trading a P/E multiple of 2.6x?)

Ah yes, the pension scheme deficit. This has been most recently recorded at £296 million (on an accounting basis). Nearly £50 million was paid into it by Reach in 2019.

According to the most recent results statement:

Contributions have been agreed at £48.9m for 2020, £56.1m per annum for 2021 to 2023, £55.3m per annum for 2024 to 2026 and £53.3m for 2027.

The good news is that RCH's annual cash flow from operating activities has been running much, much larger than these promises.

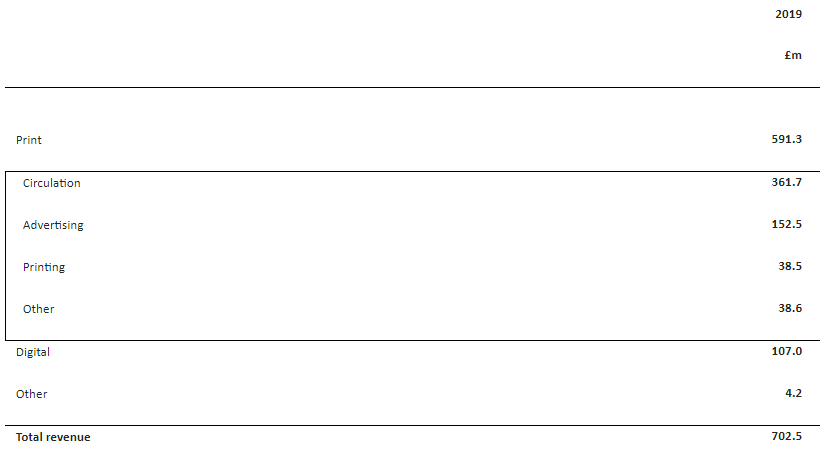

The bad news is that RCH is still primarily a print, rather than a digital business:

Source: Reach.

Last year, Print revenues were £591 million out of the £702.5 million total.

This is slightly overstated, since "Advertising" includes digital classified ads. Even so, Digital still has a long way to go, to catch up with Print. The decline in Print circulation is relentless, and is almost certainly being accelerated by the Covid-19 crisis.

I do think this share could be "cheap", in cigar-butt style: it is possible that the Print business may have more puffs left for shareholders than the share price gives it credit for.

It's tempting, but I would need to research it more.

The StockRank is an excellent 95.

Innovaderma (LON:IDP)

- Share price: 46p (+21%)

- No. of shares: 14.5 million

- Market cap: £7 million

Sales for this consumer products company have "significantly slowed" at physical retailers, though it continutes to distribute to Superdrug, Boots and Tesco.

It's not all bad news:

The Company's DTC channel, which accounted for c.60% of revenue in FY2019, continues to perform very well.

Balance sheet - at the end of March, "the Company had sufficient levels of cash and no debt". Assessing a debt facility, as a precaution.

Operationally - no problem with supply chain or deliveries and inventory levels are healthy.

My view - like many other shares, it would not surprise me if this one was currently undervalued (assuming that life goes back to normal in the short- to medium-term).

With IDP, you also get the small company discount (many investors will automatically ignore a company as small as this).

As noted before, it capitalises the amounts it spends to grow its customer list, and doesn't amortise this spending. That remains a concern to me, as it creates a risk in my mind that the reported profits aren't entirely believable.

SCS (LON:SCS)

- Share price: 152.4p (-2%)

- No. of shares: 38 million

- Market cap: £58 million

Interim dividend and Board update

This Sunderland-based home furnishings group suspends the dividend which had already been declared.

Additionally, the outgoing CEO has agreed to postpone his retirement for six months. He will stay until at least July 2021.

It appears to be trading below net cash - as of March 23rd, it had cash of £75 million after borrowing £12 million from the bank. So the net cash was c. £63 million.

Survival chances look good.

Hanging up my pen there for today. Thanks everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.