Good morning!

Graham here to round out this week's SCVR coverage for you.

This morning I've noticed RNS announcements from:

- Norcros (LON:NXR)

- Tandem (LON:TND)

- Victoria (LON:VCP)

- Property Franchise (LON:TPFG)

- Westminster (LON:WSG)

- United Carpets (LON:UCG)

Let me know if you have any other suggestions, though I reckon these will keep me busy!

Cheers

Graham

Thanks for your suggestions. This might be a quickfire report as I attempt to cover as many stories as possible.

Today's report is now finished, as I have to go to the dentist! I have noted your suggestions and will attempt to catch up on them tomorrow. Thank you!

Norcros (LON:NXR)

- Share price: 169.52p (+4%)

- No. of shares: 80.6 million

- Market cap: £137 million

I know this as the owner of Triton showers, but it also owns Merlyn shower doors and a bunch of other bathroom and kitchen brands.

It tends to trade cheaply, which I've explained as being a function of:

- low organic growth.

- exposure to South Africa.

- its net debt and pension scheme.

It issued a warning in February, as the Covid-19 situation was beginning to deteriorate, and then downgraded expectations in April.

Full-year Results

These results (to the end of March), and current trading, are better than the guidance given by the company on April Fool's Day.

Trading is "ahead of our COVID-19 operating scenario".

Underlying operating profit for FY March 2020 is still down 7.5% compared to FY March 2019.

Statutory operating profit is down 31%.

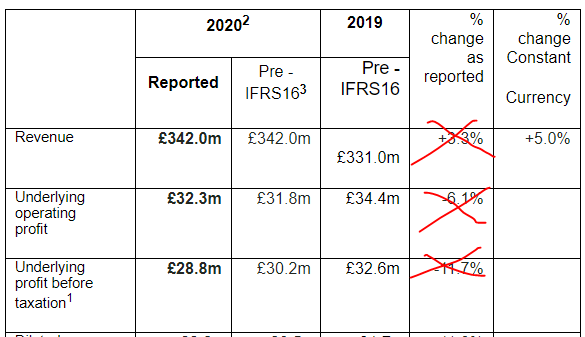

Make sure that you ignore the percentage changes in the highlights table - they aren't comparing like with like.

There is simply no point in comparing pre-IFRS 16 numbers with post-IFRS 16 numbers.

Net debt appears manageable at £36.4 million, but trading does need to normalise in order for it to satisfy covenants. Covenant waivers are agreed until March 2021.

Dividend - no final dividend is proposed. An unsurprising decision but I do think it's worth taking note of which companies have continued to pay dividends during this crisis, as they must be particularly resilient!

Pension scheme - the accounting deficit increases from £31.6 million to £48.9 million. That's a significant number for a company of this size. Norcros is paying £3.3 million into it this year.

Current trading

Current trading is gathering momentum and ahead of our COVID-19 operating scenario .Year to date revenues to the end of May were 40% of prior year with June month to date revenues running at c75% of the same period last year.

An encouraging improvement but still some way to go. Fingers crossed for the rest of the year.

Covid impact

The company provides some estimates for the impact of Covid-19 on its results in March.

Without Covid-19, they think that revenue would have been higher by £13.2 million (4% of yearly total) and underlying operating profit would have been higher by £4.6 million (14% of total).

This impact was mostly felt in the core UK business.

My view

Norcros has agreed with its lenders that net debt won't exceed £95 million until June 2021, when the earnings-based covenant tests are scheduled to resume.

That gives headroom of nearly £60 million. Enough? Probably.

For me, the company still has a "Yuck" factor, which will prevent me from investing in it, almost regardless of how cheap it gets.

Revenue growth on a like-for-like, constant currency basis was 2.3% lower. Without Covid-19, it's true that underlying revenue would have increased slightly, but not by enough to get me interested.

And the accounts are always full of adjustments. I like a clean set of numbers. The acquisition strategy has been ambitious and costly.

I will say that if you're bullish on the post-lockdown economic recovery, this would probably be a good way to bet on that.

Tandem (LON:TND)

- Share price: 273.3p (+5%)

- No. of shares: 5 million

- Market cap: £14 million

Please note that I have a long position in TND.

I was talking about this story yesterday. The largest shareholder had a private meeting with the company, in advance of this AGM, and switched from opposing management to supporting them.

There is too much background to get into, but the gist of it is that lots of shareholders have been unhappy with this company. Many shareholders have been agitating for "No" votes at the AGM.

The unhappiness has been on a number of fronts:

A) the weak dividend, relative to earnings.

B) very high management remuneration, relative to dividends, market cap and earnings.

C) a lack of engagement with existing and prospective shareholders.

I'm pleased to see that there has been some progress, at least when it comes to A) and C).

It had previously been announced that this year's final dividend would be increased, and would be supplemented by a special divi.

That makes the total annual payment for the year 6.6p (up from 4.31p in the prior year).

Note that EPS for the year was 40.5p. So there is still a long way to go before we get a generous payout ratio.

Anyway, the final/special dividend are being voted on today.

Tandem has enjoyed some incredible tailwinds in recent months: very fine weather, lockdown forcing people to exercise locally and spend more time in their gardens, and the government telling the population to avoid public transport and get on their bike instead.

The main difficulty has been in the supply chain.

I discussed that at last month's trading update. There were difficulties reported in getting bikes out of China, and I also found that swings were in short supply at Argos (the company provides a wide range of bikes, toys and outdoor products). Tandem said that summer revenue in 2020 was likely to be lower than the prior year, because of these supply chain problems.

Latest news

Today's update contains quite a few interesting snippets.

- Revenue +7% year-to-date

- Mixed performance from licensed products (e.g. Frozen, Peppa Pig). Retailers bought less product but domestic sales were nevertheless strong in certain areas.

- Bike sales +72% versus last year

- B2C revenue from outdoor products "significantly ahead" of 2019

Outlook is "broadly positive". The retailer order book is still down, but is "growing in preparation for the Christmas period".

In bikes, the company is "working hard to restore supply chains as soon as possible".

Management are "confident we will deliver another strong year" - I've been following this company for a while, and it doesn't get much better than that!

Investor Relations

This is fantastic news, and my favourite part of the RNS. The company is holding an Investor Day in September!

This will provide shareholders with the opportunity to visit our Birmingham operation to view some of our products and discuss the business with the Board and management.

I've previously heard it said that management would not allow shareholders to look around HQ at all, not even on AGM day. I'm very glad to see that attitudes have changed.

And that's not all - there will be an interim results presentation, presented on this year's investor day, and at future interim and final results. That's another thing which some shareholders have been crying out for.

My view

I'm very glad to see that there have been positive changes at Tandem. Inviting shareholders to HQ to look at the products and talk to management, and producing a results presentation, are small gestures in the grand scheme of things, but they make a big difference.

After all - it's hard enough to study small companies, even when these facilities are available.

I'd be curious to go to the investor day myself, but getting married in October will make that impossible.

As for the investment merits of the business at the current share price, I'm not sure if I have much to add to what I've already written.

There is a StockRank of 99:

I'm not so bullish on it myself, or I'd have a lot more than 3% of my portfolio in it.

Having been disappointed by the company before, it's difficult for me to get too optimistic about it.

But I am tentatively starting to believe that the company is solving the very real supply chain problems.

If those problems are solved, then this year's results should be fantastic. There is no reason for them not to be, given the strong momentum from last year, the fine weather, and the other reasons for exceptional demand.

Who knows what might happen in 2021 and 2022? But I do think that the balance sheet, even with an increased dividend, should show considerable improvement. Which will make for a safer investment.

So I'm happy to continue holding this one.

Victoria (LON:VCP)

- Share price: 230.46p (+5%)

- No. of shares: 125 million

- Market cap: £289 million

This flooring company reports that trading is ahead of expectations since it reopened.

Manufacturing and distribution operations are back in every country in which it operates, in accordance with the local easing of restrictions.

Revenues are now running at 85% of pre-Covid levels. And "further recovery is expected as orders begin to flow to Victoria from UK retailers, who were the last to start trading as they were only allowed to re-open last week." (Continental Europe has been open for a while.)

There are no supply chain issues.

Net debt is £370 million, and available liquidity is a further £200 million.

Remember that is a debt-fuelled, growth-by-acquisition stock. Much of the debt (€500 million) is in the form of bonds maturing in 2024.

Outlook - the Board is "considerably more optimistic" than it was in March. It highlights that 93% of revenue is to do with redecoration projects, not construction or commercial.

My view

Whether or not you like this company depends on whether or not you buy into the vision of its Chairman, Geoff Wilding, who has been responsible for the aggressive growth and acquisition strategy here for the best part of a decade.

The shares almost reached 900p two years ago, as people bought into the magic.

I think the records will show that I've remained fairly sceptical. Though at 445p, in January (pre-Covid), I thought the valuation was fair.

At 230p, which looks like a discount to book value, I think you might be able to make a good argument that it's cheap (but do remember that book value includes lots of intangible assets, in this case).

This is another one for contrarians who expect our economies to bounce back quickly. It could quickly bounce back to 400p-500p, but the sector (carpets) and the leverage make me nervous.

Property Franchise (LON:TPFG)

- Share price: 167.5p (unch.)

- No. of shares: 26 million

- Market cap: £43 million

These aren't exactly estate agents - they are the owner of estate agency brands (Martin & Co being the largest one). This makes the world of difference to it, as an investment.

I really like TPFG, and owned it until earlier this year. It earns excellent returns (ROCE 22%), generates healthy cash flows and (in my view, deservedly) gets a Quality Rank of 97.

It reports today that April-May revenue was down 20%. Not bad.

Net cash has improved to £5.3 million, which includes the benefit of deferring some VAT.

It sounds like estate agents are making good progress in terms of getting back to normal.

And if there are business casualties in the broader industry, TPFG has indicated that it, and/or its franchisees, might be involved in some acquisitions.

There's not much else worth talking about from this statement, so I'll move on.

Westminster (LON:WSG)

- Share price: 10.81p (+0.6%)

- No. of shares: 160 million

- Market cap: £17 million

This group provides security services to governments, including in airports. The collapse of the aviation industry was presumably a factor in WSG's share price halving from Feb to March.

But the share price and operations are both doing OK now:

Notwithstanding the impact of COVID-19, trading for 2020 started on a positive note and this has continued throughout the first six months of the year. Since the start of the COVID-19 crisis, we have maintained full employment of all our staff and have remained extremely busy, even expanding parts of our business.

It sits outside my circle of competence and I do think it's important to be sceptical when a company has had as many false dawns as this one has.

That having been said, this is a really encouraging AGM statement.

United Carpets (LON:UCG)

- Share price: 3.25p (unch.)

- No. of shares: 81.4 million

- Market cap: £2.6 million

Trading Update and Change to Accounting Year End

This tiddler is still alive, but I'm not sure if it's kicking. Let's read on...

- stores are all open again

- early indications "encouraging", signs of pent-up demand

- negotiating a CBILS loan, which it sounds like it needs to get.

UCG pulls out the old "change the accounting year" trick, which lots of cunning FD's have used in the past.

The reason given? To put the entire Covid-19 mess into one long financial year.

There is another reason given, but I think it's just waffle.

My view - this share multi-bagged before, for investors with nerves of steel who held it through a pre-pack administration. I'm far more comfortable on the sidelines, and won't experience any regret if I see it rising like a phoenix from the ashes yet again.

I'm out of time for today but I do appreciate all your comments and suggestions. I'll read them again later this evening, and see if I can use them as the basis for tomorrow morning's report.

Have a great evening.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.