Good morning! It's Graham and Roland here with today's report.

It looks like another busy day today, so please feel free to share your thoughts and views in the comments. We'll do our best to cover as much as possible, but probably won't be able to cover everything.

Today's report is now finished (11am).

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions

on them as possible candidates for further research if they interest

you. Our opinions will sometimes turn out to be right, and sometimes

wrong, because it's anybody's guess what direction market sentiment will

take & nobody can predict the future with certainty. We are

analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £1bn. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

What does our colour-coding mean? Will it guarantee instant, easy riches? Sadly not! Share prices move up or down for many reasons, and can often detach from the company fundamentals. So we're not making any predictions about what share prices will do.

Green (thumbs up) - means in our opinion, a company is well-financed (so low risk of dilution/insolvency), is trading well, and has a reasonably good outlook, with the shares reasonably priced.

Amber - means we don't have a strong view either way, and can see some positives, and some negatives. Often companies like this are good, but expensive.

Red (thumbs down) - means we see significant, or

serious problems, so anyone looking at the share needs to be aware of

the high risk.

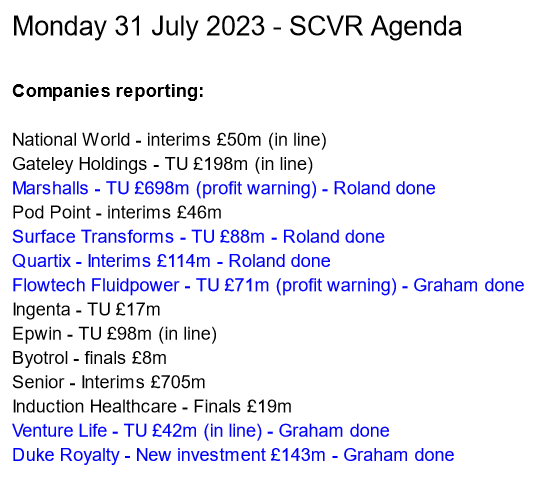

Summaries of main sections below:

Marshalls (LON:MSLH) - down 10% to 248p (£630m) - Trading Update (profit warning) - Roland - AMBER

Another profit warning from this building products supplier, which is suffering from the twin impact of lower sales volumes and lower utilisation of its manufacturing facilities. Debt levels have become a priority for the board. I think it makes sense to stay on the sidelines for now.

Duke Royalty (LON:DUKE) - up 1% to 34.6p (£144.5m) - New Royalty Agreement - Graham - GREEN

Duke announces a medium-sized (£9m) investment in a Texas-based company. I discuss various aspects of the deal, which is structured on similar terms to Duke’s other investments. It’s a good step forward in diversifying Duke’s portfolio, using their new credit facility.

Surface Transforms (LON:SCE) - unch at 36p (£88m) - Trading update - Roland - AMBER/RED

This high-performance brake disc manufacturer is making progress ramping up production and expects a big step-up in revenue in H2. However, a loss is forecast for this year and cash burn so far suggests to me that another cash call may still be needed.

Flowtech Fluidpower (LON:FLO) - down 18% to 95p (£58m) - Trading update (profit warning) - Graham - AMBER

I find it hard to get excited about investing in this one, despite the lower share price, as the company struggles to get back into growth and to restore profit margins. A new CEO offers hope of strategic improvements but I personally wouldn’t be in any rush to buy in here.

Quartix Technologies (LON:QTX) - up 4% to 244p (£118m) - H1 results - Roland - AMBER/GREEN

I’m encouraged by evidence of new subscription growth at this fleet telematics business. However, continued price erosion and elevated attrition make me wonder how strong the group’s competitive advantages are.

Venture Life (LON:VLG) - up 4% to 34.5p (£44m) - Trading statement (in line) - Graham - AMBER

Venture Life are “cautiously optimistic” they will hit forecasts this year, although it will depend on the seasonally stronger H2 period. I am cautious when it comes to my interpretation of the company’s EBITDA and cash flow claims. Cheap, possibly for good reasons.

Graham's section

Duke Royalty (LON:DUKE)

Share price: 34.6p (+1%)

Market cap: £144.5m

I’ve written about many aspects of this stock recently: both in early July and in June, and I won’t repeat all of those points today.

The big-picture summary is that I think Duke’s track record now means that they are worth a second look, especially below book value (last seen at £164m). Some points of caution are that the company’s investment portfolio is still not as diversified as it ultimately should be, and more fundraisings will be needed to get it there.

Today, Duke has announced an $11.5m (£9m) investment in a Texas-based company (“Glasshouse”) that was founded in 2002. It produces luxury custom glass for the residential and commercial markets.

One of the original selling points of Duke was that they brought a financing method popular in North America - the royalty that adjusts with revenues - to a European market where it is rarely used. But Duke still likes to invest in the US/Canada from time to time.

Today’s deal enables a management buyout at Glasshouse, putting equity control in the hands of the son of the company’s founder. Duke will also own 9.9% of the company.

Graham’s view

This has the usual positive features of an investment by Duke: there is no change in day-to-day management, who will be highly incentivised through equity ownership.

I don’t comment on every deal announced by Duke, but this one is a decent size (£9m) and will push up Duke’s net debt (which I recently estimated to be c. £40m). The newly-acquired business might be quite cyclical, being tied to real estate spending, but should still boost Duke’s overall diversification.

I’m going to remain positive on Duke. However, given the various risks I’ve outlined previously, my stance is going to be highly price-sensitive: between 40p and 45p per share, I’m likely to switch back to neutral.

The normal pre-Covid price of these shares was about 40-45p:

Duke and its portfolio got through Covid surprisingly well, with hardly any mishaps. Therefore, even with interest rates being much higher now, I think these shares may be slightly too cheap at this level:

Flowtech Fluidpower (LON:FLO)

Share price: 95p (-18%)

Market cap: £58m

I’ve not covered this one since last August, when I thought it was fairly priced at 121p (market cap £74m).

Share price performance has been mixed since then, culminating in today’s H1 profit warning:

Last year, I noted that “Primary Fluid Power” was performing much better than the larger (by revenue)“Flowtech” part of the business. That’s still true today:

Overall Group revenue has grown by 2.6% in the period with a mixed performance between the divisions. The Solutions and Services divisions have continued to operate well, showing strong growth, however, the performance of the Flowtech division has been disappointing with a decline in revenue of 5.7%. Given the lower gross margins in the Solutions and Services divisions and the underperformance of the Flowtech division, Group EBITDA in HY1 2023 is behind Board expectations.

With inflation running hot over the past year, overall revenue growth of 2.6% means a decline in real revenue. Combine that with lower margins and it’s really bad news.

Net debt is £15.6m, down by £4m over the past year. I previously thought that headroom on the company’s debt facility looked uncomfortably low; headroom is currently £9m with a further reduction in net debt expected in H2.

Comment by new CEO Mike England:

In the Flowtech division, specific actions are in flight to address commercial and operational shortfalls adversely impacting performance, some of which require targeted new capital investment and some to address legacy issues; we intend to comment more on this at the time of the interim results... The Board now expects the out-turn for FY23 to be significantly behind previous expectations.

Estimates: according to the company, it was previously forecast to generate PBT of £8.8m on revenues of £119.4m this year.

A note issued by Liberum today suggests PBT of only £5m on revenues of £115.2m this year, with a slower reduction in net debt as a result. They are still positive on 2024, looking for improvements to performance coming from the new CEO.

Graham’s view

I am reluctant to give these shares the thumbs down, as the company performed quite well in the years leading up to Covid. That said, ROCE never made it to double-digit territory as far as I know. The company doesn’t have a great deal of owned IP and is perhaps best thought of as an industrial distributor, so it suffers from a) volatile demand; and b) unimpressive profit margins.

Perhaps this is priced in now, at 12x this year’s PBT estimate and 6.5x next year’s PBT estimate? Although it’s more expensive than that when you factor in the debt.

Once again, I view this one as fully priced at current levels, so I’m staying neutral.

I’m in good company as the StockRanks also see limited value on offer here:

Venture Life (LON:VLG)

Share price: 34.5p (+4%)

Market cap: £44m

Venture Life (AIM: VLG), a leader in developing, manufacturing and commercialising products for the international self-care market, announces a trading update for the six months ended 30 June 2023…

Some key points from this H1 update, which is “cautiously optimistic” that results will be in line with expectations:

Revenue up 10.4% on a “pro forma” basis, i.e. if an acquired company had been owned during the prior period.

Excluding the newly acquired company entirely, revenue is up 11.4%.

Total revenues up 24% to £23.5m

Order book +30% since the end of the previous year, in line with expectations.

VLG tells us that cash generated from operating activities is up 158% to £4.6m, but I would treat that information very carefully as it only relates to a six-month period. Certain elements of operating cash flow have a tendency to reverse direction every few months. Also, the company capitalises some spending, so that spending goes to another part of the cash flow statement rather than to operating activities.

Going back to December 2022, net debt then was £16.6m (excluding leases). VLG tells us today that net debt reduced by £1.2m in H1, and the leverage multiple (net debt/adjusted EBITDA) reduced from 1.6x to 1.4x.

1.4x would normally be considered a modest leverage multiple, but again I would treat this cautiously as the difference between adjusted EBITDA and real profitability may be significant. Last year, VLT reported adj. EBITDA of £9m but then adjusted operating profit was only £3.5m (and actual PBT was only £0.7m).

Outlook is cautiously optimistic, with a second half weighting which the company says has been seen historically.

CEO comment:

The acquisitions we made in 2021 & 2022 are now fully integrated and delivering good organic growth, and we will be launching some great newly developed products in the second half of the year and increasing our distribution points in the UK, which will both contribute to the expected stronger revenues in H2… we expect this strong cash generation to continue through the second half, further reducing our net leverage.

Graham’s view

I have to reiterate what I said in April. I’m not convinced that VLG’s brands have a great deal of pricing power (feel free to disagree, that is just my perception), and so I would be reluctant to pay a very high earnings multiple for these shares.

The company structure is complicated by selling a broad range of products in different product areas, making it appear to lack focus. Additionally, it needs to manage that debt load and its historical financial results are uninspiring:

These shares may be “cheap”, but I am neutral on them for these reasons.

Roland's section

Marshalls (LON:MSLH)

Share price: 276p (pre-market)

Market cap: £698m

Unfortunately – but perhaps not surprisingly – today’s trading update from this building products supplier is a profit warning.

“[the company] expects to deliver a result for the full year that is lower than its previous expectations.”

Shares in this FTSE 250 firm have fallen by 65% over the last two years, highlighting the cyclicality of this business, which now falls into our small-cap coverage universe.

Profit warning/outlook: Broker forecasts for this business have been drifting steadily lower and Marshalls has already lowered expectations once this year, in May.

In today’s statement, the company says trading is no longer expected to improve in H2, due to a combination of macro-economic factors and the financial impact of scaling back production.

Marshalls has cut production to reflect lower demand, in order to manage its working capital and prevent a buildup of unsold stock. This is quite logical, but it’s having an adverse effect on operating efficiency. In effect, margins are down because the company’s fixed cost base is no longer being fully utilised.

We often talk about operating leverage here – improved profitability on higher volumes. But it's always worth remembering that operating leverage can also work in reverse, as seems to be happening here.

"Taking these factors together, and in the absence of a recovery in demand in the Group's end markets, the Board believes that the result in the second half will be markedly weaker than the first half, and consequently expects to deliver a result for the full year that is lower than its previous expectations."

Unfortunately, the company hasn’t provided any indication of its new profit expectations for the year, so we’re left guessing.

Trading update: revenue for the half year is expected to be £354m, 2% higher than the £348m reported for the same period last year.

However, adjusted pre-tax profit is expected to fall to £33m (£45m), presumably because of the double whammy of lower volumes and lower margins due to production cutbacks.

The company says that its Landscaping Products division has seen H1 revenue fall by 20% to £174m due to its exposure to new build housing.

The Building Products division, which supplies bricks, masonry and mortars, has been more resilient, with H1 revenue down by 9% to £87m.

The Marley Roofing Products business, which was acquired in early 2022 – perhaps not the best timing – is seeing “mixed demand”. Half-year revenue fell by 7% to £93m.

Management are taking steps to cut costs, including closing one factory and making a further c.250 people redundant. However, they say the company still has sufficient capacity to meet “materially higher demand than that being experienced in 2023”.

Balance sheet: the company says net bank debt was £185m at the end of June, broadly in line with the £191m reported at the end of 2022.

The board’s “ongoing priority” is to reduce leverage using free cash flow. This suggests to me that there’s a chance the dividend could be cut further than already expected:

Depending on the shortfall in this year’s profits, I estimate that Marshall’s leverage could now be c.2x EBITDA. That’s not necessarily critical, but it’s unfortunate timing.

Roland’s view

I don’t think this is a bad business and I suspect the share price is coming down to a level that might represent value, on a through-cycle view.

However, given Marshall’s relatively high leverage and falling profit expectations, I would be inclined to stay on the sidelines until the balance sheet improves, or the trading outlook stabilises.

For these reasons, I’m going to go AMBER on this one.

Surface Transforms (LON:SCE)

Share price: 36p (unch)

Market cap: £88m

“the Board maintains its 2023 revenue expectations.”

Just a quick comment on this ceramic brake disc manufacturer. I last covered Surface Transforms at the end of June, when I speculated that delays ramping up production could mean some risk of further cash shortages.

Today’s pre-close update provides some more detail on the situation.

Trading/revenue: Output rates have continued to improve, with half-year production volumes 80% higher than the same period last year.

A further £3.4m will be spent on installing additional production capacity over the remainder of this year.

The company confirms half-year revenue of £3.3m, compared to £2.9m for the same period in 2022.

Customer arrears are said to have reduced since June’s update. As a result, full-year revenue expectations are unchanged.

Revenue of £16.1m is forecast for the current year, which implies that the business will generate H2 revenue of £12.8m. If so, that would be a sizeable step up (and a decent achievement) after a difficult H1.

However, broker finnCap no longer expects the business to report a profit this year, due to the impact of the additional costs suffered so far. In a new note available on Research Tree this morning, finnCap has cut its profit forecasts and now expects an adjusted loss per share of 0.7p for 2023.

This appears to be a reduction on this consensus figures shown in Stockopedia ahead of today’s update:

Cash: revenue expectations for 2023 and 2024 are unchanged, but the production problems suffered this year “have inevitably had cost and cash implications”.

The company says that cash has been managed carefully, but gross cash at the end of 2023 may now be up to £1m lower than previously expected.

Gross cash on 30 June 2023 was £4.5m, down from £14.9m at the end of 2022, so the company burned through £10.4m of cash during the first six months of this year.

finnCap’s updated forecast guides for gross cash of £2.5m at the end of this year, with net cash falling to just £0.4m. However, analysts appear to expect the business to become cash-positive next year, with net cash rising to £2.1m in FY24.

Roland’s view

Surface Transforms’ share price has drifted steadily lower over the last year, perhaps reflecting the risk that further fundraising will be needed to get the company to a point where it’s financially self-sufficient.

Operational progress seems encouraging to me, but today’s update strengthens my previous concern that cash might still run short.

I’m going to go AMBER/RED on this. While I believe that this long-running growth story is finally starting to come good, I’m not convinced that shareholders will escape another cash call.

Quartix Technologies (LON:QTX)

Share price: 244p (+4% at 09.30)

Market cap: £188m

“This promising momentum and product innovation positions Quartix optimistically for the rest of the year."

I’ve always had a positive impression of this AIM-listed telematics specialist, but it’s looked expensive in the past. Profits have also flatlined for several years now.

However, the shares have sold off sharply over the last couple of years and recent newsflow has seemed promising to me. I’m interested to see if today’s interim results show any fresh momentum.

Financial highlights: the headline numbers from today’s refreshingly straightforward results do not seem to suggest a powerful increase in momentum.

Revenue rose by 10% to £14.6m, with annualised recurring revenue rising by 8% to £28m. This compares to reported revenue of £27.5m last year.

However, pre-tax profit fell by 7% to £2.4m, while earnings per share for the half year fell by 10.2% to 4.16p. The interim dividend was maintained at 1.5p per share.

Free cash flow was 26% lower, at £1.4m, but this was due to a higher tax payment relating to a change of accounting policy. This resulted in net cash falling from £3.9m to £3.2m. This sounds like a one-off to me, so I don’t think it’s a concern. Cash conversion has historically been very good in this business:

Trading summary: Quartix has now largely wound down its insurance business

and is focused on the fleet sector.

The company’s KPI table provides us with some clues that may help explain why profits fell in H1. I think it’s encouraging that some of these metrics are disclosed so prominently, even when they’re not all positive:

The increase in new subscriptions and the total number of units subscribed seems positive, to me, but I can see a couple of negatives:

Fleet gross attrition: if I’ve understood this correctly, this represents the proportion of unit subscriptions discontinued during the year, as a proportion of the mean subscriber base.

Chief executive Richard Lilwall says that increased attrition was the result of “increased liquidations and customers downsizing their fleets”. I would expect telematics to be a fairly sticky service, but I can see that in the SME space, in particular, there will be some natural attrition each year.

Are there any sector experts out there who know what kind of attrition figures are normal? Quartix’s H1 figure of 13.5% seems slightly high to me, but I may be mistaken.

Price erosion: this represents customers renewing their subscription at lower prices than the prior year. An average reduction of nearly 5% per year in an inflationary environment suggests to me that Quartix may have limited pricing power, or may be operating in an increasingly competitive market.

We might also question what this continued price erosion tells us about the value created by the firm’s products for fleet operators – or alternatively, how differentiated Quartix products are when compared to rival alternatives.

Strategy update: Quartix is continuing to focus its US spending more carefully and is now investing more heavily in European countries, which are said to offer “stronger return on investment”.

Two new analytical software features have been introduced over the last year, EVolve and Quartix Check. These are an EV fleet planning tool and a paperless vehicle check and incident report app, respectively.

They seem useful, but not especially groundbreaking, to me.

Outlook: it sounds like the newish chief executive is continuing to place new importance on strong commercial execution:

"sales execution excellent continues to be a key focus point for senior management”

Management say they're mindful of the uncertain economic climate, but confident in the opportunities to grow revenue in the UK and Europe.

As a result, the board expects “an accelerated financial performance for the remainder of 2023” and is confident in achieving market expectations.

To me, this sounds like we should see an second-half weighting to profits, if all goes to plan. This will be needed for the company to meet expectations.

Roland’s view

Today’s half-year results show an operating margin of 16.5% and a trailing 12-month return capital employed of 26.5%. Both are strong figures that suggest to me this business may have some degree of competitive advantage.

Top-line revenue growth of 10% is encouraging, but seems fairly modest to me given the level of inflation seen over the last 12 months. Price attrition remains a concern too, if Quartix cannot scale up quickly enough to offset this.

I’d like to see more evidence that this is converting into profit growth, but I’m encouraged by the quality and profitability of the business. I also like the strong cash conversion and net cash balance sheet.

2023 consensus forecasts on Stockopedia show earnings of 10.4p per share, which would be slightly below the 10.9p reported last year.

However, now that the exit from the insurance business has largely dropped out of the figures, I’m hopeful that the renewed commercial focus on fleet subscriptions in the UK and Europe will yield a return to growth.

Broker forecasts suggest the company will use some of its cash balance to bump up the dividend this year, giving a useful forecast yield of 3.8%. This seems to imply that profits are expected to be sustainably higher, going forward.

I would suggest the shares are probably fairly priced at the moment, but if the company delivers on consensus forecasts over the next 18 months, then I think Quartix could have decent upside.

I remain positive on this business, so I’m going to go Amber/Green on this one.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.