Can the Unilever share price keep rising?

Stockopedia’s own data points to a jarringly simple stock market truth amidst the daily whirlwind of financial data: share prices that have gone up tend to keep going up.

It sounds almost astonishingly simple but people instinctively distrust this momentum effect - surely successful investing can’t be so easy? One of the most convincing explanations for this stock market factor is the conservatism bias - the idea that people are slow to revise their expectations when presented with new information.

That means that when the market finds a stock breaking new all-time highs or beating broker estimates it tends to undervalue this development. The rational investor can take advantage of this mispricing. Stockopedia’s Momentum Rank is a convenient way of summarising the momentum attributes of a stock - let’s use Unilever (LON:ULVR) as an example.

How to spot Momentum opportunities

The Momentum Rank is inspired by the latest research into momentum from leading academics (including Jegadeesh and Titman, George and Hwang, and Seung-Chan Park) and is based on a composite of the following Price and Estimate Momentum Factors.

Each company in the market is ranked from 1 to 100 for each of these momentum ratios and a composite score is calculated as a weighted average of all valid values. Applying this to Unilever yields an impressive Momentum Rank of 97 - suggesting that this stock should be looked at more closely.

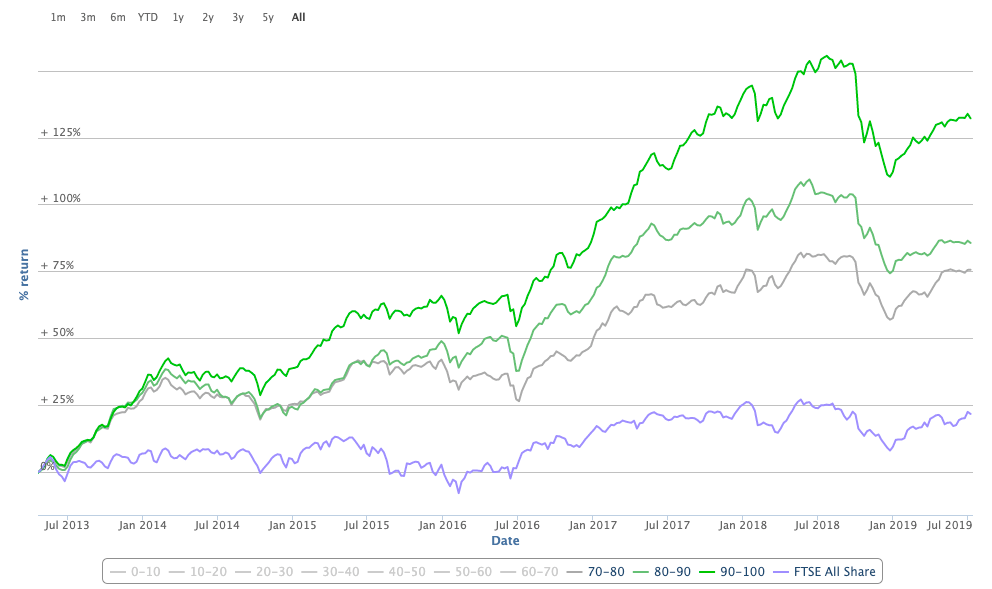

A high Momentum Rank should not be ignored - over the past seven years, a quarterly re-balanced portfolio of 90-100 Momentum Rank stocks has handily outperformed the FTSE All-Share (as have the 70-80 and 80-90 deciles).

What does this mean for potential investors?

Some of the best quality stocks in the market have defensible models that can deliver high levels of shareholder returns over the long term. But there are no guarantees and it's important to do your own research. Indeed, we've identified some areas of concern with Unilever that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.