Here's why the Rolls Royce (LON:RR.) share price might be in serious trouble

Paying attention to a few simple checklists can radically improve our risk management. One of these - the Altman Z-Score - was found to be:

- 72% accurate in predicting bankruptcy two years prior to the event in its initial test

- 80-90% accurate in predicting bankruptcy one year before the event in the 31 years up until 1999

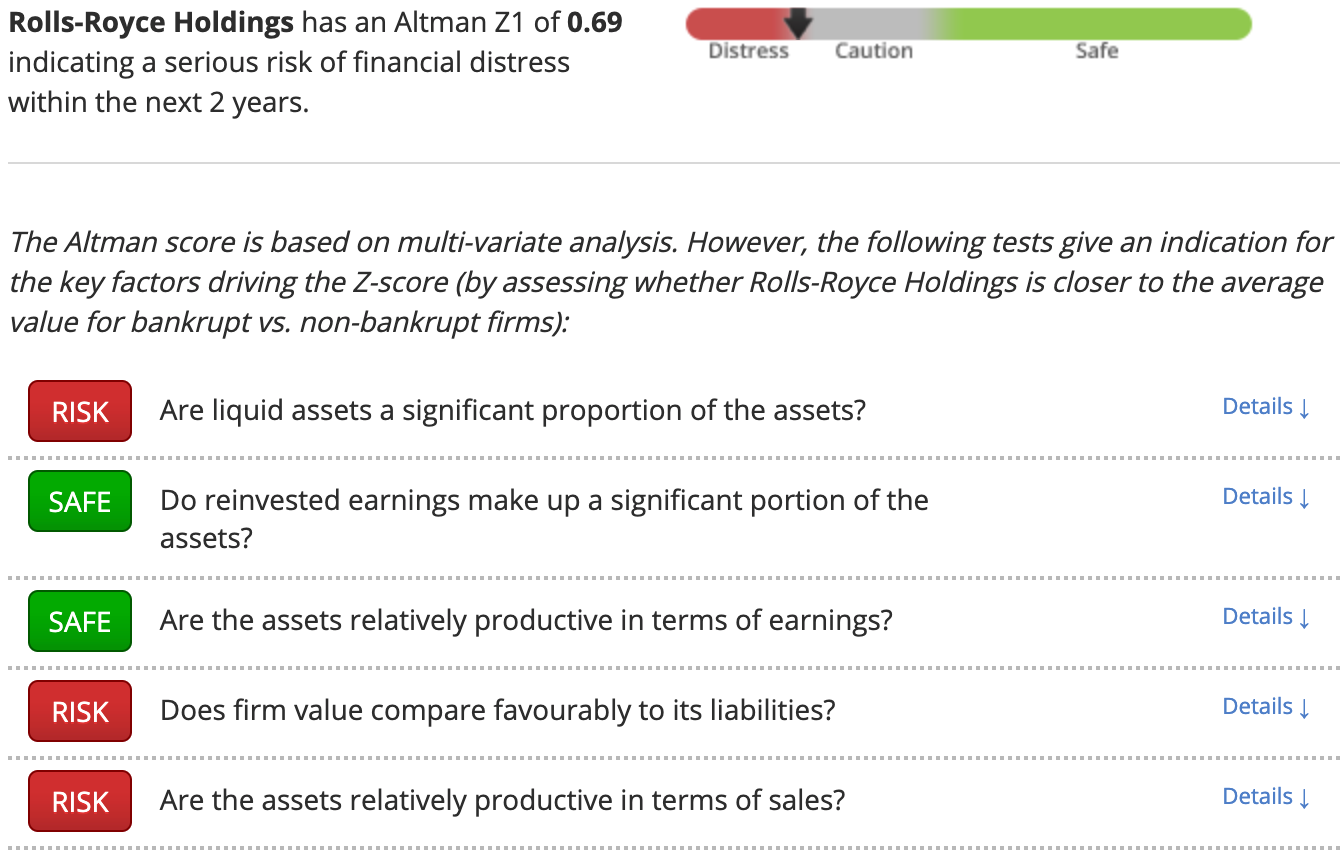

The Z-Score measures how closely a firm resembles other firms that have filed for bankruptcy by considering the following areas:

- Current assets as a proportion of total assets,

- Cumulative profitability and use of leverage,

- Productivity of assets, and

- Firm value compared to liabilities

A Z-Score of more than 2.99 is considered to be a safe company. Those with a Z-Score of less than 1.8, on the other hand, have been shown to have a significant risk of financial distress within two years. We can see the checklist in action by applying it to a listed company. Take Rolls-royce Holdings (LON:RR.), for example.

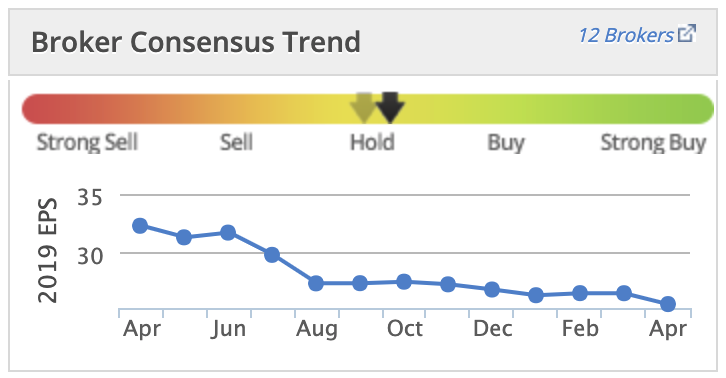

Rolls Royce is a famous name but it is not impervious to operational difficulties, particularly given the lumpy nature of its revenues and contracts. For the fiscal year ended 31 December 2018, Rolls-Royce Holding PLC revenues increased 7% to £15.73bn but the group reported a net loss before extraordinary items of £2.44bn. We can see from Rolls Royce's StockReport that the 12 brokers that cover the manufacturer have all been moving their 2019 earnings per share forecasts down:

Given its tricky current trading, how does Rolls Royce fare against Altman’s influential checklist?

What does the Altman Z-Score flag up about (LON:RR.)?

Rolls Royce gets Z-Score of 0.69, indicating that caution should be taken when considering this stock. The checks flagged as 'Risk' are all worthy of further investigation, whether you are considering buying these shares or you already own them.

Next Steps

To find more stocks like Rolls-Royce Holdings, you'll need to equip yourself with professional-grade data and screening tools to pinpoint the highest quality companies in the market. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - which gives you everything you need.

In less than a minute, you can be exploring a list of stocks with the very strongest financial ratios in the market. You'll be joining us on a journey towards owning the very best quality stocks possible. So what are you waiting for? Come and get started for free.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.