Is Foxtons (LON:FOXT) a buy for the brave?

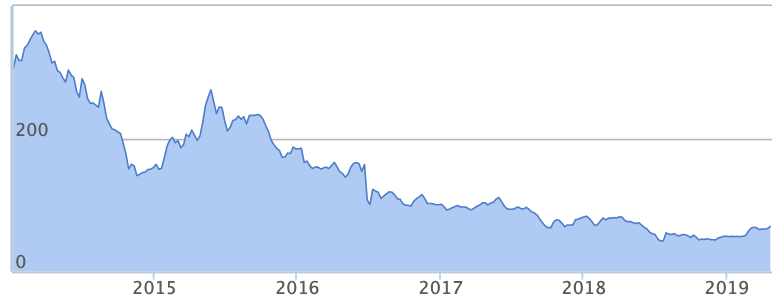

Foxtons (LON:FOXT) qualifies on Stockopedia's screens as a High Flyer after a dismal run of fortune over the past five years:

But things change. While Foxtons has rightly been given a wide berth by most investors over the past few years, might its fortunes be improving?

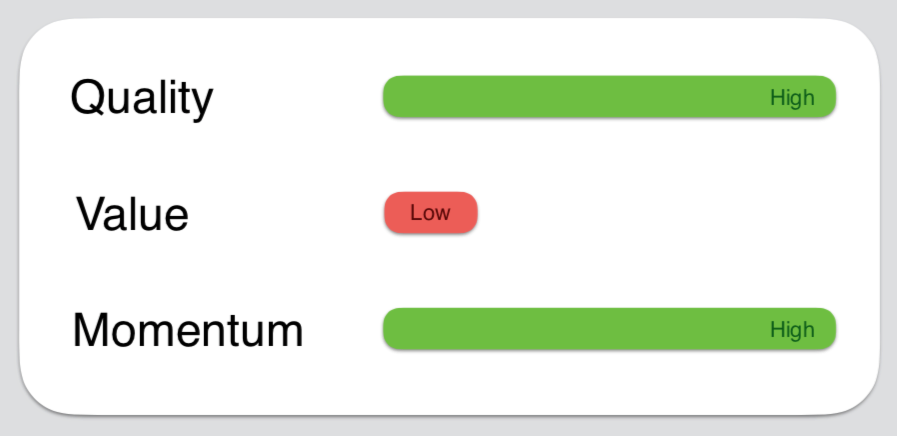

From a quantitative, factor-based point of view, Foxtons appears to be showing high quality and momentum characteristics. When previously distressed companies survive and turn themselves around, the payoff for canny shareholders can be substantial.

High Flyers are high quality...

Qualifying as a High Flyer indicates good quality, both in terms of their franchise and financial strength. This tends to show up in high profitability and strong industry leading margins. They’re stable, growing and often have accelerating sales and earnings. They also have strong and improving financial histories and no signs of accountancy or bankruptcy risk.

Foxtons is a small cap stock in the Real Estate Development & Operations industry. One of its stand out quality metrics is its 5-year Return on Capital Employed, which is a solid 10.7%. The group's current ROCE of -12.4%, however, indicating the group's fall from grace.

...and they have powerful momentum...

High Flyers also have strong momentum both in the price of their shares and their track records of earnings growth. It shows up in stocks trading close to their 52 week high prices and outperforming the market. They’ll often be beating broker estimates and getting forecast upgrades and recommendation changes.

This is true at Foxtons, where the share price has fallen by -78.9% over the past five years. Its 1-year relative price strength is -13.9%. In more recent months things have begun to look up - Foxtons' six-month relative strength is a much more encouraging 31.9%.

Despite these encouraging signs, Foxtons still has much to prove. The group posted a

net loss of -£17.2m in its FY18 and cash generated from operations crashed and the outlook for the London-based estate agent remains highly uncertain, as confirmed by the chairman himself, who says: 'The London sales market is in a prolonged downturn and the current uncertainty surrounding Brexit is clearly impacting consumer confidence.'

For now, the risks look set to continue but, if it can ride out the current storm, Foxtons might at some point make for a profitable contrarian bet.

Find the rockstars of the stock market

High Flyers are great stocks to have in your portfolio if you think you need more momentum or quality - just look out for signs that momentum might be changing. If you want to see which other stocks qualify as High Flyers, you can find a comprehensive list on Stockopedia's StockRanks page.

Simple tools can help us better measure and understand the risks we take. That's why the Stockopedia team has been busy building new ways of understanding investment risks and company characteristics. In this webinar, we talk about two or our most popular innovations: StockRank Styles and RiskRatings. These indicators transform a ton of vital financial information into intuitive classifications, allowing you to get an instant feel for any company on any market - sign up for a free trial to see how your stocks stack up.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.

.jpg)