Is Premier Foods’ (LON:PFD) share price tasty at current levels?

Turnarounds can take a long time to turn around. For Premier Foods (LON:PFD), it's six years and counting. Might this company's patient shareholders finally be about to see an uptick in fortunes?

It is certainly all change at the cake-maker, with net debt slowly coming down, its combined pension deficit having turned into a surplus, and a recent bout of activist shareholder activity that shows no signs of dying down (two of its largest independent shareholders, Oasis and Paulson, have just got seats on the board).

For the 26 weeks ended 29 September 2018, Premier Foods Plc revenues increased 1% to £358M and net loss totaled £700K (vs. a £0.3m profit for the same period a year earlier) - yet trading profit grew 6% to £51m in the period. Clearly, all the activity at the company is making the numbers slightly harder to interpret.

Luckily the Piotroski F-Score is a great way of seeing through the dust to the underlying trend - and the F-Score has good news for Premier Foods (LON:PFD).

Why we should pay attention to the Piotroski F-Score

Those that know well-respected accounting professor Joseph Piotroski are aware of the checklist that made him famous in the early Noughties. This 'F-Score' is a simple indicator to identify neglected companies whose fortunes are changing for the better.

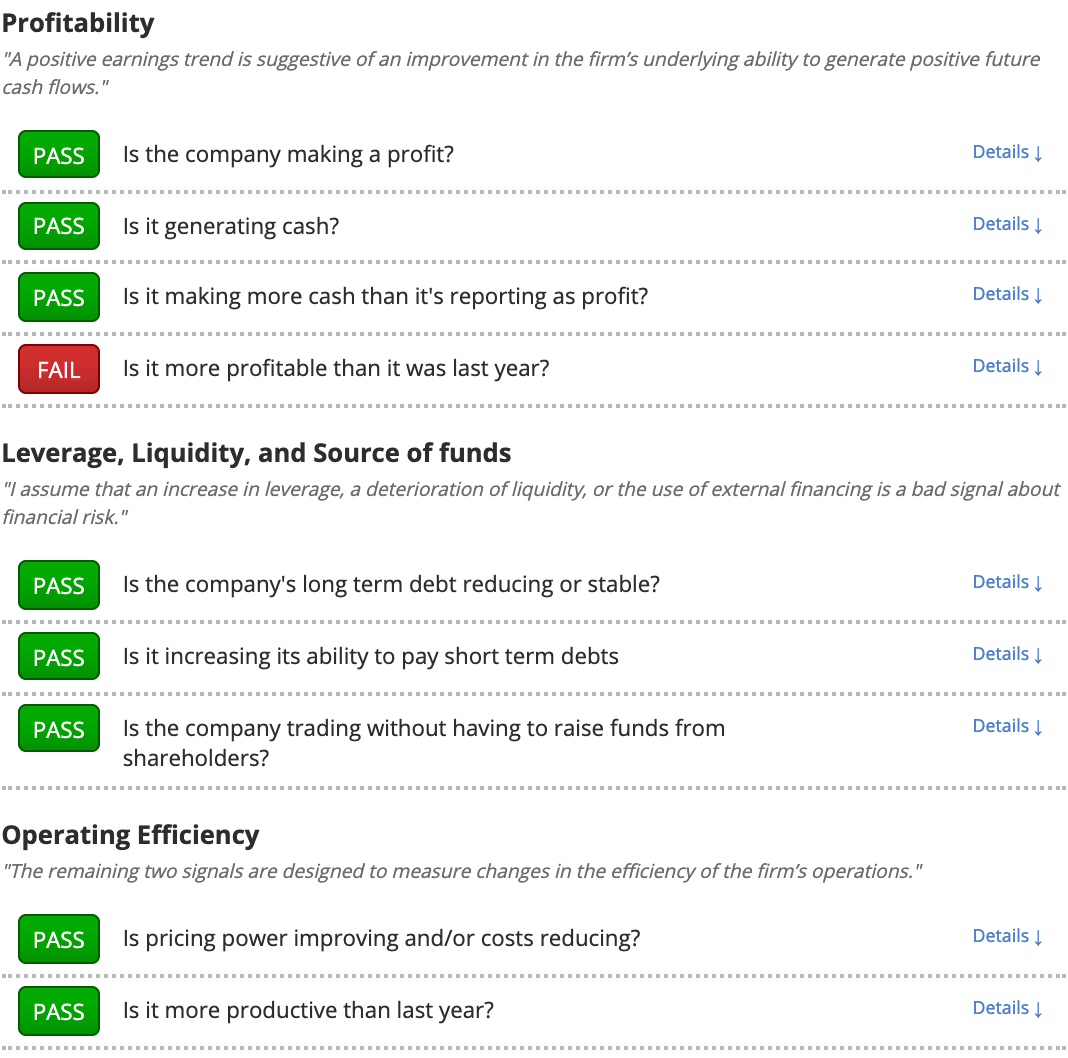

The Piotroski F-Score contains nine checks split up into three main areas of financial analysis. First is profitability, where it examines operating profits and cash flow to make sure the business can sustain itself and pay dividends. Then come three checks on the capital structure of a business, followed by a final look at the operating efficiency of the firm.

Is the future bright for Premier Foods (LON:PFD )'s shareholders?

Premier Foods (LON:PFD) scores 8 out of a possible 9, giving it a very healthy F-Score. In his landmark academic paper "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers", Piotroksi showed that by investing in companies scoring 8 or 9 by these measures over a 20-year test period through to 1996, investor returns could be increased by an astounding 7.5% each year.

This clear trend of financial improvement at Premier Foods, along with the fact that its shares trade at a depressed rolling P/E of 4.73 times, and given its stable of consumer goods brand (including Ambrosia, Bisto, OXO, Sharwood's, Loyd Grossman, Batchelors, and Mr. Kipling), suggests that Premier Foods' (LON:PFD) shares could be undervalued.

What does this mean for potential investors?

Premier Foods has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Premier Foods that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.