Is Redrow a high quality contrarian stock?

Mohnish Pabrai is a popular figure on the US investing scene. After immigrating to the US from India in the 1980s he studied engineering and later worked in IT. From there he started his own business before selling it in 2000 for a reported $20 million.

These days he’s better known for running Pabrai Investments Funds, currently with $575 million under management, as well as a zero-fee investment firm called Dhando Funds. He’s also written the books The Dhandho Investor and Mosaic: Perspectives on Investing.

In the Dhando Investor, Pabrai explains that the core of his strategy is based on the ideas that: “heads I win, tails I don’t lose much”. That means picking investments where there’s a wide margin of safety and the upside overwhelms the downside. More specifically, Pabrai - who often stresses the importance of using investment checklists - sets out a 9-point Dhando framework:

- Focus on buying an existing business (rather than backing start-ups or firms with unproven models)

- Buy simple businesses in industries with an ultra-slow rate of change (which are often unloved and potentially underpriced by the market)

- Buy distressed businesses in distressed industries (where the margin of safety may offer attractive value opportunities)

- Buy businesses with a durable competitive advantage (the very profitable moat-like strengths that Buffett is so fond of)

- Bet heavily when the odds are overwhelmingly in your favour (be patient and wait for Mr Market to serve up attractive investments)

- Focus on arbitrage (special situations where businesses for some reason become super-profitable for short periods of time)

- Buy businesses at big discounts to their underlying intrinsic value (in the classic value strategy, the aim is to buy stocks cheaply rather than overpay)

- Look for low-risk, high-uncertainty business (where the downside risk is low but the market underprices them because it doesn’t fully understand the business or its outlook)

- It’s better to be a copycat than an innovator (prefer stocks that can execute a proven idea or business model better than others)

The thrust of his strategy is to be patient and wait for value opportunities to be presented by the market, even if they are rare.

Applying Pabrai’s approach

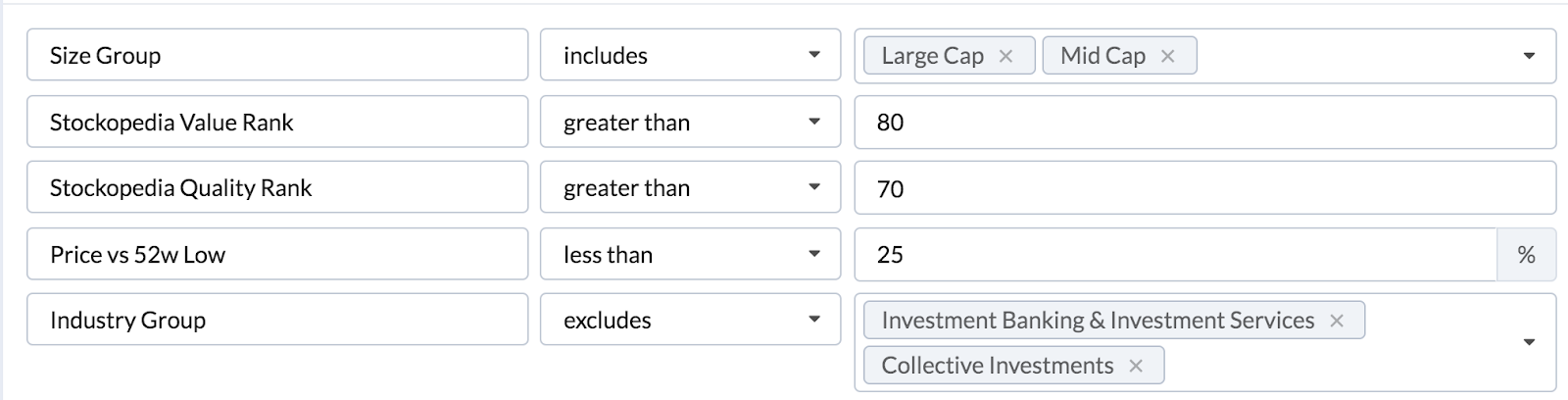

To get started with his kind of contrarian approach, you could use a screen looking for both attractive value and reasonable quality in mid- and large-cap shares trading near to their 52-week lows. At Stockopedia, we call high Quality-Value stocks Contrarians.

When we run this screen, we find that Redrow (LON:RDW) qualifies. Unsurprisingly, our algorithms classify Redrow as a Contrarian stock - this is a winning StockRank Style. It's a promising sign, although, it's worth remembering that, like many value investing strategies, Mohnish Pabrai’s Buffett-inspired approach to finding investments relies on going where others fear to tread.

In uncertain conditions, where stocks can be marked down sharply, value strategies like this are proven to be very profitable. But more broadly, the attraction of Pabrai’s framework is its simplicity and focus on buying shares where the investor has a circle of competence.

What does this mean for potential investors?

Some of the best quality stocks in the market have defensible models that can deliver high levels of shareholder returns over the long term. But there are no guarantees and it's important to do your own research. Indeed, we've identified some areas of concern with Redrow that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.