Is the Drax share price cheap at one-year lows?

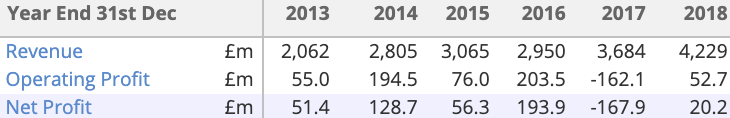

Drax Group Plc is engaged in the electricity generation; electricity supply to business customers, and manufacturing of sustainable compressed wood pellets for use in electricity production. The group has been changing its strategy in recent years in order to position itself for a greener future and this restructuring can be seen in the volatility of Drax's recent net profit figures:

Drax's share price has fallen by more than 25% so far in 2019 and sits at a one-year low of 288.2p - but is the market discounting its shares too harshly?

One metric that might help to answer this question is Stockopedia’s Value Rank, which is made up of the following ratios:

- Price to Book Value

- Price to Earnings

- Price to Free Cash Flow

- Dividend Yield %

- Price to Sales

- Earnings Yield %

How does Drax stack up?

Drax's Value Rank

We can see by using Drax’s StockReport that the group has a:

- Rolling price to book value of 0.64,

- Rolling price to earnings ratio of 16.2

- Trailing twelve-month price to free cash flow of 6.40

- Rolling dividend yield of 5.12%

- Trailing twelve-month price to sales ratio of 0.27

When we add all of these together, we find that Drax has a Value Rank of 77. Investing in high-value stocks requires finesse and a sturdy constitution but, when cheap stocks come good, the payoff can be large and sudden.

Drax’s Value Rank of 77 puts it in the cheapest quartile of the stock market. That is certainly a promising jumping off point for our analysis but it is not the whole story.

What does this mean for potential investors?

Some of the best quality stocks in the market have defensible models that can deliver high levels of shareholder returns over the long term. But there are no guarantees and it's important to do your own research. Indeed, we've identified some areas of concern with Drax that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.