Is the Unilever dividend (LON:ULVR) one of the FTSE 100's best?

There is some evidence that buying progressive dividend payers with solid balance sheets is a strategy well-rewarded by the market. This has certainly been the case with large cap Personal Products operator Unilever (LON:ULVR), which yields 2.89%. Over the past year, the Anglo-Dutch company's shares have outperformed the market by 14%.

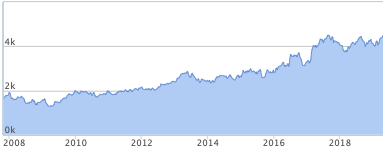

Longer-term shareholders have been rewarded even more with consistent outperformance over the past decade.

A reputation as a dependable dividend payer takes years to forge and, once created, is a valuable way for a company to signal its long-term profitability to the market and prospective shareholders. This is why it is useful to check how well these payments are covered by earnings.

Earnings per share divided by dividend per share is called dividend cover - and it’s a great way to quickly gauge a company’s capacity to continue its dividend payments

How to interpret Unilever’s (LON:ULVR) dividend cover

Generally speaking, a dividend cover of below 1.5 times is cause for concern. Above 1.5 is good, but it is when you are getting above two times cover that you see the sign of a high-quality, sustainable dividend payment. Let’s see how Unilever measures up.

The group’s FY18 earnings per share are 3.49 and its FY18 dividend per share is 1.50. Dividing the former by the latter shows that Unilever's dividend was covered 2.32 times.

This is an encouraging sign for shareholders of Unilever. Other checks you can perform to assess dividend safety include:

- Checking the current ratio is above 1.5 times and preferably above 2x

- Making sure dividend per share is covered by free cash flow per share

- Assessing balance sheet health by looking at the group’s gearing ratio

Income investing: what you need to know

For many investors, dividends are a vital part of their long-term strategy. That's why we have created a variety of income-focused stock screens, such as the Best Dividends Screen, to identify promising candidates for income portfolios. Take a look and see if any of the qualifying stocks might be worthy of further research.

If you’d like to discover more about dividend investing, you can read our free ebook: How to Make Money in Dividend Stocks.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.