Is Vodafone (LON:VOD) a FTSE 100 dividend share for your ISA?

With its c10% historic yield and a market cap of nearly £40bn, it's fair to say Vodafone (LON:VOD) contributed more than its fair share to the £100 billion dividend bonanza paid out to shareholders last year.

Even when factoring in a reduction in dividend payments, Vodafone stock still promises a forecast yield of 8.52%. Given recent operational woes and volatile market conditions, this eye-catching yield is more important than ever to Vodafone shareholders.

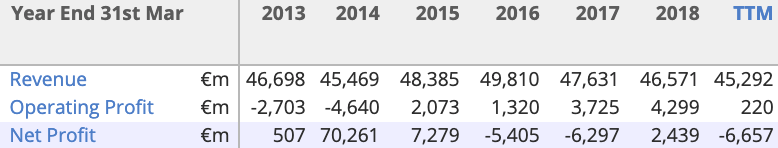

But a look at Vodafone's financial performance shows it has been a bumpy ride, with two years in the past five being substantially loss-making and the firm currently loss-making on a trailing twelve-month basis:

As a result, the group's dividend cover has been decidedly patchy. It was 1.05 times in FY18 but this is expected to fall to 0.62 times in FY19, which is dangerous territory. If Vodafone can avoid a dividend cut, you would expect its share price to rally from here - but that appears to be a big 'if'.

Four rules for finding dividend shares

1. High (but not excessive) dividend yield

Yield is an important dividend metric because it tells you the percentage of how much a company pays out in dividends each year relative to its share price. High yields are obviously appealing, but caution is needed. When the market anticipates a dividend cut, the share price will fall, which actually pushes the yield higher - but this can be a trap. So it pays to be wary of excessive yields.

- Vodafone has an eye-catching dividend yield of 8.56%. This is beyond the 'normal' range of dividend yield and signals a degree of skepticism from the market about its sustainability.

2. Safety in size

Part of the appeal of FTSE 100 dividend stocks is their financial strength. Large size and scale means that their vast cashflows tend to be predictable. It gives them the resilience to maintain their dividends through the economic cycle. And while large companies aren’t immune from making dividend cuts, their financial strength is an appealing safety factor for income investors.

- Vodafone is a balanced, large cap in the Telecommunications Services industry and has a market cap of £39,423m. Over the past five years, the group has consistently generated billions more in cash flow from operations than it has paid out in dividends.

3. Dividend growth

Another important marker for income investors is a track record of dividend growth. Progressive dividend growth can be a pointer to payout policies that are being handled carefully by management. Rather than aggressively dishing out earnings, dividend growth companies tend to have more modest yields, but are better at sustaining their payouts.

- Vodafone has increased its dividend payout 6 times over the past 10 years.

4. Dividend cover

Attractively high yields obviously turn heads - but it’s important to know that a dividend is affordable. Dividend cover is a go-to measure of a company's net income over the dividend paid to shareholders. It’s calculated as earnings per share divided by the dividend per share and helps to indicate how sustainable a dividend is.

Dividend cover of less than 1x suggests that the company can’t fund the payout from its current year earnings.

- Vodafone has a forecast dividend cover of 0.64, once more emphasising that the group has a lot of cost-cutting and turning around to do before its dividend yield can be considered safe. That said, maintaining this dividend is front of mind for Vodafone management.

Next steps

With these four dividend rules, you can track down high yield shares with a record of growth and safety. On this basis, Vodafone could be worth a closer look.

To find out more you might want to take a look at the Vodafone StockReport from the award-winning research platform, Stockopedia. StockReports contain a goldmine of information in a single page and can help to inform your investment decisions.

To find more stocks like Vodafone, you'll need to equip yourself with professional-grade data and screening tools. This kind of information has traditionally been closely guarded by professional fund managers. But our team of financial analysts have carefully constructed this screen - Stockopedia’s FTSE 350 Dividend Legends - which gives you everything you need. So why not come and take a look?

Plus, if you’d like to discover more about dividend investing, you can read our free ebook: How to Make Money in Dividend Stocks.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.