Morrisons' (LON:MRW) share price to benefit from improving financial health?

Morrisons (LON:MRW) published its full-year results in early February and is slowly steadying the ship after a couple of tumultuous years for UK food retailers. Food deflation and market share gains from fast-growing discount operators Aldi and Lidl have been considerable headwinds.

The results read well, once you account for £86m of exceptional costs. Revenues increased 3% to £17.74bn, underlying profit before tax rose 8.6% to £406m, and earnings per share before exceptionals was up 8% in the year to 13.17p. This puts the Morrisons (LON:MRW) share price on a rolling P/E ratio of 19.4.

With food deflation in the rearview mirror, Aldi and Lidl's impressive market share gains expected to moderate in future, a recent tie-up with Ocado, and recurring takeover speculation, might Morrisons' share price provide upside potential at 223p?

One way to spot a company's improving fortunes is to look at its Piotroski F-Score.

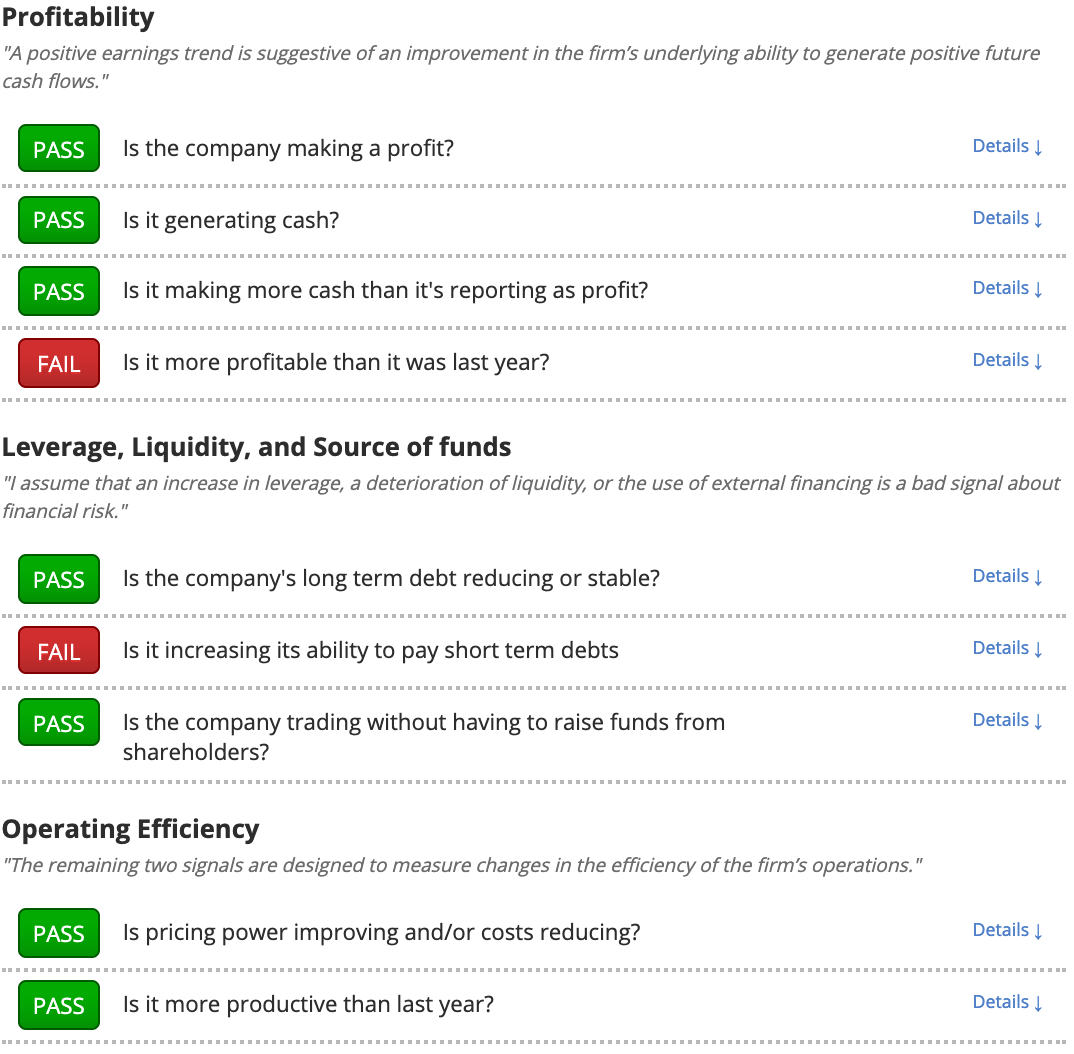

Followers of renowned accounting professor Joseph Piotroski are well aware of the checklist that made him famous in 2002. The F-Score sums up quality and fundamental momentum in one easily comparable number, allowing us to more quickly identify neglected stocks with improving prospects.

Wm Morrison Supermarkets (LON:MRW)'s F-Score: what does it mean?

Wm Morrison Supermarkets (LON:MRW) gets an F-Score of 8. In his landmark academic paper "Value Investing: The Use of Historical Financial Statement Information to Separate Winners from Losers", Piotroksi showed that by investing in companies scoring 8 or 9 by these measures over a 20-year test period through to 1996, investor returns could be increased by 7.5% each year. Below, you can see exactly how Morrisons stacks up against the checklist.

What does this mean for potential investors?

Wm Morrison Supermarkets P L C has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Wm Morrison Supermarkets P L C that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.