Why Carnival (LON:CCL) has both capital growth and income potential

Screening for companies with strong balance sheets and solid dividend yields can be a quick and simple way of identifying potentially high-quality investments that might be attractively priced. One way of doing might be to include stocks that have a Piotroski F-Score of 8 or 9 and a dividend yield of at least, say, 3%.

Take Carnival (LON:CCL), for example, which is a large cap company in the Consumer Cyclicals sector. Carnival pays out a rolling 3.74% of its share price in dividend payments.

Does Carnival (LON:CCL) pass our F-Score test?

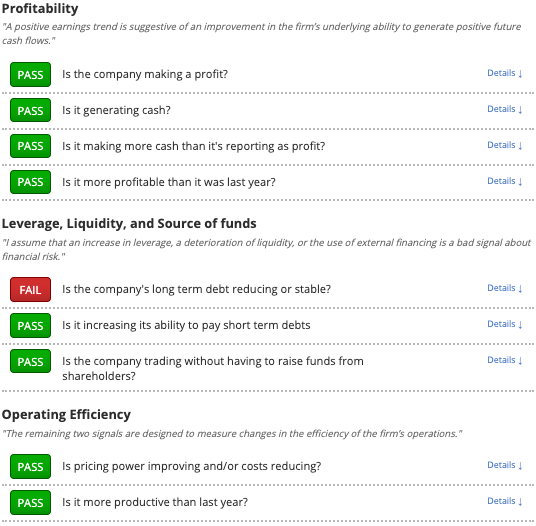

Stockopedia applies algorithms to its stream of financial data to automatically calculate the Piotroski F-Score for every stock on the market. It shows that Carnival scores 8 out of a possible 9.

By investing in companies scoring 8 or 9 by these measures, Piotroski showed that, over a 20-year test period through to 1996, the return earned by a value-focused investor could be increased by an astounding 7.5% each year. Even better, it suggests that the company is well-placed to continue to pay out attractive dividends.

Prospects for Carnival (LON:CCL)

Perhaps we can see why this is by looking at the company's most recent financial results.

Carnival appears to have an improving financial condition and a reasonable yield, however, in the group's recent results (for the three months ended 28 February 2019), Carnival plc revenues increased 10% to $4.67bn but net income decreased 14% to $336m. This fall in profitability should be investigated, considering the group's cyclical properties. Carnival's one-year share price performance also suggests the market is wary of prospects for the company:

What does this mean for potential investors?

Carnival has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Carnival that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.