Why Empiric Student Property’s (LON:ESP) dividend payment is attractive

Knowing how to steer clear of disastrous investments is just as valuable as picking winners. Take Empiric Student Property (LON:ESP), for example, which is a conservative, internally managed real estate investment trust (REIT). The Company is engaged in the acquisition, development and management of student accommodation assets in the United Kingdom, and owns or contracts approximately 70 assets (over 7,400 beds) in approximately 30 cities and towns.

Empiric Student Property (LON:ESP) pays out a rolling 5.37% of its share price in dividend payments. But sometimes a high dividend yield can signal skepticism from the market. How do we know if we can trust Empiric Student Property's forecast yield?

One way to check is to see whether its financial health is improving or deteriorating - and we have a tried-and-tested checklist tailored precisely to this task.

Why you need to know the Piotroski F-Score

Joseph Piotroski is the famous scholar behind the F-Score: a simple indicator to highlight stocks showing the most likely prospects for outperformance amongst a basket of apparently undervalued companies.

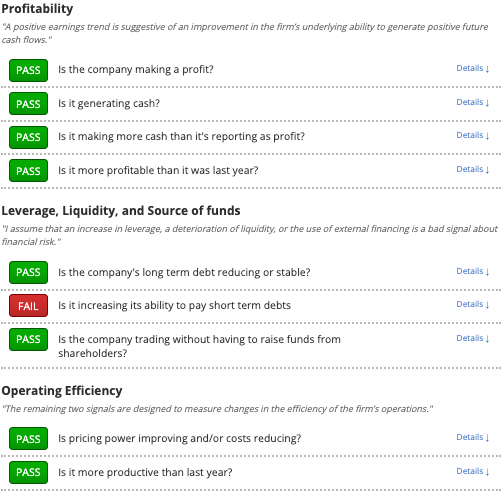

The great thing about the F-Score is that it essentially is an entire quality and fundamental momentum screen in a single number. Applying it as a filter on top of almost any strategy can help to increase returns and reduce risk. It's made up of nine checks covering profitability, capital structure, and operating efficiency.

Empiric Student Property (LON:ESP), its F-Score, and what you need to do about it

Stockopedia applies algorithms to its stream of financial data to automatically calculate the Piotroski F-Score for every stock on the market. It shows that Empiric Student Property (LON:ESP) scores 8 out of a possible 9. By investing in companies scoring 8 or 9 by these measures, Piotroski showed that, over a 20-year test period through to 1996, the return earned by a value-focused investor could be increased by an astounding 7.5% each year. Even better, it suggests that the company is well-placed to continue to pay out attractive dividends.

What does this mean for potential investors?

Empiric Student Property has an F-Score that suggests it could be a promising investment candidate worthy of further research - but it's only a first step. Higher F-Score stocks can still have weaknesses and may trade at premium prices compared to other stocks. We've identified some areas of concern with Empiric Student Property that you can find out about here.

About us

Stockopedia helps individual investors make confident, profitable choices in the stock market. Our StockRank and factor investing toolbox unlocks institutional-quality insights into thousands of global stocks. Voted “Best Investment Research Tools” and “Best Research Service” at the 2021 UK Investor Magazine awards.