Daily Stock Market Report (Fri 2 May 2025) - PSON, SHEL, GAMA, NWG, ROR, APAX, STAN

Good morning! After a busy week for company updates, let's see what the newswire has lined up for us today.

The agenda is now complete, with something of a big-cap bias today. Please share any requests for backlog items in the comments below.

11.30am: that's a clean sweep, so I'm wrapping up today's report. Thank you for reading and I hope you enjoy the long weekend. We'll be back with you on Tuesday.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

Shell (LON:SHEL) (£146bn) | Ahead of exps. Q1 adj earnings of $5.8bn (+52% vs Q4 24). Divi unch, further $3.5bn buyback. | AMBER (Roland) Q1 results have received a boost from the group’s core oil and gas production business. Shell has a clear strategy and seems to be executing well. A stronger balance than BP has allowed it to maintain aggressive share buybacks. However, earnings forecasts have been trending lower and macro uncertainty remains. Without taking a stronger and more subjective view on commodity prices, I think I have to remain neutral at current levels. | |

Natwest (LON:NWG) (£42bn) | Q1 adj profit +36% to £1,252m. Q1 return on tangible equity of 18.5%. Net impairment charge of £189m.2025 income and returns are now expected to be “at upper end” of guidance. | AMBER/GREEN (Roland) [no section below] Today’s Q1 results are ahead of consensus expectations, according to Reuters. CEO Paul Thwaite now expects full-year results to be at the upper end of expectations. Based on guidance for FY25 RoTE of 15%-16%, this implies the remainder of the year might not be quite as profitable as Q1. One reason for this might be the bank’s view on the UK economy, highlighted by today’s higher impairment charge. On a more positive note, the UK government’s holding fell below 2% yesterday, so NatWest is now fully under private ownership again, for the first time since 2008. The shares aren’t as cheap as they were, but the fundamentals look strong to me and the c.6% yield seems safe enough. I’m happy to maintain our moderately positive view on this bank. | |

Standard Chartered (LON:STAN) (£26bn) | Q1 adj profit +11% to $1,357m ahead of exps. Tariff uncertainty. 2025/2026 guidance unchanged. | AMBER (Roland) [no section below] Today’s update seems broadly positive, but highlights the “increased global economic and geopolitical complexity” resulting from tariffs. I don’t see any specific concerns, but StanChart is less profitable than rival HSBC and has much smaller scale. The shares are up >40% in 12 months and now yield under 3%. I’m inclined to take a neutral view at this level. | |

Pearson (LON:PSON) (£7.8bn) | Adj rev +1%, all units trading in line. Exp H2 weighting to growth. 2025 guidance unchanged. | AMBER (Roland) [no section below] Pearson reports sales up 1% in its core Assessment & Qualifications business (61% of FY24 profit). Performance elsewhere is mixed and this strikes me as a slightly weak update. Full year sales and adjusted profit guidance are unchanged today, but their delivery appears to be dependent on a stronger H2 performance. I note that consensus has trended lower over the last year. The profitability of this group is average (10% ROCE) but its shares trade on a P/E of 17. I can’t get higher than neutral and would personally be inclined to caution. | |

Rotork (LON:ROR) (£2.6bn) | Revenue “modestly lower” in Q1, order intake up by “mid-single digit” YoY. April trading in line. Tariff surcharge applied where needed. Mgt exp “year of progress”. | AMBER/GREEN (Roland) [no section below] The industrial flow control specialist says it has three US plants which represent c.20% of total sales and can supply “the majority” of local demand, presumably minimising the impact of tariffs. | |

Gamma Communications (LON:GAMA) (£1.2bn) | Gamma has moved its listing from AIM to the Main Market. This process has now completed. | GREEN (Roland) [no section below] Entry into the FTSE 250 later this year looks likely for Gamma, as far as I can see. This could bring the stock into more mainstream active and passive funds - although checking the shareholder register, a number of major institutions are already present. Personally, I see this move to the Main Market as a mild positive, but not in itself a reason to buy or sell the stock. I’m happy to leave Megan's positive view in March unchanged. | |

Apax Global Alpha (LON:APAX) (£573m) | Q1 NAV -5.7% to €1.16bn. Total NAV return +0.5% at constant FX. Expect only minor tariff exposure. Average TTM EBITDA growth of 16% in the underlying private equity portfolio. Valuations “generally flat overall”. | AMBER (Roland) [no section below] This investment trust provides exposure to Apax private equity funds (focused on tech, services and internet/consumer) and a portfolio of debt investments. NAV fell in Q1, although this appears to have been largely driven by USD dollar weakness. This offset earnings growth in underlying PE funds and impacted the reported value of the trust’s USD debt investments. At 119p, the shares trade at a 40% discount to today’s reported Q1 NAVps of 200p and offer a 9.3% dividend yield. I haven’t looked at this trust in detail and am not familiar with the underlying Apax PE investments. I think the main risk in PE currently is that valuations could gradually drift lower as owners are forced into realisations. However, my initial impression is that Apax Global Alpha could offer value and may be worth further research. |

Shell (LON:SHEL)

+3.5% to 2,520p (£151bn) - Q1 Results - Roland - AMBER

Today’s results from oil and gas giant Shell appear to be 12% ahead of consensus estimates, according to figures commissioned by Shell:

Q1 2025 forecast adjusted earnings: $4,963m

Q1 2025 actual adjusted earnings: $5,577m

The group’s Q1 earnings were 27% below the Q1 2024 but were 52% higher than in Q4 2024. Market convention is to use year-on-year comparators, and in most cases I think this is more useful. But for a largely unseasonal commodity producer with heavy exposure to commodity pricing, I tend to think that sequential comparisons are more meaningful.

Checking through the detail of the consensus estimates, more than half the outperformance was driven by the group’s core upstream (oil and gas production) business. Refining, Integrated Gas (LNG) and marketing delivered smaller beats to analysts estimates.

In reality, I suspect the improved quarter-on-quarter performance is due to Shell’s heavy gas exposure. Courtesy of Trading Economics, we can see in this chart that natural gas prices strengthened in Q1 versus Q4, helping to offset weaker oil prices:

Shareholder returns: Shell has announced another $3.5bn quarterly share buyback today for Q2, while the group’s quarterly dividend has been left unchanged.

CEO Wael Sawan said earlier this year that the company’s dividend is sustainable down to an oil price of $40 per barrel, while buybacks can be sustained down to $50 per barrel, so these shareholder return plans are consistent with this.

Balance sheet: Q1 adjusted earnings of $5.6bn were converted into $5.3bn of free cash flow, according to the company. This was consumed by cash outflows on buybacks ($3.3bn) and dividends ($2.2bn) during the period.

As a result, Shell’s net debt rose by $2.7bn to $41.5bn as the company funded working capital movements and payments relating to the acquisition of Singapore LNG trader Pavilion Energy.

Gearing rose to 18.7% during the quarter, but this remains well below the figure of 25.7% reported by BP earlier this week. I don’t see Shell’s gearing as a concern; as well as being lower than at BP, in my view Shell also has a stronger record of financial discipline.

Outlook: Shell is maintaining its spending plans and reiterated guidance today for capital expenditure of $20bn to $22bn in 2025 (2024: $21bn).

As far as I can see, full-year earnings expectations are not changed significantly by today’s results. However, it may be worth noting that earnings have trended lower over the last year. Macroeconomic uncertainty and recent falls in energy prices could maintain pressure on forecasts, potentially.

Forecasts suggest modest valuation multiples, albeit in a sector where this is the norm (in the UK, at least - CEO Sawan hopes to close the valuation gap with US majors):

Roland’s view

Today’s results from Shell compare favourably to those of UK-listed rival BP, whose first-quarter results came in below expectations on Tuesday (see our coverage here).

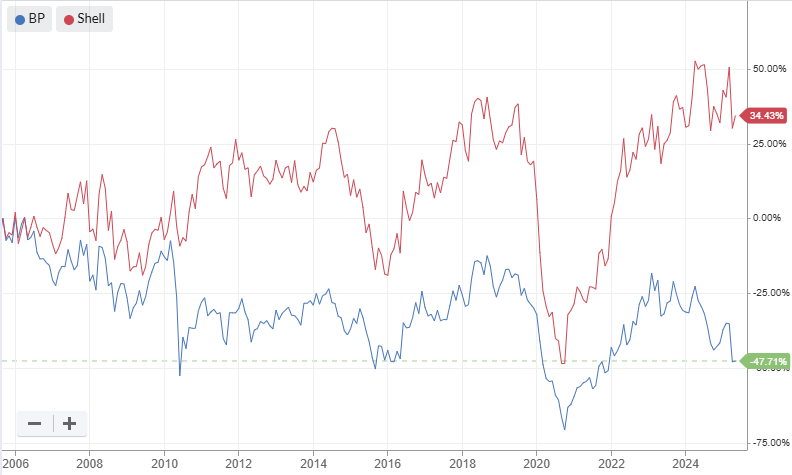

In my view, Shell has generally been better run and benefited from a more consistent and coherent strategy than BP over the last 20 years. This has been reflected in the two companies' share price performances:

Stockopedia’s algorithms style Shell as a Contrarian stock, due largely to its weakening momentum:

I might normally be tempted to take a moderately positive view here, given Shell’s strong execution, reasonable valuation and rapidly-diminishing share count. However, given the erosion to earnings forecasts and external macro risks, I think a neutral view is more sensible at the moment.

About Roland Head

I'm an investment writer and analyst, with a particular focus on systematic investing and dividends. I look for quality stocks with above-average returns, strong cash generation, and attractive valuations - always with dividends.

In my earlier life, I worked as an systems engineer in telecoms and IT. The quantitative, rules-based approach required for this kind of work suits me and has certainly influenced my investing style. I also learned a lot from seeing the tech bubble deflate in 2000/1, when I was working for a large and now defunct telecoms group.

Disclaimer - This is not financial advice. Our content is intended to be used and must be used for information and education purposes only. Please read our disclaimer and terms and conditions to understand our obligations.

I have posted yesterday the May performance for the S&P for the last ten years. No need to post it again.

You are missing the very important point that we already had one of the worst and violent corrections in history in April.

There are plenty of opportunities in both the US and the UK at the moment.

There are companies over the pond they will be growing their revenues at 25%+ CAGR for at least the next 10 years

Robinhood Markets (NSQ:HOOD) is just one of many.

All the best

Looks like Serica shares holding up well and Enquest starting to tumble a bit, normal I guess due to the reverse nature of the acquisition, Enquest had maybe been up a bit as it was expected Serica would pay some level of premium to take it on

I am long Serica and perfectly happy with the decision, much less uncertainty ahead by not doing it, doesn't feel the time anymore to do something big like this, too much uncertainty in the world already

Don't know if the writers will have time to say anything about it this late in the day but would be curious to see their thoughts next week

Further to my earlier post I have bought an opening position in Restore (LON:RST). Unexciting perhaps, but Charles Skinner, CEO knows the business inside out and like many small caps it is hardly expensive.

The share price is starting to tick up and there has been significant buying by management. Most notably Charles Skinner bought 100,000 shares at 280p last August and more recently spent a further £100,000 acquiring 44,438 shares at 225p. CFO, Dan Baker has also been a buyer, spending £150,000 on the shares between November 2023 and August 2024. More recently he purchased a further 25,000 shares at 224p.

I like it when senior management spend their own money on shares as opposed to nil cost options.

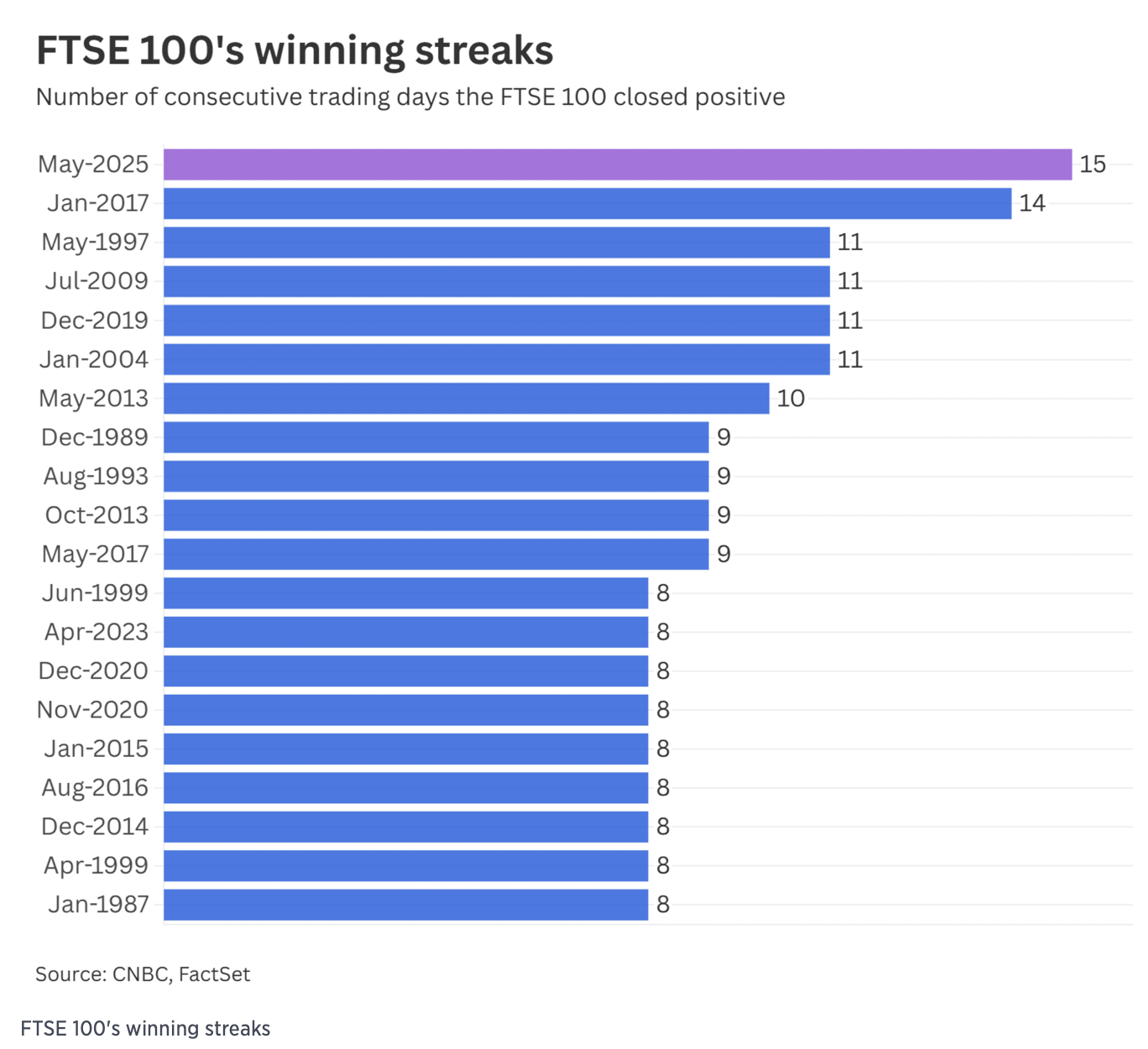

As we end the week with the FTSE 100 registering its fifteenth consecutive daily rise (yes, you did read that correctly!) it provides another reminder of the perils of market timing. Three weeks back several posters on this site were talking up how pleased they were to have sold as markets fell and that they were now staying in cash for the foreseeable future. In the horribly grim market at that time this all sounded like a perfectly sound strategy........ until suddenly, and with no obvious catalyst, it wasn't!

I am absolutely not immune to bad stock selections myself and have suffered with two or three of those in recent weeks. Luckily, what I didn't do was compound those individual mistakes by trying to be clever with the market as a whole. No doubt there are many subscribers now sitting in that uncomfortable place where they are holding too much cash but can't bring themselves to jump back in to their favoured stocks at prices now considerably higher than where they were sold. Painful isn't it?

My advice. Work out what amount you are comfortable to keep in the stock market for the long-term and then stay fully invested.

Edit: Hadn't seen sparklers post as I was preparing this. Apologies for the repetition.

Despite the weather forecast, here's something to (hopefully) cheer us all up today. Reported on CNBC today.

While global markets have been gripped by turbulence in the wake of U.S. President Donald Trump's seesawing tariffs policies, British stocks have enjoyed a bumper rally. London's FTSE 100 index, which has gained more than 5% since the beginning of the year, rose by 1.25% on Friday. It marked the fifteenth consecutive day of gains for the index, its new longest run ever.

I suspect it is more the 'comparative cheapness' of the UK market and likelihood of interest rate cuts rather than Mr Farage and his political aspirations that is providing a tailwind for UK equities. Helped by the economic uncertainty and lack of political leadership in America

As oft said careful what one wishes for!

100% Yiannos

I see opportunity and good looking charts all over my screens currently, hitting the nail on the head with your comment on last months activity

I'm glad we still have some sanity on this board

Callum

Mind you Yiannos with the benefit of hindsight a 510p strike price at a 2.5% discount to the then market price and only c4% dilution compared to today's sp at 380p looks like pretty good business to me?

Also I'm guessing that working capital needs and some decent dividends are chewing through cash at a fair lick?

Looking at elf Beauty (NYQ:ELF) makes me more sceptical than ever.

The acquisition of BA does not make any sense. £14m kept for the acquisition it seems that Warpaint London (LON:W7L) is not generating anything meaningful.

Biggest shareholders offloaded £M at much higher prices. Might have a short term bounce but the future is not bright. Growth not sustainable.

All the best

4imprint (LON:FOUR) - I was wrong on the de minimis exemption. See below:

yes, but that is also true for all the competition. It would be more concerning if until now FOUR had been getting a benefit from de minimis versus its competitors and that this might at least partly explain how it has consistently won market share.

As a bank holiday weekend special offer for investors who have never been to a Mello two day conference we are providing one day taster access for just £30 and the offer lasts until midnight on Tuesday but limited to 12 tickets

https://melloevents.com/mello2025 Just apply code NewMello25

Berkshire Hathaway (NYQ:BRK.A) Warren Buffett has announced his retirement, I’m a big fan of. Great track record in business and he hasn’t seemed to have been involved in some kind of scandal despise all his wealth and years in the spotlight.

Let’s see if he makes a few more moves with his cash pile before standing down later this year.

Here is the link announcing Warren Buffett's retirement:

MPAC (LON:MPAC) unexpectedly now a Value Trap....I think an anomaly. Lack of any flag-waving from Directors is a concern. Seems good value at this level, without the trap.

*Past performance is no indicator of future performance. Performance returns are based on hypothetical scenarios and do not represent an actual investment.

This site cannot substitute for professional investment advice or independent factual verification. To use Stockopedia, you must accept our Terms of Use, Privacy and Disclaimer & FSG. All services are provided by Stockopedia Ltd, United Kingdom (company number 06367267). For Australian users: Stockopedia Ltd, ABN 39 757 874 670 is a Corporate Authorised Representative of Daylight Financial Group Pty Ltd ABN 77 633 984 773, AFSL 521404.

Sounds like Serica Energy (LON:SQZ) Enquest (LON:ENQ) deal is not happening?