Why I'm (thinking of) buying Shell

I spent last weekend in the Suffolk town of Aldeburgh - unique for its Martello Tower; river (which runs parallel to the sea for 10 miles); and for its curious position in the renewable energy debate. Aldeburgh sits two miles south of Sizewell, where the government has just given the go-ahead (and secured funding) for a third nuclear power station. Sizewell A was decommissioned in 2006, but Sizewell B remains in operation, producing 1198 MW of energy to the National Grid per year, enough for about 2.3 million homes. The plans suggest Sizewell C will be quite a lot larger, contributing energy for 6 million homes. But the local residents are not happy about it. All over Aldeburgh there are signs proclaiming it’s not too late to stop the doomsday event that will occur if Sizewell C goes ahead (although with funding secured, at this stage I feel these protests may be fruitless).

But Sizwell is not the only energy behemoth to grace the Suffolk coastline. About 14 miles out to sea (and visible from Aldeburgh on clear days) are the Greater Gabbard and Galloper Wind Farms, which together boast over 200 turbines and are capable of generating 900 MW of power. Proposals to expand the wind farm up the coast (towards Sizewell) are being met with the same sort of negativity as the nuclear power station.

The residents of Aldeburgh are currently more concerned about the local otter population than they are about the provision of electricity - although perhaps their priorities will change if the lights go out this winter. With the energy price cap due to rise £3549 in October many of those opposing the UK’s alternative energy solutions are looking at a hefty increase in their energy bills as the price of oil and gas soars.

One of the big problems with the current energy crisis is that alternative providers are needed now, but none of the proposed solutions can provide energy immediately. Sizewell B got its full planning permission in 1987, but the finished power station was not connected to the grid until 1995. Aldeburgh’s wind farms took three years after building work started to begin providing energy to households. It’s unlikely that either of the big projects currently causing consternation in rural Suffolk will be ready to provide power to people’s homes for the best part of five years and the nuclear project will be much longer.

The businesses preparing to power the future

Still, that doesn’t mean it’s worth ignoring. The last few months have taught us how reliant the UK is on international oil and gas supply and although the current climate goals are unlikely to be met, it would take a brave government to ignore the need for more domestic renewables supply entirely. There may be regulatory and funding hurdles to overcome, but companies that have a foot in the renewable energy provision debate are likely to be in high demand.

Starting with EDF Energy - the company behind Sizewell C. The French-listed energy giant is set to be renationalised by the French government - a proposal which saw the share price leap 40% when it was announced in July. Despite the takeover situation, investors could still benefit from taking a closer look at EDFs performance. The company suffered a big drop in EBITDA in the first half of 2022 owing to a sharp decrease in global nuclear energy production - linked to stress corrosion in the European nuclear power sector. But in the UK, where demand for nuclear energy is on the up, profits have been climbing. EDF’s financial performance does provide a lesson though: investing in nuclear energy is incredibly volatile and expensive. EDF is planning on spending between £25bn and £26bn on Hinkley Point C alone, which is set to start generating power in June 2027. Sizewell C is expected to be just as expensive.

Perhaps then, an investment in wind energy is a more attractive proposition. The energy giants which have supported the roll-out of the world’s offshore wind farms in the last few years have been very popular investments. Danish company Orsted - which has turned itself from a carbon spewing company to a fully renewables business - is an incredibly popular stock. Its shares currently trade on 29 times forecast earnings, so it might be worth waiting for a more attractive entry point. Shares in Vestas Wind Systems have been in similarly high demand over recent years. For now, these are the only two significant, revenue-generating renewables companies with major offshore wind farms outside of China. We’ll be taking a closer look at both in the coming weeks.

In the UK, SSE’s share price has thrived in 2022. The company is the 50:50 joint owner of the Suffolk offshore wind farms alongside German group RWE Renewables. In November last year SSE announced a Net Zero Acceleration Programme which will see it invest in all aspects of renewable energy provision from wind and hydro farms to storage and energy distribution. RWE is also riding the wave of momentum right now, its share price has outperformed the market by 40% in the last year and the company’s momentum ranking is 99.

There are also plenty of ancillary businesses which will benefit from the push towards offshore wind. Siemens manufactured the 204 wind turbines for the Greater Gabbard and Galloper farms and is the provider of choice for the expansion project as well. Companies are required to provide the subsea cables and onshore processing plants. And while there are costs involved, there is no doubt that the market is expanding.

Why I’m (thinking of) buying Shell

And finally there are the traditional energy companies which are shifting their focus from oil drilling to zero carbon. And in the meantime, benefiting from the continued high demand for fossil fuels.

A lot of questions have been asked about the position of the oil and gas giants in the current energy crisis. Should they be benefiting financially when the UK’s residents are having to cough up such enormous energy bills? Morally, probably not. But it’s highly unlikely that the bosses at Shell or BP are complaining about it. There have been many calls for these companies to redistribute some of their profits. And they are - as dividends. Shareholders are benefiting from these companies’ successes and while there are certainly other considerations when exploring the investment case, there is a strong article for including Shell in a portfolio right now. Roland explored a couple of weeks ago, concluding that while he can see some upside, he’s cautious and everyone should decide for themselves whether the time is ripe to buy Shell. I’ll be taking my own look next week as I consider how to get my exposure to the energy sector.

About Megan Boxall

Disclaimer - This is not financial advice. Our content is intended to be used and must be used for information and education purposes only. Please read our disclaimer and terms and conditions to understand our obligations.

There are far better European (and US) big caps if you are an oil bull. Have a look at Norwegian company, Equinor (NYSE: EQNR or OSL: ENQR) for one good example. Equinor is the better company on all operating, reserve, capital allocation and geophysics metrics. In addition, most of the European majors have a high chance of further windfall taxes.

I've 90% of my portfolio in Green Hydrogen - I believe its the future. As anyone any thoughts on £plug

I'm a long term holder of Shell (LON:SHEL) and BP (LON:BP.) I did top up about 2 years ago, now I'm looking to reduce my holdings. If Shell (LON:SHEL) do reach £25, I will be selling some. There are concerns about a recession which will reduce oil prices, there is also the threat of further windfall taxes.

Re Aldeburgh, I think it's more than 2 miles from Sizewell, plenty of Martello towers along the coast.

I can understand why the residents don't want Sizewell C, this will take around 10 years to build, probably most of the energy will be exported to places like London. What is London doing about producing energy?

I agree not quick fixes when Its come to producing energy. I think the Govt. could make solar more attractive, many buildings are suitable for solar panels, large farm buildings, football stadiums, I think anywhere that has flooding should have to have solar panels and batteries.

Problem with renewables is the inconsistent power production, if no wind and sun then they produce very little energy. Around 40% of our electric comes from gas.

The question on my mind is should it be Shell (LON:SHEL) or BP (LON:BP.) or a bit of both? I see Stocko algorithms favour Shell (LON:SHEL) just now which resonates with my wariness of former nationalised industries which can be weighed down by large pension fund liabilities and sometimes by unions. Are we all agreed then?

if no wind and sun then they produce very little energy. - but the tide is a constant, why no investment here? Genuine question...

Good question, it has been looked at and we do produce a small amount, is Cardiff Bay still being considered? West coast of UK has the highest tides.

South Korea are the largest generator of tidal energy and then France then UK but that was some years ago, so could have changed.

Im reading the initial costs are very high and locations not always suitable.

We've had some good , quiet holidays in Southwold and Aldeburgh, lovely area. Though wouldn't want to live there and not because property is expensive, just seems good if you want a quiet holiday. Also I thought that the area was gradually being lost to the sea anyway.

Good article Megan. There's an awful lot of romance with renewables and I sense that it's going to be some time before we fully transition from fossil fuels, so I think Shell has both covered. Small Nuclear Reactors (SNRs) could fill the energy gap but we are still looking at long lead times there. I got caught up in the Falkland frenzy some years back and kept my holding more as a painful reminder of past mistakes. However, the prospect of these known oil and gas discoveries being developed has definitely increased with geopolitical events.

Hi, For anyone interested Offshore Renewable Energy there is a Govt funded catapult which does a lot of research into all aspects of offshore energy - wind & tidal.

Ive included the link below to an article on tidal power, but they have a lot of info on wind as well and well worth looking at to keep up with the latest news.

https://ore.catapult.org.uk/bl...

Regards

Kevin

Not me, I'm looking at the dividend and the possibilities in the long term of both reverting to the mean. I do hold shares in both and will remain diversified in this matter.

A Severn Barrage would be the most productive but all the OAP's in Weston Super Mare would lay down on the M5 in protest and why bother when Hinkley is so expandable and nuclear so controllable.

Two of the problems with Sizewell C is a lack of water supply for the build and the design, its the same as Hinckley Point. However Hinckley Point (if it ever gets completed) and the other nuclear plants still under construction will bankrupt EDF long before sizewell C is running.

Perfectly understandable that locals, wherever they are, don't want their surroundings spoilt by large and usually ugly developments whether it is power stations, houses, factories or anything else. Seems to me that there are plenty of under used industrial sites around that could offer scope for smaller generators to be built. Does anyone have any knowledge about covering existing has powered generators to run on hydrogen. Can hydrogen be produced in sufficient quantities?

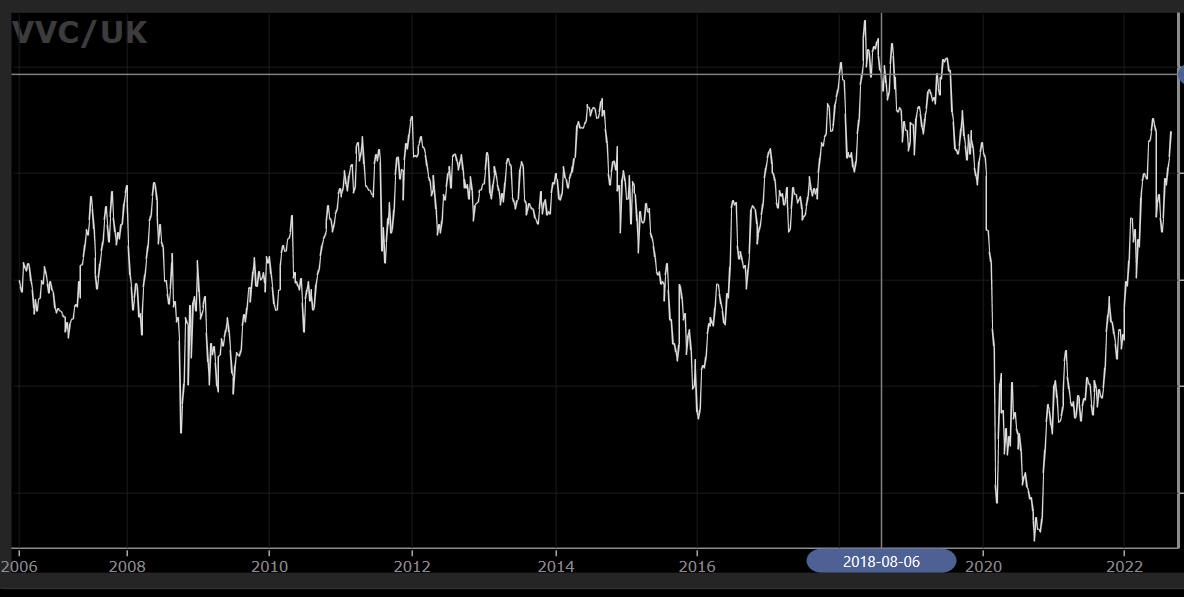

Here is a chart of:...........

SHEL since 2006. Conclusion: one had to buy and sell to make any profit.

Buy 2009, 2016, 2020

Sell 2015, 2018 and maybe now.

SHEL compared to ULVR (Unilever) since 2006. Conclusion: ULVR compounded profits. SHEL went sideways.

SHEL compared to BP since 2006. Conclusion: SHEL better investment.

SHEL compared to TSCO (Tesco) and CNA (Centrica) since 2006. Conclusion: SHEL steady.

I have not shown SSE but sold it recently. Held through the low years 2009 to 2012 and 2018 to 2020.

As with SHEL collected dividends.

I have not shown Vestas Wind Systems or Orsted but only hold them in etfs and funds because they are so overpriced. As the wind (pun intended) comes out of the funds I buy another one, now holding several. Sentiment changes so I rotate in and out frequently.

At least SHEL justifies investment on valuation, quality and momentum grounds plus income and buybacks.

Then there are the Trusts which Megan may be looking at in future articles.

Valuation open to question, so sorted here by market cap

I have noticed that if you give Megan an idea she develops it well.

Hi Megan, When you are considering exposure to the energy sector please remember that it is possible to get direct exposure to wind energy by subscribing to membership of a co-operative which builds wind (or solar) farms. This is quite a new idea but I have a tiny share in a wind farm being built in Ayrshire and will receive electricity at cost (rather than the market price) when the wind farm is built in 2023. This scheme is being managed by Ripple Energy and the higher the electricity price, the greater the benefit. Ripple is currently undergoing a round of EIS funding (for the company, not a wind farm) but I am not expressing any opinion on that. You describe Shell as shifting its focus to zero carbon and this may well be the message from the company but I think some people (including me) are attracted to the company because of its substantial and increasing interests in gas, particularly LNG. It is significantly different to many oil companies because of this, particularly those in the US where some investors regard Shell's green credentials negatively because of the financial impact.

*Past performance is no indicator of future performance. Performance returns are based on hypothetical scenarios and do not represent an actual investment.

This site cannot substitute for professional investment advice or independent factual verification. To use Stockopedia, you must accept our Terms of Use, Privacy and Disclaimer & FSG. All services are provided by Stockopedia Ltd, United Kingdom (company number 06367267). For Australian users: Stockopedia Ltd, ABN 39 757 874 670 is a Corporate Authorised Representative of Daylight Financial Group Pty Ltd ABN 77 633 984 773, AFSL 521404.

Thanks for your article Megan. I am a long term investor in Shell (LON:SHEL) and intend to remain so for the foreseeable future.