Good morning!

It has been a very busy week for updates; let's see what Friday has in store for us.

It's also the first day of the new month, and I'll be giving our spreadsheet an update later this afternoon.

I got called away to deal with something this morning, so I will be updating the report throughout the afternoon - please stay tuned! Thanks for your patience.

All finished with stock coverage for the week now, thank you.

Spreadsheet accompanying this report: link (last updated: 30th June).

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

International Consolidated Airlines SA (LON:IAG) (£17.7bn) | “Robust demand delivering good earnings growth.” Rev +8%, PAT +43.8% (€1,301m). | ||

| Intertek (LON:ITRK) (£7.8bn) | Half-year Report | SP -8% “Strong FY25 expected”, mid-single digit LFL revenue growth. On track for medium-term targets. | AMBER (Graham) This is a quality assurance provider with a fabulous track record when it comes to earning an economic return on its capital and its equity. However, today’s report only assured that the company was on track for the medium-term. The current year is a little more complicated, and the newswire confirms that these H1 results were slightly below consensus (4.5% organic growth vs. 4.7% expected). The company says it is still targeting mid-single digit growth, but of course that’s a range and not a precise figure. EPS forecasts have been nudging lower for Intertek for most of this year, which is tricky for the share price when it's much more highly-rated than the wider UK market and when growth is already so modest. Stockopedia categorises it as a Falling Star. As I do think it's a quality company, and as the miss against expectations was so slight, I'm comfortable with a neutral stance. |

Pearson (LON:PSON) (£7.0bn) | On track to deliver guidance. Stronger growth expected in H2. H1 sales +2% underlying. | ||

Melrose Industries (LON:MRO) (£6.5bn) | Guidance for the full year unchanged at constant currencies. H1 revenue +6%. | AMBER (Graham) Can't get away from a neutral stance here, as the current market cap could easily represent fair value in my view. | |

IMI (LON:IMI) (£5.5bn) | Guidance reconfirmed. H1 rev +2% organically. On track for mid-single digit organic rev growth. | ||

Alliance Witan (LON:ALW) (£5.0bn) | NAV total return -0.7% vs. MSCI ACWI +0.6%. Share price discount to NAV stable at 4.7%. | ||

Playtech (LON:PTEC) (£1.23bn) | Strong performance since May. H1 adj. EBITDA at least €90m. Confident in ability to execute. | ||

Future (LON:FUTR) (£741m) | Commencement of programme to purchase up to £55m of shares. | AMBER/GREEN (Graham) [no section below] I don't include every share buyback RNS in this summary table - only if I think it's significant relative to the company's market cap. In the case of Future, £55m is over 7% of the market cap, so I do think it's material. And it's an interesting choice when the company has junk bond ratings at S&P and Moody's (BB+ and Ba2 respectively). Clearly it thinks there is a greater opportunity in buying back its own shares rather than in boosting its credit rating! The earnings multiple is only 5.4x according to the StockReport. Remember that this owns GoCompare (a company I was very fond of, when it was listed) along with many other well-known media brands. It had a profit warning as recently as May and is probably not for those who want to sleep soundly at night, but the potential reward does look interesting to me at this level. | |

Oxford BioMedica (LON:OXB) (£487m) | Four-year loan facility of up to $125m, refinances existing $50m facility. | ||

Public Policy Holding (LON:PPHC) (£215m) | Completes acquisition of Pine Cove Capital in Austin, Texas. | ||

Amcomri (LON:AMCO) (£96m) | €2m upfront paid in cash, €1.5m deferred earn-out. | ||

Invinity Energy Systems (LON:IES) (£91m) | £10m grant and planning approval for project that will be reference site for new and existing customers. | ||

Ten Lifestyle (LON:TENG) (£59m) | Integrated with OpenTable to provide a joined-up digital dining service. "Ten's high-net-worth and mass affluent members can search and book over 60,000 restaurants in markets including the UK, USA, Canada, Middle East, Mexico, Australia and parts of Asia. Offering superior access and benefits not available on the internet or restaurant's own website..." Also launches an AI tool to review customer communications. | AMBER (Graham) [no section below) This "global concierge technology platform" has intrigued me in the past, but its lowly profit margins suggest that it has limited pricing power. Its customers are family offices, private banks and wealth managers who wish to provide luxurious lifestyle services to their clients. I was neutral on it at a similar share price last year and Mark was neutral on it more recently. Today's two initiatives do sound interesting, and the CEO says that they "represent a step-change in our ability to serve more members with higher quality, greater consistency and improved operational efficiency." I would think that premium restaurant booking facilities are a key element of the service. But I shouldn't budge from our neutral stance until there is some evidence of financial gains for Ten's shareholders. This RNS was published via RNS Reach, implying that it's not material to the company's short-term results. | |

Windar Photonics (LON:WPHO) (£55m) | In a strong position, well-placed to deliver significant increase in revenues during 2025. | ||

Time Finance (LON:TIME) (£51m) | Improved facilities to an aggregate of more than £250m. Embarking on a new three-year growth plan. | GREEN (Graham) [no section below] I’m a fan of this small-cap business lender with a focus on “hard” finance (secured lending of two types: invoice finance and asset finance). Today’s announcement should enable continued scaling up of their business. If I go back to the last set of full-year results published for May 2024, I calculate that the company had total available facilities then of slightly more than £200m (£154m in Asset Finance and £50m in Invoice Finance). The growth and development of these facilities over time is exactly what investors will want to see - plus, at some stage, their diversification into other forms of funding. But for now there doesn’t seem to be any problem with their current facilities. This trades at a P/E multiple of 8x and is a Stockopedia Super Stock. | |

CEL AI (LON:CLAI) (£10m) | SP -17% | DARK RED (Graham) [no section below] This is one of the worst announcements I’ve ever read. The company formerly known as Cellular Goods is fleeing from LSE main market regulation, and it is not even going to put up with the regulation on AIM (where a prospectus is often not necessary to raise money). Instead, it wants to join Aquis in order to “execute our Bitcoin treasury strategy aggressively”. As I wrote earlier this week, I’m automatically RED on any company with a Bitcoin Treasury policy, as I presume they are already overvalued or are seeking to become overvalued, in order to raise funds at an excessive price. The London market needs a simple bitcoin ETF to take the air out of these Bitcoin Treasury companies. |

Graham's Section

Melrose Industries (LON:MRO)

Up 7% to 548p (£7.0bn) - Half-year Results - Graham - AMBER

Melrose Industries PLC ("Melrose", the "Company" or the "Group"), a world-leading global aerospace and defence business, today announces its interim results for the six months ended 30 June 2025 (the "Period").

This has never been covered in the SCVR/DSMR, and it’s a quiet Friday, so let’s take a look!

Defence is a popular sector these days, but MRO shares remain within their range, no runaway gains here:

Note that it demerged Dowlais (LON:DWL) back in 2023.

The company’s Engines and Structures divisions “provide technology for more than 100,000 flights a day”.

Some nice results here today, with everything moving in the right direction. There’s positive operating leverage and a very large increase in adjusted profits:

Notably, the unadjusted pre-tax profit is even higher than what’s shown above (£379m).

CEO comment:

"We delivered a strong performance in the first half with a 29% improvement in profit and cash flow significantly stronger than last year despite the backdrop of supply chain and tariff disruptions. Our multi-year transformation programme will be completed by year end and the benefits are already reading through with more to come… We are confident about delivering sustained increases in profit and cash flow in the years ahead and our free cash flow target of £600 million in 2029."

Engines: growth of 11%, and it sounds busy with contract extensions and a “deepened relationship with the Swedish Defence Administration”.

Structures: this is “a design-to-build partner on the world's most successful and highest volume aircraft”

Revenue growth is only 3% on a like-for-like basis, and there’s a decline of 7% including the loss of exited businesses. Still, adjusted operating profit grew by 32%. A restructuring programme is “nearing completion with full benefits expected in 2026 and beyond”.

Guidance: unchanged on a constant currency basis, excluding any tariff impacts.

Changing currency rates are having a negative impact and the company provides new numbers based on the stronger pound and weaker dollar. Adj. operating profit of £620-650m (previously: £650-690m).

Graham’s view

I can’t pretend to be an expert on this business, but I’m intrigued by the fact that it has a StockRank of only 13 and is categorised as a Sucker Stock. That’s pretty poor for a FTSE-100 share!

But the financial track record is indeed pretty poor, looking at the statutory numbers:

And in the absence of real profits, it hasn’t been able to generate decent quality metrics:

Another negative is that the company is only forecasting that it will generate £100m of free cash flow this year, despite an adjusted operating profit of up to £650m. That seems like pretty poor cash conversion to me. It is planning for much higher free cash flow in future years.

An obstacle facing it is the interest bill which isn’t small, running at over £100m a year currently.

Net debt is £1.4 billion, with a leverage multiple of 2.0x. It’s pretty normal for the big-caps to leverage up, so I guess this isn’t a big surprise.

To try to find a conclusion, I’ve applied some checklist items, including a quick review of the company’s earnings forecast trend (it’s negative).

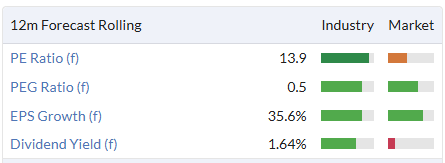

In the end, I just can’t get away from a fairly boring AMBER stance on this one. It's trading at a modest P/E multiple which could easily represent fair value in my view. The Sucker Stock categorisation is probably a bit harsh:

In conclusion: I guess this is why we don’t study big-caps as often - it's difficult to form a strong opinion on them! But at least we have this one in the archives now.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.