Good morning! It's a little bit hectic today. Good luck if you have multiple portfolio holdings updating at the same time!

Fortunately most of the company news today is very positive. I'm even wondering if this is some kind of record. By my count, over a dozen companies have beaten expectations or raised guidance!

Personal update: I have today added ASA International (LON:ASAI) to my personal portfolio, a stock which I wrote up late last week in a brief stock pitch.

16:30 : We're finished for today, see you tomorrow!

Spreadsheet accompanying this report: link (updated to 16th December)

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

BHP (LON:BHP) (£124bn | SR96) | Copper prices are up 32% and iron ore prices 4% higher. “We have increased FY26 group copper production guidance off the back of stronger delivery across our assets.” | ||

| GSK (LON:GSK) (£74bn | SR92) | GSK to acquire RAPT Therapeutics | RAPT is “a California-based, clinical-stage biopharmaceutical company dedicated to developing novel therapies for patients living with inflammatory and immunologic diseases”. Net of cash acquired, GSK's estimated upfront investment is $1.9 billion. | |

Informa (LON:INF) (£11bn | SR54) | Full year results in line with or ahead of market guidance. Increase in Group underlying revenue growth guidance to 6%±. £200m of new share buybacks. Partnership with Dubai World Trade Centre, combining their live events businesses in the region. | ||

Wise (LON:WISE) (£10.3bn | SR33) | Quarterly cross-border volume grew +25% YoY. Underlying income: expects to be around the middle of the guided range of 15-20% growth for FY26. Now expects FY26 underlying PBT margin to be towards the top of the medium-term target range 13-16%. | GREEN ↑ (Graham) This is a slightly adventurous "GREEN", but I think it makes sense. I'm not intimidated by a PER of 20+ for a successful and growing fintech business, and the valuation is not large at all compared to Revolut (of course there is always the chance they are both overvalued!). | |

Qinetiq (LON:QQ.) (£2.77bn | SR48) | 2026 full-year guidance: “Whilst subject to near-term spending uncertainty we continue to expect to deliver c.3% organic revenue growth, an operating margin of c.11%, cash conversion of c.90% and EPS growth of 15-20%.” | ||

Just (LON:JUST) (£2.25bn | SR51) | Still expects the acquisition of Just by BWS to complete during the first half of 2026. | PINK | |

Big Yellow (LON:BYG) (£2.1bn | SR45) | Q3: total revenue +2%, LfL store revenue +2%. Anticipates adjusted EPS growth for the full year of approximately 2%. The previous year benefited from one-off insurance proceeds. | ||

Seplat Energy (LON:SEPL) (£2.0bn | SR94) | The 300 MMscfd ANOH gas project has achieved first gas. Wet gas production has been stabilizing, delivering 40-52 MMscfd of processed gas directly from the ANOH gas plant to the Indorama Petrochemical Plant. | ||

4imprint (LON:FOUR) (£1.23bn | SR87) | A resilient operational and financial performance in 2025 amidst a volatile macroeconomic environment. Both revenue and profit before tax are above the upper end of the current range of analysts' forecasts. Revenue $1.35bn (2024: $1.37bn), PBT at least $149m (2024: $154m). | AMBER/GREEN = (Roland) An encouraging end to 2025 is tempered by a slightly more cautious view on 2026 from paid research provider Edison, who cite tariff pressures on import costs. On balance my view on this business is unchanged; I think it’s an excellent business with strong quality metrics and good market share. While the near-term may be a little uncertain, I would be highly confident that performance will improve when conditions in the US economy stabilise or improve. I don’t think the valuation is unreasonable, so my view remains unchanged today, on a medium-term basis. | |

| Cairn Homes (LON:CRN) (£1.13bn | SR46) | Trading Update | Beats upgraded c.€160 – c.€165 million operating profit and c.16% ROE guidance, and introduces guidance for FY26: operating profit €175-180m. | GREEN ↑ (Graham) An excellent update and I'm happy to upgrade my stance here. It's a little more adventurous than the usual housebuilder investment idea, as the reasons to invest are forward-looking rather than backward-looking. But with the company performing extremely well and supported by positive macro conditions, I think it's fair to be GREEN on this. |

Kier (LON:KIE) (£981m | SR94) | H1 (to December) and estimated full year performance remain in line. Order book remains at record levels (£11.6bn), 94% of FY June 2026 revenue estimated to be secured. | ||

Craneware (LON:CRW) (£669m | SR47) | H1 revenue +6% to c.$106m and double-digit growth in Adjusted EBITDA to approximately $33.4m. ARR +4% to $184.3m. Continues to trade in line with current market expectations for the year ending 30 June 2026. | ||

Ibstock (LON:IBST) (£538m | SR30) | Solid performance in FY25 with revenue up 2% to c.£372 million. Market share growing. EBITDA for the full year anticipated to be in line with previous guidance. | ||

DFS Furniture (LON:DFS) (£429m | SR95) | SP +4% | AMBER ↑ (Graham) As promised in November, I’m reverting to neutral on this, as I was overly cautious on it in the past. It enjoys a StockRank of 95, and had a very strong StockRank through 2025, so this was an instance where the machine defeated the man! H1 adjusted profits are massively higher and if last year’s full-year results are anything to go by, there’s a chance that the results could be clean without too many adjusting items. Net bank debt still strikes me as very significant at over £60m (Dec 2025), but I must concede that this is greatly improved from the June 2025 figure (£107m) and that the leverage multiple is not excessive at 0.8x (it’s also within the company’s target range). I still would not be an enthusiastic buyer here, personally, but I have to admit that it’s trading better than expected and that its cash/debt position is much improved. Also, if a furniture group like DFS is doing so well, that must say something profound about the UK consumer - sentiment cannot be as bad as some companies would have us believe! | |

Funding Circle Holdings (LON:FCH) (£382m | SR27) | Revenue of c.£204 million, up 28%, and profit before tax of c.£20 million, ahead of current market expectations of £191 million and £17 million respectively. Current guidance for FY 2026 is for revenue >£200 million. Having achieved this a year early, will provide updated guidance on 5th March 2026. | AMBER/GREEN ↑ (Roland) [no section below] Today’s update contains a significant upgrade, with 2025 pre-tax profit now expected to be 18% above previous expectations. There was good growth in new lending during the year, with total balances under management up by 7% to £3.0bn. There’s no comment today on credit quality or impairments, but given the upgrade in profit expectations I’m willing to believe borrower quality remained consistent last year. This isn’t a stock we’ve covered often, but I note our last view in Feb 25 reflected some uncertainty over a legal case that’s now been favourably resolved. The company has now met its revenue target of £200m a year ahead of schedule. As a result, updated guidance for 2026 onwards will be provided with the FY25 results in March. Existing 2026 consensus forecasts suggest a return on equity of c.13% in 2026. With the stock trading at 2x book value I’d normally take a neutral view here on valuation grounds, but given the strength of today’s upgrade and the potential for enhanced guidance, I’m tentatively moving our view to AMBER/GREEN ahead of March’s full-year results. | |

Niox (LON:NIOX) (£288m | SR47) | Revenue +17%. Adjusted EBITDA ahead of consensus expectations, and up 21% to approximately £16.7m (expectations £15.9m). Looking ahead: “We enter 2026 with a strong balance sheet, close to £20m in cash, good commercial momentum, and a clear focus on driving further adoption of FeNO testing worldwide.” | ||

Yu (LON:YU.) (£278m | SR96) | 48% growth in meter points supplied. FY25 revenues c. £700m (2024: £646m). EBITDA forecasted to be in line with expectations (£50.3m). | ||

Capital (LON:CAPD) (£277m | SR94) | Full-year revenue at the upper end of revised and raised guidance for both the Group and MSALABS. Revenue guidance for 2026 will be provided at FY 2025 results. | ||

Public Policy Holding (LON:PPHC) (£253m | SR44) | Ahead of expectations: FY25 revenue +24.7% to $186.5m (+6.2% organic). Adj EBITDA +17.9% to $45.5m. Experiencing strong demand in US. | ||

Avacta (LON:AVCT) (£242m | SR24) | Phase 1 trials of AVA6000 and AVA6103 making progress. Expect clinical testing of AVA6103 in Q1 2026. Raised £22.5m in 2025, cash of £16.9m at 31 Dec 25. | ||

Concurrent Technologies (LON:CNC) (£198m | SR71) | FY25 revenue and pre-tax profit to be “in line with market expectations”, with double-digit growth vs FY24. Market forecasts for FY25 are £46m and £6.2m respectively. | ||

Midwich (LON:MIDW) (£189m | SR66) | FY25 revenue broadly flat at c.£1.3bn, w/ return to growth in H2. Adj pre-tax profit to be in line with expectations of £30m. | ||

Reach (LON:RCH) (£173m | SR76) | SP +7% | AMBER/GREEN ↑ (Graham) [no section below] This stock has been rather divisive, and I might be on my own with a fully positive view on it. However, today’s full-year update emboldens me to do so (see here for more detailed coverage in October). The bull thesis is that the company survives to finish paying pension contributions from 2028. As that day inches closer, we can look forward to the company being left mostly unencumbered, except for a modest financial net debt balance. Meanwhile, it's paying an enormous double-digit dividend yield: a cigar with more than a few puffs left? | |

Treatt (LON:TET) (£126m | SR78) | Full Year Results & Relationship Agreement and Board Appointment | Revenue -11.8% to £132.5m, adj PBT -44.4% to £10.3m. In line with July 2025 guidance. Reports “important” sugar reduction win & commercial progress in Asia. FY26 YTD in line with Board’s expectations. | |

Team Internet (LON:TIG) (£118m | SR57) | Strong momentum in Q4 despite challenging conditions. Now expects to report FY25 revenue and adj EBITDA towards top end of current forecasts (EBITDA forecasts $40-43m). Discussions relating to disposal of DIS “are progressing well”. | ||

Eagle Eye Solutions (LON:EYE) (£90m | SR55) | H1 ahead of exps, FY26 adj EBITDA now expected to be “comfortably ahead” of market forecasts. H1 ARR +3% to £42.2m, revenue -5% to £23m. Adj EBITDA -28% to £4.3m. Expect to exit FY26 with 20% EBITDA margin run rate. Shore Capital updated forecasts:- FY26E adj EPS: 0.7p (prev. 1.9p loss) - FY27E adj EPS: 11.6p (unch) | AMBER ↑ (Roland) [no section below] In June last year I discussed how personalised marketing specialist Eagle Eye appeared to have lost its largest customer, Neptune Retail Solutions. The shares tanked at the time but have since regained ground as Eagle Eye has reported a string of customer wins, generating replacement revenue. Today’s update shows H1 26 revenue only 5% below H1 25, despite the loss of NRS. Annual Recurring Revenue (ARR) is now 3% higher than it was a year ago, reflecting the more recent wins. While the adjusted EBITDA margin of 18% is still well below the 24% reported in H1 25, I am encouraged by progress made in rebuilding and growing the business. With the stock trading on a FY27E P/E of 30, I’m cautious on valuation but am happy to upgrade our view to neutral today, reflecting the StockRank. | |

Kromek (LON:KMK) (£75m | SR93) | H1 revenue £15.0m (H1 25: £3.7m), pre-tax profit £3.1m (H1 25: £5.7m loss). Growth due to “landmark agreements” with Siemens Healthineers in FY25. FY26 results expected to be in line with market expectations. | AMBER ↑ (Roland) These results show a massive improvement in profitability, but much of this is due to the one-off benefit of last year’s high-margin, front-loaded Siemens Healthineers contract. As this fades, margins are expected to ease back to previous levels. Meanwhile, the company already appears to have slid back into a net debt position. The challenge for management is to maintain sufficient revenue growth to achieve sustainable profitability. I can see this may be possible but am not sure how likely it is. In the meantime, the stock is already priced for significant growth on a FY27E P/E of 52. To reflect recent progress and a shift to profitability, I’m moving to a neutral view on this growth stock. I’d need to do further research to form a stronger conviction. | |

Gear4music (HOLDINGS) (LON:G4M) (£65m | SR95) | FY26 EBITDA is now expected to be ahead of consensus market expectations, with EBITDA of not less than £17.7m (expectations: £16.7m). FY27 Board expectations upgraded reflecting the continuing very strong underlying trading and revised capital expenditure profile. | GREEN ↑ (Graham) EPS forecasts have been on a tear here recently and I’m happy to relent and take a fully “GREEN” position on the stock today following a Q3 update. According to Progressive, this is the sixth consecutive upgrade. Weakened competition is a very important factor but in footballing terms you can only beat the opposition that’s in front of you: G4M are proving to be highly successful in the current competitive environment. The company has experienced rapid revenue growth (+32%) and improved gross margins, and FY March 2026 EBITDA is expected to be ahead of expectations by about 6%. And capex plans have been slightly “rephased” (delayed), and combined with stronger trading, it means that earnings expectations have been raised for the next three years. One thing to beware of: future financial years are expected to see lower gross profit margins and higher operating costs, as the company enters an investment phase to boost capacity. So there will be execution risk as G4M attempts to enter the next phase of growth. With the stock trading at about 15x next year’s earnings, and enjoying strong sales momentum, I’m happy to give it the benefit of the doubt for now. | |

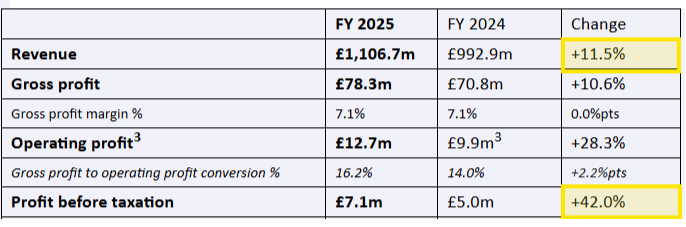

Staffline (LON:STAF) (£55m | SR96) | Revenue +11.5%, pre-tax profit +42% to £7.1m. FY25 results to be “significantly ahead of market expectations” (Panmure Liberum previously had adj PBT of £6.0m). | AMBER/GREEN ↑ (Graham) At the end of the day, this is a recruitment business, and we are unlikely to see it trading on a P/E multiple of 20x any time soon. But this is a truly impressive update and I think it justifies some optimism, so I’m giving this stock a one-notch upgrade. | |

Creo Medical (LON:CREO) (£51m | SR35) | Revenue +50% to £6m, in line with exps. Operating costs -20% to £18.4m, operating loss -40% to £13.3m. Confident of meeting FY26 expectations. | ||

Helium One Global (LON:HE1) (£43m | SR10) | First helium gas in Dec 25, operator now focused on stabilising output. Trailer on site for filling ahead of first sales. | ||

Flowtech Fluidpower (LON:FLO) (£38m | SR43) | Full Year Trading Update & Acquisition & Proposed Placing and Retail Offer | Revenue +8.9% to £116.9m, adjusted EBITDA c.£7.7m, “broadly in line with expectations”. Reports some H2 25 projects have slipped into H1 26. Acquiring Q Plus in Netherlands for an EV of €9.25m (4.6x - 5.5x EBITDA). Will double the size of Benelux operations. Raising up to £10m in placing/retail offer. | |

System1 (LON:SYS1) (£27m | SR75) | FY26 guidance maintained. Q3 platform revenue of £9.5m was flat YoY but ahead of Q1/Q2. Revenue from new client wins +10% to £7.4m in 9M26. Net cash £8.3m. |

Graham's Secction

Cairn Homes (LON:CRN)

Up 0.4% to 182.2p (£1.14bn / €1.31 billion) - Trading Update for the Year Ended 31 December 2025 - Graham - GREEN ↑

Apologies for missing this Irish housebuilder in our table first thing this morning. It’s yet another ahead-of-expectations update:

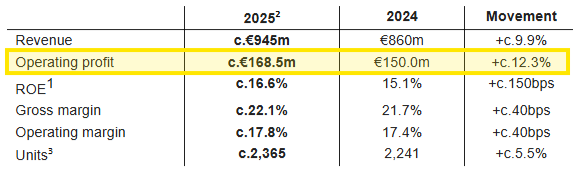

The Company again presents strong financial results, delivering on our 2025 revenue guidance of c.€945 million, and beating our upgraded c.€160 – c.€165 million operating profit and c.16% ROE guidance.

Highlights:

I’ve highlighted the profit figure, as it’s ahead of guidance, but the other figures are excellent, too.

A very powerful H2 performance carried the company through, with revenue of €660m (70% of the full-year result) and operating profit of €126m (75% of the full-year result) happening in the second half of the year.

We studied Cairn’s interim results last year, noting that the full-year revenue outlook had slightly deteriorated, while the guidance for operating profit was upgraded from €160m to €160-€165m. As we now see, the full-year result is even better than that.

There was an “exceptional sales environment experienced throughout 2025, with 22 active selling sites, primarily addressing demand within the First Time Buyer market.”

Forward order book: this has relaxed to 3,000 homes since Sep 2025, when it was over 4,000. There was clearly a vast number of deliveries in the final months of the year.

Looking at it year-on-year, the forward order book is still up by 27% in terms of the number of homes, and by 26% in terms of value.

They have six “forward fund” projects, “which allows the Company to deploy capital in a more efficient manner enabling the delivery of apartments to our State partners at competitive price points.”

As we’ve noted before, a large percentage of Cairn’s building is on behalf of state-fund organisations such as local authorities. Forward funding is great for Cairn (less capital required up front) and great for these organisations too (assuming that Cairn is passing on a reasonable discount).

More broadly, Cairn has a “strategic pipeline” for up to 6,000 new homes.

FY26 outlook: reaffirmed.

Revenue of c.€1.02 – c.€1.05 billion;

Operating profit of c.€175 – c.€180 million; and

ROE of c.16.5%.

I’ve said before that companies should be using ROE (or similar) as a standard KPI, but very few of them do it. Cairn is not only using this metric prominently but also generating excellent numbers for it.

CEO comment:

“It is unlikely that Ireland has ever witnessed the current level of demand for residential homes. This extraordinary demand is the result of a decade of significant undersupply of new housing during a period of sustained economic expansion and continued population growth, alongside Ireland's working population increasing from two to almost three million people.

He says: “Cairn's total output will now reach 6,000 new homes between 2026 and 2027.”

Graham’s view

This is a terrific update and consistent with our methodology, I’m going to upgrade our stance on this to fully GREEN.

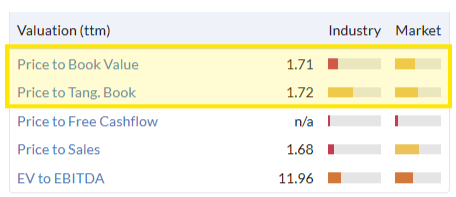

I still think it’s quite expensive against balance sheet value:

So to be perfectly clear, this is not what I would consider to be a typical housebuilder investment idea. I prefer to be positive on housebuilders when they are cheap against their asset base, and rather unloved.

In this case, Cairn’s stock trades at an expensive premium against book value and is not all that cheap against short-term earnings either, given the sector.

The market cap today is €1.31 billion, and net debt is €172 million, so the enterprise value is €1.5 billion, against forecast (pre-interest, pre-tax) operating profits of up to €180 million.

So investors here have to be very clear about why they own it, and I think the best reasons are:

Management's laser focus on ROE, and they are delivering very strongly against this metric

Extremely strong demand in Ireland for new homes likely to continue for the foreseeable future

Cairn strategically placed to deliver both in the private market and to public bodies

Cairn’s output seen rising to 6000 new homes by 2027

These are all very exciting and positive reasons to invest in the stock, but they are not a guarantee and they are “riskier” than the usual reasons I’d put forward for investing in a housebuilder (i.e. it’s cheap against book value and earnings multiple).

So hopefully I’ve made this clear: I’m fully GREEN on this, but as always it’s a case of “do your own research”!

Wise (LON:WISE)

Up 14% to 954p (£9.78bn) - Q3 FY26 Trading Update - Graham - GREEN ↑

There have been some excellent comments today about this stock - thank you everyone.

Let’s pick out the highlights from this Q3 update, which has sent the stock soaring.

The growth numbers are a little mind-boggling for a company that is already so large:

Quarterly volumes +25% year-on-year (26% at constant currencies)

Active customers +20% to 10.9 million

Customer holdings +34% to £27.5 billion.

The “take rate” (fee charged on currency conversion) is 52 basis points, down from 56 basis points a a year ago, “reflecting continued focus on investing for long-term growth”.

The bottom-line profitability is still not huge, but it’s expected to be at the top end of the medium-term target range this year (FY March 2026):

Focused on the long-term growth opportunity and becoming 'the' network for the world's money while investing to target an underlying profit before tax margin of 13-16% in the medium term. We now expect FY26 underlying PBT margin to be towards the top of this range, including costs related to Wise's dual listing.

The CEO adds that “we remain on track to meet our guidance”

Also, they are going to be dual-listed in H1 2026. US investors tend to be a very bullish, optimistic crowd, so I’d expect this to support Wise’s valuation!

Some more colour from the CEO:

We served nearly 11 million active customers this quarter, helping more people and businesses around the world with more of their financial needs. We launched the Wise travel card in India to exciting demand, with over 75,000 customers joining the waiting list in just one month, and introduced Google Pay for customers in the Philippines as the first non-bank to do so. We secured a conditional licence approval in South Africa - our first in Africa, and went live with our direct integration to Japan's Zengin system, bringing our total number of direct integrations to domestic payment systems to eight.

"We delivered 74% of payments instantly, up nine percentage points year-on-year. This is a clear benefit of our continued focus on infrastructure - our licences, integrations, technology and operations.

Graham’s view

This stock has plenty of supporters and it’s easy to understand why: fantastic growth and a bold, ambitious plan to be the world’s major money network, competing directly with the likes of Revolut.

Revolut achieved a $75 billion valuation at its latest funding round, five times bigger than Wise!

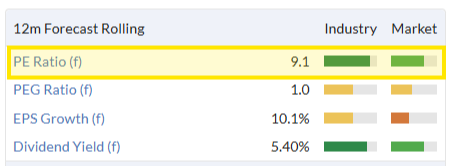

I’m happy to be fully GREEN on this as I’m not intimidated by a PER of 20+ for a successful and ambitious fintech. I’m pretty confident that North American investors won’t be intimidated, either!

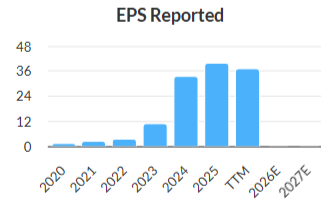

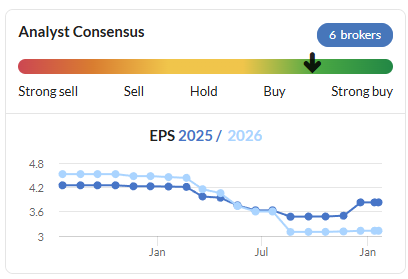

EPS forecasts have been a little volatile:

But the trend is clearly higher, and management hasvebeen clear that they are not trying to maximise profits at this stage of the company’s development - which makes perfect sense to me, given the top-line growth they are achieving.

So this is another slightly adventurous “GREEN”.

Staffline (LON:STAF)

Up 9% to 48.7p (£60m) - Full Year Trading Update - Graham - AMBER/GREEN ↑

Staffline (AIM: STAF), the recruitment group, provides the following trading update for the year ended 31 December 2025

I’ve been really worried about the recruitment sector, but Staffline is a little different in the sense that it’s a “blue-collar” specialist. Business was very strong in 2025, with an 11.5% revenue increase being converted into a 42% increase in PBT:

The PBT result is ”ahead of market expectations” and even better than that, it’s clean. There were “no material non-underlying items”.

Before extrapolating this forward, please bear in mind that Board expectations for FY26 are unchanged.

Net cash (excluding leases) has fallen from £9.6m to £1.5m, which sounds like bad news, but it’s also “better than expected”.

The reduction in cash “the planned working capital investment in both new customers, including the new strategic partnership, as well as in the strong growth in existing customer activity”.

I’m highlighting this because, for a £60m market cap company, an £8m swing in net cash is noteworthy! And I’ve only come to appreciate in recent years that recruiters can have very volatile cash movements.

So when you see a large net cash balance at a recruiter, it might be an illusion: it may represent working capital that the company actually needs.

And at Staffline, there’s another important factor involved: a £7.5m buyback that’s ongoing and nearly completed. £6.5m was repurchased in 2025.

Commentary

We looked at Christie (LON:CTG) yesterday, which is an example of a company that divested a loss-making division in order to focus on its core operations.

Staffline looks like a similar story: they sold their training business last year.

The benefits of a more focused mission have been felt very quickly:

Staffline's strategic shift to focus on pure-play recruitment has contributed to an excellent financial and operational performance for FY 2025. Organic growth remains a key strategic priority, delivering remarkable success during 2025. Staffline's scale and reach, combined with its financial strength and high governance standards, ideally positions the business in a market where competition remains fragmented and customers, both new and existing, continue to consolidate their labour suppliers.

Recruitment GB: there’s a 6.8% increase in year-on-year temporary hours worked.

The landmark partnership with Culina (not specifically named in the RNS) is also boosting Staffline’s GB results.

Recruitment Ireland: 10.3% year-on-year growth in permanent recruitment fees.

CEO comment:

We are delighted to have delivered such a strong performance in FY 2025, underpinned by another successful Christmas peak trading period and significant new contract wins. Following the disposal of the PeoplePlus training business in Q1, Staffline has been able to focus exclusively on the recruitment sector, using its financial strength and specialist expertise to grow its market share significantly in a challenging jobs market.

Graham’s view

I’m happy to take our stance on this up by one notch to AMBER/GREEN.

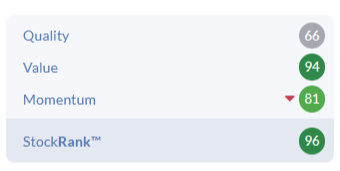

Note the extremely high StockRank:

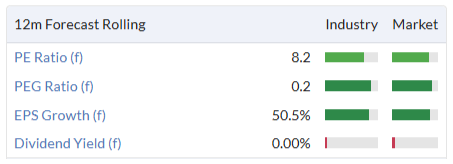

Valuation is moderate, as you’d expect for a recruiter:

While recruitment in general is a very scary sector for investors these days, Staffline’s blue-collar focus seems to be working.

Reasons to consider backing Staffline:

Beating expectations for FY25.

Their willingness to divest a non-core business is highly encouraging.

They’ve even managed to make a success of their permanent recruitment business in the Republic of Ireland, despite the tough environment.

Clean results without any large “non-underlying” items (to be verified when official results are posted).

Reasons to be cautious? Well, FY26 expectations are unchanged, so maybe FY25’s success is due to one-off factors?

And at the end of the day, it’s a recruitment business - don’t expect to see the P/E expanding to 20x any time soon.

But I do think the excellence of this update, and the factors mentioned above, merit some optimism

Roland's Section

4imprint (LON:FOUR)

Down 1.1% at 4,300p (£1.21bn) - Trading Statement - Roland - AMBER/GREEN =

Today’s full-year update from this leading promotional goods marketer is ahead of expectations, but still looks a little mixed to me.

My key takeaways are:

2025 pre-tax profit guidance has been raised from >$142m in November to >$149m;

Order volumes fell by 3% last year;

Input cost increases (e.g. relating to China tariffs) is putting pressure on gross margin;

4Imprint’s ability to raise prices may be limited;

Dialling down marketing spend is helping to protect operating margins.

In more detail:

The decline in order volumes last year was driven by a reduction in new business. While orders from existing customers were flat, new customer orders fell by 12%.

The average order value for the year only rose by 1%. This suggests to me that 4Imprint is unable to raise its prices to reflect inflation or that customers are making smaller orders.

Today’s gross margin guidance of “around 32%” is also weaker than the “just below 33%” cited in November. 1% of gross margin on $1.35bn of revenue is $13.5m, so it’s not insignificant in terms of how much falls through to pre-tax profit.

The significance of a lower gross margin is that it suggests cost increases on inventory may be exceeding 4Imprint’s ability to raise its own prices. Competitive pressures are a factor here – if rivals start discounting heavily, 4Imprint may have to choose between protecting its market share or protecting its volumes.

In fairness, management makes the point that they can dial marketing spending up or down to reflect wider economic conditions. As in 2025, this can help to protect operating profit when sales growth falters.

Outlook & Broker Estimates

After a series of downgrades, FY25 earnings estimates have been recovering recently, but this hasn’t been backed by corresponding increases for FY26:

The only updated forecasts I have access to today come from commissioned research provider Edison. Unsurprisingly they have increased their FY25 numbers to reflect today’s updated guidance.

However, what surprised me slightly is that they’ve trimmed FY26 estimates. The main reason given is that Edison expects to see continued gross margin pressure next year from the impact of tariffs. If correct, this will extend the diverging trend shown in the consensus trend chart above.

Here are the updated Edison estimates:

FY25E adj EPS: 398.03c (+4.3% vs 381.66c previously)

FY26E adj EPS: 319.58c (-2.8% vs 328.90c previously)

Admittedly, these aren’t big changes. However, recent share price gains mean that 4Imprint is now trading on a FY26E P/E of around 18.5 – not quite as obviously cheap as a few months ago, despite the cautious earnings outlook.

Roland’s view

4Imprint generates virtually all of its revenue in the US. In my view, it can be seen as an interesting play on the health and growth of the real economy in the US – a broad range of SMEs and larger companies.

My assumption is that today’s updated FY26 forecast from Edison reflects the view of 4Imprint’s management.

However, the company’s outlook statement sounds quite confident to me:

The Board is very confident that the Group will continue to effectively navigate market conditions, delivering solid financial results while positioning the business to take advantage of opportunities that will present themselves as economic and market conditions improve.

I don’t think 4Imprint’s operational excellence or market share have diminished. What is uncertain are the direction and timing of changing market conditions. When these improve – or even stabilise – I would be confident that the performance of the business will improve.

Whether this will happen in 2026 seems uncertain to me – but if it does, I’d guess there would be a good chance of upgrades to today’s forecasts.

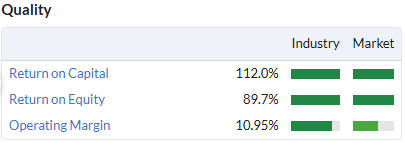

Regardless of the short-term outlook, 4Imprint remains a high-quality business with a strong balance sheet:

Super profitability means I don’t think the shares are unreasonably expensive at current levels.

For all of these reasons, I’m going to leave my AMBER/GREEN view unchanged today, with the caveat that this reflects my medium-term view.

Kromek (LON:KMK)

Down 8% at 10.6p (£67m) - Interim Results - Roland - AMBER

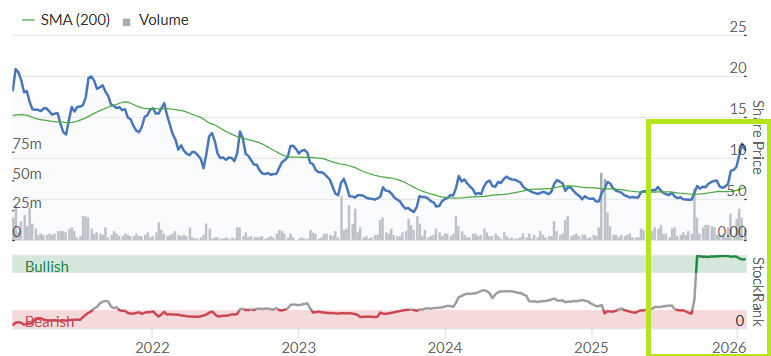

Graham and I have persisted with a mildly negative AMBER/RED view on this 2026 NAPS stock in recent months (here & here), but so far we’ve been wrong to oppose Kromek’s recently elevated StockRank and Super Stock styling:

Today’s half-year results have received a mild negative reaction from the market. Is our cautious view about to be vindicated, or does today’s drop simply represent some logical profit taking after a strong run?

H1 results - main points:

These results cover the six months to 31 October 2025, an interesting period for the company.

Encouraging underlying growth was supplemented by a large cash inflow from a January 2025 deal with Siemens Healthineers to produce CZT detectors for computed tomography. I discussed this four-year, $37.5m contract in more detail in October.

CZT detectors are a technology that’s said to be replacing “conventional scintillator technology” to provide higher-quality imaging in medical scans.

Revenue up 305% to £15.0m, including £8.3m from Siemens

Gross margin improved to 71.7% (H1 25: 56.9%)

Pre-tax profit: £3.1m (H1 25: £5.7m loss)

Divisional summaries:

Kromek’s operations fall into two divisions, Advanced Imaging (healthcare) and CBRN Detection (security and defence). CBRN stands for Chemical, Biological, Radiological & Nuclear.

Advanced Imaging: revenue rose to £10.8m (H1 25: £1.7m), driven by an £8.3m contribution from the Siemens Healthineers contract. This high margin revenue generated an operating profit of £3.5m (H1 25: £(4.1m)).

The Siemens contract has been good news, but as I discussed in October the vast majority of the revenue due under this four-year contract has now been booked (in its first year). This means that new sources of revenue are essential to sustain growth and prevent the business falling back into operating losses.

Stripping out the Siemens revenue gives underlying H1 revenue of £2.5m, implying growth of 47%, which seems cautiously encouraging.

In today’s results Kromek says progress was made on four “collaboration programmes” with companies in this segment, generating commercial revenue and opportunities for “early-stage commercialisation”.

The company also reports “excellent results” in validation trials with a leading US clinic for technology developed a new breast imaging programme.

CBRN Detection: revenue rose by 116% to £4.3m, narrowing the division’s operating loss to £(294)k (H1 25: £(662)k.

Market conditions recovered from the impact of UK and US elections on government defence spending in the early part of last year.

One highlight of the period was an initial £1.7m order under the UK Government’s Radiological Nuclear Detection Framework. Kromek is pre-qualified in three product categories on this four-year programme, so perhaps further orders will follow.

Elsewhere, the company continued to deliver on multi-year UK and US contracts to develop biological-threat detection systems. A third programme (18 months, £250k) from the UK MoD was also secured.

Biological-threat Detection projects are said to be on budget, with the technology expected to reach “full maturity” in 2027, at which time production will be scaled up, potentially opening up new “partnerships and avenues for commercialisation”.

Cash generation & balance sheet: before turning to the outlook, I think it’s worth a quick look at the accounts. Kromek is a relatively cash-hungry business. H1 profits were flattered by £2.1m of capitalised R&D costs. Without this, operating profit would have been just £1.1m.

These outflows are reflected in the cash flow statement – my sums show a free cash outflow of £1.25m in H1.

While early cash inflows from Siemens allowed the group to repay previous loans, Kromek already appears to be moving back into a net debt position.

The half-year accounts show net cash of just £133k, excluding leases. A footnote reveals that the company has drawn a further £2m on its overdraft since the end of the half year, implying net debt of c.£2m.

Outlook & Broker Estimates

The company’s expectations for the current financial year are unchanged today:

With operational momentum, a strong pipeline of opportunities and effective cost management, the Group looks forward to continuing to execute on its strategy and deliver results for FY 2026 in line with market expectations.

With thanks to house broker Cavendish on Research Tree, we can see that FY26 and FY27 forecasts are also unchanged:

FY26E adj EPS: 0.38p

FY27E adj EPS: 0.20p

I think it's worth noting that while revenue is expected to rise from £26.5m in FY25 to £30.5m in FY27, gross profit is expected to fall from £21.4m to £16.8m over the same period.

This highlights the one-off boost to profitability provided by the high margin Siemens revenue. Kromek’s gross margin peaked at 80.9% in FY25 but is expected to return to its pre-Siemens level of c.55% by FY27, compressing profitability.

Roland’s view

Current forecasts leave Kromek trading on a FY26E P/E of 28, rising to a FY27E P/E of 52.

I’m not surprised the shares have fallen today in the absence of any upgrades or major new contract wins.

Kromek has clearly had some early success with its CZT technology – Siemens Healthineers is a global player in medical imaging and diagnostic technology. The question today is whether this initial deal will translate into similar further wins.

Without further research, I don’t know much about the competitive landscape for the business or the addressable market for its technology.

Even so, I think broader-based growth is definitely a possibility. In such a scenario, this business could be worth significantly more in the future. Reflecting this bullish view, Cavendish has a price target of 26p.

On the other hand, it’s possible that the company will fail to achieve the broader market share it’s aiming for.

I also can’t help wondering if the Siemens deal will prove to be a short-term win, at the expense of longer-term market share. Front-loaded payments on this four-year contract allowed Kromek to repay its borrowings and continue funding product development. But the end result of this deal will be that Siemens gains both the knowledge and equipment needed to produce its own CZT detectors. This will presumably reduce the need to purchase them from Kromek in the future.

To reflect this mix of views and the company’s high StockRank, I’m going to move our view up by one notch to neutral (AMBER) today. While this isn’t a stock I’d buy, I can see that it might be worth further research as a possible growth opportunity. It may be worth noting that investors have valued the business significantly more highly in the past, even though it was loss making.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.