Good morning!

My optimistic comments around the UK market yesterday were overshadowed by Nvidia ($NVDA), which fell by 16% and lost $600bn in market value - the largest fall in value by a single stock in financial history. The Nasdaq as a whole fell by 3%.

The reason? Fears around Chinese AI startup DeepSeek, which claims to offer AI language models that require only a fraction of the computing power of US-based rivals.

It’s fascinating how narratives can change so suddenly. A bubble can persist for years, and then collapse for particular reasons that few, if anyone, could have predicted. But the overvaluation was visible for a long time in advance. Yesterday’s events look to me like they could herald the beginning of the end of the AI boom.

If that’s true, it could be relevant for a theme I’ve highlighted before - the excessive concentration of ETF products in Mag 7 stocks such as Nvidia. In my view, this creates the risk of unexpected volatility for investors who wrongly assume that these products are more diversified than they really are.

From stockcharts.com, here are the weightings of the top three S&P 500 components, which together account for nearly 20% of the value of the index:

Perhaps if we see unexpected volatility in the US indexes, that could lead to renewed interest in non-US markets (such as the UK) and in active investing? Or perhaps that’s just wishful thinking on my part!

Nvidia’s stock price has still had a very good year:

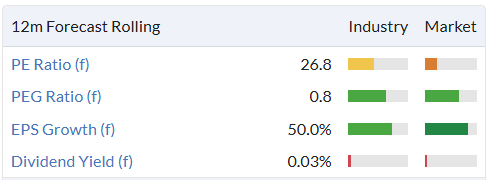

And here are its value metrics (updated to reflect yesterday's fall). I’m not tempted yet!

1pm: all done for now, thank you.

Companies Reporting

| Name (Mkt Cap) | RNS | Summary | Our view (Author) |

|---|---|---|---|

Rentokil Initial (LON:RTO) (£9.8bn) | TU | FY24 trading in line. | |

RS (LON:RS1) (£3.2bn) | Q3 TU | Full year pre-tax profit is likely to be “around the bottom end of the consensus range”. | |

Computacenter (LON:CCC) (£2.2bn) | FY TU | 2024 adj pre-tax profit to be “at the lower end of the range” of forecasts. Y/E net cash £480m. | GREEN (Roland - I hold) |

SSP (LON:SSPG) (£1.4bn) | TU | Q1 LFL sales +6%, FY guidance unchanged. | |

Pets at Home (LON:PETS) (£967m) | Q3 TU | FY25 in line. | AMBER (Graham) Full-year guidance is unchanged. Company is doing well in tough circumstances but I think it could be at fair value here. |

A G Barr (LON:BAG) (£653m) | TU | 24/25 results in line with revs +5%. FY25 expectations are unchanged. | GREEN (Graham) Pleasing performance with rising margins and good progress integrating Boost. Not much to dislike here. |

Harworth (LON:HWG) (£536m) | TU | 2024 EPRA NDV to be “broadly in line” with consensus. | |

PPHE Hotel (LON:PPH) (£533m) | FY TU | 2024 results to be in line with expectations. LFL room rev +2.1% to £306m. | |

Foresight group (LON:FSG) (£419m) | AUM update/acquisition | £800m added to AUM primarily by the acquisition of WHEB Asset Management. | |

SThree (LON:STEM) (£383m) | Final Results | Fees -9%, PBT -13% to £68m. Challenging conditions persist. FY25 PBT estimate: £25m (unch). | |

Big Technologies (LON:BIG) (£375m) | TU | FY24 in line with exps, with revs -9% to £50.3m and adj EBITDA -18% to £27m. FY25 also in line. | |

Wickes (LON:WIX) (£371m) | TU | FY24 profit expected to be towards upper end of forecast range. | |

Idox (LON:IDOX) (£291m) | Final Results | FY24 results in line. | |

| Henry Boot (LON:BOOT) (£285m) | TU | FY results to be in line with market exps. Have “a bit more optimism” for 2025, increasing planning apps. | |

Halfords (LON:HFD) (£276m) | TU | Upgrade to FY25 profit exps after strong Q3 trading. Adj PBT exps £32m to £37m. | AMBER (Roland) |

Franchise Brands (LON:FRAN) (£269m) | FY TU | Adj EBITDA to be “very marginally below” current expectations. | |

dotDigital (LON:DOTD) (£251m) | HY TU | Performance tracking in line with expectations for the full year. | |

Synthomer (LON:SYNT) (£245m) | TU | 2024 results to be in line with expectations. Volumes improved in H2. | |

S4 Capital (LON:SFOR) (£205m) | TU | 2024 results expected to be slightly ahead of current consensus with reduced debt. | |

Foxtons (LON:FOXT) (£201m) | FY24 TU | “2024 earnings ahead of market expectations” on market share gains. Adj op profit +33%. | |

accesso Technology (LON:ACSO) (£196m) | TU | FY revenue in line, “cash EBITDA” ahead of expectations. | |

Eurocell (LON:ECEL) (£160m) | FY TU | 2024 profits in line with expectations. Sales down 2% to £358m. | GREEN (Roland) |

Eleco (LON:ELCO) (£118m) | FY TU | Rev +16%, 2024 results to be “ahead of market forecasts”. | |

Microlise (LON:SAAS) (£107m) | FY24 TU | Adjusted EBITDA and net cash “comfortably ahead of market expectations”. | |

| Time Finance (LON:TIME) (£60m) | Interim Results | Rev +16% to £18.2m, PBT +44% to £3.9m. NTAV +14% to £41.5m. FY trading exp “at least” in line. | AMBER/GREEN (Graham) Mildly positive view as it's expensive but offers unusual growth for a lender and improving quality. |

Personal group (LON:PGH) (£54m) | TU | Adjusted EBITDA ahead of expectations. | |

Lords Trading (LON:LORD) (£51m) | FY24 TU | FY24 adjusted EBITDA slightly below consensus. | |

Dialight (LON:DIA) (£37m) | TU | Q3 “slightly ahead” of expectations. | |

Pressure Technologies (LON:PRES) (£13m) | Contract award | Delivery of pressure vessels to a US defence contractor in Q1 2026. | |

Northcoders (LON:CODE) (£13m) | TU | FY24 in line with exps. Revenue +24% to £8.8m. |

Graham's Section

Time Finance (LON:TIME)

Down 2% to 63.5p (£59m) - Interim Results - Graham - AMBER/GREEN

We already covered the H1 update for TIME in December.

Today we have the interim results.

Headlines for the six months to Nov 2024 are as seen in the trading update:

Revenue +16% to £18.2m

PBT +44% to £3.9m (so that the PBT margin improves)

Net tangible assets +14% to £41.5m

It’s good to see the company itself highlighting its net tangible assets, although I must note that this stock now trades at an even larger premium (42%) against that number.

TIME’s lending activities continue to grow: lending book +11% to £209m. And it continues to perform well with deals in arrears falling to 5% of the lending book. This info was already provided in December.

The Outlook is a good place to look for new information:

Continued positive trading momentum throughout December 2024 gives significant confidence that full year trading will be at least in line with market expectations.

Estimates: in December, broker Cavendish was of the view that TIME had “a good chance” of outperforming their recently upgraded forecasts for FY May 2025.

So it’s quite possible that some investors were hoping for an upgrade today, but this has not yet materialised.

Forecasts at Cavendish remain unchanged today. They continue to suggest FY May 2025 PBT of £7.2m, and earnings per share of 5.9p.

Strategy: the company’s four-year strategy from June 2021 to May 2025 is “well on track” to meet its targets, so a new strategy is set out to guide the company until 2028.

The new strategic targets:

Lending book growth to over £300m from TIME’s existing funding lines.

Arrears and write-offs well controlled at broadly current levels

PBT margin % rising to the mid-twenties

ROE % increasing to the mid-teens

Graham’s view

The target for lending book growth does not strike me as excessively ambitious. It amounts to about 14.5% growth annually (compounded).

An improvement in ROE to the mid-teens would be an amazing improvement:

I calculate the ROE that was just earned in H1 as annualising to about 9%, higher than the full-year number shown in the table above.

Indeed, the general trend in ROE post-Covid has been positive:

Pre-Covid, I think the company did earn an ROE in the mid-teens, so maybe it can do it again? It has a much bigger asset base now than it did before, and so I’d like to think that we will see both positive operational leverage and economies of scale.

Therefore, my overall view is that the company's 2028 targets are demanding but not unrealistic.

It must be said that this stock remains expensive both against assets and against earnings. Most lenders trade at cheaper earnings multiples than this:

However, the growth and the prospects at TIME strike me as being better than average, with the most important factor being the potential for profit margins and ROE to grow. Let's hope that TIME can continue lending intelligently at higher volumes. I’m comfortable leaving my AMBER/GREEN stance unchanged.

Pets at Home (LON:PETS)

Up 4.5% to 219.8p (£1.01bn) - Q3 FY25 Trading Statement - Graham - AMBER

Roland looked at the most recent interim results for this company in November.

Today’s Q3 update leaves full-year guidance unchanged.

Key points for Q3:

Total revenue down 0.2%, like-for-like revenue down 1%

Retail revenue down 2.4%, down 2.8% like-for-like.

Vet revenue up 21.3%, up 19.9% like-for-like,

Compared to H1, retail revenue is doing a little worse, while vet revenue is doing a little better.

PETS notes that Q3 saw “a more challenging UK consumer backdrop with particularly weak footfall from October”.

But the outlook section has been viewed as positive by investors this morning:

We are on track to deliver modest growth in underlying PBT this year as set out at our H1 results. Against a still subdued consumer backdrop, we have maintained a disciplined gross margin performance, supported by strong Christmas seasonal sell through, and effectively managed our costs.

There is a slight (£4m) increase in non-underlying costs in the current year, but it’s positive news: PETS exiting its Northampton distribution centre faster than it expected to.

The company says it will finish the year with a “robust” balance sheet, even after returning £85m to shareholders in dividends and buybacks.

Estimates

It has been a poor year for EPS expectations at PETS:

But perhaps it has bottomed out now? Today’s announcement does read confidently.

Zeus re-published their FY 2025 forecasts this month: adjusted EPS of 20.6p on a slight increase in group sales, and finishing the year with a net cash position.

Graham’s view

Like my co-writers previously, I’m not persuaded about the opportunity here.

Quantitatively, it looks interesting:

The StockRanks love it:

It even passes two bullish stock screens.

Qualitatively, I think it’s mostly the lack of growth and the sector (retail) that is putting me off. There is also the CMA investigation behind the scenes to worry about. This is just such a tricky sector, and throwing a regulatory problem into the mix doesn't help. As things stand, it seems to me that PETS is trading around fair value.

But who knows, maybe consumer spending on pets could pick up this year? It might deserve AMBER/GREEN, but I’ll leave it at AMBER for now.

A G Barr (LON:BAG)

Up 5.5% to 615p (£691m) - Trading Update - Graham - GREEN

I took this off my 2025 watchlist due to last year’s CEO appointment.

Fortunately today we have an in line update from this maker of IRN-BRU and other drinks.

Revenue for FY Jan 2025 will be up 5% to c. £420m, and the adjusted operating margin will improve from 12.3% to c. 13.5%.

It’s good to see that Boost (the energy drinks brand) is being successfully integrated. This acquisition caused a drag on the company’s metrics but they say they are prioritising “value over volume” for it, and that it has seen a step-up in profitability.

Net Cash: rising from £53.6m last year to finish this year at over £60m.

CEO comment:

"A.G. BARR is in line to deliver another year of strong top line growth, margin improvement and cash generation. These headline metrics highlight excellent progress towards our long-term financial goals. We have sustained brand momentum despite the well trailed wider market pressures, and continue to make good progress towards our margin target.

We are committed to consistent long-term revenue growth and have confidence in further margin improvement as per our previous guidance. Our expectations for 2025/26 are unchanged and in line with market expectations"

Expectations: continued momentum is anticipated through to FY January 2026:

Graham’s view

I’m still very fond of this one, even if I no longer have a place for it on my annual watchlist, so I’ll be staying GREEN on it today.

It remains a very quiet source of news, which is something I like - little controversy or drama, just good solid operating and financial performances.

Valuation hasn’t changed much:

If you go back to pre-Covid performance, net profit margins were well in excess of 10%.

The main rate of corporation tax has increased since then and I acknowledge that this is an obstacle to getting back to those levels.

Investors might also want to think about the Deposit Return Scheme that is due to begin in October 2027.

But still, there is a nice trend of increasing profit margins at BAG - e.g. the officially adjusted operating profit margin that has improved from 12.5% to 13.4% and is expected to rise further to 14.5%.

Hopefully the net profit margin will not be too much further behind.

The chart might not seem too excited, or exciting, but these are pleasant times for BAG.

Roland's Section

Computacenter (LON:CCC)

Up 3.6% to 2,188p (£2.3bn) - Pre-Close Trading Update - Roland (I hold) - GREEN

At the time of publication, Roland has a long position in CCC.

This IT reseller and services group saw profits boom during the pandemic and again more recently as the AI rollout drove massive spending on data centres.

The picture has cooled slightly recently though, and as a shareholder I was keen to see whether today’s update would contain any further downgrade to expectations.

It looks like Computacenter has just about avoided another profit warning, but perhaps only just:

...we now expect adjusted profit before tax for 2024 to be at the low end of the range of analysts' forecasts.

Let’s take a look.

2024 trading summary: market conditions are said to have been more challenging last year. Total revenue for the year was broadly flat, up 0.5% in constant currency but down 2% reported. This highlights some forex headwinds which are also expected to have had a £7m adverse impact on 2024 pre-tax profit.

However, trading during the second half of the year does seem to have strengthened, reversing the slowdown seen in H1 (figures at constant currency):

H2 Technology Sourcing gross invoiced income +13% (H1: -14.8%)

H2 Services revenue +5% (H1: 0.6%)

The company ended the year with a record number of customers generating over £1m of gross profit per annum – this is a key metric used by the company.

While Computacenter was founded in the UK, Germany and North America now generate the largest contributions to profit.

Both markets are said to have delivered “strong performances” last year, but management admits that some Technology Sourcing projects in both the US and UK slipped from 2024 into early 2025.

2024 profit estimate: The company says H2 2024 was “Computacenter’s most profitable half-year in its history”. Adjusted operating profit for H2 is expected to be ahead of the equivalent figure for 2023, which I calculate as £153m.

Adding this to the group’s H1 24 figure of £81m gives me a 2024 adjusted operating profit estimate of at least £234m. At current levels, that gives the stock an earnings yield (EBIT/EV) of around 12% – potentially good value.

Computacenter expects to report a year-end net cash figure of £480m for 2024, excluding leases. This is ahead of the £344m figure reported for 2023, despite a £200m share buyback last year. While the year-end is a seasonal peak, this business is an excellent cash generator in my experience.

2025 outlook: the tone of the outlook comments is notably different for the three main geographic reporting regions:

UK: the increase in employer taxes from April are expected to have a £5m impact in 2025.

Europe: management remain “mindful” of uncertain macro and political conditions in some countries

North America: “we continue to be excited by the growth opportunities we see ahead”

Order intake during the second half of last year was said to be strong, driven by demand from North American customers:

...we exited 2024 in a robust position with a committed product order backlog at the end of December which is significantly ahead of our position in December 2023, as well as at the end of June 2024.

Computacenter says it expects to “make progress” in 2025, with earnings per share benefiting from this year’s £200m buyback – significant for a £2.2bn company.

Consensus estimates ahead of today were for 2025 earnings of 184p per share, putting the stock on a forward P/E of 11. That’s at the lower end of the valuation range for recent years:

Roland’s view

Computacenter is a high volume, low-margin business that generates high returns on capital through its scale and consequent ability to leverage large supplier relationships.

The reality is that there are only a limited number of customers who are large enough to be worth dealing with. In the UK and perhaps some key European markets, many of these are already Computacenter customers.

Naturally, many of the remaining growth opportunities for the group are in North America, which is also a newer market for the company.

Indeed, I wonder sometimes whether a trade sale to a US business could be the eventual exit route for Computacenter’s two founders:

Today’s update appears to be no worse than expected and the outlook looks reassuring to me. The positive share price reaction this morning may also suggest that the market now believes Computacenter’s slowdown has bottomed out (as Ed discussed recently).

On balance I think Computacenter looks in good health and could offer decent value at current levels. GREEN.

Halfords (LON:HFD)

Up 19% to 150p (£328m) - Trading Update (FY25 profit upgrade) - Roland - AMBER

The full title of today’s update includes the magic phrase “upgrade to FY25 profit expectation”.

Updated profit guidance: today’s upgrade appears to be significant. Let’s take a look at what this retail and services group has to say.

In recent months we have seen an improvement in trading alongside continued progress on a number of key initiatives, including our pricing and promotion strategies and cost reduction measures. Cumulatively, these factors lead us to expect FY25 underlying profit before tax of £32m to £37m.

I can’t find any updated broker notes today. But November’s note from Zeus suggests that Halfords was previously expected to report an underlying pre-tax profit of £28.5m for the 2025 financial year.

Taking the mid-point of today’s update suggests the company’s new guidance represents an increase of 21% in profit expectations for the year, albeit adjusted. That’s a hefty upgrade.

I estimate this could convert into underlying earnings per share of c.12p, 26% above current consensus of 9.5p per share. That would leave the stock on a P/E of 12 after today’s upgrade, broadly unchanged.

However, reading the remainder of the trading update has left me unsure whether these gains are coming mostly from cost savings, rather than any significant improvement in trading.

Q3 Trading Update: overall like-for-like sales growth during the company’s third quarter (Sept-Dec) was said to be “positive” in both Retail and Autocentres.

Sadly the company does not see fit to reveal the actual LFL figure. My guess is that it was not far above the flat result reported for H1 25.

Instead, management has cherry-picked some lower-level sales metrics to focus on recent highlights:

Strong Christmas gifting in cycling contributed to like-for-like retail sales growth of 13% in December.

In motoring, the Autocentres business enjoyed LFL growth of 10.3% in Q3 (Sept-Dec).

Colder weather has contributed to Motoring Product LFL sales growth of 5.5% in January.

The lack of disclosure of the full Q3 revenue result is disappointing, in my view.

However, it does look like Halfords is going to benefit from a significantly lower cost burden this year than previously expected:

Hedged FX rates expected to be “better than previously anticipated”

Freight costs headwinds expected to be below previous guidance of £4m-£7m

Costs “well managed”, savings on track to exceed £30m FY target

Again, no specific figures are provided for these cost benefits. But my feeling is that it’s not too hard to imagine them adding up to a few million, potentially accounting for most of today’s upgraded guidance.

FY25 outlook: the company says that recent months have seen “an improvement in trading” alongside progress on pricing, promotion strategies and cost savings.

These factors are said to have contributed to the increase in FY25 profit expectations, but it’s hard for us to get an idea of how much trading has contributed given the lack of disclosure on revenue.

FY26 outlook (Apr 25 - Mar 26): management notes “considerable uncertainty” about the UK consumer outlook. The company says that April’s National Insurance and minimum wage increase will add c.£23m to direct labour costs in FY26.

Halfords says it’s working on “possible mitigations” and makes the point that the effect of these changes on the demand environment is hard to predict – many people will benefit from the increase in minimum wage.

Consensus estimates on Stockopedia ahead of today’s update suggested FY26 earnings of 11.5p per share.

We will have to wait and see if these are updated after today’s update. Given the increased cost headwinds for FY26, I suspect forecasts will remain cautious for next year.

Roland’s view

Today’s update is clearly good news, at least as far as it goes. However, I remain sceptical given that the increase in employment costs pencilled in for FY26 could wipe out as much as 75% of today’s updated profit expectations.

More broadly, I’m not really a huge fan of this business. Halfords is exposed to lots of competitive pressures and has a relatively high fixed cost base.

The company has promised more information on how it plans to mitigate these cost increases with its FY25 results, which are normally published in June. For now, I’m inclined to remain neutral despite today’s upgrade. AMBER.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.