Good morning and welcome to today's report.

Wrapping it up there, thank you!

Spreadsheet accompanying this report: link.

| Name (Mkt Cap) | RNS | Summary | Our View (Author) |

|---|---|---|---|

GSK (LON:GSK) (£79.3bn | SR91) | Revenue +4% to £32.7bn, adj op profit +7% to £9.8bn. Adj EPS +8% to 172p, in line with exps. 2026 guidance unchanged for adj profit growth of 7% to 9%. | AMBER/GREEN = (Roland - I hold) A solid set of results, with good progress on new medicines and unchanged guidance for continued growth in 2026. GSK looks in good shape and boasts strong quality metrics. With the stock trading on a forward P/E of 11, I don’t think this business looks too expensive. I’m happy to retain a broadly positive view in the hope that recent momentum can develop into sustainable growth. | |

SSE (LON:SSE) (£29.4bn | SR71) | FY26 adj EPS expected to be 144 to 152p (previous consensus 150p). Reports improvement in Renewables output due to capacity additions. | ||

Beazley (LON:BEZ) (£6.95bn | SR69) | Zurich and Beazley have reached agreement in principle on the key financial terms of a possible recommended cash offer for Beazley: total value up to 1335p, including 25p of dividends. (Last night’s share price: 1160p.) | PINK (Graham) | |

DCC (LON:DCC) (£3.96bn | SR89) | SP +8% Q3 adj op profit “grew strongly” compared with prior year. DCC Energy saw strong trading for Energy Products, partially offset by weaker trading for Energy Services in the UK. Full year guidance unchanged. | GREEN = (Roland - I hold) A solid quarterly update that’s received a surprisingly positive reception, in my view – after all, it is only in line with previous profit guidance. I am a long-term bull here and am obviously also biased, as a shareholder. However, I believe the simplification of DCC's business into a pure-play energy group should create a higher quality business, with stronger growth prospects. While this isn’t yet fully evident in the numbers, I think the valuation and opportunity remain attractive and am leaving my positive view unchanged. | |

Atalaya Mining Copper SA (LON:ATYM) (£1.45bn | SR87) | Trafigura [Urion Holdings] has sold 14m shares at 945p, raising gross proceeds of £132m. Trafigura’s remaining shareholding is 10.9%, from 21.9% previously. | AMBER/GREEN = (Roland) [no section below] Commodity trading giant Trafigura’s investment in Atalaya stretches back to 2008, when it was EMED Mining. In 2014/15 the position was increased to c.20%, where it’s remained since. Atalaya shares have tripled over the last 12 months. While it’s hard to be sure, I think it’s likely that this has been a 10-bagger for Trafigura. By selling now Trafigura is almost certainly reclaiming its original investment and a healthy profit, while leaving the rest to run for a little longer. With copper at a 25-year+ high and ATYM shares trading at c.3x book value, this seems a logical decision to me by a very well-informed investor. I’ll leave our view unchanged today, but I might be inclined to turn neutral if the shares get much more expensive. | |

Grainger (LON:GRI) (£1.44bn | SR87) | Rental growth of 3%, in line with guidance. Occupancy at 96.0%. Outlook “strong and positive”. | ||

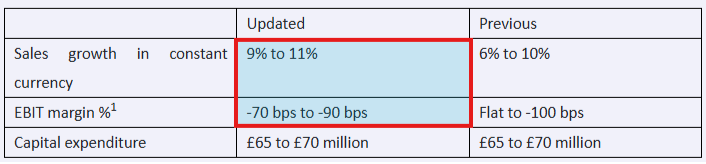

Watches of Switzerland (LON:WOSG) (£1.2bn | SR96) | Q2 sales growth ahead of exps, completed acquisition of for Rolex dealers in Texas. Upgraded FY26 guidance: sales growth 9% to 11% (prev. 6% to 10%). | AMBER/GREEN ↑ (Graham) The market’s muted reaction to this sales upgrade reflects two factors: 1) the sales upgrade is not a like-for-like upgrade, as it includes the purchase of four showrooms in the United States; and 2) the EBIT margin is now seen coming in at the lower end of the previous forecast range (although the company promises that the decisions being made now will pay off in future years). I have a generally positive view of this business (e.g. see my write-up here) and appreciate its US exposure. It also has a StockRank of 96. Therefore, a moderately positive AMBER/GREEN stance makes sense to me at this point. | |

Oxford BioMedica (LON:OXB) (£986m | SR28) | New Commercial Supply Agreement for the manufacture and supply of lentiviral vectors for Bristol Myers Squibb. Expected to generate meaningful multi-year revenue, supports the Company's existing medium-term financial guidance. | ||

GlobalData (LON:DATA) (£731m | SR25) | The company expects that admission to the Main Market (from AIM) will take place on 5th March 2026. | ||

Air Astana AO (LON:AIRA) (£437m | SR86) | New CFO is announced, effective 1st March 2026. There will be an appropriate handover period before the current CFO becomes CEO effective 1st April 2026. | ||

Gulf Keystone Petroleum (LON:GKP) (£398m | SR52) | Intention to complete listing on Euronext Growth Oslo and fully underwritten retail offer | Has applied for listing on Euronext Growth Oslo. Also making a fully underwritten retail offer of up to €1 million (price: 10% discount to VWAP between 4th - 13th February. | |

Pensana (LON:PRE) (£349m | SR21) | The final funding tranche of the $25m financing has been received and is being deployed towards the Longonjo main construction workstreams. | ||

YouGov (LON:YOU) (£259m | SR69) | SP -5% H1 in line with expectations. Low-single-digit revenue growth. “Continues to expect to deliver modest year-on-year revenue growth for the full year, while operating profit delivery will be dependent on cost management initiatives and the return on investments we are making…” | AMBER = (Graham) [no section below] We've been cautious on this one, and that continues to look appropriate after a fairly cautious outlook statement. The company reassures on the revenue outlook, with expectations continued as before, but takes a timid stance when it comes to operating profit delivery. This is not a profit warning but it can justifiably be interpreted as the precursor to one, with the exact earnings outturn dependent in the short-term on various initiatives being taken by management. The cheap single-digit earnings multiple is tempting, but YouGov's results are rarely clean and there is also £144m of net debt to bear in mind. I'd need to see clean results here before getting too excited about the opportunity. | |

Sintana Energy (LON:SEI) (£92m | SR36) | SEI’s “Patriot” subsidiaries have successfully reached agreement to resolve the previously announced arbitration against ExxonMobil re: VMM-37 in Colombia. $3 million plus a second payment of $6 million conditioned on approval by Colombian governmental agencies. | ||

Andrada Mining (LON:ATM) (£76m | SR31) | The two key conditions that trigger the initial investment by BWCAM (an affiliate of ACAM LP) as part of its staged earn-in partnership, have now been satisfied. Andrada will receive $10m towards the initial development of Brandberg West in the next few days. |

Graham's Section

Beazley (LON:BEZ)

1160p (pre-market) (£6.95bn) - Joint Statement Regarding Possible Offer - Graham - PINK

We noted recently that with Zurich having suggested a price of 1315p back in June 2025 (a fact that was only disclosed to the market in January 2026!), it might be difficult for Beazley shareholders to accept a lower offer.

The more recent proposal (at 1280p) has indeed been further improved to 1335p, or to 1310p if we exclude a 25p dividend. Last year’s dividend was also 25p, and this level of dividend is easily covered by earnings.

Some quick calculations suggest to me that Beazley’s net tangible assets per share are likely to be around 558p currently; if true, this suggests that the new 1335p offer is at a P/TBV multiple of 2.4x. This now approximately matches the multiple that was offered in June last year.

So if this new offer is accepted by shareholders, then perhaps we can conclude that last year’s offer would also have been accepted, if the Board had only made it public?

Either way, Beazley has been a tremendous success for its investors. Hiscox (LON:HSX) and Lancashire Holdings (LON:LRE) shares are still trading in London for anyone who wishes to stay involved in the sector.

Watches of Switzerland (LON:WOSG)

Unch. at 513.5p (£1.2bn) - Q3 FY26 Trading Update - Graham - AMBER/GREEN ↑

The market hasn’t responded with much excitement to this update, but it’s a decent one:

Trading throughout Q3 FY26, including the Holiday trading period, was strong across the Group, consistent with trends in the first half of the year and with sales growth ahead of expectations.

US trading

In the US, WOSG made an acquisition last month: Deutsch & Deutsch, an authorised distributor of Rolex, Roberto Coin, etc., with four showrooms in Texas.

The combined annual revenues of these four showrooms is $67m, “with profitability in line with [WOSG's] existing US retail business”.

That brings WOSG’s total number of “Rolex anchored” showrooms in the US to 25.

A brief update on this acquisition today:

The initial integration is progressing well, and the Group looks forward to realising the strategic benefits of the acquisition.

More generally, WOSG has seen “sustained broad-based growth across categories, brands and price points” in the US.

UK trading: conditions have been “consistent with recent periods”, which I interpret to mean somewhat muted (context: UK and Europe revenue growth in H1 was 2%).

CEO comment:

"I am pleased to report another period of strong performance, building on the sales momentum established in the first half and reflecting strong trading over the Holiday period…

"It is particularly pleasing to be achieving these results despite an unusually volatile operating environment, including macroeconomic uncertainty and tariffs, and is testament to the collective contribution of our colleagues which will be reflected through our staff incentive arrangements.

N.B: the reference to “staff incentive arrangements” suggests to me that we could be looking at a heftier share-based payments charge for this year, compared to previous years, and/or larger cash bonuses to staff.

Checking recent results, I note that the SBP for each of the last two years has been roughly in the order of £2m. Just something to be aware of, as usual, when “adjusted EBITDA” is mentioned - it doesn’t include the effect of any SBP-related dilution.

But WOSG’s typical level of SBP expense is not excessive, in my view, against operating profits of over £100m every year (with forecast operating profits of over £160m for the current financial year).

Outlook: upgraded guidance.

A reason for the market’s muted reaction might be the tightening of EBIT margin guidance at the lower end of the range:

So with a slightly higher range of forecast sales at what could be considered a slightly disappointing EBIT margin, I guess it washes out roughly even compared to prior investor expectations.

And very importantly, the sales growth shown above is not like-for-like; it includes the effect of the Texas acquisition.

Drilling into the EBIT margin in more detail, for those who really want to get into the weeds:

We expect EBIT margin % to improve in the second half of the year compared with the first half. Updated guidance reflects the impact of brand margin adjustments, product mix, and one-off items relating to Roberto Coin department store debtor provisions as well as infrastructure investments in US ecommerce and Group marketing. These investments will support growth and profitability in future years.

I read this as a tacit acknowledgement that the EBIT margin is a little lower than might have been achieved, but a promise that it will be worth it later.

Graham’s view

I selected this as one of our “12 Stocks of Christmas” series, emphasising the US focus which has only intensified in 2026 after the Texas acquisition.

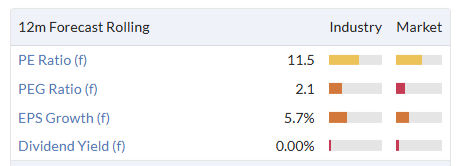

It continues to carry an excellent StockRank, qualifying as a Super Stock:

And the valuation is not too punchy (although in the bricks-and-mortar retailing sector, it shouldn't be):

One interesting point is whether tariffs might have pulled forward demand into H1 of the current financial year. Just before the Texas acquisition was announced, I looked into this question and noticed that most revenues (52%) were still forecast to come in H2.

For now, Switzerland has secured a 15% tariff, in line with the EU, so I’m not currently expecting a major tariff impact on WOSG.

There are some risk factors here which are unavoidable: exchange rates, in particular. And the tariff question doesn’t feel entirely settled at this point.

With the company enjoying strong profitability and hitting its targets, Mark’s AMBER stance strikes me as a little ungenerous; I’m comfortable with AMBER/GREEN.

Roland's Section

GSK (LON:GSK)

Up 3.6% at 2,016p (£82bn) - Final Results - Roland - AMBER/GREEN =

(At the time of publication, Roland has a long position in GSK.)

Investors have recently gained new levels of enthusiasm for the UK’s second-largest pharmaceutical company. GSK’s share price has now broken out of its 10-year trading range and is currently trading at a 24-year high:

Whether this will prove to be a false dawn or a genuine move to close the growth and valuation gap with rival AstraZeneca remains to be seen.

New CEO Luke Miels has a good reputation and is seen as having played a key role in rebuilding the group’s portfolio and pipeline in his previous role as COO. Today marks his first set of results in charge following the departure of Dame Emma Walmsley at the end of last year.

2025 results - key points

Today’s full-year results are reassuringly in line with expectations and include unchanged forward-looking guidance.

Revenue up 4% to £32.7bn (+7% at constant exchange rates)

Adjusted operating profit up 7% to £9.8bn (+11% CER)

Adj EPS up 8% to 172p (+12% CER)

Operating cash flow up 14% to £8.9bn

Full-year dividend up 8% to 66p per share

Trading commentary: for a pharmaceutical company of this size, a key requirement is to develop (or acquire) a steady supply of new blockbuster medicines (annual sales >$1bn) which can move the needle and replace previous big sellers whose patent expiries are approaching.

I’ve highlighted some recent regulatory approvals for new significant products in recent weeks (e.g. here, here and here). Today’s results include a summary of recent progress:

5 major FDA approvals: Blenrep, Exdensur, Nucala COPD, Penmenvy, Blujepa;

7 “pivotal trial starts” in 2025

29 projects currently in clinical development in Oncology and Respiratory, Immunology & Inflammation (RI&I).

There is huge amounts of detail on all of this in today’s results, but I don’t have the sector knowledge (or space) needed to try and dissect it here. I’d recommend taking a look yourself if you would like to go deeper.

Looking across the business, sales growth was concentrated in the Specialty Medicines division, which includes HIV, RI&I and Oncology:

Specialty: revenue +17% CER to £13.5bn;

Vaccines: revenue +2% CER to £9.2bn;

General Medicines: revenue -1% CER to £10.0bn.

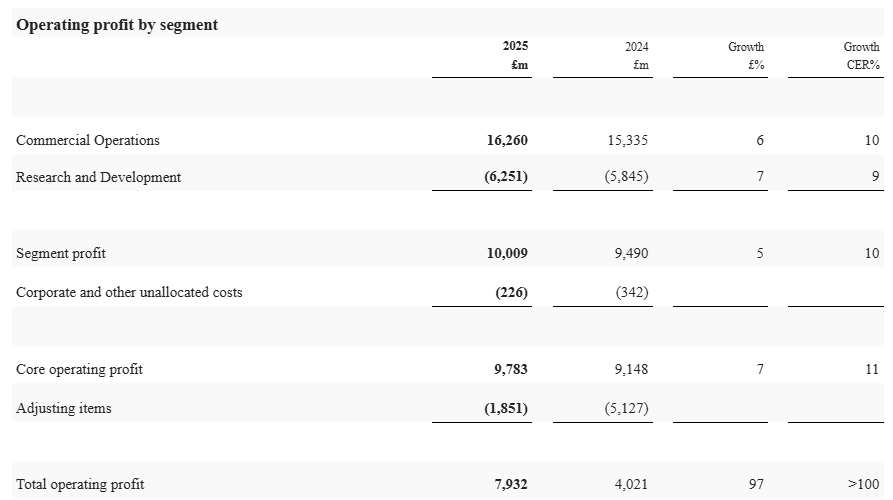

Profitability: sadly, GSK no longer reports divisional operating profits for each of the categories above. Instead, these are lumped into a single “Commercial Operations” segment, profits from which are offset by notional losses from the R&D operating segment:

While the lack of divisional reporting is frustrating for investors, I can imagine that the political sensitivity of medicine pricing might make it expedient to obscure the profitability of individual product segments. Today’s results note that in December 2025, GSK entered into “an agreement with the US Administration to lower the cost of prescription medicines for American patients”.

What we do know is that GSK’s overall operating profit margin improved in 2025:

Core [adjusted] operating margin: 29.9% (2024: 29.2%)

Reported operating margin: 24.3% (2024: 12.8%)

The big change in the reported operating margin over the last year largely relates to legal costs – in 2024 GSK booked a £1.8bn charge relating to heartburn medicine Zantac, in settlement of allegations that it caused cancer.

Whether this should be adjusted out of profits or not is a personal choice. I would be inclined to view this kind of situation as a regular risk of doing business for pharmaceutical firms, but its inclusion does make it harder to gauge underlying progress on current sales.

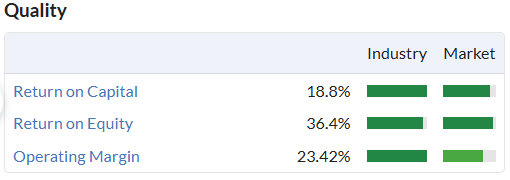

Turning to other measures of profitability, my sums suggest a return on capital employed of 20% and return on equity of 35.8%, both calculated on the same basis used for the StockReport. These numbers show a modest further improvement over the TTM figures:

Cash flow & Balance Sheet: I am always encouraged when a company’s own measure of free cash flow matches up with my own calculation. That’s true here. Last year’s net profit of £6.3bn converted into free cash flow of around £4bn, prior to £1.7bn of acquisition spending.

Net debt rose by £1.4bn to £14.5bn during the year, as this acquisition spending was added to £2.6bn of dividends and £1.4bn of share buybacks.

While I’d probably prefer to see GSK dial back the buybacks, I am comfortable with this level of borrowing, which equates to 1.3x adjusted EBITDA or 2.3x net profit (a measure I prefer to use).

Outlook

GSK helpfully provides explicit guidance for the year ahead, which is unchanged today:

Turnover is expected to rise by 3% to 5%;

Core operating profit to rise by 7% to 9%;

Core earnings per share to rise by 7% to 9%;

Dividend expected to be 70p per share.

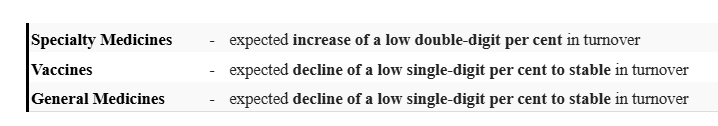

Once again, sales growth is expected to be driven by the Specialty Medicines business, with flat or declining results expected elsewhere:

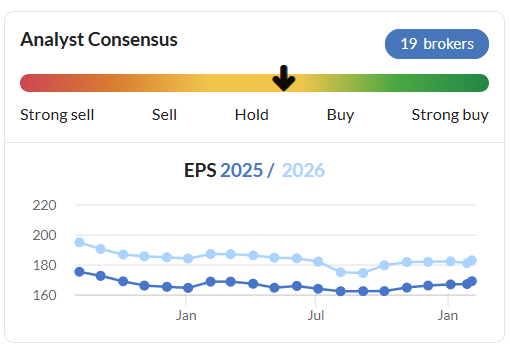

The StockReport consensus forecast currently suggests earnings of 183p per share for 2026. That would represent a 6.4% increase over today’s core EPS of 172p, so I wonder if we might see earnings forecasts tweaked slightly higher over the coming days, building on modest upgrades over the last six months:

Roland’s view

GSK still has to prove that it can deliver sustainable growth over longer periods. Press commentary suggests that analysts have mixed views on the credibility of the company’s medium-term target of hitting £40bn revenue in 2031.

However, hitting this target would only require the 4% growth rate seen last year to be maintained for the next five years, so I would like to think the idea of £40bn in annual sales isn’t completely unrealistic.

As things stand today, GSK shares trade on 11 times FY26 forecast earnings, with a forward dividend yield of 3.5%.

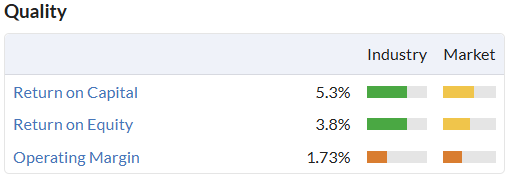

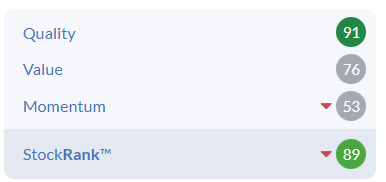

For a business of this size and quality, I don’t think that’s expensive. While there are certainly opportunities for disappointment, I think it’s reasonable to maintain our broadly positive view today, reflecting the company's strong quality and momentum credentials:

DCC (LON:DCC)

Up 8% at 5,020p (£4.3bn) - Q3 Trading Statement - Roland - GREEN =

(At the time of publication, Roland has a long position in DCC.)

Investors have given today’s third-quarter update from this FTSE 100 energy distribution and services group a surprisingly positive update. Surprising to me, at least, because it’s an in line update, with profit guidance for the year to 31 March 2026 left unchanged. Perhaps the market was expecting a cut to guidance.

Q3 update - key points

Adjusted operating profit “grew strongly” compared to the same period last year;

Organic growth was positive and there was also a contribution from November’s acquisition of FLAGA in Austria – a typical bolt-on deal for the Energy business, which has a long track record as a consolidator. See here for other recent deals – DCC has recently entered a number of new European markets where consolidation opportunities exist.

Energy: the larger part of this business is Energy Solutions.

Within this, Energy Products supplies liquid fuels and gas to business customers and off-grid users.

There’s clearly a heavy seasonal component to this, so it’s too soon to be sure how the full year will turn out. However, management reports a “strong performance in Energy Products” with weather impact to date “broadly in line with the prior year”.

The other part of Energy Solutions is Energy Services, which provides services such as renewable installation and energy management solutions for SMEs. Performance was weaker here, due to “challenging trading conditions” in the UK.

Given that the period included November’s Budget, perhaps we might hope for some improvement in customer confidence going forward.

Finally, DCC Energy’s Mobility business is said to have performed well “generating excellent organic profit growth during the period”. Mobility operates service stations and provides fleet services to commercial operators. It generated c.25% of overall Energy profits last year.

Restructuring: DCC has sold its Healthcare business (see below) and is on track to complete the disposal of its Technology distribution operations by the end of calendar 2026. This will create a pure-play energy business.

This is a strategy that makes sense, in my view, as Energy is by far the largest and most profitable part of the group.

Outlook

We don’t have access to broker notes for this business, so we’re stuck with management guidance. This is clear, but not very specific:

Outlook - Operating profit guidance for year maintained

DCC continues to expect that the year ending 31 March 2026 will be a year of good operating profit growth on a continuing basis, significant strategic progress and ongoing development activity.

Broker forecasts have trended somewhat lower over the last year, but appear to have stabilised recently:

I would expect forecasts to remain stable today, or perhaps even edge higher, based on the market reaction.

On this basis, DCC’s valuation looks undemanding, on a FY26E P/E of 11.5, falling to a FY27E P/E of 10.

The dividend – which hasn’t been cut for 31 years – offers a useful forecast yield of 4.2%.

Roland’s view

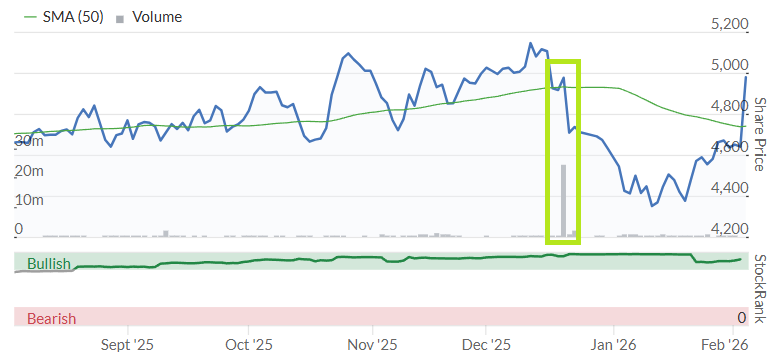

There are a couple of points I think are worth making here. The first is that the recent share price graph looks a little weird:

The reason for this is that DCC completed a £600m tender offer at 5,170p in December to return some of the proceeds from the sale of its Healthcare business. I’m not entirely sure why the shares fell so sharply in the aftermath, but this effect now seems to have worked its way through.

Investment case: the second – and more important – point is the basis for the investment case here, at least as I see it.

By selling its Healthcare and Technology businesses, DCC plans to become a pure-play Energy business. Energy has historically generated mid-teens returns on capital (at least using DCC’s own calculations) and is by far the largest and most profitable part of the group.

While the Energy strategy remains heavily focused on liquid fuels and gas, DCC is also leaning into renewables and transition solutions through its Services business. This has been quite acquisitive in recent years.

There are a couple of risks I think are worth flagging at this point.

The first is that while DCC’s QualityRank is high, its profitability has been very poor on a statutory basis:

I accept that these figures probably need to improve to justify a higher valuation. My analysis suggests statutory profitability should improve when the non-Energy businesses are removed, but I can't be certain of this as the level of information available in the balance sheet doesn’t fully separate out divisional operations.

The second risk is that while I am confident in DCC’s ability to make money from its traditional fuels business, my feeling is that the profitability of Energy Services is less proven. This is especially true for businesses that have only been acquired in recent years – are they generating attractive returns on capital?

My hope is that there will be an improved level of reporting disclosure on Energy Services over time, when the restructuring is complete.

My view: Full disclosure – I have held DCC shares for a number of years and recently added to my holding, which is a top six position for me.

Naturally I am biased, but my view is that the Energy business should be able to deliver attractive profitability and growth over time, justifying a materially higher valuation on a medium-term view.

Even in the absence of high rates of growth, my feeling is that the current valuation is undemanding. When the simplification of the business feeds through to the statutory accounts, I believe DCC could start to look like a higher quality operation.

The StockRanks were taking a Neutral view ahead of today’s update, but do flag up fairly strong Quality and Value metrics. I think that's consistent with my view that this business has the potential to enjoy a re-rating over time.

For all of these reasons, I am leaving my previous positive view (April 2025) unchanged today.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.