Good morning,

Paul is taking a well-deserved break today. So I'll be covering today's trading updates solo!

Last night, Paul added a few more sections to his report, which now includes all of the following (click here to read):

- AO World (LON:AO.)

- JD Sports Fashion (LON:JD.)

- Moss Bros (LON:MOSB)

- Mothercare (LON:MTC)

- Robinson (LON:RBN)

(Yesterday's Part 2, covering Premier Oil (LON:PMO), SuperGroup (LON:SGP), GYM (LON:GYM), Stadium (LON:SDM) and STM (LON:STM), is here.)

Onward!

Countrywide (LON:CWD)

Share price: 176p (+3.5%)No. shares: 216m

Market cap: £381m

In line with the range of expectations for 2016:

Total group income for the year was circa £737m (2015: £734m) with income for Q4 of £179m (2015: £196m).

EBITDA for 2016 is expected to be in line with the current range of market expectations.

As anticipated, the underlying level of market transactions in Q4 continued to run below 2015 and we continue to expect full year 2016 market volumes to reflect a drop of circa 6% on 2015 levels.

Countrywide notes that Lettings provided an offset to weaker Sales volumes (which sounds rather similar to Foxtons (LON:FOXT) ).

Elsewhere in the statement:

The roll-out of our digital proposition remains on track and we continue to see performance in line with our expectations

For an example of the online sales effort, see the Frank Innes website. The fixed fee is a little bit lower than the Purplebricks ex-London price. Perhaps these hybrids can stand their ground?

There is not much success priced in here. The PE ratio (7.5x) and Dividend Yield (6.9%) make it a contrarian play.

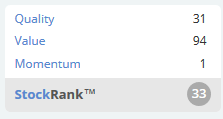

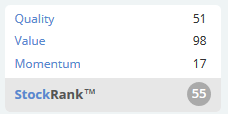

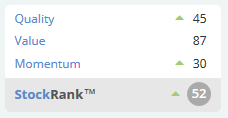

Countrywide has a superb Value Rank, but shockingly poor Momentum:

Share price momentum:

My opinion

I think a cheap rating makes sense here: Macro cyclicality plus online competition plus lack of barriers to entry. But maybe the rating is cheap enough now, making it a pretty reasonable hold.

Lavendon (LON:LVD)

Share price: 265.6p (+0.4%)

No. shares: 170m

Market cap: £452m

I'm surprised that the shares are only up by 0.4%, but remember that this is a bid situation, with rival bids currently sitting at 260p and 261p.

So shareholders pushing the price higher today might lose out, if the company ends up accepting one of those bids (the BoD previously said they intended to recommend the 260p offer).

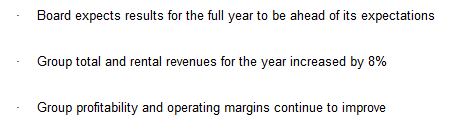

The 8% growth rate mentioned above is at constant exchange rates; at actual rates, revenues increased 15%.

The translational impact of currency also increases the debt position, which is now £157 million.

I see that Lavendon qualifies for the James Montier "Unholy Trinity" short-selling screen, which reflects high asset growth and a weak financial health score.

I think that's more a reflection of the industry it's in than of Lavendon itself, which appears to have executed its strategy very well. But I'd happily bank gains at 260p, based on what seems to qualify as a fair valuation range in this sector. Just my opinion!

Debenhams (LON:DEB)

Share price: 56.6p (-1.2%)No. shares: 1228m

Market cap: £695m

Listening to the conference call, the emphasis on non-clothes sales is apparent. Non-clothing is up to 57% (up from 55% last year, so it's not a dramatic change).

The numbers are all reasonable, although like-for-like sales in constant currency (the best measurement, in my view) are almost flat.

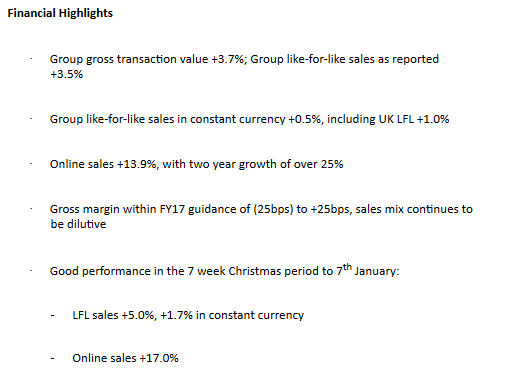

The main interest here in terms of growth is online - see the 13.9% and 17% growth rates mentioned above.

Online sales are still quite small, unfortunately, relative to the size of the company as a whole (less than 15% of total sales in the previous financial year). So the primary valuation here needs to be on offline sales.

Net debt of £280 million means that the enterprise value is c. £950 million.

With brokers forecasting EBIT of c. £120 million this year, that's still rather cheap-looking, even for a low-growth retailer.

The problem is that it's hard to see any growth drivers, apart from online, in the medium-term (typical customers are in their mid-40s; strategy now is around trying to connect with a younger audience).

So it's hard to get very excited about the opportunity, as you might expect for a value share. It could be a nice buy-and-hold opportunity, if you think there is good longevity in the brand.

Mitchells & Butlers (LON:MAB)

Share price: 268.5p (+3%)No. shares: 414m

Market cap: £1,076m

An encouraging update from the owner of O'Neill's, All Bar One, Harvester, etc.

Like-for-like sales growth for the year-to-date has increased to 1.7%, continuing to build on the progress reported earlier in the year. Trading over the festive period was particularly strong across all brands, with like-for-like sales growth of 4.7% for the four weeks to 7 January 2017.

Total sales have increased by 2.3% in the year-to-date.

There is a reminder that increased cost pressure will hurt margins - Living Wage, presumably. Checking back to the full year results, there were a couple of headwinds mentioned in relation to margins:

- Living Wage

- Potential increases in National Minimum Wage

- Foreign currency purchases

- Business rates

I would need to do quite a bit of work to figure out if there is value here: the PE ratio is a measly 7.5x, the performance seems to be improving, the brands are valuable, and yet there are headwinds beyond the company's control and an interesting capital structure which includes £1.8 billion of net debt.

Dunelm (LON:DNLM)

Share price: 694p (-6.5%)No. shares: 202m

Market cap: £1,400m

Shares in Dunelm are down by 13% in total, following yesterday's Q2 trading update.

Total revenue for the second quarter rose by 6.6% to £261.9m. Total revenue, excluding the acquisition of Worldstores, for the second quarter rose by 3.3% to £253.8m. Total like-for-like (LFL) growth (combining LFL stores and Home Delivery) increased by 0.2%. Due to the change in the accounting period end date, the figures include six days of the Winter Sale, compared to eight days in the comparative period last year. Without this impact LFL growth would have been approximately £4.0m higher (equivalent to 1.7% in the quarter and 0.9% over the half year). We expect this to reverse in the second half of the year.

So many numbers to get through, before we get to the most meaningful ones!

Basically, like-for-like sale are up 1.7% in the quarter (or +0.2%, if you don't adjust for the different exposure to Winter Sales).

The problem within that is that within like-for-like, LFL Stores are much weaker than LFL home delivery (and Stores account for more than 90% of sales).

LFL store sales are down 1.4% in Q2, compared to the corresponding period in the previous year. For H1 as a whole, LFL store sales are down 3.1%.

Gross margin

Gross margin for H1 is said to be "broadly flat", year-on-year. Importing is getting more expensive for sourced items. From a valuation point of view, it seems prudent to assume that margins are softening.

It makes for a nervous picture: like-for-like sales on a downward trend, and margins under pressure.

Leadership

Dunelm's founder remains on board as President and as a major shareholder, which for me is a good sign.

The Chief Exec, previously CEO at tesco.com and Dixons Retail, and with a short-lived stint as Head of Retail at Apple, spent the first ten years of his career in banking and consulting. I suppose he must be doing well, if the Board are happy with him - but for me, it's not an ideal CV for the top job here.

Overall, I can't help but feel lukewarm toward these shares.

That's about it for today. Sorry I didn't have particularly strong views on any of today's stocks - it goes like that sometimes!

Thanks for reading.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.