Good morning!

I'm giving Paul a break after a couple of mammoth weeks on the job here.

His top holding has announced a trading update, and there are plenty of other stories for us to digest.

I'm not sure how far I'll get, but these are all the small-caps I noticed which made announcements this morning.

Finished at 5.20pm: Made it as far as APTD.

- Sosandar (LON:SOS)

- Audioboom (LON:BOOM)

- Kape Technologies (LON:KAPE)

- Distil (LON:DIS)

- Mincon (LON:MCON)

- Aptitude Software (LON:APTD)

Not covered today:

- AFH Financial (LON:AFHP)

- Argo Blockchain (LON:ARB)

- Accrol Group (LON:ACRL)

- Renewi (LON:RWI)

- Bonhill (LON:BONH)

- M&C Saatchi (LON:SAA)

- Tekcapital (LON:TEK)

- Coral Products (LON:CRU)

In the world of big-caps, Fevertree Drinks (LON:FEVR) announced revenue growth of 10% - "below the Board's expectations, primarily reflecting subdued Christmas trading in the UK".

Fever-tree's margins have also declined, and it says 2019 earnings will be 5% below those of 2018.

That is not baked into any public forecasts I can see, and I would therefore expect to see significant selling pressure on the stock this morning.

Long-term prospects are probably still excellent, I think - I've been thinking about buying into it for a while, and will be checking to see how far it falls today!

Sosandar (LON:SOS)

- Share price: 28.25p (pre-market price)

- No. of shares: 163 million

- Market cap: £46 million

I'm happy for Paul and other holders of this share:

Revenue for the full year on track to be ahead of market expectations

But the loss for the year will also be higher then expected:

Given the upfront cost of acquiring new customers against the benefit over the lifetime of the customer, the Company expects this investment to result in the net loss for the full year being higher than previously anticipated with the increased benefit to be experienced in future years.

Sosandar's plan is to build its customer base through aggressive marketing spend, and then to profit in the long-run on the back of significant repeat orders.

There is no doubt that it could work. I understand that a customer list and a customer relationship are valuable assets. It might be worth suffering losses in the short-term, for the sake of building them.

But in the end, I think you still need a differentiated product or customer experience, not just a big marketing spend. Without that element of differentiation, the business will ultimately wither, if the market spend slows down.

For now, Sosandar's revenues are enjoying the rush caused by a big advertising budget.

Key highlights of today's Q3 (October to December) update:

- Q3 revenue of £3.8 million (versus combined Q1 and Q2 revenue of £2.8 million)

- active customer database >110,000 (up 93% year-on-year, up 47% during the quarter)

- repeat orders +140% (not too relevant, since the company is still so young)

Figuring out the customer list

I've been a little slower than expectations this morning (!) due to some work trying to figure out the customer database at Sosandar.

The CFO has written back to me to confirm that the customer database (currently standing at 208k) includes prospects, i.e. people who have given their email address but haven't placed an order yet. While this is an interesting number, I can't use it to analyse customer longevity, since it doesn't necessarily have anything to do with orders.

The success of the business plan hinges on this notion of longevity: will customers come back, unprompted by expensive advertising, to make more orders? It is these unprompted orders which will ultimately create a profitable business.

Focusing on "active customers" (i.e. those who have placed an order in the last 12 months), that metric is up from 62,200 in March 2019, to 110,000 December 2019.

And repeat orders reached 51k, out of 84k total orders in the quarter.

That doesn't sound too bad, actually: it means that 60% of the orders in the quarter were of the profitable kind, rather than first-time orders triggered by a costly advertisement on TV, Google, etc.

Cash drain

Sosandar reports a cash balance of £6.9 million at the end of September.

By the end of December, this had reduced to £4.2 million, i.e. down by £2.7 million.

The company points to a £1.6 million increase in inventory during the quarter, "increased stock landing pre-Christmas for post-period selling".

If the company intends to grow, then inventory is only going to go in one direction and so I would expect cash to be continuously converted into inventory.

Setting that that to one side, the ex-inventory cash burn is £1.1 million.

Current trading

Trading in January sounds good:

Sosandar saw steady progress in performance month-on-month, with October revenues up 108%, November up 138% and December up 153% year on year. This momentum has continued post-period, with January tracking up over 160%, and pleasingly repeat order performance is exceeding that in the highly successful Autumn/Winter period.

My view

As much as I enjoy gambling, I don't do it for large sums. So let me be clear that I've never seriously considered investing in this one, as I consider it to be a startup.

The cash burn is very significant, although I wouldn't necessarily fault the company for this: it is carrying out its business plan, albeit with slightly more aggression than might have been anticipated.

A growing pile of inventory is inevitable if it intends to grow. Similarly, if the plan is to rapidly grow the customer base, the upfront losses are inevitable.

Many industries work on this basis, not least financial services. One of my former employers used to suffer nasty losses whenever it signed up a new customer, as the bonus for the salesman would be worth several years' worth of revenues from each customer. The company expected the customer to stick around for decades, however, so it was good business. In insurance, we call it "new business strain".

The FY March 2020 forecast was for a pre-tax loss of £3.8 million. I will presume this is now going to be £4 million+.

If things go to plan, then FY March 2021 should see many of the recent customers making fresh orders without expensive prompting - perhaps just with the prompting of a cheap email.

The final result will depend on how aggressively the company wishes to keep growing: will it continue to spend on TV ads, for example? Or will it harvest the proceeds of work done in previous orders, and accept a greater proportion of repeat orders?

The problem with valuing a share like this is that a valuation exercise needs a "steady state" or a reasonable terminal growth rate. Extreme growth rates can't last forever, but predicting whether they will end in success or failure for a company like this relies on all sorts of assumptions.

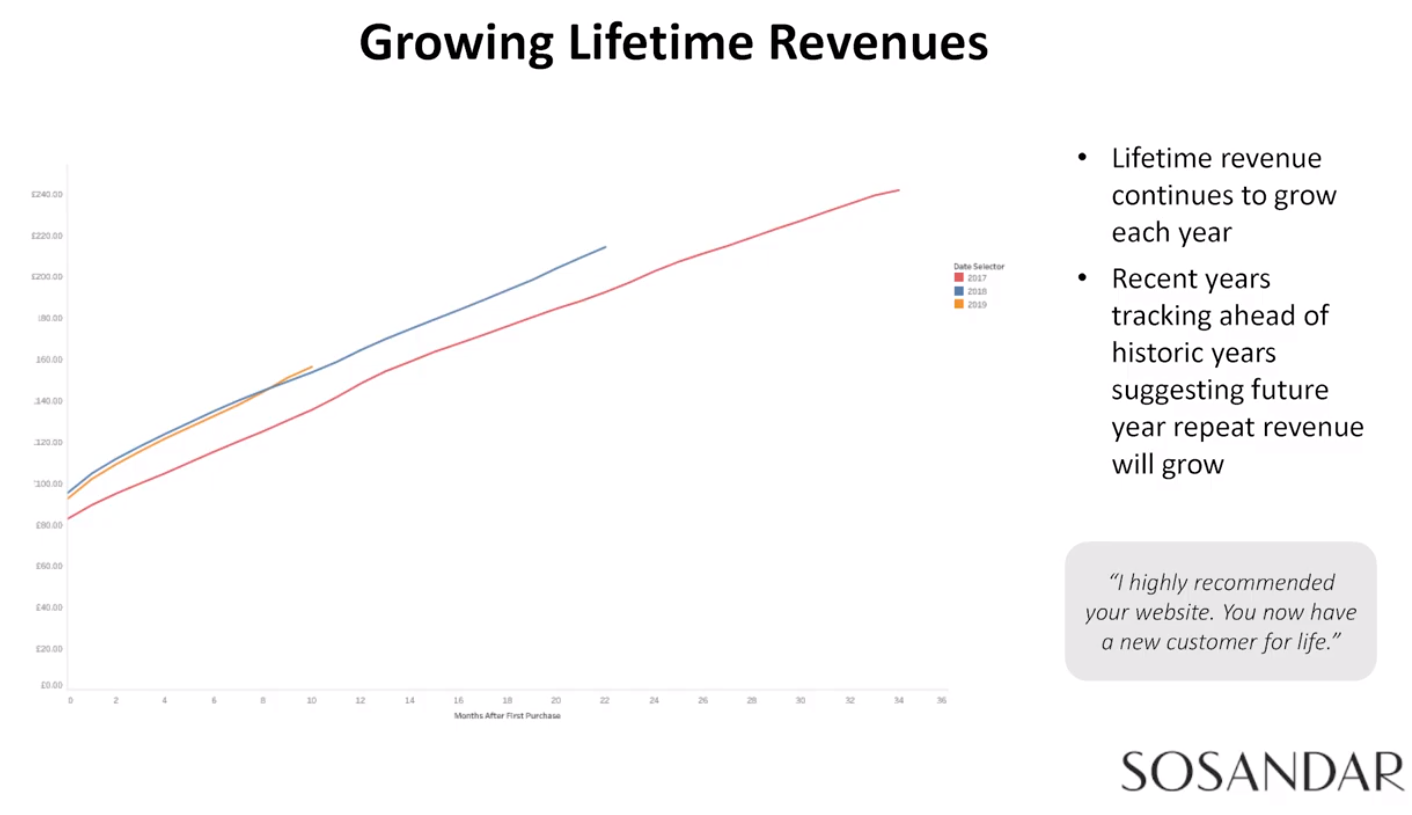

The primary assumption is customer lifetime value. I've stolen this chart from a PIworld video produced in December (about five minutes in):

What it says is that the average customer continues to generate revenue for Sosandar, even nearly three years later (the red line). There is perhaps an ever-so-slight reduction in the rate of revenue generation by these customers. The question is: at what point do they start to level off and stop becoming revenue generators?

The blue line shows more recent customers, over their first approx. 2 years since acquisition. They are more valuable than the earlier customers, and they continue to generate revenue at a steady pace. Great news for Sosandar!

If I was seriously considering this share, I'd want to know how many years it will take until a customer pays off their acquisition cost. Has anybody asked the company this?

It might be commercially sensitive info, since it's the sort of basis on which these online retailers compete against each other. More expensive marketing means faster growth, but needs a much bigger customer response to justify it. And if you spend more per customer acquisition, then you will have to wait longer for each customer to pay back their acquisition cost.

The main risk that I would like to flag, which might turn out to be a false alarm, is the possibility of another fundraising.

In April 2019, the FY March 2020 operating loss was forecast to be £1.6 million. As stated above, I think we can now pencil in a loss of £4 million+.

Back in April, I said that I was leaning towards the view that another fundraising would be needed "in about a year". The subsequent fundraising happened much sooner than that, in July.

At the time, Sosandar's cash pile was c. £3.6 million, i.e. not much smaller than its current level.

I would therefore pencil in another fundraising over the next twelve months.

I could be wrong about that, but if I'm right, then shareholders need to take into account the possibility that it happens at an unfavourable level.

That's the big problem with companies which need cash injections. If it happens at a low share price, and if you don't take part in it, then the dilution can be a serious drag on your future returns.

FY March 2021 now seems to be a make-or-break year for Sosandar. If repeat orders come through in sufficient numbers to fund the company's marketing budget and other overheads, it will have proven the business model. If it doesn't, then it will remain in the highly speculative bucket in which it currently sits.

Some back of the envelope calculations:

- 51,300 repeat orders in Q3 annualises to c. 205,000 repeat orders

- average order value £102 implies £21 million total order value

- after returns and COGS, you might get gross margin of £5 million from this (based on H1 performance stats)

Putting it all together, I can no longer see FY March 2021 producing a breakeven result, unless marketing spend was stripped to the bone and the company was content to let the gross margin from repeat orders cover its overheads. Which would sacrifice its growth opportunity, at least in the short-term.

It's still very possible that this could come good for shareholders, but it's only suitable for the adventurous, in my view!

Audioboom (LON:BOOM)

- Share price: 234.4p (-3%)

- No. of shares: 14 million

- Market cap: £33 million

Audioboom (AIM: BOOM), the leading global podcast company, is pleased to provide an unaudited trading update for the 12 months ended 31 December 2019.

This started life as a tech company, with an audio platform. It's now a content company, buying up podcasts to publish on the platform.

I've been bearish on it for as long as I can remember. The platform didn't seem to have any chance of succeeding as a stand-alone product.

Its current incarnation as a publisher involves paying upfront to make and buy content, and then hoping to get a return on the investment through advertising income.

2019 sees it turn in an adjusted EBITDA loss of $3 million, which is at least a reduction on the loss in 2018. Revenue nearly doubled to $22 million.

This bit is comical:

The Board is pleased to report this strong performance for the year to 31 December 2019 with the Company exceeding market expectations for the first time in its history.

This is comical because:

- a) Audioboom has been around for a long time,

- b) it is still making significant losses, and

- c) exceeding market expectations only requires a company to set conservative forecasts. That's basically the only thing a company needs to do, to exceed market expectations.

To get a sense of H2 growth, let's compare it versus the H1 result:

- H1 revenues $9.8 million

- H1 adjusted EBITDA loss $1.4 million

So in H2, we must have had:

- H2 revenues $12.2 million

- H adjusted EBITDA loss $1.6 million

This doesn't provide us any evidence of operational leverage working in the company's favour in H2, but at least there was some revenue growth.

My view

As a stand-alone audio publisher, producing content and monetising it through advertising, I actually find this story less attractive than the Netflix ($NFLX) business model.

At least with Netflix, there is recurring revenue from customers.

With Audioboom, the customers are principally the 300-odd advertisers. It could work, but I'd prefer to see a focus on having thousands of individual customers paying small amounts every month or every year, instead of selling B2B. Especially if it's premium content - aren't customers usually happy to pay for content of superior quality?!

We can also compare Audioboom to Youtube*, which makes most of its revenues from B2B advertising.

YouTube works well as a consequence of the network effects at play: it's the default place where people go to publish their video content, because it happens to be the place where all the viewers are.

Audioboom doesn't have the scale to support significant network effects, so instead of creators coming to it with their content, it has to buy their content off them - much less attractive.

Good luck to Audioboom, but I see zero evidence so far of a sustainable business in the making.

*I have a long position in Alphabet ($GOOGL), the parent company of Youtube.

Kape Technologies (LON:KAPE)

- Share price: 169p (+5%)

- No. of shares: 154 million

- Market cap: £260 million

Kape (AIM: KAPE), the digital security and privacy software business is pleased to provide an update on trading for the year ended 31 December 2019.

I covered this stock in November when it announced the large (£74 million) acquisition of a VPN company ("PIA").

The company says it has a "SaaS operating model". While the phrase "SaaS" is over-used and overvalued at present, I have been impressed by this company's numbers to date:

Kape's user base grew to 2.35 million subscribers at year-end (30 June 2019: 1 million), comprising 74.3% organic growth within the privacy vertical not including PIA. Reflecting the growth in our customer base, Kape expects to deliver $98.8 million1 in revenues from existing customers in future financial years, up 260% (30 June 2019: $38.0 million).

That $98.8 million includes deferred revenue (where the customer has already paid, but the revenue hasn't been booked yet) and what the company calls "first renewal of the existing user base". If it only counts one renewal, then maybe it's a conservative estimate?

This goes back to the Sosandar debate, which applies to many companies across different industries. When you acquire a new customer, how long will you have them for? And therefore how much revenue will they generate?

FY December 2020 guidance is reiterated, and is important since the company is now much larger after the acquisition:

- revenue $120 million - $123 million

- adjusted EBITDA $35 million - $38 million

The market cap is worth c. $340 million, and net debt is around $36 million. If you want a number to compare against EBITDA, the enterprise value is c. $376 million, giving us an EV/EBITDA multiple around 10x.

I expect that the amortisation charge will be pretty big in the wake of the acquisition (usually there are a lot of acquired intangibles that have to be amortised). Many investors are happy to ignore this charge and look at EBITDA instead.

Where exactly is it?

Noting that Kape is registered in the Isle of Man, I have checked the locations of its employees on LinkedIn. This is what I get:

I'm not sure what to make of this but clearly it's something you would want to be aware before investing in it!

The same test for the recently acquired company, Private Internet Access, shows almost all employees based in the United States.

(By the way, this is a very handy service by LinkedIn. All you need to do is type in the company name at the top (as if you were searching for an individual).

When you find the company page, click "People" and you get company analytics. Seeing where the company's employees consider themselves to be resident is a great help to find out where the company is "really" based, not where it tells you that it is based!)

The bottom line for Kape is that its recent acquisition is based in the US but its PLC employees are a more mysterious bunch.

Sell-side analysts have made no changes to estimates, despite EBITDA coming in slightly ahead of expectations for 2019. EBITDA is forecast to reach $40 million in 2021, generating free cash flow of $20 million.

Based purely on the numbers, this looks fairly valued to me at present. I can't tell whether the company's services are truly differentiated or not, but I do think that it looks quite promising from a quantitative point of view.

Distil (LON:DIS)

- Share price: .801p (+14%)

- No. of shares: 502 million

- Market cap: £4 million

Allow me to briefly mention this tiny tiddler. It develops spirits brands - its flagship brand is Redleg Spiced Rum.

I took a loss on this share last year, after buying it at an average of 2.3p and then exiting at 1.7p.

At current levels, I'm wondering if I should look at it again (though it's really too small now):

Year-on-year third quarter (October to December) revenues increased by 7%, supported by continued levels of up weighted marketing investment.

"Marketing investment" sounds much better than "marketing spend"!

Unfortunately, financial year-to-date sales are down 13% in both revenue and volume, "with marketing rates maintained".

The outlook for FY March 2020 is "broadly in line with market expectations". Sell-side forecasts are unchanged for PBT of £210k. It also has a cash balance of £1 million.

My view

I'm tempted to buy back into this, but I won't - it's too small, illiquid and low-growth, and competing in crowded markets.

Rum volumes are up 16% and it's that category where I think Distil could be on to a winner. For now, the declining gin sales are camouflaging the excellent progression in rum. But of course it is hard to say whether Redleg Rum will have real sticking power.

Separately, I note that an individual called Roland Grain, via an Austrian company, has been stake-building in Distil in recent months.

Roland, described as a "dedicated whisky lover", appears to be a shareholder and director of a company called Manly Spirits.

So I reckon that Distil makes for an interesting bet at this valuation. The market cap is no longer very speculative in relation to current profitability, there is at least one brand which is growing well, and we have some interest in it from a stake-builder with industry expertise.

The problem is that its current scale doesn't justify it being publicly listed, and it's unlikely to reach significant scale for years. Economically, the correct thing for it to do is to give up on the listing and grow in private.

Most shareholders don't seem to want that, so they will continue the long wait for a major to take it off their hands. I hope they achieve a decent price! I do agree with them that it is probably too cheap at present.

Mincon (LON:MCON)

- Share price: 84.5p (-3%)

- No. of shares: 211 million

- Market cap: £178 million

Rare value on offer at the moment from Mincon, whose share price reached 150p in August 2018.

This is an Irish engineering group with an excellent track record of profitability over the years. It specialises in drilling equipment (i.e. the opposite of £SOM!)

Commentary from this management team always strikes me as reserved and realistic.

Today's news is that it is buying a Finnish manufacturer for whom Mincom is the primary customer: Mincon was responsible for €9 million of the Finnish company's €13 million total revenue last year. Mincon is paying €8 million to take it over, or 3.6x EBITDA. Sounds fine.

While I tend to be wary of M&A (most deals probably destroy value), I'm encouraged when I see deals between companies who already have strong commercial relationships. They likely have a level of understanding which will make combining the two cultures that much easier.

Aptitude Software (LON:APTD)

- Share price: 544p (-15%)

- No. of shares: 56 million

- Market cap: £306 million

Trading update, Board changes & Notice of results

This financial software provider was formerly known as Microgen (MCGN). Its homepage says that it makes "financial management software for the CFO office".

Update - the 2019 result will be in line with expectations.

There is a slight problem with its software for insurance companies, as the new accounting rules which it is designed to tackle might be delayed for 12 months. This has made it more difficult to sell the software:

These delays have had minimal impact on 2019 recognised revenue but have suppressed Annual Recurring Revenue ("ARR")1 growth as at 31 December 2019 from what would otherwise have been achieved.

Another problem has been the strengthening of Sterling. Aptitude must have lots of dollar income:

Despite the strengthening of Sterling versus the US Dollar in the final quarter of 2019, which reduced the Group's ARR at the year-end by £0.9 million, ARR increased in the year to £28.6 million, growth of 22% on a constant currency basis ("C/C") (31 December 2018: £23.5 million; 30 June 2019: £27.0 million (both comparatives restated for C/C)).

Outlook

The company cuts the profit outlook for 2020 in the most benign way possible. 2020 will only be marginally more profitable than 2019, because of all of the company's wonderful investment opportunities (in its Poland centre of excellent, in the training of its clients and its own employees, in customer support, and in various professional services):

With the Board's overall revenue growth expectations for 2020 unchanged, the above investments (together with the aforementioned foreign exchange impact on ARR) are likely to result in 2020 adjusted operating profits being marginally ahead of those expected for 2019.

You have to read twelve paragraphs before you get to the profit warning. Not good enough! I should give it joint-first place with Sosandar, which also took twelve paragraphs and bullet points today before giving us the profit warning.

My view

The enterprise software space looks extremely bubbly to me, and APTD is no exception. Not all of these companies are going to be long-term winners, and stratospheric earnings multiples provide no downside protection if things don't work out as planned.

I'm out of time for today, but thanks for your interest everyone! I'll be back first thing in the morning.

Best wishes,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.