Good morning!

Lots of updates to look at today.

This list is final:

- Sosandar (LON:SOS)

- Cake Box Holdings (LON:CBOX)

- Luceco (LON:LUCE)

- Debenhams (LON:DEB)

- Property Franchise (LON:TPFG)

- Billington Holdings (LON:BILN)

- Premier Asset Management (LON:PAM)

Mello 2019

A quick reminder that Mello is coming up next month, with a Trusts & Funds event on Wednesday 15th, followed by the main event.

There is a 40% discount for the main event with the discount code STOCKO40, and then the Trusts and Funds event can be added to your trip for the princely sum of £10.

The conference will incorporate the Mello Awards, so you can get your nominations in now if you'd like to influence the awards ceremony!

It will be a great chance to meet a wide range of company CEOs and fellow investors, and I look forward to seeing many of you there.

(Update by Paul Scott, who owns shares in SOS.)

Sosandar (LON:SOS)

- Share price: 28p (+6%)

- No. of shares: 116 million

- Market cap: £32.5 million

Excellent update - sales ahead of last Shore Capital forecast of £4.35m. Not sure why the company uses odd phrase "comfortably in line", instead of ahead?!

Gross margin improved to 57.7% in Q4, which I've calculated on a spreadsheet using the H1 numbers, and the Q3 trading update, plus of course today's update. This is a very high gross margin, for a company ordering small production runs. It indicates strong pricing power, and that most styles are being sold mostly at full price (little discounting). An absolutely key metric - very few competitors of this size will be getting anywhere near that level.

Cash burn (once you strip out increased inventories) is about £0.75m, down from £1m per quarter previously. That's all as planned, so I find it most odd that some posters here mention cash burn as if it's a surprise. It's not, it's as planned. They're driving growth, and that costs money. I reckon breakeven revenues are about £12m p.a.. Likely to get fairly close this year, with house broker forecasting £9.5m revs this year (ending 31/3/2020). After that, it moves into substantial profitability, and of course then the market cap would be multiples of the current level, as the market prices in continuing growth.

Another key metric is repeat orders - which are running at 54% of all orders. This proves that customers love the product, because they come back to buy more. Also, marketing spend drives additional customers, which together with repeat orders, is what's fuelling this exceptional growth.

After some terrible updates from, e.g. Quiz, and Bon Marche, I think some people mistakenly might have thought this would read-across to Sosandar. It hasn't, they're trading as well/better than expected. So I'm very pleased with this update.

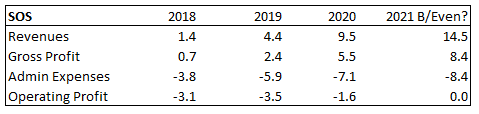

Graham's view: I've played around with a few of the numbers.

Firstly, the balance sheet: the £3.6 million cash balance will be needed to fund a loss in the current financial year, FY March 2020, of perhaps £1.6 million (most recent consensus forecast visible to me), plus inventory build-up and any other balance sheet expansion. And then more of the same in FY 2021, unless it starts to become cashflow-positive by then.

Now to the income statement, where I am reverse-engineering the estimate for administrative expenses in the current financial year, assuming a 58% gross margin.

Consensus forecasts seem to suggest that a £1.2 million increase in administrative expenses this year (from £5.9 million to £7.1 million) will be able to support a £5 million increase in revenues (from £4.4 million to £9.5 million), and the loss will wind up at £1.6 million.

I've had to work this out back-to-front, so take it with a big pinch of salt:

On this basis, I can therefore agree with Paul's view on breakeven in the sense that if administrative expenses stayed fixed at £7 million, breakeven would be achieved with £12 million of revenues at a 58% gross margin.

However, I would bet that administrative expenses would need to grow to support higher revenues. If the existing customer base came back unprompted and without any need for marketing spend, then maybe administrative expenses wouldn't need to grow very much. So far, it does seem that Sosandar's customers are very loyal.

However, it would be pretty unheard of, for a business like this to see its revenues roar higher while administrative expenses stayed flat.

In the table above, I assume that another £1.3 million increase in administrative expenses would be needed to grow the top line by another £5 million in FY 2021. In that scenario, Sosandar achieves breakeven.

I don't know if this forecast is too optimistic or pessimistic, and this is why I don't invest in early-stage companies! There's a very wide range of possibilities around these numbers. For what it's worth, I am leaning towards the view that another fundraising will be needed in about a year.

Cake Box Holdings (LON:CBOX)

- Share price: 159p (+1.6%)

- No. of shares: 40 million

- Market cap: £64 million

There are some obvious similarities with CAKE here, but CBOX has its own unique identity.

It's a franchisor selling egg-free cream cakes from 114 stores. It makes most of its money by selling food product to its franchisees.

The usual disclaimers for new shares must apply: this company has been listed for less than a year.

Today's update is in line with expectations:

- like-for-like sales growth of 6.5%.

- revenue up 30% due to store openings and LfL growth.

- new warehouse & distribution centres in Bradford and Coventry

It is forecast to do £5 million of pre-tax profit in FY March 2020, so the forward multiple looks quite reasonable.

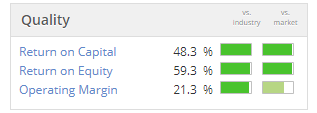

Stockopedia has noticed the high quality of earnings (thanks to the franchise model). It also pays a dividend.

This is definitely worth researching in more detail, in my view. Unfortunately, the spread is rather wide - otherwise I would probably open a small, starter position, pending further research. When the spread is too wide, I can't afford to do that!

Luceco (LON:LUCE)

- Share price: 80.35p (+5.6%)

- No. of shares: 161 million

- Market cap: £129 million

Luceco plc, a manufacturer and distributor of high quality and innovative LED lighting products, wiring accessories and portable power products, today announces its audited results for the year ended 31 December 2018 ("FY 2018" or "the period").

This has enjoyed a super recovery in the share price for anyone who bought when sentiment was most bombed out. Participants in the IPO, however, are still nursing a nasty loss.

I covered it in July 2018 (share price 34p) and January 2019 (share price 55p).

It claims to have 16% market share in UK wiring accessories, and 43% in UK portable power.

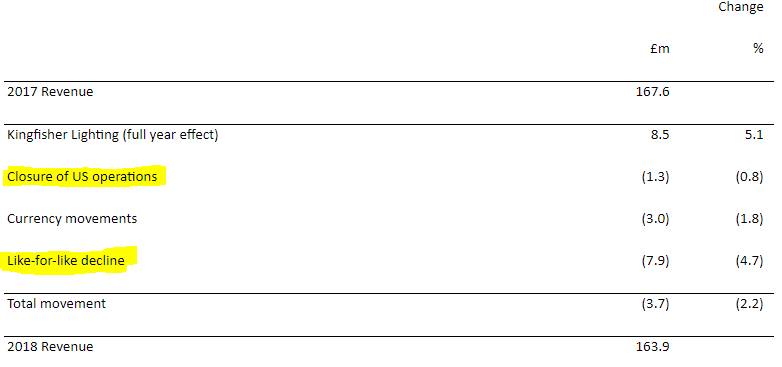

Here is a nice breakdown of the revenue movement in 2018:

The closure of US operations is a good thing, since they were loss-making.

The like-for-like decline is a bit more worrying, and is blamed on destocking by UK retailers and weak consumer condifence.

Luceco is exposed to UK high street conditions but also highlights that it supplies a few pure-play online retailers. Their share of the group's sales is still tiny at 3.4% of the total.

The company is also exposed to copper prices and currencies - the collapse in the share price a year ago was caused by the failure of the previous finance function to manage these exposures. Luceco now seems to be on top of them.

Net debt has reduced to £32 million, another sign of stabilisation.

Debenhams (DEB)

- Suspended at 1.83p (market cap £22 million)

STOP PRESS - Debenhams has gone into administration. The equity is wiped out.

The good news for the business is that it will continue without disruption to customers, suppliers, landlords, etc. The ownership of the holding company has merely been transferred from the previous equity holders to the secured lenders.

The pre-pack administration will now be followed by a sale process. The chances of any distribution being made to shareholders following the sale are slim to none.

It's bad news for Mike Ashley and Sports Direct (SDI), who will see their 30% shareholding in Debenhams wiped out.

As recently as this morning, SDI was publishing RNS statements about its proposals to rescue the value of the equity. Unfortunately, its proposals were rejected by the Debenhams Board:

While SDI has made a number of highly conditional proposals, each of which was fully considered by the plc board, none were deemed deliverable given conditionality, timing and other stakeholder obligations and considerations.

That's a bit vague but I'm not going to use up too many brain cells figuring out exactly what went wrong with Mike Ashley's proposals.

The bottom line is that we have another casualty in high street retail, and another clear warning about the danger of getting involved in this sector.

Paul has written many times about the danger posed by Debenhams shares and deserves kudos for that.

The share price has been in a major downward spiral since 2012/2013. Hopefully anyone who wanted to get out by now has already recovered at least some of their initial stake.

Property Franchise (LON:TPFG)

- Share price: 154.5p (+5%)

- No. of shares: 26 million

- Market cap: £40 million

The Property Franchise Group PLC, one of the UK's largest property franchises, today announces its final results for the year ended 31 December 2018.

(Please note that at the time of publication, I have a long position in TPFG.)

Nice results from this estate agent franchisor.

In addition to its conventional estate agent brands, TPFG owns a small, profitable hybrid estate agent - Ewemove.

Ewemove has just produced pre-tax profit of £0.4 million, "in a year when most competing hybrid estate agents produced losses" - not bad. TPFG bought Ewemove for £8 million back in 2016.

In hindsight, that deal doesn't seem to have worked out as well as it was hoped. Only half of the contingent consideration associated with it became payable.

Overall, though, TPFG strikes me as a very responsible company. It keeps a tidy balance sheet and focuses on earning strong returns.

Then when it tries something a bit different, like Ewemove, it keeps it at a modest scale until it proves the concept. This might be less exciting than what happens with the likes of Purplebricks (LON:PURP), but it provides a great deal of safety.

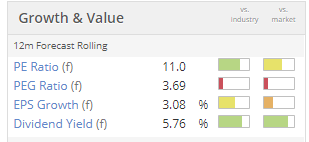

And it's not as if investors have suffered at TPFG: the dividend has risen for three years in a row, with the forecast yield approaching 6%.

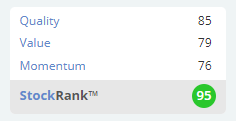

The StockRank is 97, i.e. this is a Super Stock.

Outlook is positive, with strong views that lettings are the right place to be:

...the private rented sector will continue to grow because of macro-economic drivers - continued high levels of net inward migration to the UK, the formation of smaller households because of changing family circumstances and lengthening life expectancy, the unaffordability for many people of owner occupation, negligible investment in social housing building programmes, and the lack of alternative investments with similar yields and potential for long-term capital gains.

My view

I've watched the latest interview with CEO Ian Wilson at piworld. Mr. Wilson highlights that acquisitions might be considered over the next two years, and I can understand why.

Debts have been paid down so that the company now has cash of almost £4 million, versus just £1.6 million of borrowings.

Most of the amounts borrowed are due to be paid back later this year,

As the borrowings move to zero, TPFG will have to decide what it wants to do with its large, royalty-based cash inflows.

In 2018, it generated £5.1 million in operating cash flows, before changes in working capital. Capex needs are modest, so you get a huge conversion to free cash flow.

I've been aware of this company's attractions since 2017 and have decided to take the plunge today with a starter position. Having studied it and admired it for a while, I don't want to risk seeing it continue to do very well while I'm sitting on the sidelines without even a small stake!

Competitors include Belvoir Lettings (LON:BLV) and M Winkworth (LON:WINK). They look like good companies in their own right, too, though they don't have the hybrid offering that TPFG does.

One other thing I should mention is the Tenant Fee Ban, coming into force from June 2019. This could create some disruption but I ultimately expect that fees will be passed on to landlords instead (who might pass them on to tenants). I will observe and will consider adding to my stake if business continues to run very smoothly over the summer.

Billington Holdings (LON:BILN)

- Share price: 290p (+4%)

- No. of shares: 13 million

- Market cap: £37 million

Billington Holdings Plc (AIM: BILN), one of the UK's leading structural steel and construction safety solutions specialists, is pleased to announce its audited results for the year ended 31 December 2018.

I haven't looked at this company since it's full year results statement a year ago.

Highlights:

- 5% increase in revenues (£77 million)

- 11% in increase in PBT (£4.9 million)

- Cash increases to £9.3 million

Outlook

"...trading in the current year has got off to a very positive start, with all divisions enjoying strong order books and we are seeing a robust pipeline of potential new work and opportunities."

Last year, I was looking for clues in the statement about where the company might be in its cycle. The signs seemed good for continued growth, and that has indeed turned out to be the case.

Signs for the company in the immediate future seem even better, with an "unprecedented" amount of secured work.

There is a reference to increasing capacity in the structural steel market, so that operating margins are expected to stay flat around the current level (6.5%).

On the demand side, consumption of structural steel is forecast to increase by just 0.5% in 2019, before picking up again to grow by 2.3% in 2020.

On this basis, maybe the big-picture view is a little bit more mixed. Brexit will also have to be navigated as the company has a lot of dealings with the EU. But I'm guessing that it's still too soon to call the top of the cycle.

While I haven't studied this company in any detail, my impressions on the surface remain positive, as they did a year ago.

This is another Super Stock:

Premier Asset Management (LON:PAM)

- Share price: 200p (-2%)

- No. of shares: 106 million

- Market cap: £212 million

Net inflows have unfortunately reduced to a trickle at PAM in Q2. Its UK equity funds suffered a net outflow.

This reflects what I said yesterday about retail investors not participating in the recent UK share buying spree. PAM reports "record low investment industry net flow figures", and "net outflows for the industry as a whole".

Here is its list of funds - you can see that it has a strong bias to UK equities, within a multi-asset offering.

I'm not quite as fond as this as I am of Impax Asset Management (LON:IPX), because I'm not sure if PAM has a niche that can grab customers in a world where passive funds dominate.

Also worth pointing out, as I said last time, that performance seems to have been a little bit average over the past few quarters.

On balance, I do still have a positive view of Premier, and will keep it on the watchlist.

I've run out of time for today - that was a busy round of udpates.

Have a great evening.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.