Good morning!

This list is final:

- Spaceandpeople (LON:SAL)

- Sopheon (LON:SPE)

- Filtronic (LON:FTC)

- Venture Life (LON:VLG)

- Warpaint London (LON:W7L)

- Luceco (LON:LUCE)

- CVS (LON:CVSG)

At the end of the report, I briefly cover updates from Brady (LON:BRY), PZ Cussons (LON:PZC), Crimson Tide (LON:TIDE) and Team 17 (LON:TM17).

Spaceandpeople (LON:SAL)

- Share price: 14.5p (-15%)

- No. of shares: 19.5 million

- Market cap: <£3 million

This retail marketing group, a serial underperformer, is now in "why are you listed?" territory with a market cap of less than £3 mllion.

Up until today, it officially traded at a forecast P/E ratio of only around 4x - a fine example of the danger of buying into so-called "cheap" shares!

December is reported as subdued, "in part due to well documented difficult high street trading conditions".

Spaceandpeople produces "experiential" campaigns for brands, and provides temporarry venues for retailers. To put it as simply as possible, declining footfall reduces the value of what it does.

It is now set to report a small underlying loss for 2018.

2019 will hopefully show an improvement, and the Board is showing confidence by continuing to pay a dividend, albeit at a reduced level.

The problem is that the company has been around for a long time and it's hard to see why it might at last generate consistent profitability at a level which would justify being publicly listed.

And I have to say that this paragraph looks a bit off:

The Board has also taken the decision to write off the carrying value of the goodwill in relation to SpaceandPeople India Pvt Limited of £0.24 million. The Indian business continues to trade at expected levels, however, the level of profitability cannot support the carrying value of this goodwill at the moment.

Goodwill is only impaired when an acquisition fails to justify its expectations at the time of purchase.

So there would be no need to recognise an impairment to the Indian business if its expectations had never been reduced.

Therefore what this paragraph says to me is that the company previously lowered its expectations of the Indian business, but failed to officially recognise the impairment until now. That would be a fuller explanation of the truth than is presented in the RNS.

SAL goes on my bargepole list - not suitable for a public listing at this point.

Sopheon (LON:SPE)

- Share price: £12.60 (-3%)

- No. of shares: 10.1 million

- Market cap: £127 million

This international group helps corporate customers with "software, expertise and best practices", all under the banner of "Enterprise Innovation Management solutions". So it's all about helping companies to perform well.

Its own performance is worth shouting about: EBITDA and pre-tax profits are set to come in significantly ahead of upgraded market expectations, due to higher revenues and lower than planned costs.

Funnily, the share price isn't too impressed (the market as a whole is up 1.5% today, making Sopheon's 3% fall even more unusual).

It could have something to do with the fact that valuation was already punchy. If "buy the rumour, sell the news" is commonly practised, then today might be a selling opportunity for those waiting for confirmation that 2018 was such a strong year for the company?

On the negative side, it sounds like cost savings were achieved because Sopheon failed to make the new hires it was looking for:

Recruitment continued to be a challenge last year, with a tight market in particular for US software engineers, contributing to the cost saving.

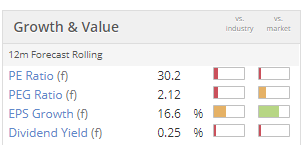

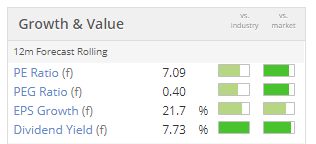

Overall, though, it's a positive update and I'm scratching my head as to why the share price hasn't reacted in a better way. I can only conclude that the market cap has reached the limits of what people are willing to pay, given its current stage of development and growth outlook (e.g. the PEG ratio is 2x, according to the Stockopedia table above).

Looking at my previous notes on Sopheon, I felt that a share price of 1000p might be justified by its very strong business performance. Maybe the 1300-1400p region was pushing things a bit too far?

Filtronic (LON:FTC)

- Share price: 6.4p (-3%)

- No. of shares: 208 million

- Market cap: £13 million

Lots of problems with this as an investment: customer concentration, lumpy sales, loss-making, occasional dilution to bail it out.

It describes itself as "a world leader in the design and manufacture of a broad range of customised RF, microwave and millimetre wave components and subsystems."

There was a profit warning in December, covered by Paul, as a customer delayed its purchases.

Today's news is also a bit grim:

- revenues down almost 20% to £10.4 million

- loss-making at the EBITDA level

- impairment of capitalised development costs associated with the delayed order

- cash reduces by £1.6 million over six months to £2.2 million

Status of the delayed order:

Our client has informed us they are still marketing this antenna, and we understand there will be an ongoing level of business, but demand volumes for this mMIMO variant beyond the current financial year are now uncertain.

The net loss is £1 million over the six-month period.

I'd be concerned that the cash balance is going to run out if the current streak of bad luck lasts for much longer.

Conclusion: Highly speculative.

Venture Life (LON:VLG)

- Share price: 48.85p (+6%)

- No. of shares: 84 million

- Market cap: £41 million

Good news from this producer of mouthwash and other consumer health products.

Adjusted EBITDA is set to be at least in line with market expectations.

Revenues will be up 16% year on year. Apply caution to this - there was an acquisition in August 2018.

There are also positive developments in terms of distribution. The acquired Dentyl brand of BB Mints is set to reach nearly 300 Morrisons stores and 150 new Superdrug stores.

UltraDEX Whitening, a new variant on the mouthwash, is also getting rolled out.

CFO leaving - an amber flag, since it appears that he has been with the company for less than two years. He has left "with immediate effect to pursue other opportunities", and the Board wishes him well.

Not good that there is no handover period or a more helpful explanation as to why he left so suddently.

My view - I maintain my positive overall view of the company, though I expect that it is fully valued at present.

Warpaint London (LON:W7L)

- Share price: 77.5p (-9%)

- No. of shares: 76.7 million

- Market cap: £59 million

A short update from this cosmetics company, owner of the W7 brand.

It gives us one sentence:

Subject to audit, the Company expects to report revenue of £48.5 million and adjusted profit before tax* of £8.25 million for the year ended 31 December 2018.

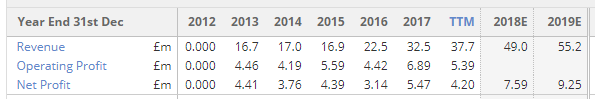

A quick check of the StockReport confirms that £48.5 million is below the broker's revenue forecast. But it's within the range suggested by the company back in September (£48 million to £52 million).

For the share price to come off nearly 10% when revenues are 1% less than the central estimate - that looks too harsh to me. Markets are very unforgiving at present! And the sentiment attached to this share has collapsed since it released a profit warning in October.

It IPO'd at 97p in 2016, and soared to over 300p at one point. Last September, it was at 265p. There must be a lot of stale bulls, who've had enough.

I already have a biggish position in Creightons (LON:CRL) and should be careful about getting too exposed to this sector, but surely this one is worth researching in further detail at this level.

In 2017, it raised over £20 million at 190p to fund an acquisition. Those who took part in the placing are likely to be licking their wounds now.

I'm tempted to get involved, but I can't quite convince myself about the value of the brands it owns.

Here's a YouTube video from June 2018 with almost 200k views, reviewing W7 makeup. The disclaimer says "This video is in collaboration with W7, but all thoughts and opinions were 100% honest".

Her conclustion is "I literally think I loved pretty much everything" (!)

And here's a written review (not sure if it was sponsored). Her conclusion:

I am impressed with W7 I think it is a perfect range for the teenagers starting out, college ladies who cannot afford the higher end products but still wanna look fab and to be honest anyone who doesn't want to have to invest hundreds on a new face of makeup... try W7!!!

I'm going to do some more background reading on this.

Luceco (LON:LUCE)

- Share price: 55.1p (+4%)

- No. of shares: 161 million

- Market cap: £89 million

This is "the manufacturer and distributor of high quality and innovative LED lighting products, wiring accessories and portable power products".

It has an accident-prone recent history - see the archives. In July, with the share price at 33.8p, I said that it was at a level that could be good for a contrarian bet, but was beyond my personal risk tolerance.

Today's update says that the full year is in line with market expectations. Margins have been restored and net debt has been reduced.

It's beginning to feel like a law of nature that newly listed companies must first produce an awful disappointment, before recovering to an acceptable performance in line with reduced forecasts. I suppose this is why investment bankers get paid so well - to drum up expectations in advance of the IPO, even if those expectations turn out to be silly.

Outlook: "cautious optimism".

My view: in common with Paul, I share a lack of interest in LED lighting as an investment sector.

CVS (LON:CVSG)

- Share price: 464p (-29%)

- No. of shares: 70.5 million

- Market cap: £327 million

A nasty profit warning from this veterinary group.

I last looked at it in February 2018, noting its aggressive acquisition strategy and rising debt levels.

The company now says that FY 2019 EBITDA will be materially below expectations. H1 2019 EBITDA wll be flat compared to H1 2018, despite acquisition.

Results from recent purchases in the Netherlands and in Farm/Equine practices have been disappointing. Management might be admitting defeat in terms of this strategy now:

The Group believes that acquisition multiples being sought by practice owners are increasingly above levels which will deliver acceptable financial returns. Whilst the group has a further pipeline of acquisitions, for which terms have been agreed in principle, the Board is re-evaluating all acquisitions and particularly the multiples it is willing to pay.

The company reports a shortage of vets and a reliance on temporary cover, which means that salary costs are escalating. Great news for vets, not such great news for shareholders.

I think it's a respectable strategy to avoid all professional services companies on the basis that all of them can be held to ransom by the salary demands of their professional employees. The traditional parthership model, such that they are owned by their senior managers, makes more sense to me.

CVS now has bank covenant leverage of 2.4x, and says it is "comfortably within its covenants". The covenant allows for a maximum reading of 3.5x.

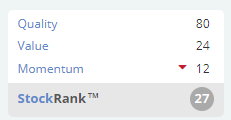

A debt-ridden acquisition strategy in professional services is a good example of the type of thing I avoid. As of last night, the StockRanks shared my caution.

Other updates today:

- Brady (LON:BRY) (SP minus 1%, £52 million)

Risk management software company. Revenues and adjusted EBITDA "broadly in line with consensus market expectations". Forcasts suggest it could make net income of £1 million in FY 2019 and £1.6 million in FY 2020. I would treat these forecasts with a jar of salt.

- PZ Cussons (LON:PZC) (SP minus 11%, £800 million)

H1 results from this consumer products group. Like-for-like revenue -4.6%, operating profit -21%. Suffering from conditions in Nigeria. Group adjusted PBT set to be c. £70 million for the year. Significant share price discount available now for those like me who've been watching it for a while. P/E ratio (ignoring net debt) is c. 14x for a company with a fine history and good brands. No immediate end in sight to the problems in Nigeria, however.

- Crimson Tide (LON:TIDE) (SP plus 22%, £11 million)

Creator of mpro5, an app which enables professionals to work out of office more easily. "Customers generating long-term revenues up 18%". Optimistic comments. Likely to still be very early stage but looks like it could have potential.

- Team17 (LON: TM17) (SP unch., £292 million)

Video game developer. Reports revenues ahead of expectations, adj. EBTIDA at upper end of expectations. Won lots of industry awards and nominations in 2018. "Solid portfolio" of launches coming up in 2019. Could be worth researching although valuation is racy.

All done for today - cheers.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.