Good morning, it's Paul here.

What fresh horrors has the market served up for us today? It looks like at least 3 profit warnings, judging from the top % fallers list, so I'll start with them.

Superdry (LON:SDRY)

Share price: 380p (down 33.7% today, at 09:10)

No. shares: 82.0m

Market cap: £311.6m

Interim results for the 26 weeks ended 27 Oct 2018.

Good grief, I didn't expect this fashion brand to come back within my small cap remit again - its market cap was over £1.6bn at the start of this year, and is now just over £300m. I know this share is popular with private investors, so my commiserations to any readers who are holding this one.

The share price is all over the place, it's up 22p to 402p just in the time I wrote the above.

I reported on the profit warning in Oct 2018 here, fearing that it had another profit warning to come.

Note that Superdry has a profit seasonality leaning towards H2. So the H1 numbers need to be seen in that context.

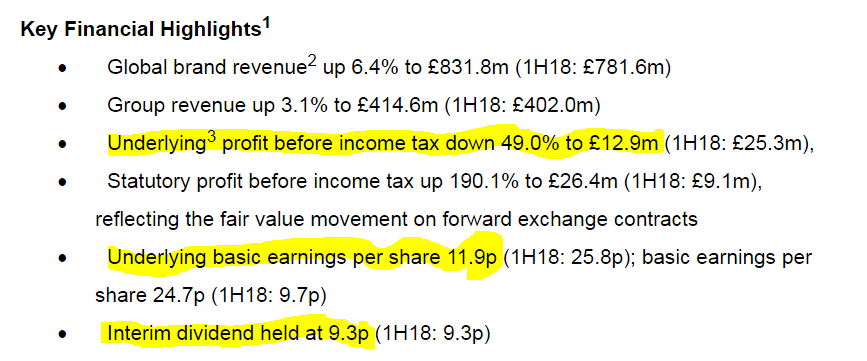

The highlights today look grim, with profit down by almost half;

Although it's interesting to see that the dividend has been held.

Current trading & outlook

Unseasonably warm weather has continued through November and into December (Superdry's two biggest trading months in the year) across all of our key markets. Given Superdry's reliance on cold weather related product continues and a lack of innovation in some of its core categories, sales have remained under pressure despite a strong performance in the Black Friday week. This has resulted in an adverse profit impact of around £11m in November and the Company expects a potentially similar profit impact in December if trading conditions do not improve.

There is still considerable uncertainty in terms of the weather outlook, the changing shape of consumer behaviour in the peak trading period and the impact of wider economic and political uncertainty. Reflecting those impacts and the uncertainty in the remainder of the financial year the Company expects underlying profit before tax to be in the range of £55m to £70m.

It's very helpful when companies give specific profit guidance like this. My initial reaction is that the market cap of c.£300m looks a bargain if the company is still on track to report £55-70m underlying profit, in a bad year, when plenty of things seem to have gone wrong. That compares unfavourably with £97.0m underlying profit last year (ending 28 Apr 2018).

I suppose the market's worry is that the trajectory of profits is now downwards. So next year could be profits down to c.£30m, and then breakeven or a loss the following year, if this trajectory continues.

The other question is whether current management will be chucked out by the founders? There has already been a public spat where founders (big shareholders still) have slated the strategy of current management. That could give the share price a nice boost, potentially, on hopes for a turnaround, maybe?

The narrative with today's results talks about improving its product. That's the fundamental problem it seems, with weather exacerbating it - the company has mentioned before that it relies heavily on sales of winter coats. Although does the public really need to buy a new coat every winter? I'm still wearing an old £8 gilet from Primark, and it does a perfectly satisfactory job.

Another worry with Superdry is whether the company has signed up for too many expensive shop leases? It seems to like expensive, flagship style shops, in pricey locations. That could become a millstone as High Street footfall continues to decline.

Balance sheet - looks pretty solid to me, which strengthens the case for having a punt on this share, in the hope of a trading recovery next year.

There doesn't seem to be any bank debt. It held net cash of £19.2m at end Oct 2018, down from £33.8m a year earlier. This looks to be a seasonal low for cash, with inventories turning into cash over Nov, Dec & Jan, giving historically higher cash balances at the year end in April.

Inventories & receivables look rather high to me. So I imagine the company will have to discount its winter stock, to clear it - giving a double whammy of lower sales, and lower gross margin.

It does have to dip into its overdraft a little from time to time;

During the period the Group increased its uncommitted bank facility from £20m to £40m. This will reduce back to £20m in the second half of the year.

The maximum drawdown on this facility in the period was £26m.

In recognition of the continued growth of the Group's Wholesale operation and changes to inventory flows reflecting the increasingly global nature of the brand, and in planning for the longer term, the Group is in the process of arranging a revolving credit facility to accommodate peak working capital requirements, ready for year end.

I don't think there's any reason to be alarmed at this. The amounts are relatively small, compared with even the reduced level of profits. Also, there are substantial inventories & receivables, to give the bank comfort that it's not risky lending to Superdry.

Overall then, I'm happy with its financial strength.

My opinion - this looks a lot of business for the money. I'm sorely tempted to catch the falling knife, as there could be a decent % gain here from any recovery in trading, or from a change in management.

Filtronic (LON:FTC)

Share price: 8.2p (down 54% today, at 10:21)

No. shares: 208.1m

Market cap: £17.1m

Trading update (profit warning)

Filtronic plc (AIM: FTC), the designer and manufacturer of antennas, filters and mmWave products for the wireless telecoms and critical communications markets, provides the following trading update.

Unfortunately for shareholders, it's a profit warning for H2;

Sales in the first half of the financial year were £10.4m (H1 FY2018: £12.8m). Whilst sales were lower than the prior year we have traded ahead of our internal sales projections in the half.

However, despite good early take up, we regret to report that demand for the recently introduced Massive MIMO ("mMIMO") antennas is now expected to be substantially lower than we had forecast in the second half of FY2019 and as a result, the Company expects to be loss-making for the current financial year.

The other part of the business is trading alright.

Cash - the company says it has enough;

Net cash at 30 November 2018 was £2.3m (H1 FY2018: £3.1m). The Board is of the opinion that it has sufficient cash reserves to allow it to operate at this lower level of revenue whilst it explores and executes an alternative strategy for the antenna business.

My opinion - this company has historically disappointed, because it has so little visibility on sales, and hence profits. It needed a rescue fundraising to prevent it going bust a few years ago. £2.3m cash doesn't strike me as providing much headroom, now the company is loss-making again.

If I held this share, I'd probably just take the loss, and move on.

DP Poland (LON:DPP)

Share price: 17.0p (down 28% today)

No. shares: 152.8m

Market cap: £26.0m

DP Poland, through its wholly owned subsidiary DP Polska S.A, has the exclusive right to develop, operate and sub-franchise Domino's Pizza stores in Poland. There are currently 62 Domino's Pizza stores, 36 corporately managed, 2 under management contract and 24 sub-franchised.

- Softening of LFL sales growth in Q4 (Oct-Dec 2018)

- Increased competition from delivery aggregators

- Reduced marketing spend, to focus more on profits than sales growth

- EBITDA for 2018 expected to be broadly in line with expectations

- Sales & EBITDA for 2019 will be impacted

My opinion - this company has a terrible track record. In a nutshell, its business model simply isn't working. It's never made a profit, and costs seem to go up as fast as sales increase.

Why invest in something that has proven to be a commercial failure (i.e. constantly loss-making), over more than 8 years?

Fulham Shore (LON:FUL)

Share price: 10.75p (up 14% today)

No. shares: 571.4m

Market cap: £61.4m

(at the time of writing, I hold a long position in this share)

This is a small casual dining group, operating Franco Manca pizzerias (mainly in London), and The Real Greek.

Interim results announced today cover the 6 months ended 23 Sept 2018.

As has been widely publicised, the casual dining sector is suffering badly at the moment, due to;

- Over-capacity - too many restaurants chasing too few customers

- Heavy price discounting from struggling operators

- Reduced footfall on High Streets

- Increased costs, especially wages, business rates, etc

So there's no doubt that things are grim out there.

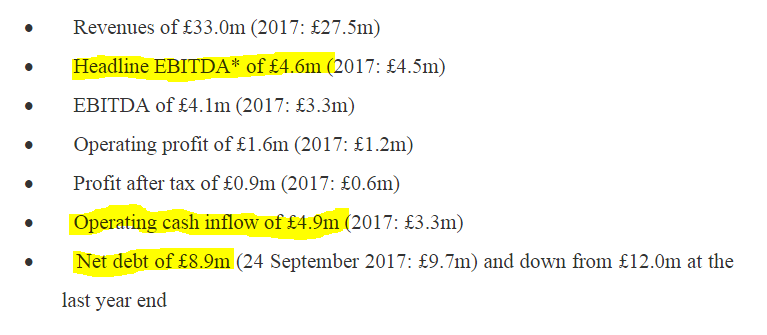

Against that backdrop, FUL's interims today look solid;

Note how EBITDA is very similar to operating cashflow. That's why it's a very useful measure in the retail & hospitality sector. Less so in other sectors (e.g. tech companies that are capitalising a ton of payroll costs).

Cashflow statement - this shows the strength of this business. The new site openings programme was slashed, due to difficult market conditions. As a result, the business is now generating plenty of cash.

Note how net debt reduced by £3.1m in the 6 months, even after having spent £1.7m on capex for new sites. I was a bit concerned previously that net debt was running a little warm. Today's figures are reassuring on that front. So I no longer see the net debt as a potential problem. It's now relatively modest, at roughly 1 times EBITDA.

So investors who focus too much on the statutory P&L figures, are missing the main point! It's all about generating cash, and recycling that into new sites. This is a self-funding roll-out, one of my favourite type of investments.

New sites - retail or hospitality companies which have a successful & differentiated offering, can do tremendously well by expanding at times like this, by negotiating fantastic deals with desperate landlords. This is confirmed by FUL today;

We continue to look for well-located new sites at reasonable rents throughout the UK, for both Franco Manca and The Real Greek. The increasing availability of restaurant space, lease incentives and capital contributions, in the current climate, should enable us to achieve higher site returns on capital than we have previously recorded.

We are conscious that the longer we wait on a new site or location, the greater the choice of sites, and potentially the better the incentives from landlords.

We believe that our two brands are now firmly established; we can afford to grow at a measured pace.

What a difference between canny management here, waiting for great deals to fall into their laps, and the PE-fuelled mania of restaurant openings which is now going so badly wrong for many competitors.

In the bad times, the best businesses can actually flourish. Hence why I hold this share personally, as it seems clear to me that both Franco Manca and The Real Greek are excellent formats, which are attractive to customers.

Outlook comments are positive. The most important bit is this, indicating that the (previously paused) roll-out plans are being stoked up again - excellent news;

During the current financial year to date we have seen sales and profit growth, improved operating cash flow, and reduced debt exposure for the Group. These factors, together with our successful new opening so far this year, have led us to consider increasing our opening programme beyond the current financial year, subject to how political events in the UK develop.

In the financial year ending March 2020 ("FY2020"), we plan to open more restaurants than the current financial year. We have to date exchanged contracts for a new Franco Manca in Edinburgh to open in FY2020 and have a number of further locations in advanced legal negotiations with landlords.

My opinion - it's pleasing to have one glimmer of light in my otherwise fairly battered portfolio!

It's clear to me that FUL is going to be a long-term success story. Today's reassuring results make me happy to continue holding, and will probably increase my position size here when funds permit, especially if that coincides with a dip in price. 9p feels the right sort of level to be buying more, in my opinion.

The widespread availability of good sites, at low rents, make this the perfect time to be expanding a successful restaurant format. That should sow the seeds for a much bigger, and more profitable business in say 5+ years' time. Meanwhile, weaker competitors fall by the wayside, leaving more market share for the restaurant formats that the public prefer. Therefore the dismal outlook for the sector as a whole, creates opportunities. That's the creative destruction of capitalism at work.

I'll leave it there for today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.