Good morning!

I got home at about 1am last night, after a delayed flight. But am feeling surprisingly chirpy, all the same.

The overall level of the market remains on my mind. I might have underestimated the extent to which the air coming out of US equities could be a headwind for UK shares. And I do think there is a lot of air that needs to be extracted from the US markets.

That being said, President Trump is not going to want a stock market crash to be the backdrop for his 2020 re-election campaign. He regrets hiring Fed Chairman Jerome Powell, who bears the ultimately responsibility for rising interest rates:

"So far, I'm not even a little bit happy with my selection of Jay," Trump told the Post. "Not even a little bit. And I'm not blaming anybody, but I'm just telling you I think that the Fed is way off-base with what they're doing."

If the Fed slows down its rate hikes under pressure from the President, that will certainly be good news for equity prices.

The market has started to price that in: after yesterday's rally, the Dow Jones Industrial Average is only about 6% off its recent all-time high. That still sounds rather optimistic to me!

Like most of you, I continue to spend most of my time looking at individual companies. But it's nice to have a sense of history and of overall valuation levels, to give the context for what we're doing. I remain bullish for UK shares, while acknowledging that the road higher will be a rocky one.

Today we are looking at:

- Ramsdens Holdings (LON:RFX)

- Character (LON:CCT)

- Motorpoint (LON:MOTR) (by Paul Scott)

- Premier Asset Management (LON:PAM)

Ramsdens Holdings (LON:RFX)

- Share price: 163p (unchanged today)

- No. of shares: 31 million

- Market cap: £50 million

Interim Results - Six Months ended 30 September 2018

What a crazy range this one had yesterday: a high of 167.5p, a low of 147.5p. Results had been reported in line with expectations.

It ended the day 2p higher than the previous day, at 163p.

Ramsdens is a pawnbroking/financial services chain based in the North of England.

It tends not to compete head-on with H & T (LON:HAT) (in which I have a long position). H&T is more concentrated in the South.

Let's take a look at some key points from these H1 results:

- FX income down marginally due to "staycations" in the UK and Easter falling outside the period

- steady progress in pawnbroking pledge book and income

- jewellery retail revenue up 27%. H&T has also made a lot of retailing progress in recent years.

- gold and silver purchasing profit up moderately.

Overall, the four divisions seem to have done well.

Perhaps some holders were surprised by this:

A small and expected decline in EBITDA year on year, reflecting the absence of peak Easter holiday FX trading, the opening costs associated with new stores, and investment in the infrastructure and team to support growth, in part compensated by improved retail jewellery and pawnbroking trading.

Despite that small decline, the cash position remains large relative to the size of the business, at £12.4 million, and the interim dividend is increased.

Why did the share price fluctuate?

This can't be answered authoritatively without interviewing the buyers and sellers. Possible causes would be:

- an unexpected reduction in profits, as holders didn't know what management's expectations were

- disappointment that FX declined, even with the excuses given for it. Last year, currency exchanged was up 22%. This year, it fell 3%. So this segment has arguably lost its momentum.

I would have a question mark about the excuse that people stayed at home due to the hot UK weather. Don't most people book holidays well in advance of knowing what the weather is going to be like at home? Are people really waiting to see what the weather is like in spring and early summer, before deciding to book? If anyone knows, please let me know!

- the outlook statement not being sufficiently rosy. H2 is said to have made a "solid" start:

Despite a backdrop of Brexit uncertainty impacting consumer confidence and struggling high streets, the Board believes that our outstanding value proposition for customers will enable the Group to continue to grow and prosper.

Why are the pawnbrokers so cheap?

This is a great question.

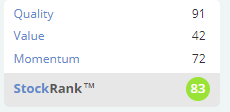

Ramsdens has a StockRank of 91 while H&T is rated 87.

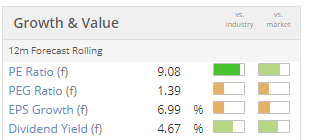

Ramsdens value metrics:

H&T value metrics:

I suppose the first way to tackle the question would be to ask: why should they be more expensive than this?

After all: they are unlikely to be long-term compounders. They are essentially like small banks with retail services and some retailer characteristics. Does that really deserve an above-average P/E ratio?

My view is that they do not deserve above-average P/E ratios. But I still like them, and find them attractive at single-digit earnings multiples.

What I like about them is that if they are managed well, they can be very dependable businesses (if they are mismanaged, they can of course blow up).

On top of that, they have some counter-cyclical characteristics and provide me with some positive correlation to the gold price.

H&T's 7.4x P/E ratio stands out to me as possibly deserving of a purchase, while Ramsdens at 9x is also quite interesting.

The recent share price weakness for both of them look to me as if it could be related to:

a) generalised High Street fears around declining footfall. Ramsdens mentioned in its results yesterday that it is relocating multiple stores - maybe this is due to the decline of certain traditional shopping streets?

b) fears around financial mis-selling claims. This doesn't affect Ramsdens so much because it doesn't have a personal loan product. It does threaten H&T. I am quite certain that any loan mis-selling claims against H&T would be frivolous, but it remains a threat.

Conclusion

Ramsdens is a cheap and cheerful stock which could be worthy of further research and purchasing at current levels.

One of my few concerns would be its growth strategy. It is pushing the boat out by seeking to open 12 new stores per annum over the medium term.

H&T's store count, by contrast, is basically flat. I prefer the strategy of sweating its existing estate. That makes sense to me in a mature industry. H&T can always swoop in and buy up failed rivals whenever the sector goes through another rough patch.

So I wonder if 12 new stores from Ramsdens each year is perhaps a little bit too ambitious. Time will tell. I do like both of these shares.

Character (LON:CCT)

- Share price: 513p (+4%)

- No. of shares: 21 million

- Market cap: £109 million

This toy company (it designs, develops and distributes them) looks to have had a good H2. It says it comfortably achieved market expectations.

Let's break down the progress in each half-year period.

FY 2017 sales:

- H1 £61.5 million, H2 £53.8 million

FY 2018 sales:

- H1 £50.5 million, H2 £55.7 million

The £50.5 million figure for H1 2018 was the truly disappointing one. We've covered the Toys R Us bankruptcy which created the mess - see the Stockopedia discussion archives for CCT.

£55.7 million of revenue in H2 2018 says that CCT has returned to its previous strength, outstripping the previous H2 figure by 3.5%.

The recovery is attributed to:

"our collaborative culture (both within the Group as well as in partnerships with customers and suppliers), the agility of our business model in addressing changes and challenges within our market and the proven skills of our central management team"

Dividend

Reflecting management confidence, we also see a 20% increase in the final dividend.

Buybacks

Character has the authority to keep buying back its own shares. Makes sense to do this in my view, given the net cash position (£15.6 million) and the excellent cash-generating ability of the business (at least historically).

Acquisition

The small acquisition of a Danish toy distributor seems to be going well so far - good news. I don't mind small acquisitions when there is a clear reason given. This acquisition gives Character a toehold in the EU for a post-Brexit environment.

Outlook - in line with expectations.

My view - all very encouraging.

Note that this share is usually cheap versus earnings, since design and distribution aren't rated as highly as ownership of the underlying IP (Peppa Pig, etc.).

That being said, I maintain a positive impression of the group. StockRanks like it too:

(This section by Paul Scott)

Motorpoint (LON:MOTR)

- Share price: 216.5p

- No. shares: 97.2m

- Market cap: £210.4m

"Motorpoint, the largest independent vehicle retailer in the UK, today announces its unaudited interim results for the six months ended 30 September 2018 (FY19 H1)."

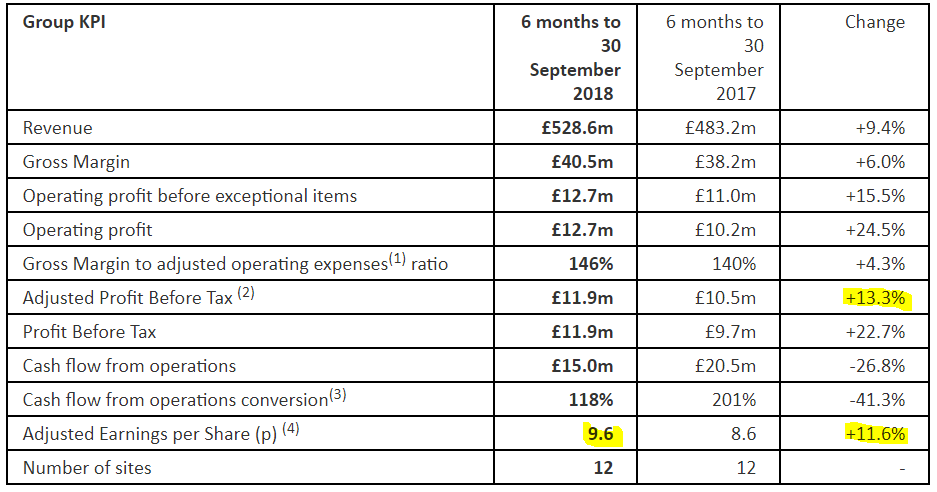

The KPIs table below looks pretty good, at a time when many other car dealers are reporting reduced profits. That's because Motorpoint has a different business model. It's not a franchised dealer of new cars, but instead sells nearly new secondhand cars, at keen prices.

There's not really a great deal to say about this.

There doesn't seem to be much H1/H2 seasonality, therefore the broker consensus of 19.4p for the full year ending 31 Mar 2019 looks reasonable. That gives a PER of 11.2 . This is a good bit higher than bombed out shares of more conventional car dealers, which are typically on a rating of about 6-8 times. The premium for Motorpoint makes sense to me, as it has a better & lower risk business model.

Outlook comments - the key bit says they're in line, but with loads of disclaimers for possible unknown Brexit-related upheaval;

Current trading is consistent with market expectations for the full year. However, we remain mindful of the current political uncertainty, and that the potential outcomes from the Government's Brexit negotiations could influence our future performance in unpredictable ways. We are particularly mindful of the potential impacts on stock supply and general customer confidence, resulting from, inter alia, exchange rate volatility, new import tariffs or other supply chain friction, employment and inflation or interest rate changes. As per Motorpoint's normal seasonal trends, our fourth financial quarter is the most material of our full year's performance, and is therefore a key focus to ensure we remain on track.

We believe our unrivalled choice of nearly new vehicles and ongoing dedication to Choice, Value and Service positions us strongly to take advantage of any market disruption, and to continue to deliver as the Car Buyers' Champion.

Balance sheet - looks fine, no issues there. Note that inventories of vehicles are quite modest, as they're shifted fast, and there are borrowing facilities to part-finance inventories.

Also note that fixed assets are very modest. This is another advantage of the car supermarket business model - there's no need for fancy premises to promote brands for the manufacturers.

My opinion - this is an excellent business model, which I like a lot. Growth comes from new site openings, so it should be a good roll-out over time.

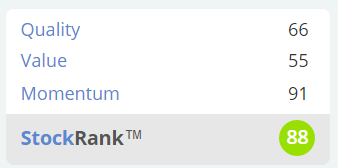

Stockopedia likes it too;

(This section by Graham.)

Premier Asset Management (LON:PAM)

- Share price: 203p (+0.5%)

- No. of shares: 106 million

- Market cap: £215 million

The last time we looked at this was in July.

Premier is a fund manager that serves a retail audience and specialises in multi-asset and income funds.

I've been impressed by its AuM growth. Exellent long-term performance must have helped. I'm not sure how Premier has done so well. All i can say is that it has caught my eye!

AuM grew another £0.8 billion to £6.9 billion by end-September 2018. It has since reduced to £6.6 billion.

Let's look at the market cap/AuM metric again: it is now 3.25%.

That feels cheap to me. When I looked at the same metric in July, it was 4.2%. The share price is down by a third from its high!

It's true that the relative performance of its funds has weakened: over five years, 83% of AuM is now beating the median return. It was 96% last time I checked. 83% is still excellent in my book.

Net inflows remained positive: 22 consecutive quarters of net inflows.

Financial results:

- adjusted PBT +29% to £19 million

- actual PBT +38% to £16 million

- EPS 12.1p

- Full-year dividend +28%, 70% payout ratio versus adjusted net income.

Outlook

The outlook sounds very challenging in the short-term:

Trading during the early part of the current financial year has been more difficult. The combination of more volatile investment markets and the ongoing uncertainty around Brexit have impacted on both the level of assets under management and the rate of fund flows. Anecdotal evidence suggests that retail investors are taking a wait-and-see approach and, as a result, fund flows have been slower in the first few weeks of the current year than they have been in recent months.

My view

I am going to research Premier in more detail. It looks to me as if the market may have over-reacted to some short-term difficulties and discounted the valuation too much. Stockopedia estimates the forecast P/E ratio at 12.4x (using last night's close) and the forecast dividend yield at 5.4%.

If I knew more about its underlying approach and how it has generated such good returns in its funds in recent years, I could easily be tempted to open a position in it!

That's all for today, thanks for dropping by and for your comments!

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.