Good morning!

It's Labor Day in the US which tends to make the global financial markets a lot quieter than usual. US institutions will be taking the day off.

And while the North Korean hydrogen bomb test might have spooked a few people, the FTSE is only a few points lower as of 8.45. Gold is up another 1% around its 1-year highs.

I don't usually devote any time to macro issues here, but Wall Street being closed and a hydrogen bomb seemed worth mentioning!

I will be starting stock coverage with Blancco Technology (LON:BLTG).

Cheers,

Graham

Blancco Technology (LON:BLTG)

- Share price: 77p (-25%)

- No. of shares: 64 million

- Market cap: £49 million

Updates on Revenue and Management

There has been a sea of red flags here for considerable time, both at Blancco and at its predecessor entity Regenersis.

In stock investing, there is such a thing as a smell test, and when a company fails it then you are nearly always better off staying away.

For a review of the various ways that Blancco has stood out as a low-quality offering, have a look through the archives here. It's very genesis as a stock market company was in a failed growth strategy dreamed up by investment bankers. Its accounts have been a mess, cash flow and balance sheet weak, key people have left, etc.

The red flags keep piling up here:

Blancco Technology Group plc announces that, following matters that have recently come to the Board's attention, the Board has decided to reverse £2.9m of revenues represented in two contracts that had previously been booked during the financial year ended 30 June 2017.

Revenue growth is still expected to be quite large (15% in constant currency), and cash flow is not impacted. But it confirms over-aggression in the company's revenue recognition policies.

The CEO tacitly takes responsibility by leaving with immediate effect, and the CFO becomes the new Interim CEO.

Remember that the Chairman is leaving next month, and we already had a CFO resignation in March this year.

Something has been rotten about this share from the beginning. In my opinion, it's not yet investible from a corporate governance point of view. Well done to the Stockopedia algorithms for identifying it as a Sucker Stock.

Kainos (LON:KNOS)

- Share price: 289p (unch,)

- No. of shares: 118 million

- Market cap: £341 million

My first time looking at this IT business offering digital services and digital platforms. Much of its work is focused around the implementation of Workday software - that's a US company with which I do have some familiarity. Workday competes with Oracle and SAP in human capital management (HCM) and other forms of "enterprise resource planning", to use the modern jargon.

Today's update says that full-year results (to March 2018) are set to be in line with current market expectations, based on current trading. Digital Services has delivered a "solid performance" while Digital Platform has seen very strong Workday-related growth offset by "investment" in Kainos' healthcare platform.

Checking some historic metrics, I see free cash flow conversion averaging around 100% here. Today's update confirms that the Group continues to have "a robust balance sheet and good cash generation".

My opinion

I quite like this business. Quality Rank is 96, though if you mix that with an already-high valuation, you get merely a good Magic Formula rating:

To provide a little bit of caution, I should point out that the current phenomenon of large numbers of companies migrating to the cloud for HCM solutions is not something that will last forever. According to some Workday research (external link) I've been reading, about 50% of the Fortune 500 have already made the decision about which HCM provider they will use. I wonder what percentage of large UK & European companies have made the decision yet and have moved?

Once they have effectively all moved, the current very high levels of demand for related consultancy and migration services might die down a bit. It might be several years away, it's just something I'd bear in mind if I was considering an investment here.

Overall, I'm fairly impressed by what I've read about Kainos so far. I would need to see a bit more in terms of how to justify the current valuation, but it does look worth studying in greater detail.

BNN Technology (LON:BNN) (this section written by Paul Scott)

Hi, it's Paul here. Graham has just texted me to say he has to pop out for an hour, so he's let me loose on this report to add some sections between now and lunchtime!)

Suspension of trading on AIM - this is a Chinese company on AIM. Therefore it is uninvestable as far as I'm concerned. I've had a 100% ban on any AIM Chinese companies for several years now, which has served me (and readers) very well. The trouble is that so many Chinese companies which list on AIM are frauds. We've known that for a while now, e.g. Naibu & Camkids blowing up. Plus there have been others. The whole thing is a sick joke in my view. The purpose of Chinese companies listing on AIM has mainly been to extract money from British investors.

BNN is not a company I've even looked at before, but it looks as if something has gone seriously wrong. Its shares have been suspended immediately, because;

Immediate suspension of trading. Resignation of CFO. Suspensions of both the Company CEO and the China CEO

It's not clear exactly what has gone wrong, but it's clearly serious.

The (now former) CFO, Scott Kennedy has resigned, and seems to have blown the whistle on some kind of wrong-doings within the company;

Mr Kennedy, as part of his resignation, has made a number of serious allegations with regards to the Company and the actions of Mr Darren Mercer, Chief Executive Officer and Mr Wei Qi, China CEO and Group Chief Operating Officer.

The company is now conducting an investigation.

My (Paul) opinion - I'm guessing here, but this sounds like it might be misappropriation of funds.

BNN raised £25m in a placing in Apr 2017, so possibly that might have proved too tempting for management?

Given the high prevalence of fraud at Chinese companies on AIM, we simply cannot trust any of them, in my view. It's too risky, so why get involved? I cannot understand why anyone would put money into a placing for a Chinese company on AIM.

Mark Slater reckons that Hutchison China MediTech (LON:HCM) is a rare exception, with good corporate governance. Personally though, each time a Chinese AIM stock blows up, it just reinforces my conviction that it's safest to avoid the whole lot. Why waste time & money trying to pick a needle in a haystack?

Anyway, I hope no readers were daft enough to have punted on BNN. It really is best to completely avoid all AIM Chinese stocks. Not just China either. There's usually something wrong with most overseas AIM stocks. They list on AIM because it has effectively no regulation with any clout. So it's an easy place to rip off gullible punters. Also the culprits never seem to be brought to justice. Where's Costis, with his stolen loot from Globo, for example? Sadly, white collar crime on AIM does pay. Which is why we have to be so careful, and not be a mug punter that is parted from our money.

At this stage, we don't know what has gone wrong at BNN, but it's clearly serious, as the company says in today's announcement.

IQE (LON:IQE) (this section written by Paul Scott)

(in which I, Paul, hold a long position)

Results & analyst meeting - this is a very interesting stock, and currently my largest long position. It's reporting tomorrow, and eagerly awaited news about the new Apple iPhone is one of the potential reasons to think this stock might out-perform.

I wrote very positively about IQE recently, when it was 90p. It released an intriguing RNS which sounded like potentially game-changing profit potential is in the pipeline. Several brokers have been issuing increasingly upbeat research notes lately, indicating potentially considerable upside on 2018 & 2019 forecasts.

Several readers have asked me if I can attend the analyst meeting tomorrow. So I tried to book a place, but unfortunately Instinctif Partners said no. It's just for proper analysts. Hmmmm, that's not very helpful. I don't usually have any trouble going to analyst meetings, and indeed do it all the time. Usually companies are very pleased to meet me, and thereby establish a link with 10k readers per day here. So I put a call in to IQE, asking if they would grant me access to the meeting.

Anyway, I've tried, but at the moment it's not looking promising.

Whatever the case, I'll be reporting on IQE tomorrow. I know the market cap has now risen well above our usual range here, but it's such an interesting company that it's an exception.

Bioventix (LON:BVXP) (this section written by Paul Scott)

Share price: 2545p (up 15.9% today)

No. shares: 5.14m

Market cap: £130.8m

Trading update - shareholders here must be delighted with a positive update today. This company is pretty much unique on the London market, to my knowledge. It's a tiny company, with only about a dozen staff, which produces specialist antibodies for use by pharmaceutical companies. There are long lead times to developing the products, and specialist knowledge. This enables the company to deliver spectacularly high profit margins.

The Board is pleased to report that revenues for the financial year ended 30 June 2017 are expected to be marginally in excess of 7M (2015/16: 5.5M). Since the cost-base of the Company continues to follow a similar shallow trajectory as in previous years, both revenues and profits before tax are expected to be ahead of market expectations for the year ended 30 June 2017.

A friend tells me that some of BVXP's customers report royalties in arrears, on a self-certifying basis. Hence why the figures for year ended 30 Jun 2017 are being revised at this late stage.

My opinion (Paul) - this is a remarkable little company. The bull case is compelling. The only reason I've (wrongly!) avoided the shares in the last few years, is that its tiny size & dependence on a handful of key people struck me as a risk factor.

The company is quite unusual for a highly rated growth stock, in that it pays generous & rising divis. The accounts are excellent - profit reliably turns into cash, there are no accounting issues at all here, everything looks fine to me.

Remember that this is a bull market, and considerable multiple expansion has taken place. When we first looked at this stock, it was on a PER of only 13. That has now roughly doubled to mid-twenties. I think a high PER is indeed justified, whilst the company keeps reporting strong performance. Some of the upside has come from forex benefits, which is worth bearing in mind.

I feel that high ratings are justified, providing companies keep reporting positive results & newsflow. That's exactly what Bioventix has done, so it looks good to me.

Incidentally, I don't recall ever mentioning this before, but Stockopedia has a neat feature on every company's StockReport, where it flags up which guru screens that share has passed. So you can click on that link, to view the relevant stock screen, which might flag up similar companies. This can be a very handy way of finding good stock ideas, and it's worked for me on a number of occasions.

I've not looked at the Martin Zweig Growth Screen before, but this is a snippet of some of the stocks within that screen (I've sorted this list in ascending market cap order, and have selected the view which shows StockRanks);

I hope that is legible. If not, I'll re-do the picture.

The stock screening features on Stockopedia are great fun for playing around with on a Sunday afternoon, when the market is not open to distract me. I've often found some smashing stocks in this way, that otherwise would have flown under my radar.

Also, you can tweak all stock screens to better fit your own personal investing criteria, which again I find very handy. I try to design stock screens which pick up as many of my current favourite investments as possible. That is a great way to find other shares with similar characteristics to the ones which are performing best in your portfolio.

Johnson Service (LON:JSG) (this section written by Paul Scott)

Share price: 141p (unchanged today)

No. shares: 366.5m

Market cap: £516.8m

Interim results - for the 6 months to 30 Jun 2017. This is a textile services business - supplying & cleaning linen and workwear for hospitality companies & others, I believe.

The headline numbers look good on a quick skim.

However, I do want to flag my concerns over the balance sheet. The group has grown through acquisitions, and this has hollowed out the balance sheet. NAV is £157m. However, once you strip out intangible assets, NTAV (a much better measure of financial strength) reduces to just minus £2.6m. I don't think that is anywhere near adequate as a capital base.

However, I should point out that net debt has been falling decently in the last 18 months. It is reported at a still-too-high £90m.

I recall how in a previous recession, a business in the same sector went badly wrong. The reasons were: too much debt, and needing to write-off a lot of the hire products because they had been under-depreciated, and/or clients with branded products went bust, rendering those products almost worthless.

Combine that with a far-from-cheap PER, and I cannot see any value here.

That said, the outlook comments today are good, in particular;

...The addition of PLS, together with continuing strong performance across all our existing brands gives us confidence in the second half performance. We expect results for the full year to be slightly ahead of current market expectations.

I've just started reading Keith Ashworth-Lord's book called "Invest in the Best". He sounds some excellent warnings about groups which grow through acquisitions, many of which ultimately go wrong. So that's worth bearing in mind.

Although for now, JSG seems to be doing well. I am nervous about the hospitality sector - where there is over-capacity, and a lot of weaker players are struggling. Could that mean JSG suffers from customers going bust in future? It's a very real risk. So that's another reason to be a bit careful with this stock, and don't all into the trap of over-paying for something which might have got a bit ahead of itself in valuation perhaps?

OK, that's me (Paul) done for now. I'll pass the baton back to Graham!

Tax Systems (LON:TAX)

- Share price: 80p (unch.)

- No. of shares: 80.7 million

- Market cap: £65 million

This has only been on the market for a year or so in its current form, after reversing into a cash shell.

It provides corporation tax software along with related services to UK & Ireland clients, and Paul has covered it here.

I am very cautious about valuations in the business software sector at the moment, but am trying to approach this with an open mind.

Nevertheless, there are prima facie reasons to be sceptical of the valuation here.

- Operating loss of £0.7 million.

- Low half-yearly revenues (£7 million) versus the market cap.

- Higher enterprise value of almost £90 million, once net debt is included.

- Negative net tangible assets of minus £35 million.

Putting all that to one side, the company achieved £3.3 million in cash generated from operations, before exceptional expenses.

The exceptional costs do have a solid justification, in my view, so on the basis that the numbers are trustworthy, almost £1 million in costs which resulted in the operating loss relate to one-off events.

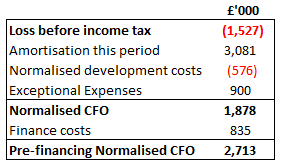

However, while debt remains elevated, finance costs will too. These costs came in at £0.8 million in the latest half-year period. The CEO notes in his report that:

"..it is critical that we continue to function effectively and get the right balance between developing the business but not overstretching it by having too much leverage."

The other very big item on the income statement, bigger than the two just mentioned put together, is amortisation, which amounted to £3 million. Most of this is the amortisation of customer contracts.

The trick you need to watch out for is when a company strips out amortisation from its adjusted operating profit (as Tax Systems (LON:TAX) does) and also continues to spend resources capitalising lots of new intangible assets, over multiple time periods. When that happens, you can be fairly sure that the company is just trying to eliminate certain ongoing, predictable costs from its adjusted profit figures.

But we can give Tax Systems (LON:TAX) the benefit of the doubt that it is not doing this, as its capitalised development costs were less than £0.6 million (£576) during the period, i.e. much less than the amount of intangibles which it amortised.

Below shows how I would estimate pre-tax normalised cash flow for the interim period, using the figures given in the statement. I am willing to add back the very large non-cash amortisation, but I also deduct £576k as an estimate of normal development spending (it is the amount of development spending which the company actually capitalised over this period).

A new subsidiary ("OSMO", purchase value £3 million) was only owned since April, so it would presumably make a small improvement to the results if included for the entire half-year period.

And then the whole thing needs to be annualised, and we can make growth assumptions based on the most recent pro-forma like-for-like growth rate of 7%.

My opinion

My conclusion from all of the above is that the valuation is not as expensive as it first appears. The lack of profitability stems from the amortisation of goodwill, which stems from the assumption that the value of the customer contracts paid for at the formation of the company is headed toward zero.

Like nearly everything else in the sector, it is also probably overvalued at the moment, but it is fair to put it on a respectable multiple. Stockopedia has it on 17x.

The gearing makes it a high-risk play.

That's all for today. Many thanks to Paul for chipping in with several stocks midway through!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.